How to Make $1,000/Month From the Market (No Matter What)

Create your ideal trade every month and earn between 10%-30% every month with one quantitative strategy

I want you to envision the stock market as a busy hallway. In a sense, that’s all it is: massive amounts of activity moving in both directions.

The biggest gains might be made in knowing which way the crowd is moving, and joining them.

Or you might make gains by guessing the precise moment when the crowd changes directions.

And while it might seem like it would be easier to guess that the crowd (the market) will keep going in one direction than to guess when it switches directions, I’m here to tell you:

It’s not the case.

From one moment to the next, your best guess about the direction of the market, or a sector or an individual stock, is just that: a guess.

More to the point, if you want to earn regular and reliable profits from the market, you don’t need to know which direction the market is moving.

In fact, betting on the direction of the market is a quick way to go broke. That’s not my opinion: it’s a mathematical certainty.

Unless you have infinite capital, making all-or-nothing bets based on a 50-50 outcome (like market direction) is a guaranteed path to massive losses.

And yet, that’s how many market participants behave: They luck into a few wins and think they can predict the future of the market. It’s absurd – but almost always financially fatal.

So how do you profit from the movement of the crowd?

Simple: You build trades that benefit no matter what direction the market is moving.

As a former Wall Street trader, I can tell you that most professional traders make their fortune from the traffic alone.

No matter which way it’s moving.

My name is Andy Crowder, and I left a lucrative Wall Street career as a trader over 20 years ago.

If you’ve ever worked in a high-pressure corporate office, you can guess why I left.

Too many meetings… too much time in a stuffy office – and not enough time spent doing what I thought I was hired to do:

Help people make money.

Since I left Wall Street, my professional life has been geared 100% towards helping regular investors navigate the markets.

Time and time again, I find that people want to make the same kind of high-risk, one-way bets that I know will only hurt them in the long run.

So if you take anything away from this letter, I want you to understand that you will never prosper by doing the same thing as 90% of the market.

Most people like the ease and simplicity of just guessing which way the market or a stock will move. It’s usually a bullish guess.

But markets (as we’ve seen recently) don’t always rise.

Sometimes they fall.

Sometimes they go nowhere.

But professionals profit anyway.

The most successful traders with small portfolios of less than $100 million only care about a special kind of trade that benefits regardless of the direction of the market.

In fact, the smaller the portfolio, the more easily this type of trader can benefit.

I’m talking about a sophisticated trade that only benefits from that “hallway” traffic – whatever direction it’s going.

Let me show you what I mean:

Here’s a trade I published in July of 2021…

It was based on a bullish trend in the iShares Russell 2000 ETF (IWM) – representing the 2,000 largest publicly-traded companies in the market.

- Just from the “traffic” in the options market, you could have made this trade in 31 days – with a Max Potential Return: 11.6%

Even better: you had a probability of success of over 80%. I build in a margin of safety so that IWM can go up and you make money…

It can stay flat and you make money…

It can even go down… and you make money.

I published a similar trade on the S&P 500 ETF (SPY) in February 2022.

Again, it had a probability of Success: 88.76% and a max Potential Return of 13.6% - all in 51 days.

But these aren’t isolated examples…

I made very similar trades 11 times in the past year.

On SPY

August 2021:

- Probability of Success: 81.46%

- Max Potential Return: 21.1%

September 2021:

- Probability of Success: 78.66%

- Max Potential Return: 37.7%

December 2021:

- Probability of Success: 85.40%

- Max Potential Return: 16.8%

December 2021 (again)

- Probability of Success: 84.72%

- Max Potential Return: 16.3%

January 2022

- Probability of Success: 83.03%

- Max Potential Return: 22.0%

January 2022 (again)

- Probability of Success: 85.33%

- Max Potential Return: 19.0%

January 2022 (a 3rd time)

- Probability of Success: 84.99%

- Max Potential Return: 19.0%

February 2022

- Probability of Success: 86.09%

- Max Potential Return: 15.4%

February 2022 (a 2nd time)

- Probability of Success: 88.29%

- Max Potential Return: 13.6%

On IWM

September 2021:

- Probability of Success: 81.80%

- Max Potential Return: 17.6%

October 2021:

- Probability of Success: 81.94%

- Max Potential Return: 23.8%

While most retail investors only look for directional trades, a handful of sophisticated traders profit from the real currency of the market: volume.

Without volume, there is no market.

Without people making bids and asking for bids, the market is volatile – an uncertainty that can blow up even the biggest hedge funds and investment banks.

