This month, I introduce a new stock that has outshined most stocks in the retail sector. The company will add 100 new stores in 2017, which will surely add significant growth, but there’s much more to the story. Today’s issue describes how this specialty retailer has thrived in a difficult sector.

Benjamin Graham Enterprising 274E

Benjamin Graham is called The Father of Value Investing. His influence has inspired many successful investors, including Warren Buffett.

[premium_html_toc post_id="133973"]

AAA Stocks Soar

Large-cap growth stocks, especially technology stocks, have been red hot so far in 2017. Other stocks, though, have been left far behind. Some stocks that received big bumps in November and December have now fallen on hard times.

Alphabet, Amazon and Apple—the AAA stocks—have soared an average of 26.5% in 2017. Compare this to a gain of only 7.2% for the S&P 500 Index and a disappointing 2.9% increase by the S&P 500 Value Index. Value stocks performed very well in November and December, but the Trump rally has fizzled for value stocks in 2017.

Recent performance for value stocks Chicago Bridge & Iron, Greenhill, Triumph and Maiden Holdings has been discouraging. These and other value stocks will likely bounce back with a vengeance if President Trump and Congress can produce some satisfactory results regarding tax cuts, infrastructure spending and regulation reform. Until then, value stocks could continue to underperform large-cap growth stocks.

My new stock in this month’s Cabot Enterprising Model is a company in the retail industry that has avoided Amazon’s dominance. Specialty retailer Five Below (FIVE) sells low-priced merchandise at bargain prices and is faring quite well. FIVE joins my Cabot Value Model because the company is growing very rapidly based on its trendy merchandise for children and young adults. The stock isn’t cheap, but FIVE could easily follow in the footsteps of the AAA stocks.

“I call investing the greatest business in the world … because you never have to swing. You stand at the plate, the pitcher throws you General Motors at 47! U.S. Steel at 39! and nobody calls a strike on you. There’s no penalty except opportunity lost. All day you wait for the pitch you like; then when the fielders are asleep, you step up and hit it.” —Warren Buffett

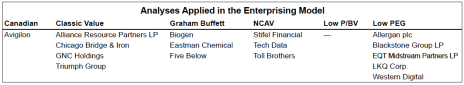

Cabot Enterprising Model

My Enterprising Model is composed of 16 stocks, which I have selected by using one of six analyses. The analyses I utilize are Undervalued Canadian, Classic Value, Graham Buffett, Low NCAV, Low P/BV and Low PEG. The Model is well diversified, represents many industry sectors, and is composed of stocks of undervalued companies that are expected to produce consistent growth. The analysis used to select the each Enterprising Model stock is included in each summary and in the Analyses table below. For additional details, please email me at roy@cabotwealth.com.

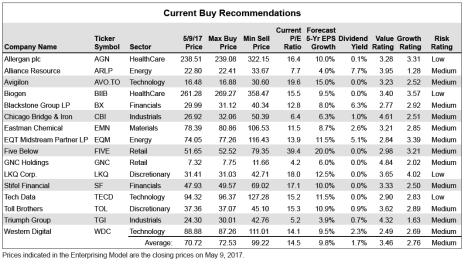

Usually stocks in the Enterprising Model are purchased at their current prices, but because of the current stock market volatility, I now recommend that Enterprising Model stocks be purchased at or below my Maximum Buy Price. Enterprising Model stocks should still be sold at their Minimum Sell Prices. For an explanation of how my Max and Min Prices are calculated, you may email me at roy@cabotwealth.com.

Model Buy Recommendations

The Enterprising Model on page 3 contains 16 stocks with one new stock: Five Below (FIVE). One stock transitions out of the Model: Ulta Salon (ULTA).

Ulta is now listed on page 7 in the table of Hold and Sell Recommendations. Ulta remains an excellent investment, and should continue to be held. Keep your “Hold” stocks until your selection reaches its Min Sell Price, at which time I will issue a sell alert by email, in the Value Investor or Enterprising issues or in the Weekly Update. I will also indicate that you should sell when a disappointing performance or adverse condition affects any company.

