Why the World’s Top VC Firms Invested over $33 Billion into Blockchain

Some of the world’s top venture capital and hedge funds are pouring billions into blockchain technology…they’re all-in on a specialized crypto opportunity that will revolutionize money as we know it.

Crypto is here to stay… but it’s just a tiny part of an entirely new “blockchain” technology that’s going to change the world in unexpected ways.

First, it’s indisputable that crypto has already changed the world’s monetary systems forever.

Even though President Joe Biden recently signed an Executive Order focusing on the regulation of crypto, that’s just confirmation of crypto’s dominance.

Presidents don’t sign Executive Orders lightly…

Some people will argue that they’re still a fad… but crypto is larger than the GDP of most of the world’s countries.

And Fortune Business Insights recently forecast a 58% annual growth rate for blockchain technology for the next 6 years…

But what most people don’t know, however, is currency is just one aspect of the market that is having a “crypto moment.”

Because it’s not just our money that is being disrupted by blockchain…

Medicine. Sales. Entertainment. Real estate. Manufacturing. Shipping…

Crypto vs. Blockchain: What’s the Difference?

Blockchain is simply the name given to the overall technology that powers cryptocurrencies. At its simplest, blockchain is just a digital kind of accounting, that shares information across many different users. There’s no “central” ledger: it’s shared between the user base.

That makes it wildly different from centralized systems, and extremely valuable because it can create and track transactions, show proof of ownership, and do so safely and MUCH more cheaply than traditional systems.

Blockchain is not just used for cryptocurrencies and has far-reaching applications for basically every aspect of modern life and technology.

All of these trillion-dollar sectors are going to be up-ended, improved, and democratized by the same technology that created Bitcoin.

And today I’m going to tell you about 3 of these crypto moments that you can buy and profit from for years to come – including the #1 crypto asset I think you should own right away.

And listen: I get that cryptocurrencies and blockchain seem complicated, or maybe even strange.

I think if you remember back in the early days of the internet, it too was kind of odd and didn’t seem very useful.

Most people couldn’t understand how a “gimmick” like electronic mail was worth making a fuss over.

But of course: the internet turned out to be more than email.

That’s the same path we’re on for blockchain.

Yes… we have cryptocurrency. But that’s just one tiny application out of many.

So, in this report, my goal is to demystify some of the oddities about blockchain – and focus on the real opportunities that I think will have the biggest profit impact in the near future.

Knowing the difference between the crypto fads and the real-world use-cases for blockchain could help make you very wealthy in the coming years.

I will show you the 3 kinds of blockchain assets you need to own today to benefit as blockchain becomes a dominant fixture all over the world.

How Blockchain Has Already Changed the World

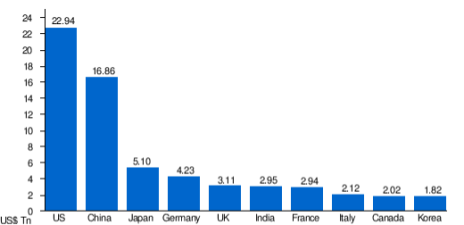

If cryptocurrency was a country, it would be the 11th largest in terms of GDP, right after Korea.

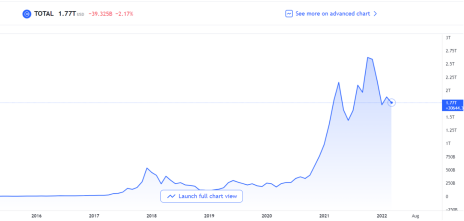

The total market cap of all cryptocurrencies is about $1.8 trillion.

That’s up from $250 billion just a couple years ago…

And it’s up from $20 billion in 2016.

The amount of money already in cryptos is so huge that it is now a fixture in the world economy.

There’s nothing you or I or the International Monetary Fund or the World Bank can do about it.

If you believe that Korea’s GDP is a real part of global finance, and that Korean currency will continue to exist, be traded internationally and be used to buy goods and services…

Then you must understand that cryptocurrencies are going to be around for the same reasons.

The idea that any individual state or central bank can now put the crypto genie back in the bottle is very unrealistic.

The time to stop worldwide currency adoption is before it becomes a currency adopted worldwide, not after!