The flow of trades that happens every day creates an opportunity that most people will never “get.”

That’s why I’ve put together this presentation: to show you a trading strategy that’s a step too far for most investors.

But it can help you collect reliable gains no matter what is happening in the market.

The few minutes a week it takes to make this kind of trade could earn you hundreds or thousands of dollars every month… even if the market is moving sideways… or tanking.

In fact, this is the exact kind of trading that I do in my own personal accounts, and for my family.

I recently used similar trading to help grow my 3-year-old daughter’s account from $4,400 to over $30,000 in less than a year.

Now, I’m not saying your account will rise 7-fold in a year… only that it’s possible.

But more importantly, in this letter I will show you ways to profit that are independent of the market’s direction.

How do these trades work?

Well, it’s easier to show you than to tell you…

A coin that lands on heads 80% of the time

The best way I can explain this type of trading is to re-frame that market traffic that I was talking about.

Instead of thinking about direction…

Up or down…

Think about magnitude: In other words, think about how much the market moves on any given day.

You know that unless there’s a highly unusual event, the traffic in the market tends to move relatively slowly.

Outside of a few outliers every year, the market RARELY moves much more than 1% up or down in any given day.

It’s much easier to predict that the market will not jump 10% in a day or 100% in a month – because it never does.

So, you don’t have to know which direction a stock or an ETF or the market itself will move over a given time period in order to profit.

If you know the market is likely to stay within a certain price range over a certain time frame, you can collect regular profits.

That might sound difficult… it sounds like a lot of math…

And that’s true, but today, almost every brokerage account has the math already worked out for you.

In essence, you can look at the likelihood that almost any publicly traded company, ETF, or stock index will hit a certain price within a certain time period.

The amount of math involved is something you might typically find in a graduate-level MBA program…

And until 10-15 years ago, this kind of data was unavailable to most retail investors.

Today, you can punch in a price for a stock, enter a date, and your brokerage will spit out all the info you’ll ever need to make reliable 10%+ gains in any given month.

Take a look at this table below showing different information about options for the S&P 500 ETF…

Take special note of the “delta” column:

Delta has a few different uses, but for our purposes, you just need to know that it represents the likelihood that SPY will hit a certain price (the strike) by a certain time.

In this case, you can see that Delta is around 0.20.

That represents a 20% likelihood that SPY will rise to 429 by June 17, 2022.

That means there’s an 80% chance that SPY will NOT rise to 429.

Now, instead of a 50-50 coin flip betting that the market will go up or down…

You have an 80-20 coin flip, and you can take the 80 side…

And even better: You can do it over and over again, month after month, and win about 80% of your trades.

If that sounds unbelievable, I get it…

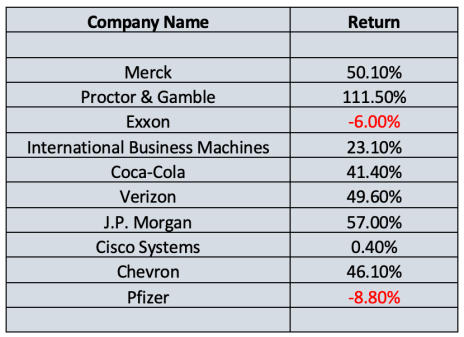

But take a look at my trading track record using Delta to build trades back in 2019…

You’ll notice I have 10 trades… 8 winners… and 2 losses.

80% winners.

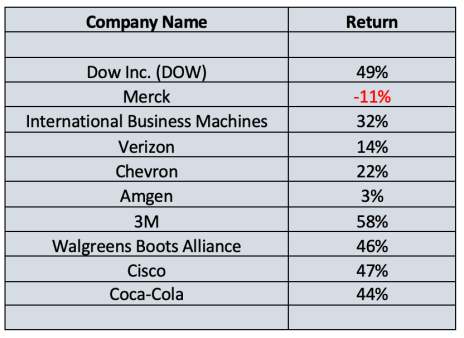

Then take a look at a similar portfolio of trades I made in 2021:

This time, you’ll notice 10 positions, and 9 winners. A 90%-win rate…

That’s a little better…

But you’ll also notice one of my positions was in the black by just 3%... That’s close enough to a loss for my taste – and it reveals how near I came to an 80%-win rate…

The real takeaway I want you to realize is that over short periods of time, the market is reliable enough to make profits from the traffic – independent of market moves.

