This month’s Cabot Value Model contains a diversified list of high-quality Buy recommendations. Many of these companies have been neglected by investors in 2017 and are now poised to rise dramatically. Buying blue-chip companies seems prudent when the stock market is noticeably overvalued!

Cabot Benjamin Graham Value Investor 277

Benjamin Graham is called The Father of Value Investing. His influence has inspired many successful investors, including Warren Buffett.

[premium_html_toc post_id="137024"]

Patient Value Investors Will Be Rewarded

So far, 2017 has been a bummer for value stocks. Cabot Value Model stocks have gained only 8.78% in 2017 compared to the S&P 500’s gain of 10.34%. Fellow value investor, Warren Buffett, has pushed his Berkshire Hathaway ahead by only 7.65% in 2017. The value and growth indexes paint an even more surprising picture. Vanguard’s Growth ETF (VUG) has soared 17.14%, year to date compared to the Vanguard Value ETF (VTV) paltry advance of 5.67%.

Part of the problem for value stocks might be the lack of progress in President Trump’s policies. Back in November, value investors hoped that the President’s bold new agenda would be highly favorable for value stocks in the infrastructure, financial and energy industries. The lack of progress in Washington has weighed heavily on value stocks, while growth stocks have performed well, bolstered by an improving economy and higher earnings.

The huge difference in growth and value stock performances will not continue forever. Growth stocks are considerably overvalued, whereas value stocks are clearly undervalued. The pendulum could swing the other way soon. August is traditionally a weak month for stocks, and September tends to be even worse. I will be looking for a mild correction in growth stocks with rotation into value stocks. I expect patient value investors will be rewarded between now and the end of the year!

This month’s Cabot Value Model contains a wide variety of stocks as usual, with a slight focus on companies in the technology and financial sectors. This month’s Buy recommendations include conservative stocks that will perform well if the stock market falters a bit during the next couple of months. Patient value investors will benefit handsomely!

“Even the intelligent investor is likely to need considerable willpower to keep from following the crowd.” — Benjamin Graham

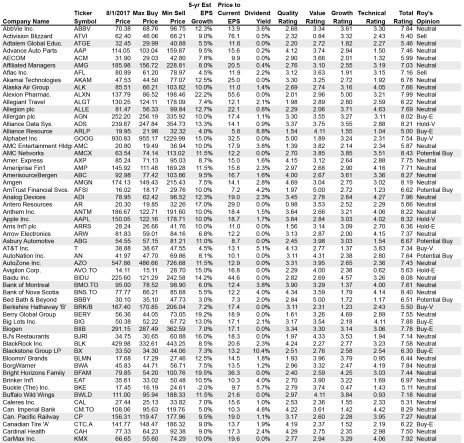

CABOT VALUE MODEL

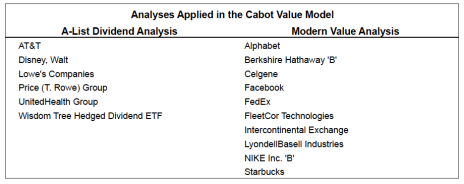

The Cabot Value Model applies A-List Dividend and Modern Value Model analyses.

The stock choices using the A-List Dividend analysis meet the following criteria:

(1) Dividend increases every year for 25 years or 10% dividend increases every year for 10 years

(2) Standard & Poor’s Quality Rating of A+, A, or A-

(3) Dividend yield is 1.0% or higher

(4) Dividend payout ratio is less than 50%

The Modern Value analysis uses a system initially developed by Benjamin Graham and Dr. Wilson Payne in 1946, and later modernized and enhanced by J. Royden Ward. The analysis uncovers undervalued stocks of well-known, high-quality companies which have recorded steady earnings growth. Ward’s Modern Value analysis is similar to the approach used by Warren Buffett.

When the market is low and undervalued, the Cabot Value Model will hold 75% moderately aggressive stocks and 25% conservative, counter-cyclical stocks, bonds or ETFs. When the market is high and overvalued, the Model will hold 25% moderately aggressive stocks and 75% conservative, counter-cyclical stocks, bonds or ETFs.