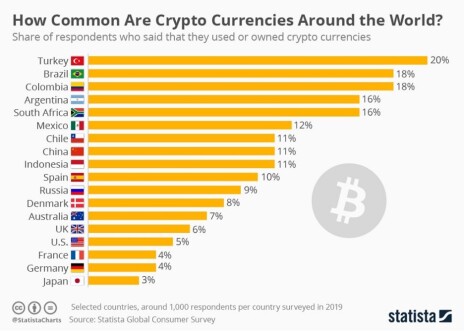

Today, many people in countries all over the world are adopting cryptocurrency themselves.

- In India over 100 million people own cryptocurrency, making it a de-facto backup to the rupee.

- In Turkey over 20% of the population owns some kind of crypto…

- Even in China, which banned some kinds of cryptos outright, has over 10% adoption…

But they’re not alone:

And you might look at that chart of global cryptocurrency value and think “well, it looks like the growth story is over.”

But the real opportunity is that no country on the planet has more than 20% crypto adoption… That means we have a huge growth opportunity because still… despite the massive gains in crypto, less than 10% of the world’s population owns any…

But there’s another story you haven’t heard about cryptocurrency.

And it might be the final opportunity to take advantage of growth in crypto.

Here’s why:

Crypto Moment #1: Breaking out of the Bank

Most cryptocurrencies that people buy are a kind of play on the weakness of centralized monetary systems.

Think, the dollar, the euro, the yen, etc.

These state-managed currencies are all basically guaranteed money losers if you hold them for any period of time.

That’s because the default setting for central banks is to devalue their currencies.

The Federal Reserve, for instance, has long targeted an inflation rate of 2% per year.

That means that keeping your cash in a bank account (where you won’t see anything close to 2% in interest) is a guaranteed way to lose.

Cryptocurrencies like Bitcoin and Ether aren’t being actively managed to devalue.

In fact, there are strict limits on how many Bitcoins will ever exist. Ether is a little different, but it too has limits on the number of coins.

That’s a huge advantage over central bank-managed currencies!

The problem is – if you want to benefit from holding Bitcoin, Ether, etc. – in most cases you need to transfer them back into a central bank currency.

- So you buy Bitcoin…

- Let it sit (hopefully rising in price)

- The dollar devalues…

- And then if you want to benefit from any appreciation, you need to sell your Bitcoin for dollars.

There’s a couple big problems with this arrangement.

The first problem: It triggers a tax event. Many crypto traders get into big trouble because they’ll have a huge capital gain on one crypto, and then buy another crypto that drops. They still have a massive tax bill from the capital gain…

The second problem is a little more serious… because it reveals that many of these cryptos aren’t currencies unto themselves. They’re almost acting like a derivative of central bank currencies.

The whole point of buying cryptos for these folks is to get money out of the inflationary central bank monetary system.

If you still need to access that monetary system… then you haven’t really broken out of it.

That brings me to a new kind of crypto that’s just starting to take off.

It’s a kind of crypto that CAN be transferred back into dollars or euros…

But it’s also part of an entirely new market ecosystem unto itself.

I call it The Reserve Currency of the Digital Age.

I’ve written a full report on this opportunity, and I’ll show you how to get it in a minute.

But I want you to understand the true magnitude of what’s happening.

The Dream of Crypto

First, think of the US dollar.

Ask yourself why it’s the “best” central bank currency.

- It’s not because it holds its value (it’s dropped 90%+ over the past 60 years).

- It’s not because it’s backed by anything.

- It’s not because the US government is being run by competent, careful stewards…

It’s because through treaties and market preference and a dozen other circumstances, it’s become the currency everyone agrees to use to buy oil and other valuable commodities.

That means that if you’re China or Brazil or Liechtenstein it doesn’t matter:

You need dollars to buy oil. So, every country on Earth needs to arrange their financial affairs to get their hands on dollars.

This might seem like a minor benefit, but it gives the US dollar a unique and powerful position in global finance.

It’s so important that it even has a name you’ve probably heard:

The petrodollar.

Without this unique arrangement, the dollar is just a dollar. It’s just another global currency.

But as the petrodollar, it has incredible value that goes beyond ordinary applications.

But what if you could own a cryptocurrency that was in a similar globally unique position:

- What if there was a crypto that was the ONLY way to buy certain assets?

- And what if this crypto also had an advantage over the dollar in that it wasn’t actively being devalued?

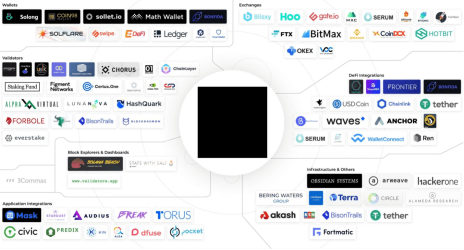

- What if this single crypto was at the center of dozens of online exchanges and applications?

