In this issue, I begin to transition stocks from Roy Ward’s Value and Enterprise Models to my new, more consolidated Prudent Model. My top recommendation is a new stock for us, and I give it a thorough write-up.

Cabot Benjamin Graham Value Investor 279

Benjamin Graham is called The Father of Value Investing. His influence has inspired many successful investors, including Warren Buffett.

[premium_html_toc post_id="140172"]

Finding Value at Current Market Valuation

I’m pleased to present my first issue as the new chief analyst of Cabot Benjamin Graham Value Investor. After accepting this role, I consulted with Roy Ward for several weeks until his retirement at the end of September. My intention is to transition Roy’s stocks into a single, more consolidated portfolio, beginning with this issue. I invite you to send any questions to me via email at azmath@cabotwealth.com.

This month, the S&P 500 touched an all-time high of 2,550. At this level, the S&P 500 is trading at an earnings yield of 4% and a dividend yield of 1.1%. You might ask why an investor would be satisfied with such a small yield? There are numerous theories circulating among academics and investors, but Benjamin Graham investors know that the current market valuation is not high compared to the 10 year U.S. Treasury yield of 2.36% and Moody’s AAA corporate bond yield of 3.6%.

As comforting as that may be, you should be careful about the gradual shift of capital into bonds as interest rates are set to gradually rise. The implications are twofold. First, there is significant downside risk for stocks, and second, the upside potential from the market’s current valuation is very limited. However, the good news is that carefully chosen value stocks should outperform other asset classes in long run. Even at the current valuation, we can find a handful of deep value stocks. I feature one such stock in this issue, and I will recommend more deep value stocks in upcoming issues.

Based on the above thesis, I suggest that you hold around 20% cash. As I mentioned in last week’s update, I suggest that you continue to hold the stocks you currently own until I recommend that you sell. My sell recommendation will be based on the company’s unsatisfactory balance sheet or unpredictable revenue stream. My intention is to protect your assets should the market enter into a downturn.

“The longer the bull market lasts the more severely investors will be affected with amnesia; after five years or so, many people no longer believe that bear markets are possible.” — Benjamin Graham

BUY RECOMMENDATIONS

Gentex (GNTX: 20.05)

Gentex Corporation was founded in 1974 to manufacture the world’s first dual sensor photoelectric smoke detector, which was invented by its founder and current CEO, Fred Bauer. Currently, Gentex’s major product is auto-dimming rearview and sideview mirrors. The interior and exterior auto-dimming rear view mirror accounts for 86% of the company’s revenue. The auto-chromatic technology increases the driver’s safety by detecting the headlight and reducing the glare from vehicles traveling behind.

Gentex has a near monopoly in this market with 92% market share worldwide. It currently sells its auto-dimming mirrors to Audi, BMW, Chrysler, Citroen, Fiat, Ford, General Motors, Honda, Hyundai/Kia, Infiniti, Jaguar/Land Rover, Lexus, Mazda, Mercedes-Benz, Mitsubishi, Nissan, Opel, Peugeot, Renault, Rolls Royce, SAIC, Samsung, SEAT, Skoda, Toyota, Volkswagen and Volvo. In September 2013, Gentex acquired Homelink, the world’s most widely used vehicle-based wireless system, from Johnson Controls.

Gentex’s revenue has been growing at an average of 10% while the operating profit has been growing at an average of 17% for the past five years. Thus the operating margin has consistently grown from 21.32% to 30.49% between 2012-2016. This increase is largely due to higher automation in the production facility. During the stressful recessionary period of 2008-2009, Gentex maintained an operating margin of 10% (currently 20%) despite record low global auto sales growth. The company has a consistent history of strong free cash flow with a clean balance sheet.