Buy Recommendations

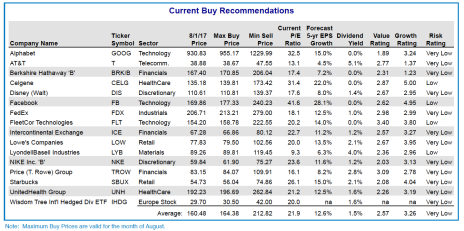

The Cabot Value Model contains 16 securities this month with one new stock: Facebook (FB). One stock transitions out of the Model: Alliance Data Systems (ADS).

Alliance Data is now listed in the table of Hold and Sell Recommendations. The table shows my Hold/Sell Opinions for these securities and previous recommendations that have transitioned out of the Model. My Hold recommendations remain excellent investments. You should continue to hold your stocks and ETFs until your selection reaches its Min Sell Price, at which time I will issue a sell alert. I will also issue a sell alert when a disappointing performance or adverse condition affects any company or ETF.

Currently, two stocks in the Cabot Value Model are priced slightly above their Max Buy Prices. Before buying Cabot Value Model stocks, you should wait until the price of the stock decreases to or dips below its Max Buy Price.

Defensive Securities: This month’s allocation for the Value Model remains at Level 5, which calls for a mix of four stocks and 12 defensive positions. The defensive or protective portion of the Model is composed of stocks, ETFs, bonds and cash, and is fulfilled by AT&T, BRKB, DIS, FDX, GOOG, ICE, IHDG, LOW, NKE, SBUX, TROW and UNH.

My objective for portfolio allocation is to increase the defensive holdings in the Model when the market rises and becomes overvalued, and decrease the defensive holdings in the Model when the market declines and becomes undervalued. I believe my strategy of increasing or decreasing the number of defensive positions will help you reduce your risk and enhance your profits.

The Dow Jones Industrial Average, at 22,016, is slightly above my peak Minimum Sell Price target of 21,895 indicating that the stock market is overvalued. My current allocation of four stocks and 12 defensive positions for Level 5 will not change if the stock market climbs higher. If the Dow falls to 20,226, my allocation mix will change to Level 4: six stocks and 10 defensive positions.

AT&T (T) Industry: Telecommunications–Integrated Telecom Services; Very Low Risk; 5.1% Yield; A-List Dividend Analysis

AT&T, Inc. (T: Current Price 38.88; Max Buy Price 38.67) is the largest telecommunications company in the U.S. and one of the largest in the world. The company’s AT&T Mobility division provides the largest wireless service in the U.S. In July 2015, AT&T purchased satellite TV operator DirecTV for $48.5 billion. DirecTV propelled AT&T to the highest position in the U.S. pay-TV market.

AT&T’s purchase of DirecTV is a game-changer. Through DirecTV’s massive customer base, AT&T is attracting many new users to its wireless business. The merger will provide $2.5 billion ($0.40 per share) of cost synergies annually starting in 2018. The company’s DirecTV-Now introduced a video streaming service over the internet that offers HBO, Cinemax, ESPN and other television programming. DirecTV-Now requires neither set-top boxes nor satellite dishes. The new streaming service serves every segment of the streaming video industry and offers customers content at any time and in any location. The service competes with Dish Sling TV, Hulu and PlayStation Vue.

AT&T’s recent $18 billion purchase in government auctions included significant radio spectrum that will enable the company to pursue new business in the fast-growing Internet of Things market, where objects can be sensed and controlled remotely across existing wireless infrastructure.

AT&T boasts the fastest internet speeds in the U.S. via its 4G network, which reaches over 350 million customers. Recently, the company announced plans to expand its super-fast fiber optic broadband service, GigaPower, to 38 additional cities, tripling its city locations. The fiber optic network is becoming the most sought-after technology for secure and fast data transmission. The company also bought wireless assets in Mexico with plans to greatly expand its telecom business in Mexico and other Latin American countries.

AT&T reported strong second-quarter results. Sales dipped 2% but EPS climbed 10% as the company’s bundled phone, TV and internet service attracted customers despite stiff competition. AT&T lost another 199,000 video customers in the U.S., though its new DirecTV Now streaming service gained 152,000 subscribers to finish the quarter with 491,000 accounts.

AT&T is waiting for government authorities to approve its proposed purchase of Time Warner. If successful, the acquisition will add CNN, HBO and the Warner Bros. film and TV studio to AT&T’s portfolio. The deal, valued at $85 billion is due to close in the fourth quarter.