And right now, we’re entering a period that’s making it extra profitable to do this kind of trading.

Why now is the best time in years to make this kind of trade

If you haven’t figured it out yet, I’m talking about options trading.

But I don’t trade options the way most people do.

You see, about 80%+ of people simply buy options as speculations on price movement. It’s a leveraged way to benefit.

If you think the market’s going up, you buy calls and you can double or triple your money in a matter of days.

If you think the market’s going down, you buy puts and if the market falls, you get your 100%+ payout.

But you’ll notice this is exactly the mathematically unsound behavior I referenced at the beginning of the letter.

Unless you have infinite capital, this methodology inevitably results in your ruin.

If you know anything about gambling (which is what most of these people are doing) you might have heard of something called the “Martingale betting system.”

It’s a strategy people came up with that’s supposed to help you win games where you have a 50-50 chance of success. (Of course, there aren’t any games like this in a casino…)

This “strategy” involves increasing your bet every time you lose. And it works great: as long as you have infinite money to continually double your bet – or you have incredible luck.

I don’t know about you, but I’m not interested in making bets based on luck.

But right now, the odds are even worse for these stock market gamblers:

That’s because the price you pay to buy options (puts and calls) is at all-time highs.

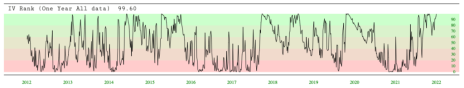

Below is a chart showing the price of options.

This isn’t just some options: This chart represents an average price of all options of all expirations.

People are buying options near record high prices.

But that means we can sell high….

And generate even more gains with less risk, or in less time…

So how can you get started with this “80% coin flip” trade that I’ve been talking about?

I’ve put together a brand-new research report showing you exactly how to make your own 80% probability trades.

It’s called Evergreen Trading Strategies that Work in Every Market.

And it shows you, step by step, how to collect reliable gains (on about 80% of your trades) with any brokerage account.

I’d like to send this report to you right now so you can see for yourself.

But I need to inform you:

These options trades are not for everyone.

If you’re more interested in making big gambles and betting on your luck in the hopes of making 100% or more overnight…

Then this report is not for you.

It will bore you.

But if you want to learn how to make 10%+ monthly gains with statistically sound trades?

I will send you this report in the next 5 minutes.

The only thing I ask:

Take a risk-free trial to my brand-new options trading service.

It’s called Cabot Options Institute Quant Trader.

Click here to start your risk-free trial.

In this new service, I not only have a report on how to make these trades – I’m also starting up a model portfolio, where I’ll send out live trades of the three types of 10%+ monthly trades I’ve been talking about.

What can you expect?

I’ve just launched this service, and I can tell you it’s one of the most comprehensive options services in the market.

I think anyone with a brokerage account can benefit from my research… but this might not be the most beginner-friendly service.

To help you get started, I’ve also put together a special primer: Cabot Options Institute Quant Trader Guide.

This guide gives you a high-level view of the options world. Consider it a crash-course on getting started with options, with a glossary of terms, and some basic concepts to put you on sure footing.

I’d love to send you this guide so that you can learn from my 25+ years of experience as an options trader.

Yes… I’ve been doing this for my entire professional career.

And in the past, I’ve helped thousands of readers learn about these kinds of options trades.

I was even hired to go teach an options class in Chicago to a tiny group of high-net-worth investors.

And I’ve been writing about and trading options for nearly 3 decades.

In the past, I’ve been paid upwards of $300,000 a year for my research…

But today, to get access to all of my Quantitative options research –

Through this special charter offer, you’ll pay just $1,997 for a full year’s access to Cabot Options Institute Quant Trader.

That’s not all you’ll get though…

In addition:

Issues

Every Friday I will publish a weekly issue that discusses our open trades and how we plan to proceed going forward. Each weekly issue will include the companies that I plan to focus on plus several other trade ideas for those that wish to trade a bit more often on their own.

Member Calls

Every month, on the third Wednesday of the month (options expiration), we will get together for a live Member Call. In each Member Call we will discuss not only open trades, but potential trades as well.

These live Member Calls are my bread and butter – where I can give you true value and education so that you fully grasp my concepts and how to get the most out of your membership.

Alerts

You will receive email alerts when market or trade conditions warrant it; during each expiration cycle I will issue between 3-8 alerts using our risk-defined strategies.

Special Reports

Our catalog of Special Reports provides further options analysis that offers a deeper dive into trading strategies and tactics. Here you will find all of my step-by-step strategy guides for the strategies we use most frequently, plus the statistical approach I use around each and every trade.