In my May 10 Special Report, I recommended that you sell Lear (LEA) and Penske Automotive (PAG) now. Lear is an Enterprising Model stock and Penske is a Value Model stock. Both companies operate in the automotive sector, which has peaked.

All Enterprising Model stocks in the Enterprising Model are now recommended to be purchased at or below their Max Buy Prices – the same as Cabot Value Model stocks. Enterprising Model stocks should be sold when they achieve my Min Sell Price.

Because I use six different analyses to find stocks for the growth-oriented Enterprising Model, these stocks are quite different from the stocks in the conservative Cabot Value Model. I base my choices for Enterprising stocks on favorable shorter-term market and sector trends and find a variety of stocks in many sectors. In addition, I have not applied my defensive risk allocation, which I apply to my Cabot Value Model, because the objective of the Enterprising Model is to provide choices to help you diversify your portfolio. Enterprising Model stocks carry more risk than Cabot Value Model stocks.

Prices indicated in the Enterprising Model are the closing prices on May 9, 2017.

Alliance Resource Partners LP (ARLP) Industry: Energy–Coal & Consumable Fuels; Medium Risk; 7.7 Yield; Classic Value Analysis

Alliance Resource Partners LP (ARLP: Current Price 22.80; Max Buy Price 22.41) produces and markets coal, largely to utilities and industrial users in the U.S. The company produces a range of steam coal with varying sulfur and heat content. Alliance Resource Management GP, LLC serves as the general partner of the company. ARLP is a master limited partnership, founded in 1971 and headquartered in Tulsa, Oklahoma.

Alliance’s mining activities are conducted in two geographic areas: the Illinois Basin and the Appalachian region in Illinois, Indiana, Kentucky, Maryland and West Virginia.

Coal production in the U.S. fell 18% in 2016 while stockpiles decreased 25 million tons. Growing demand from foreign buyers is encouraging, which has led to higher demand for coal from U.S. miners, including Alliance Resource.

President Trump signed a measure that rolls back a rule aimed at stopping the coal mining industry from dumping waste into nearby waterways. The President and Congress will likely ease additional rules that hamper the coal mining industry.

Alliance reported exceptional first-quarter sales and earnings. Sales surged 12% and EPS tripled. Higher coal volumes from new contracts, cost cuts and improved mining efficiency bolstered results. Management forecast strong growth during the remainder of 2017 and hinted at higher dividends. The master limited partnership currently distributes well-covered dividends yielding 7.7%.

Forecasts for 2017 earnings per share are rising fast and now stand at $3.25, an increase of 25%. Sales will likely rise 10%. Alliance paid down considerable debt in 2016 and the first quarter of 2017, and now boasts a strong balance sheet. The current price-to-book-value ratio is 1.45 and current price to cash flow is 2.9, well below peer valuations.

I expect ARLP to surge 48% and reach my Min Sell Price of 33.67 within two years. Buy at or below 22.41.

Avigilon (AVO.TO) Industry: Industrials–Security Systems; Medium Risk; No Dividend; Undervalued Canadian Companies Analysis

Avigilon Corp. (AVO.TO: Toronto Stock Exchange Current Price 16.48; AIOCF: U.S. Over-the-Counter Current Price 11.95) is a leading designer, manufacturer and marketer of network-connected video surveillance systems, surveillance cameras and video analytics (software that scrutinizes video input). Customers include police departments, schools, hospitals, prisons, airports and public transportation systems. Avigilon provides the security video systems for San Diego’s public transit system, Toronto’s Rogers Centre stadium, the entire University of Tennessee campus and many other venues. Avigilon is headquartered in Vancouver, British Columbia.

Avigilon’s research goal is to upgrade surveillance cameras to high-definition quality, enabling customers such as retailers and governments to protect against theft or terrorism by providing detailed images usable in court or usable by facial recognition software. The company’s cameras can identify faces and license plates from 46 meters (150 feet) away.