Sales and EPS will likely advance 2% in 2017 before accelerating thereafter. The company’s balance sheet is strong, and my risk rating for AT&T is very low risk. The company, a Dividend Aristocrat, has increased its dividend for 33 consecutive years. The company’s increase at the beginning of 2017 now provides a generous 5.1% yield.

At 13.1 times current EPS and at only 5.5 times cash flow, AT&T shares are a bargain. AT&T’s stock price will likely climb 22% and reach my 47.55 sell target within 12 to 18 months. Buy at 38.67 or below.

FedEx (FDX) Industry: Industrials–Air Freight & Logistics; Very Low Risk; 1.0% Yield; Modern Value Analysis

FedEx (FDX: Current Price 206.71; Max Buy Price 213.21), based in Memphis, Tennessee, provides transportation, e-commerce and business services to businesses and individuals. The company offers domestic and international shipping services for delivery of packages and freight via ground or air transportation. FedEx Office, formerly Kinko’s, provides business services such as printing, copying and sign and banner making to customers and serves the company’s own needs.

FedEx’s purchase of TNT Express, the Netherlands-based carrier with operations throughout the world, is benefiting FedEx. The acquisition is providing a pan-European road network that will greatly expand FedEx’s share in Europe’s growing cross-border e-commerce market. FedEx’s new European operations recently suffered a cyber-attack. Repairs are costly and are taking longer to rectify than initially expected. The company’s computer systems will likely resume normal operations soon. Strong e-commerce sales in the U.S. continue to significantly bolster FedEx’s sales and earnings results.

The company will retire 15 aircraft and modernize its fleet. FedEx will buy 50 additional 767-300F aircraft from Boeing. The purchase will upgrade the company’s aircraft fleet and expand its capacity in anticipation of higher growth.

Amazon, one of FedEx’s largest customers, is beginning to develop its own transportation system in-house. Amazon, though, is one of the least profitable customers for FedEx because Amazon’s size enables it to negotiate big discounts. FedEx could replace Amazon’s volume with lucrative deals with smaller retailers with expanding e-commerce sales.

FedEx reported excellent results for the quarter ended May 31. Sales surged 21% and EPS jumped 29%. Revenue and earnings benefited from higher base rates, increased volume, continued cost management and the inclusion of TNT Express. Management provided a robust outlook for the next 12-month period. As a result, analysts raised their forecasts for the company’s fiscal year ending May 31, 2018.

I expect sales to rise 9% and EPS to climb 14% during the 12 months ending August 31, 2017. At 18.1 times latest 12-month EPS, and with current cash flow exceeding $23 per share, FedEx offers investors a great opportunity to participate in the escalating e-commerce shipping segment. The company’s dividend, recently increased, provides a respectable 1.0% yield. I am confident that FDX will advance 35% to my Min Sell Price of 279.00 within 12 to 18 months. Buy at 213.21 or below.

LyondellBasell Industries NV (LYB) Industry: Materials–Commodity & Chemicals; Low Risk; 4.0% Yield; Modern Value Analysis

LyondellBasell Industries NV (LYB: Current Price 89.26; Max Buy Price 89.81), based in Rotterdam, The Netherlands, is one of the largest plastics, chemicals and refining companies in the world. Lyondell produces and markets olefins and other petroleum-based products. These include ethylene and ethylene components, which are used in many segments of the economy, such as the manufacture of consumer goods; packaging, housing and automotive components; and other durable and perishable goods. Lyondell’s refining segment is a significant producer of gasoline and diesel fuel and gasoline blending components.

Falling oil prices negatively impacted sales and earnings during the past two years. Future results will be aided by increasing global demand for petrochemicals, and more favorable raw material costs from increased U.S. natural gas supply. LYB’s investments in high return projects will drive EPS growth, while cost cuts and operational improvements will provide additional gains.

LyondellBasell recorded excellent second-quarter results. Sales advanced 15% and EPS climbed 10%. Ethylene production surged 27% and oil refining volumes jumped 45% from a year ago. Lyondell increased its quarterly dividend to $0.90 per share from $0.85. LYB’s dividend yield is now 4.0%.