24/7 Archives

Your subscription gives you access to our vast online library of analysis, including past weekly updates, reports, related Member Calls, and other educational content published by Cabot Wealth Network.

Direct Contact

Outside of our live Member Calls where you can ask as many questions as you would like, whenever you have an investment-related question, you can also email me directly. (I’ll send you my email address in the guide when you become a member.)

I pride myself in corresponding and interacting with my readers whenever they have any questions, comments, or concerns. No matter what’s going on, I am available for you as a resource.

I don’t think you’ll see this kind of “behind the curtain” information in any other service.

I reveal this information because I think the best way for you to succeed as a trader is to truly understand what you’re doing … and why …

You can, of course, just follow my trades and make reliable gains …

But once you understand exactly what I’m doing, I know you’ll be able to make even more gains for yourself. You’ll be able to open up your brokerage account to find your own 10%+ gains – any time. Any place.

With or without my help or trades.

You will discover a new skill that will last you the rest of your life. And this skill is something that you’ll have one year, five years, or two decades from now – whether you continue to be a reader of mine or not.

Why Give Away so Much?

I think the best way to create long-term value is for my readers to excel.

If I’m hiding my best ideas from you … you’re not going to excel. You might stay on for a year, but you won’t learn anything. Even if you make money just following my trades you probably won’t tell many people about me.

The dirty secret of investment research publishing is that we live or die on word of mouth and customer testimonials.

Readers who do “just OK” but never grow or excel? Well, they don’t tend to write very compelling testimonials or tell their friends, family, and neighbors about this great new thing they found.

But if I can help you become an expert-level options trader?

If I can I show you exactly how to make your own trades … to create your own gains … month after month?

I bet you’ll tell everyone you know.

Maybe a few people will take a look at my work – and become members themselves.

That’s how I like to do things, and I know it’s how Cabot likes to too.

So if you’re interested…

If you want to get my Cabot Options Institute Quantitative Strategy Guide and my report, Evergreen Trading Strategies that Work in Every Market…

All you have to do is take a trial membership to Cabot Options Institute Quant Trader.

As a member you will get all of my trade recommendations every single month.

Each trade will give you a statistically likely chance to easily earn hundreds of dollars in profit every month.

You can also opt in (for free) to get trade alerts direct to your phone…

AND access to my live portfolios and updates as needed.

For just $1,997.

I think if you’re making hundreds (or thousands) of dollars of extra profit every month, that’s a bargain.

But I also want to give you the best money-back guarantee I can.

I get that my options research may not be ideal for everyone.

Like I said: I want happy, prosperous readers who are succeeding.

If you find that my work is not right for you – I’d rather give you all of your money back and part on good terms.

That’s why Cabot has agreed on a 30-day money-back guarantee.

If you’re not completely satisfied with my work, my trades, my special reports or my strategy…

If you feel like you just can’t use my research for any or no reason…

You get a full 30 days to decide if you want, every dime, of your $1,997 back.

For me, it’s a matter of principle. I only think it’s fair to make this guarantee…

And if you decide it’s not a good fit, it’s all good.

Simply call our customer support team and they will send you a full refund, no questions asked!

If that sounds like a fair deal, and you want to start making hundreds or thousands in extra money every month, and you’re ready to start your journey to financial freedom…

Then all you need to do is join today for the special charter offer of $1,997.

I say “special” because I’ve certainly charged more than $1,997 for my research in the past. It’s likely that Cabot will want to raise the price in the near future.

And remember: You get a full 30 days to decide if my Quantitative option trades are right for you. That’s plenty of time to see the gains roll in. It’s entirely possible that you pay for your entire year of this service with just one trade…

The risk for me is that you take my Evergreen Trading Strategies that Work in Every Market and my Cabot Options Institute Quantitative Trader Guide, and you don’t need my trades.

But I think you’ll want to follow along for at least one year to make sure you’re truly getting it.

What else can I say?

I think if you take a risk-free trial membership to Cabot Options Institute Quant Trader, you’ll open up a whole new huge world of reliable trading.

You might even give up stock trading forever and just focus on these kind of trades…

All you have to do:

But I know if you read my reports and see my trades for yourself, you’ll agree this is simply the best way to make reliable gains from the market – no matter what is going on.

Click here to start your risk-free trial.

Your Guide to Options Trading,

Andy Crowder

Chief Analyst

Cabot Options Institute