Management plans to continue growing sales, but with a “stronger focus” on increasing profitability. Avigilon sales have been strong during the past five years, but earnings have been lagging. Now, the company’s earnings will likely grow at a much livelier pace.

Avigilon also successfully introduced new lower-priced surveillance systems and lowered the prices of older high-priced systems. This strategy created noticeably more sales volume, as Avigilon begins to take significant market share from larger rivals. Avigilon’s new earnings growth path has helped propel the company’s stock price substantially higher during the past six months.

Avigilon boasts a strong balance sheet with modest debt and strong cash flow. The current 19.6 P/E (price-to-earnings ratio), based on 2017 EPS, is easily justified by Avigilon’s growth prospects. The company is scheduled to report first-quarter results on May 15.

The sharp fluctuations in AVO.TO’s stock price are unnerving, but the wide swings provide profitable opportunities for nimble traders. For longer-term investors, the current price offers an excellent entry point to buy an exciting company in the rapidly growing surveillance sector. I expect AVO to rise 86% and reach my Min Sell Price of 30.60 on the Toronto Stock Exchange or 22.19 on the U.S. Over-the-Counter market within two years. Buy Avigilon at or below 16.88 on the Toronto Stock Exchange (AVO.TO) or 12.24 on the U.S Over-the-Counter market (AIOCF).

Five Below (FIVE) Industry: Retail–Specialty Stores; Medium Risk; No Dividend; Graham- Buffett Analysis

Five Below (FIVE: Current Price 51.65; Max Buy Price 52.52) is a specialty value retailer offering merchandise marketed to teen and pre-teen customers in the U.S. The company offers products priced at $5 or below, including select brands and licensed merchandise across a broad range of categories, which it refers to as worlds: Style, Room, Sports, Media, Crafts, Party, Candy and Seasonal.

Five Below offers a wide variety of merchandise that includes sporting goods, games, fashion accessories and jewelry, hobbies and collectibles, bath and body, candy and snacks, room décor and storage, stationery and school supplies, video game accessories, books, DVDs, iPhone accessories, and novelty and seasonal items. Five Below is headquartered in Philadelphia, Pennsylvania. As of May 5, 2017, the company operated 555 locations in 31 states. The stores average 8,000 square feet and are typically located in shopping centers.

Five Below is expanding rapidly by opening lots of new stores. The company’s 2017 plans include 100 new stores that will extend into new markets, including California. In addition, TV advertising will be increased and e-commerce on the company’s website will be enhanced.

For the 12 months ended January 31, 2017, sales surged 20% and EPS jumped 24%. Similar growth is also forecast for the next 12 months. Five Below’s outstanding performance stands out in the retail sector. The company is not Amazon-proof, but young shoppers are attracted to the trendy bargain-priced merchandise for $5 or less at their favorite mall.

Five Below shares are not bargain-priced, however. With a P/E of 39.4 times latest 12-month EPS, FIVE sells at a 10% lower multiple than Ulta Beauty, which sports a P/E of 43.5. Both retailers are expected to grow earnings at a torrid 20% pace during the next five years, and neither pays a dividend. Five Below is expected to report first-quarter results on June 5.

FIVE will likely climb 54% to my Min Sell Price of 79.35 during the next one to two years. Buy at 52.52 or below.

GNC Holdings (GNC) Industry: Retail–Specialty Stores; Medium Risk; No Dividend; Classic Value Analysis

GNC Holdings (GNC: Current Price 7.32; Max Buy Price 7.75) is the leading retailer of health and wellness products. GNC’s offerings include vitamins, minerals and herbal supplements, sports nutrition and diet aids. GNC sells its products through company-owned and franchise stores, e-commerce and corporate partnerships.