Sales will likely increase 3% and EPS will rise 4% to $10.00 in 2017. A pickup in the U.S. economy, increased infrastructure spending, and the possibility of lower corporate tax rates could enable sales and earnings to grow much more rapidly. At 9.3 times current EPS and 7.1 times cash flow, LYB shares are clearly undervalued. The company’s stout cash flow has enabled management to strengthen the balance sheet after LyondellBasell’s emergence from bankruptcy in 2010.

I expect LYB to advance 34% to my Min Sell Price of 119.45 within two years. Buy at 89.81 or below.

NIKE ‘B’ Shares (NKE) Industry: Consumer Discretionary–Textiles, Apparel & Luxury Goods; Very Low Risk; 1.2% Yield; A-List Dividend Analysis

NIKE (NKE: Current Price 59.84; Max Buy Price 61.90) designs, develops, markets and sells athletic footwear, apparel, equipment and accessories. The company sells to retail accounts through NIKE-owned retail stores and internet websites, and a mix of independent distributors and licensees throughout the world. NIKE is the global leader in athletic footwear and apparel with operations in over 160 countries. NIKE’s “swoosh” logo and “just do it” tagline are widely recognized around the world.

The company focuses on sportswear and other products for running, basketball, soccer, men’s and women’s training, and golf. The company’s portfolio brands include the NIKE Brand, Jordan Brand, Hurley, and Converse. NIKE’s association with celebrity athletes, such as Labron James, Kevin Durant and Roger Federer and with top professional and college teams, ensures top-notch name recognition for the future.

NIKE surprised investors when the company reported better than expected sales and earnings for the three months ended May 31. Sales rose 5% and EPS surged 22%. Sales in China and emerging markets outpaced lackluster sales in North America. Management stated the company will eliminate 1,000 jobs, step up online offerings, and sell directly on the Amazon.com website. NIKE will also trim a quarter of its shoe styles in an effort to become more agile.

At 23.6 times current EPS, NKE shares are now reasonable. Sales and earnings growth will likely accelerate in 2017 and 2018. The balance sheet is solid, and the dividend has been increased nearly every year by more than 10% during the past decade. I expect NKE to climb 26% to reach my Min Sell Price of 75.27 within one year. Buy at 61.90 or below.

Starbucks (SBUX) Industry: Retail–Restaurants; Very Low Risk; 2.1% Yield; Modern Value Analysis

Starbucks Corp. (SBUX: Current Price 54.73; Max Buy Price 56.04) is the number-one roaster and retailer of specialty coffee in the world. The company operates 25,734 stores in 75 countries. In addition to fresh-brewed coffee, offerings include many complementary food items and a selection of premium teas and other beverages, sold mainly in the company’s restaurant stores.

Starbucks also sells packed coffee and a variety of ready-to-drink beverages and single-serve coffee products to grocery, warehouse clubs and specialty retail stores. In addition to its Starbucks Coffee brand, it also sells goods and services under Seattle’s Best Coffee and La Boulange brands.

Starbucks’ loyalty cards are gaining popularity. The company has 12.9 million active members in the U.S. My Starbucks Rewards loyalty program has evolved into one of the most important business boosters at the company. Starbucks also has more than eight million reward members in China.

Starbucks is introducing many technology innovations to strengthen its brand, improve efficiency and increase profitability. Starbucks’ mobile app is one of the most widely used mobile payment apps in the U.S. with over 20 million mobile app users. Starbucks Mobile Order & Pay service processes more than 10 million mobile orders every month. The company introduced nitro cold brew coffee in stores, to capitalize on the explosive growth in iced coffee drinks. The company expects cold coffee sales to double in the next three years.

Second-quarter sales advanced 8% and EPS rose 12%. Same-store sales increased 5% compared to 3% growth in the prior quarter. Customers are visiting Starbucks stores less often but spending more during each visit. Stores in China posted same-store sales growth of 7%.

Management recently reduced its EPS estimate for the quarter by 5% and forecast soft sales. Starbucks is closing all 379 of its Teavana mall-based stores, which will hurt sales and earnings in the current quarter. Starbucks will spend $1.3 billion to buy the 50% portion of the business in East China that it doesn’t already own. Starbucks currently owns and operates 1,500 stores in China and has said it plans to operate 5,000 Starbucks shops in China by 2021.