The dream of crypto has always been that it turns into a standalone, self-sufficient currency OUTSIDE of central banks.

And today, there’s a very short list of cryptocurrencies that are making this dream a reality.

One specific crypto is now the only way to buy billions of dollars of online/digital assets.

I get into the nitty-gritty details of how this works in my report, but essentially, we already have the reserve currency of the digital age.

This currency is being used to buy and sell over $60 million in assets every day.

There’s no dollar middleman.

There’s no central bank involvement.

And already, this single currency sits at the middle of dozens of other online digital marketplaces.

It’s becoming exactly like the petrodollar except not just for one asset.

It’s already a vital, central part of digital transactions that every major crypto player needs to get their hands on in order to buy and sell hundreds of thousands of valuable online assets.

If you’ve heard of Non-Fungible Tokens or the Metaverse, those are two examples of the kind of assets I’m talking about. In many cases, the only way to buy NFTs or properties in the Metaverse is with this “digital reserve currency.”

And the opportunities are only getting bigger…

In fact, the New York Stock Exchange just announced it will launch digital assets that will benefit our digital reserve currency.

If you’re looking for a one-stop way to benefit not just from the growth of crypto, but from all blockchain progress, this is it.

And I’ve written a full report on how to own this valuable crypto.

It’s called The Reserve Currency of the Digital Age.

I simply can’t fit all the details of this opportunity in this short letter.

The truth is: there’s a key education aspect that you need to understand before you can grasp the magnitude of what’s happening.

That’s why my report isn’t just “buy this crypto, set it and forget it.”

I go into great detail about why this specific crypto is so important. I also give you the full rundown on exactly how to buy it and hold it.

These two facets are extremely important.

But if you can set up a brokerage account, you have the sophistication necessary to own this valuable crypto.

Ok, but who am I? And why should you listen to me when it comes to crypto or blockchain?

Your Personal Blockchain Expert

My name is Ian Beaudoin. I’ve been a crypto and blockchain investor since 2016.

That might not seem like long, but 2016 is ancient history in terms of blockchain.

The world of crypto alone has grown 10x since 2016.

That’s helped me rack up personal gains of:

8.5x my stake on Ether. I bought it in 2016, and it jumped from $400 to over $3,400 as of this writing...

And a 4.6x gain on a little-known crypto called FTT.

But I firmly believe these kinds of gains are just the beginning.

The people who “get” what’s happening next are going to see massive fortunes in the coming years.

I think back to the early days of the internet, because many people had an idea that it would be huge, but no one really understood exactly how.

That meant there were a lot of silly projects that failed…

And there were opportunities like Amazon, Ebay, PayPal, Apple, Microsoft, and on and on that turned even tiny stakes into massive fortunes.

And that’s exactly the place we’re in right now with blockchain.

There are silly projects out there that are going to fail.

But there are early opportunities that give you the chance at massive fortunes…

How can you tell the difference?

For starters, you need to start thinking about different blockchain applications more like you would traditional financial asset classes.

You have your monetary asset class in crypto, but that’s just one application.

Like I said, we’re looking at at least 3 crypto moments coming down the pike.

Besides the digital reserve currency there’s also the need for a massive new kind of infrastructure to make blockchain scale up.

Right now, there’s a massive and growing demand for blockchain that’s creating an expensive bottleneck…

That’s where most of my research is focused on right now.

Expensive problems make fortunes for the people who can solve them.

Crypto Moment #2: The Blockchain Bottleneck You Need to Know About

Remember the early days of the internet?

It was slow. It disconnected or timed out frequently.

That made it impossible to have much e-commerce.

The impediment to a “better” internet was the ability to improve speed, reliability and consistency.

People clearly wanted to interact and transact online – but the limitations of the early net made it difficult if not impossible.

As soon as the technology improved to make the internet fast and reliable enough, that’s when we saw the biggest growth.

Companies like Sun Microsystems, Oracle, Intel, and others literally had to build the machinery and software infrastructure to handle internet traffic and buildout capacity for billions of online connections and operations.

Oracle is still enjoying growth from its server and network solutions…

And it’s up over 149,000% from the early days of the internet in the late 1980s…

Intel is up over 19,000% in that same time:

These companies became the go-to solutions for the massive buildout of the internet. Without them, we’re still stuck on dial-up…

So where are we right now with blockchain?