As of March 31, 2017, GNC had 3,499 retail stores in the U.S. and Canada, 1,164 U.S. franchise locations, 2,371 Rite Aid franchise store-within-a-store locations and 1,949 international stores. GNC also distributes through Sam’s Club and PetSmart. The company has a total of 8,983 store locations worldwide, a decrease of 36 stores from six months ago.

GNC plans to increase the proportion of stores operated by franchisees by opening new franchise stores and converting 200 company-owned stores to franchise-owned stores in 2017. The company is also interested in creating higher industry standards for quality and compliance throughout the dietary supplement industry.

Weak sales and earnings have caused GNC’s stock price to plummet from a high of 61 at the end of 2013 to the current 7.32. Increased competition and scrutiny related to product safety and efficacy continue to beleaguer the company. Sales and earnings will continue to fall during the first half of 2017 but management’s efforts should produce positive growth in the latter half of 2017.

GNC management’s turnaround program includes a new loyalty program, an increased e-commerce presence and higher marketing expenditures. First-quarter sales dipped 4%, EPS plunged 49% and same-store sales slipped 3.9%. On the brighter side, management said it added five million users to its newly launched My GNC Rewards program, which helped to generate 9% more transactions per store. Management’s decision to lower prices across the board pushed average transaction amounts down 12%.

GNC Holdings’ shares are dirt cheap. At 4.2 times current EPS and 3.1 times cash flow, the stock is the most undervalued stock in my 1,000-stock database. Buying the stock now will be akin to catching a falling knife, but if management can show slight improvements, GNC’s stock price should surge. President Trump’s tax plan could provide a significant boost to earnings if implemented. GNC’s income tax rate is a hefty 35%. I expect GNC to rise 59% to my Min Sell Price of 11.66 within two to three years. Buy at 7.75 or below.

Triumph Group (TGI) Industry: Industrials–Aerospace & Defense; Medium Risk; 0.7% Yield; Classic Value Analysis

Triumph Group (TGI: Current Price 24.30; Max Buy Price 30.01) makes a wide variety of structural products for military and commercial aircraft, and designs, manufactures and retrofits a variety of aircraft components. The company serves a broad, worldwide spectrum of the aviation industry, including original equipment manufacturers of commercial, business and military aircraft and aircraft parts suppliers, as well as commercial and regional airlines and air cargo carriers. Triumph was founded in 1993 and currently resides in Berwyn, Pennsylvania.

Sales and earnings have suffered during the past 18 months because production at Boeing, Airbus and Gulfstream for older aircraft slowed. New management is implementing a plan to downsize the company’s manufacturing operations, improve efficiency and cut costs. Several aircraft makers will begin work on new aircraft in 2017, which will provide a boost to sales for Triumph. The company also won a new contract from Raytheon.

A news article in the May 9 Wichita Eagle newspaper revealed that Triumph filed an amended credit agreement that “provides the company’s Vought Aircraft Division … with the option, if necessary, to commence voluntary insolvency proceedings within 90 days.” A Triumph spokesperson explained that a voluntary insolvency proceeding is just one of several possibilities under consideration and no decisions have been made.

Triumph is in a battle with Canadian business jet maker Bombardier over uncompensated cost overruns. The threatened insolvency of one of Triumph’s subsidiaries, Vought, could be a negotiating tactic to win a favorable settlement. The news sent TGI stock price down 11% during regular hours on May 10.

Sales will likely slip another 4% during the next 12 months because of Triumph’s ongoing downsizing. EPS will rise 5% to $4.50 spurred by management’s new plan to streamline operations throughout the company. A corporate income tax cut by the new Republican administration could propel earnings considerably higher. The company’s current tax rate is 30%.

TGI sells at only 5.2 times current EPS and 3.2 times cash flow, which is extremely low. Triumph will report first-quarter results on May 24. I expect TGI to advance 76% and reach my sell target of 42.76 within two years. Buy at 30.01 or below.