At 26.1 times current EPS, SBUX shares are reasonable in view of sales and earnings growth that will likely continue to advance at a steady, rapid pace. The balance sheet is solid, and the dividend has been increased every year by more than 20% since the initial payment in 2010. I expect the company’s stock price to climb 37% to reach my Min Sell Price of 74.86 within 12 to 18 months. Buy at 56.04 or below.

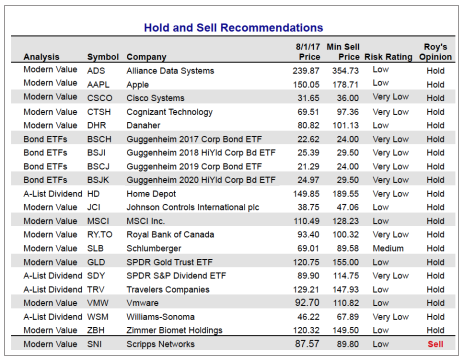

Hold and Sell Recommendations

The following table includes my Hold and Sell Opinions for securities appearing in previous Cabot Value issues. These stocks have transitioned out of the Model, but remain excellent investments. You should continue to hold the stocks and ETFs you purchased until your selection reaches its Min Sell Price, at which time I will issue a sell alert. I will also issue a sell alert when a disappointing performance or adverse condition affects any company or ETF. The stocks recommended to be sold in prior issues are not included in the table.

My Buy recommendations (including Risk Ratings) for the August 2017 Model are listed in the Current Buy Recommendations table.

Sell Changes Since Last Issue:

Scripps Networks (SNI 87.57) will be acquired by Discovery Communications. SNI shareholders will receive $90.00 per share in the form of $63.00 cash plus $27.00 in Discovery Communications common stock. Scripps was first recommended in June 2015 at 67.58. The company was featured in the Cabot Value Model using the Modern Value analysis. SNI has advanced 29.6% in the past 26 months compared to a gain of 18.9 % for the Standard & Poor’s 500 Index during the same time period. Scripps has not quite reached its Min Sell Price of 89.80, but I recommend selling now because SNI shares will likely stay near their current price (89.55) until the merger is finalized. SELL.

Buy and Hold Changes Since Last Issue:

Facebook (FB) Hold to Buy. Second-quarter sales and earnings beat estimates by a wide margin. The current FB price is fully warranted.

Alliance Data Systems (ADS) Buy to Hold. Reported disappointing second-quarter sales and earnings, but management forecast big improvements in 2018.

Model Performance

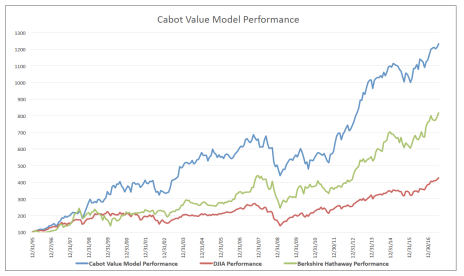

Performance calculations for the Cabot Value Model include all Buy-rated and all Hold-rated stocks.

The Cabot Value Model advanced 1.79% in June, compared to an increase of 2.54% for the Dow Jones Industrial Average. The Model gained 8.78% during the first seven months of 2017 compared to an increase of 10.77% for the Dow. Value stocks continue to underperform in 2017.

The Cabot Value Model was first published in Cabot Benjamin Graham Value Investor 14 years ago. Since then, the Model has increased 257.0% compared to increases of 146.1% for the Dow and 163.8% for the Standard & Poor’s 500 Index. All performance numbers do not include dividends.

The Cabot Value Model has also been used extensively by investment advisors since 1995 and individual subscribers since 2002, and has outperformed the Dow Jones Industrial Average by a wide margin during the past 21 years. Since inception on 12/31/95, the Cabot Value Model has provided an impressive return of 1,133.7% compared to a return of 718.6% for Warren Buffett’s Berkshire Hathaway! During the same 21-year period, the Dow has gained just 327.8%.

The Cabot Value Model performance includes the performance results of the Modern Value Model for the period from 12/31/95 to 11/30/02. Performance for the period from 11/30/02 to 3/3/14 was derived from the average monthly performance of the Classic Value Model and Modern Value Model, weighted equally.