The demand for blockchain is there… but the limitations of different networks… and how they interact… and how quickly individuals can connect and transact…

Well… to put it in internet terms, we’re still only barely coming out of the dial-up era.

But there’s a whole subset of solutions coming.

These are called “layer 2” applications.

Layer 1 is simple: it’s stuff like Bitcoin and Ether, as well as the digital reserve currency I mentioned.

Layer 2 is all of the behind-the-scenes tech making layer 1 work better, more efficiently, and more quickly.

Without layer 2, crypto can’t scale.

That’s because the more people involved in a network, the more computing power, the more energy and the more powerful the network needs to be.

You don’t have to understand how an Oracle server farm works in order to realize that it makes the internet faster and more reliable…

And you don’t have to understand how layer 2 can improve blockchain reliability, consistency, and speed to see that it’s a vital part of this growing opportunity.

But you should read my report on what layer 2 opportunities are worth your attention.

It’s called The Blockchain Bottleneck and I’d like to send this report to you immediately.

In my report, you’ll get an expert-level view of how these layer 2 solutions are paving the way for better blockchain: just like how Oracle and Intel made the internet faster and more reliable.

I’m really proud of this report, because I think it might be the only explainer for the layman to understand this vitally important opportunity.

It’s part of a much larger project I’ve been working on for the past year.

You see, Cabot Wealth Network has asked me to create their first-ever service dedicated to showing Cabot readers how to benefit from blockchain.

It’s called: Cabot SX Crypto Advisor.

As a Cabot reader, you know that the firm’s 50-plus year history puts it in rare company in the financial research world.

No other firm has the longevity and reputation of Cabot.

That’s why I’m thrilled to help Cabot readers navigate the somewhat complicated and murky waters of blockchain.

My goal is to make this service as accessible and useful as any other Cabot research service.

If you can’t use my research, it doesn’t matter how good it is…

That’s why I created a special part of Cabot SX Crypto Advisor dedicated to regular stocks that will benefit from blockchain developments.

This is the 3rd Crypto Moment (and You Can Buy it in a Regular Brokerage Account)

Think of them as the picks and shovels of the blockchain world. These companies don’t own, sell or manage cryptocurrencies or blockchain tech.

They simply sell the goods and services that make blockchain possible.

And I’ve created a special report all about this opportunity called Blockchain Blue Chips.

You can buy and sell these companies in any online brokerage. You don’t need a special wallet or app.

These are regular companies that manufacture the computer graphics cards necessary to mine cryptos…

Or the microchips that make layer 2 solution work possible…

Or the network firms that connect all blockchain participants through the internet…

Or even something as simple as clean-tech companies that offer cleaner energy solutions for blockchain miners and users.

And I give you the full details of these Blockchain Blue Chips in my report.

How can you get it?

Today, I think you have a rare and historical chance to get on board with blockchain right at the turning point – where it goes from dial-up to high speed.

Today. Not 12 months ago, or 2 years from now.

That’s why I’m launching a brand-new service as a part of Cabot’s specialized “Sector Xpress” suite…

What is Cabot’s “Sector Xpress” and how do I join Cabot Sector Xpress Club?

Most of Cabot’s services are focused on broad sectors of the market – like income, growth investing, small caps, or options trading.

But we understand that some of our readers want more specific, granular research with in-depth coverage on a narrow sector.

So, we created a special suite of services called “Sector Xpress” that are all singularly focused on one specific sector of the market.

Today, we have “SX” products focusing on cannabis, greentech, gold & metals – and now blockchain.

We recognize that more generally focused products just can’t give the kind of detailed analysis necessary to truly keep on top of these unique sectors, so these advisories allow you to really dig in.

As a special bonus, we’ve also created a special bundle to get all of our SX research—we call it Cabot Sector Xpress Club.

Read through to the P.S. below for more information…

It’s called Cabot SX Crypto Advisor.

I want to help as many Cabot readers as possible to have success in this space.

So, to help make this as easy as possible, I want to send you my 3 reports FREE – I just need a small favor.

I don’t want to send these reports out to everyone – only to people who are genuinely interested in getting on board with blockchain.

So, I just ask that if you want my free reports, you take a risk-free trial to Cabot SX Crypto Advisor.

Click here to try Cabot SX Crypto Advisor

Normally, a high-end service like Cabot SX Crypto Advisor would not be eligible for a trial offer. But I think if you see my research, and what is coming for the world of blockchain, you’ll be glad to stay on as a Charter Subscriber.