I believe that the Integrated Toll Module (ITM) is the key to growth for Gentex in future. According to the Gentex’s published annual report: “The Gentex Integrated Toll Module™ (ITM™) is a nationwide toll collection technology for factory integration into new vehicles. The system uses a mirror-integrated multi-protocol toll tag that provides motorists with access to toll roads throughout the U.S.” The company claims that its system will offer a seamless driver and passenger experience. The advantages of this system are: no need to maintain multiple accounts for different toll systems, reduced windshield clutter and access to all toll-roads across the country.

In the U.S., around 17.5 million light auto vehicles are expected to be produced in 2017, and approximately 51% of them—8.9 million—will have Gentex’s interior mirrors. By integrating its nationwide integrated toll module in partnership with TransCore, Gentex will provide OEMs a unique opportunity to expand a value-added proposition to the end customers. There are around 263 million vehicles in the U.S., which make 5.7 billion trips through toll booths annually (the average vehicle passes through toll booths 22 times annually). Thus, conservatively estimating that Gentex sells just 50% of its interior mirrors with ITMs, Gentex has a total market potential to release 97 million toll passes per year.

The potential for earnings through either a subscription-based business model or one-time fee would be considerable for the company. A subscription-based model will generate continuous income for the lifespan of the vehicle with relatively minimum cost. I do not see that the market has added any premium for the prospect of this business model in Gentex’s current valuation.

In 2013, $13 billion of revenue was collected by toll agencies in the U.S., of which 82% was collected through transponders (average revenue collected is $2.30 per car pass. If Gentex takes only 50% of this revenue, with the rest going to its key partner TransCore, the potential revenue for Gentex would be around $100 million.

The key advantage is the compounding nature of this revenue and its zero-cost nature. And every year, there’s the potential to add 97 million or more toll passes, generating $100 million more of revenue each year. My bottom-up analysis reveals around $413 million in revenue by 2021. This will boost the existing financials in a compound trajectory.

At the current market valuation, GNTX is a bargain. I recommend it as a Buy and give it the highest ranking in the portfolio. BUY.

Additional Buys

Gilead Sciences (GILD: 82.57)

Gilead Sciences discovers and commercializes treatments for viral diseases, including HIV, influenza, Hepatitis B and Hepatitis C. In August, Gilead announced its acquisition of Kite Pharma, which is a leader in immunotherapy. The purchase will compensate Gilead for the loss of revenue due to falling sales of its core HCV drug, Harvoni. Even at a very conservative revenue growth estimate, GILD is a bargain at its current P/E of 9. Gilead is ranked second in the portfolio. BUY.

William-Sonoma (WSM: 50.70)

William-Sonoma is a specialty retailer of kitchen and home products with an established e-commerce and retail business. The company has almost no long-term debt and a clean balance sheet. With a conservative growth projection, I expect a long-term gain of 13% to 18% in the share price. The stock is trading at a historically low price-to-earnings ratio. Thus, I consider WSM a very safe bet with good appreciation potential. The stock is ranked third in our portfolio. BUY.

Magna International (MGA: 54.81)

Magna International is a global auto supplier that designs and manufactures automotive systems and parts. They also assemble complete vehicles for OEMs (original equipment manufacturers). Magna has 317 manufacturing plants worldwide. Magna’s revenue grew 12% and cash flow grew 20% annually over the past five years. I expect the revenue to grow at 8% in long-term with a net profit margin of 5.6%. With a current price-to-earnings ratio of 9, MGA is a good bargain. I estimate long-term growth of 15% in shares with limited downside risk. Magna is ranked fourth in the portfolio. BUY.

SELL RECOMMENDATIONS

Here are the stocks that I recommend that you sell over the coming days. All prices are as of the market close on 10/11/17.

Chicago Bridge & Iron Company (CBI: 15.72)

Chicago Bridge & Iron Company is a global engineering, construction and procurement (EPC) company with revenue of $9.4 billion. The company has a serious issue with its debt burden. Its new CEO, Patrick Mullen, is focusing on restructuring the business by selling its business segments to pay off its debt. This strategy coupled with other cost reduction methods could help the 118-year-old company to get back on track. However, the uncertainty of such a recovery coupled with a lack of an economic moat after the sale of its technology segment makes it too risky for a Ben Graham portfolio. SELL.