Beginning March 3, 2014, the Cabot Value Model includes buy recommendations derived from the Modern Value and the A-List Dividend analyses. Performance calculations for the Cabot Value Model now include all Buy-rated and all Hold-rated stocks. Prior to March 3, 2014, performance calculations included only stocks contained in the Model.

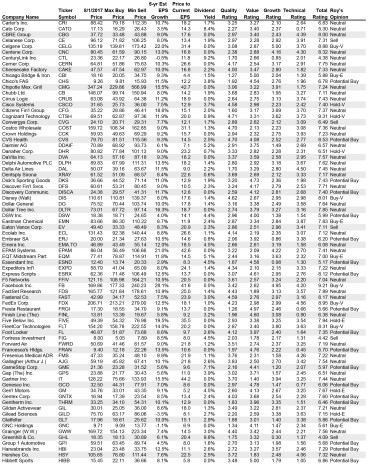

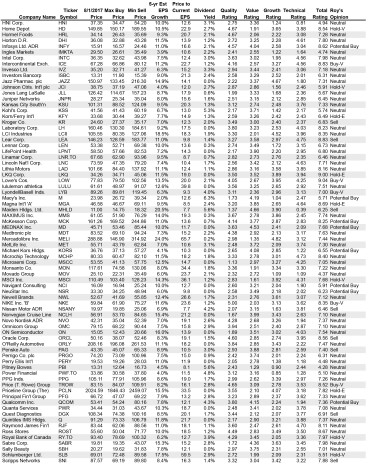

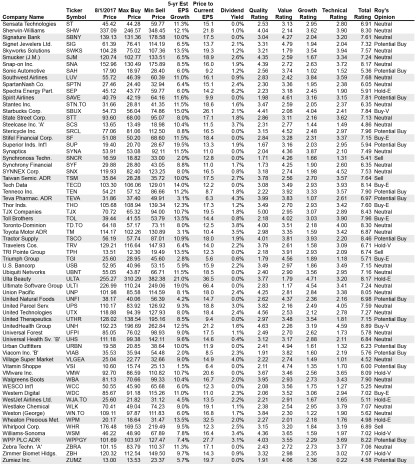

Top 275 Value Stocks

Following are the highest rated Top 275 Value Stocks in the Benjamin Graham database. Use the Top 275 to look up data and ratings for stocks you already own or in which you have an interest. The table is also available on the Google cloud as an interactive, real-time worksheet. The maximum rating for Quality, Value, Growth and Technical is 5.00, which is best. The maximum Total Rating is 10.00, also the best.

Explanation of terminology for the Roy’s Opinion column:

Buy-V: Cabot Value Model stocks recommended to be purchased.

Buy-E: Cabot Enterprising Model stocks recommended to be purchased.

Potential Buy: Stocks with the possibility to be recommended. Their current prices are below their Maximum Buy Prices.

Hold-V: Cabot Value Model stocks recommended to be held until Roy issues a sell alert or the stock reaches its Minimum Sell Price.

Hold-E: Cabot Enterprising Model stocks recommended to be held until Roy issues a sell alert or the stock reaches its Minimum

Sell Price.

Sell: Stocks recommended to be sold.

Neutral: Interesting stocks in Roy’s database but not sufficiently researched to form an opinion.

[premium_html_footer]

Send questions or comments to roy@cabotwealth.com.

Cabot Benjamin Graham Value Investor • 176 North Street, Salem, MA 01970 • www.cabotwealth.com

Cabot Benjamin Graham Value Investor is published by Cabot Wealth Network, independent publisher of investment advice since 1970. Neither Cabot Wealth Network nor our employees are compensated by the companies we recommend. Sources of information are believed to be reliable, but are in no way guaranteed to be complete or without error. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on the information assume all risks. © Cabot Wealth Network. Copying and/or electronic transmission of this report is a violation of U.S. copyright law. For the protection of our subscribers, if copyright laws are violated, the subscription will be terminated. To subscribe or for information on our privacy policy, call 978-745-5532, visit https://cabotwealth.com// or write to support@cabotwealth.com

THE NEXT CABOT BENJAMIN GRAHAM VALUE INVESTOR WILL BE PUBLISHED AUGUST 31, 2017

We appreciate your feedback on this issue. Follow the link below to complete our subscriber satisfaction survey: Go to: www.surveymonkey.com/bengrahamsurvey

[/premium_html_footer]