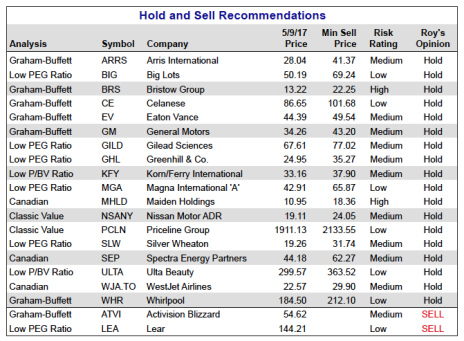

Hold and Sell Recommendations

The stocks in the table below were previously recommended in the Cabot Enterprising Model and are recommended to be held until their stock prices rise to my Min Sell Prices.

Sell Changes

I have two sell recommendations.

Activision Blizzard (ATVI 54.62) eclipsed 50.00 and is now overvalued despite not reaching my Min Sell Price of 58.33. Analysts have lowered their first-quarter EPS forecast to $0.22 from $0.32 during the past 90 days, and also reduced their 2017 estimate to $1.95 from $2.09. ATVI shares now sell at 25.6 times 2017 EPS estimates, which is well above its 10-year average P/E of 18.3. I advise taking advantage of the recent strong rally in ATVI to sell at the current high price. Sell ATVI now.

Lear (LEA) Auto parts makers are being adversely affected by the beginning of the decline in auto sales. In my Special Report, “Has the Auto Industry Peaked?”, I provided my reasons why the auto industry and auto parts stocks look weak. To read to my report, go to the Strategy section of the Cabot Benjamin Graham Value Investor page on cabotwealth.com or click here (https://cabotwealth.com///topics/value-investing-topic/special-report-stocks-buy-stocks-hold-stocks-sell/). My conclusion is to Sell LEA now.

Buy and Hold Changes

I have one new change.

Ulta Salon Cosmetics (ULTA) Buy to Hold. The stock’s recent rise places it out of buying range. I recommend waiting for another pullback before buying ULTA. Hold.

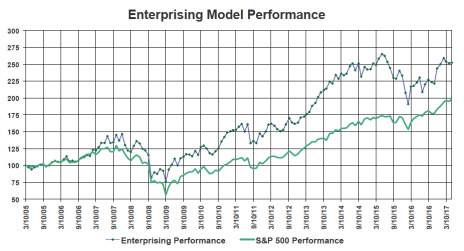

Enterprising Model Performance

After rising sharply after the U.S. Presidential election, value stocks have temporarily fallen out of favor. During the four weeks ended May 9 2017, the Enterprising Model advanced 0.34% compared to an increase of 1.83% for the S&P 500 Index. Performance was dragged down by Chicago Bridge, Silver Wheaton, and Triumph.

The Model is up 13.2% during the past 12 months compared to an increase of 15.0% for the S&P 500. During the past five years, the Model has advanced 64.1% compared to an increase of 77.3% for the S&P 500.

Since inception on March 10, 2005, the Enterprising Model has provided an impressive return of 152.5% compared to a return of 98.6% for the S&P 500 Index.

[premium_html_footer]

Send questions or comments to roy@cabotwealth.com.

Cabot Benjamin Graham Value Investor • 176 North Street, Salem, MA 01970 • www.cabotwealth.com

Cabot Benjamin Graham Value Investor is published by Cabot Wealth Network, independent publisher of investment advice since 1970. Neither Cabot Wealth Network nor our employees are compensated by the companies we recommend. Sources of information are believed to be reliable, but are in no way guaranteed to be complete or without error. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on the information assume all risks. © Cabot Wealth Network. Copying and/or electronic transmission of this report is a violation of U.S. copyright law. For the protection of our subscribers, if copyright laws are violated, the subscription will be terminated. To subscribe or for information on our privacy policy, call 978-745-5532, visit https://cabotwealth.com// or write to support@cabotwealth.com

We appreciate your feedback on this issue. Follow the link below to complete our subscriber satisfaction survey: Go to: www.surveymonkey.com/bengrahamsurvey

[/premium_html_footer]