Johnson Controls (JCI: 41.35)

Johnson Controls is a global diversified technology and multi-industrial company, with revenue from creating intelligent buildings and next-generation transportation systems. 77% of its revenue comes from Tyco, a security and fire protection company, which merged with Johnson Controls in September 2016. It spun off its Automotive Experience Group to Adient in October 2016. The company expects its thin profit margin to improve due to its synergy with Tyco and other cost-cutting plans. If the company can successfully improve the current profit margin to 10% with long-term revenue growth of 10%, the stock would be a good bargain. However, that projection is solely dependent on new management. If the company fails to improve its margins, along with stiff competition faced in the security segment, investors could take a hit. Under these uncertain circumstances, I would not hold the stock. SELL.

Note: There has been a sudden spike in options trading in JCI this week, which could be due to a takeover rumor. For a short-term profit (which is not a Ben Graham Value investor’s goal), you could hold JCI and wait to see if a takeover takes place.

Schlumberger (SLB: 67.74)

Schlumberger is one of the world’s leading service providers for the oilfield industry. With revenue of $25.8 billion, Schlumberger has operations in 85 countries. Due to a decrease in oil prices which led to lower oil exploration activities, Schlumberger has had a significant setback in recent years. Its revenue fell at an annual rate of 15% and diluted EPS decreased 66% in the past three years. Schlumberger could come back on track as exploration activities and revenues from its land market improve. The company’s cost-cutting measures could also lead to profit margin improvement. Even under such an optimistic scenario, Schlumberger seems overvalued at the current price. SELL.

Tech Data (TECD: 94.28)

Tech Data is a leading wholesale distributor of hardware and software products to resellers and retailers. The company failed to improve its net profit margin of ~1% for more than a decade. This indicates a highly competitive industry with strong bargaining power among its customers. With a price-to-earnings ratio of around 12, the stock appears undervalued, but its low profit margin makes the company susceptible to loss under stressful situations. SELL.

Triumph Group (TGI: 31.95)

Triumph Group is another example of a turnaround investment. Triumph Group designs and manufactures aerostructures and aircraft components. The company has had -3% annual growth in revenue over past three years. It is uncertain if the company will improve its revenues as it renegotiates its contracts. The result of these contract renegotiations is likely to show in 2018. Due to these uncertainties, I recommend selling even though the stock seems undervalued from an optimistic scenario. SELL.

Western Digital Corporation (WDC: 85.62)

Western Digital is a household name for hard disk drives—I own one. Due to tough competition, the company has been undergoing stiff financial pressure. After Western Digital’s purchase of SanDisk in September 2016, revenue jumped 47% to $19 billion in fiscal year 2017. However, its net income margin is narrow at around 2%, resulting in a return on equity of a mere 3.5%. The obvious disadvantage is the highly commoditized nature of the disk drive business. I recommend selling the stock at its current price. SELL.

Wheaton (WPM: 20.91)

Wheaton Precious Metals is the world’s largest metal streaming company with $890 million in revenue. Wheaton is not a mining company but pays upfront to gold and silver mines with the agreement to buy the precious metals later. The future free cash flow is heavily dependent upon the volatility of precious metal prices. Due to the speculative nature of the business, I would not hold the stock. SELL.

GNC Holdings (GNC: 8.01)

GNC Holding is a specialty retailer focused on health and performance supplements. The company has around $1.5 billion in debt that is due in five years. With its free cash flow of around $130 million and a market cap of $600 million, default on the maturing debt is a concern. The company is taking measures to improve its sales and earnings through strategic initiatives, and the stock looks dirt cheap from a P/E perspective, but I’m concerned about growth in its book value over the long-term. SELL.