After all, I believe we have a decade (at least) of blockchain growth. You’ll want to be on board for years – not just the next 30 days.

The deal: normally, the price for a full year of Cabot SX Crypto Advisor is $1997. I think that’s an incredible bargain if you’re in on the ground floor of blockchain opportunities that could multiply your wealth many times over…

But for a limited time, you can take a trial offer for a massive discount – as a special “Charter member” only deal.

Instead of paying $1997 for a full year, you can become a full member at a 50% discount.

That means you only pay $997 today and you receive everything I’ve mentioned…

And if within the first 30 days you’re not completely, 100% satisfied with my work – just let us know and you’ll get a full refund.

This is the first time I’ve brought my blockchain research to the public, but I’m comfortable giving you the next 30 days to try out Cabot SX Crypto Advisor – and if you’re not happy, you get your money back and we part as friends.

No matter what happens, you keep my reports:

To recap, here’s what you get as a subscriber to Cabot SX Crypto Advisor if you claim this offer today:

- Regular monthly issues of Cabot SX Crypto Advisor delivered to your inbox – as well as weekly updates and trade recommendations as needed. You’ll receive portfolio guidance and new recommendations for action to take.

- Bonus Report #1: The Reserve Currency of the Digital Age—a brand new digital marketplace is emerging, and one major cryptocurrency appears to be the new “reserve” for the millions of market participants buying and selling… Learn how to own this crypto to benefit from this new marketplace…

- Bonus Report #2: The Blockchain Bottleneck—find out how to profit from layer 2 solutions that will open up blockchain to faster and faster adoption, creating massive growth for decades to come.

- Bonus Report #3: Blockchain Blue Chips—the easiest way to profit from the blockchain revolution is to own these regular pick and shovel companies that make blockchain possible. Buy them with any regular brokerage account as soon as you become a member…

- A full 30-day money-back guarantee to read all my blockchain research to see if it’s right for you.

If that sounds good to you – all you have to do is click the link below and fill out the brief order form.

But please don’t sleep on this decision. This Charter Subscription offer will not last.

Don’t miss out on this discount:

CLICK HERE TO GO STRAIGHT TO THE SECURE ORDER FORM

Sincerely,

Ian Beaudoin

Chief Analyst

Cabot SX Crypto Advisor

P.S. Please act today and take advantage of this limited-time Charter Subscription offer for Cabot SX Crypto Advisor —and get three groundbreaking reports for FREE. Click here to claim your deal!

P.P.S. As I mentioned, Cabot SX Crypto Advisor is a part of Cabot Sector Xpress Club. Through this special Charter offer, you can get ALL of Cabot’s SX research for a massive discount.

If you bought each SX service individually, it would cost you over $4,000 – but through this offer, you can upgrade your Cabot SX Crypto Advisor membership to the Cabot Sector Xpress Club, and get all of our Sector Xpress research for just $1,247—only $250 more…

Cabot SX Gold & Metals Advisor: Twice-monthly advisory about the best and latest gold and metals stocks you should consider for your investing strategy. You get full, immediate, and ongoing access to our portfolio with all of our current recommendations. Plus, weekly updates and alerts about our current stock picks and the latest market conditions. Chief Analyst Clif Droke is available to answer your specific questions about gold and metals investing!

Cabot SX Greentech Advisor: Published twice a month with specific advice and stock recommendations in the clean-and-renewal-energy sector, plus other green-economy stocks set to soar. You get full, immediate, and ongoing access to our portfolio with all of our current recommendations. Plus, weekly updates and alerts about our current stock picks and the latest market conditions. Chief Analyst Brendan Coffey is available to answer your specific questions about greentech investing!

Cabot SX Cannabis Advisor: As marijuana becomes increasingly legal in both the U.S. and abroad, it makes sense for growth-oriented investors to pay attention to cannabis stocks. The opportunities are much bigger than most investors realize and Chief Analyst Timothy Lutts will guide you through the best ones to buy—and when to buy and sell them in this monthly publication.

Membership Calls: Claim your invitations to our regular Cabot Sector Xpress Club calls and hear from our top sector-specific investing analysts about the current state of the market. For members only—and conducted online so you can attend from anywhere!

P.P.S. Don’t forget: Your subscription is guaranteed 100%. If you’re not satisfied with our recommendations or your investment results in the first 30 days, just let us know. We’ll refund your entire subscription fee.