ARRIS International (ARRS: 28.39)

ARRIS International manufactures telecommunication equipment for high-speed data and telephone systems. The company has a record of inconsistent revenue growth with a sub-par profit margin. Its acquisition-driven growth is another indicator of its poor business nature. At the current price-to-earnings ratio of 42, there is a significant downside risk in the case of a recession. SELL.

LyondellBasell Industries (LYB: 97.26)

LyondellBasell Industries engages in converting liquid and gaseous hydrocarbons to plastic resins. Due to its dependability on oil prices, the business is very cyclical. The company appears cheap with a price-to-earnings ratio of just 10, and its free cash flow is healthy. There’s good appreciation potential if the company can manage its top line growth. However, I will stop following the company due to its unpredictable revenue stream. SELL.

These 10 Sell recommendations are intended to reduce your downside risk. That said, if you are highly confident about management’s turnover strategies, you could continue to hold CBI, JCI, GNC, TGI and SLB.

Additional Sells

I will also stop tracking a few other stocks due to their high valuations. Even a great business is not worth an astronomical price. Eventually, in the long term, the intrinsic value of the business will meet its price. I believe the following companies are overvalued, and thus I wouldn’t hold them at their current valuations.

Five Below (FIVE)

Alliance Data Systems (ADS)

VMware (VMW)

Korn Ferry International (KFY)

Priceline (PCLN)

MSCI Inc (MSCI)

United Health (UNH)

FleetCor Technologies (FLT)

Citizens Financial Group (CFG)

Eastman Chemical Company (EMN)

Facebook (FB)

Travelers (TRV)

AT&T (T)

Danaher Corporation (DHR)

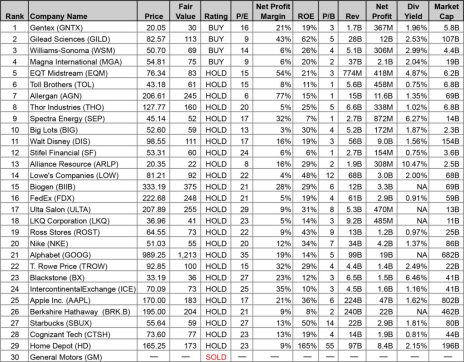

PRUDENT PORTFOLIO

I have ranked the remaining stocks from Roy’s Value Model and Enterprising Model in a new consolidated portfolio, now called the Prudent Portfolio. The stocks are ranked based on various factors, including the prospect of appreciation, maximum downside risk and expected annualized yield. I suggest that you allocate more capital to the top stocks than the bottom ones in the order of ranking.

You may notice that some of the top-ranked stocks are trading close to their fair value, yet they are ranked higher. That’s due to higher ranking in safety from a potential loss. For example, EQM, which is trading at a discount of only 15% from its fair value, is ranked sixth on the list because of lower downside risk. The fair value numbers may change from month to month.

[premium_html_footer]

Send questions or comments to azmath@cabotwealth.com.

Cabot Benjamin Graham Value Investor • 176 North Street, Salem, MA 01970 • www.cabotwealth.com

Cabot Benjamin Graham Value Investor is published by Cabot Wealth Network, independent publisher of investment advice since 1970. Neither Cabot Wealth Network nor our employees are compensated by the companies we recommend. Sources of information are believed to be reliable, but are in no way guaranteed to be complete or without error. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on the information assume all risks. © Cabot Wealth Network. Copying and/or electronic transmission of this report is a violation of U.S. copyright law. For the protection of our subscribers, if copyright laws are violated, the subscription will be terminated. To subscribe or for information on our privacy policy, call 978-745-5532, visit https://cabotwealth.com// or write to support@cabotwealth.com

THE NEXT CABOT BENJAMIN GRAHAM VALUE INVESTOR WILL BE PUBLISHED NOVEMBER 9, 2017

We appreciate your feedback on this issue. Follow the link below to complete our subscriber satisfaction survey: Go to: www.surveymonkey.com/bengrahamsurvey

[/premium_html_footer]