This month’s Cabot Value Model contains a diversified list of Buy recommendations, with a focus on high quality companies with proven records of steady sales, earnings and dividend increases.

Falling Prices, Rising Earnings—BGV

Benjamin Graham is called The Father of Value Investing. His influence has inspired many successful investors, including Warren Buffett.

[premium_html_toc post_id="132819"]

Falling Prices, Rising Earnings

April showers bring May flowers. This old saying applies not only to the weather, but to the stock market too. Over the past several decades, the trend has been for stocks to go down during the first couple of weeks of April and then rise during the remainder of the month.

Stocks are clearly overvalued, which makes looking for bargains difficult for value investors. The 16 stocks included in Cabot Value Model on page 3 are solid companies that will perform very well in rising or declining stock markets.

I am not a contrarian, but I’m not afraid to invest in stocks that are in a downtrend. If earnings are going up and the stock price is going down, it makes sense to me that the stock will follow the flow of earnings. AT&T, Berkshire- Hathaway, LyondellBasell, NIKE, Schlumberger and UnitedHealth are all examples of companies with rising earnings and falling stock prices. All of these choices should shine in 2017.

This month, I commence covering Lowe’s Companies, a top-notch organization. The company operates in one of retailing’s strongest sectors. Its shares are cheaper than Home Depot and its earnings are growing faster. Lowe’s is also Amazon-proof! Read why this stock is an excellent investment in the current stock market environment. Buy now, you’ll be glad you did.

“Without a saving faith in the future, no one would ever invest at all. To be an investor, you must be a believer in a better tomorrow” — Benjamin Graham

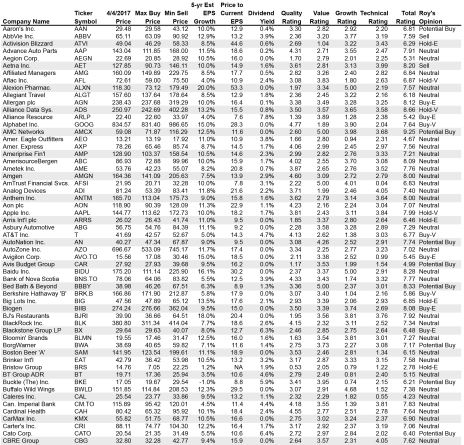

CABOT VALUE MODEL

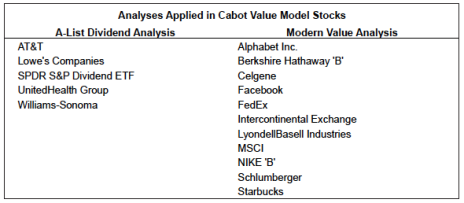

The Cabot Value Model applies A-List Dividend and Modern Value Model analyses.

The stock choices using the A-List Dividend analysis meet the following criteria:

(1) Dividend increases every year for 25 years or 10% dividend increases every year for 10 years

(2) Standard & Poor’s Quality Rating of A+, A, or A-

(3) Dividend yield is 1.0% or higher

(4) Dividend payout ratio is less than 50%

The Modern Value analysis uses a system initially developed by Benjamin Graham and Dr. Wilson Payne in 1946, and later modernized and enhanced by J. Royden Ward. The analysis uncovers undervalued stocks of well-known, high-quality companies which have recorded steady earnings growth. Ward’s Modern Value analysis is similar to the approach used by Warren Buffett.

When the market is low and undervalued, the Cabot Value Model will hold 75% moderately aggressive stocks and 25% conservative, counter-cyclical stocks, bonds or ETFs. When the market is high and overvalued, the Model will hold 25% moderately aggressive stocks and 75% conservative, counter-cyclical stocks, bonds or ETFs.

Buy Recommendations

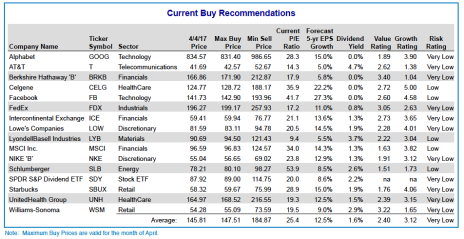

The Cabot Value Model on page 3 contains 16 securities this month with two new stocks: Celgene (CELG) and Lowe’s Companies (LOW). Two stocks transition out of the Model: Danaher (DHR) and Home Depot (HD).

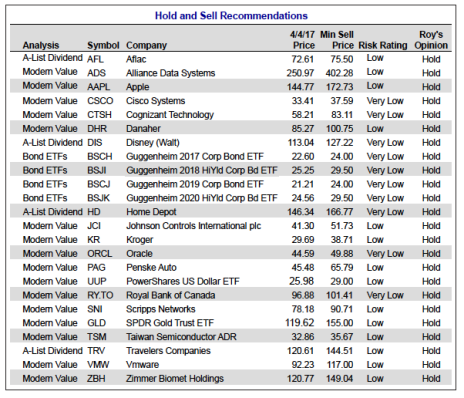

Danaher and Home Depot are now listed in the table of Hold and Sell Recommendations on page 7. The page 7 table shows my Hold/Sell Opinions for these securities and for my previous recommendations, which have transitioned out of the Model. My Hold recommendations remain excellent investments. You should continue to hold your stocks and ETFs until your selection reaches its Min Sell Price, at which time I will issue a sell alert. I will also issue a sell alert when a disappointing performance or adverse condition affects any company or ETF.

One stock in the Cabot Value Model is currently priced slightly above its Max Buy Price. Before buying Cabot Value Model stocks, you should wait until the price of the stock decreases to or dips below its Max Buy Price.

Defensive Securities: This month’s allocation for the Value Model remains at Level 5, which calls for a mix of four stocks and 12 defensive positions. The defensive or protective portion of the Model is composed of stocks, ETFs, bonds and cash and is fulfilled by AT&T, BRKB, FDX, GOOG, ICE, LOW, LYB, NKE, SDY, SBUX, UNH and WSM.

My objective for portfolio allocation is to increase the defensive holdings in the Model when the market rises and becomes overvalued, and decrease the defensive holdings in the Model when the market declines and becomes undervalued. I believe my strategy of increasing or decreasing the number of defensive positions will help you reduce your risk and enhance your profits.

The Dow Jones Industrial Average has reached my peak Minimum Sell Price level of 20,870 indicating that the stock market is overvalued. My current allocation of four stocks and 12 defensive positions will not change if the stock market climbs higher. If the Dow falls to 19,263, my allocation mix will change to six stocks and 10 defensive positions, or Level 4.

Celgene (CELG) Industry: HealthCare–Biotechnology; Low Risk; No Dividend. Modern Value Analysis

Celgene Corp. (CELG: Current Price 124.77; Max Buy Price 128.72) is a biopharmaceutical company focusing on the discovery, development and commercialization of treatments for cancer and other severe conditions. The company concentrates on various cancers including multiple myeloma and myelodysplastic syndromes; chronic lymphocyte leukemia and non-Hodgkin’s lymphoma; glioblastoma and ovarian, pancreatic and prostate cancers.

Revlimid is Celgene’s leading drug, comprising 62% of the company’s total sales. Revlimid is an oral cancer drug used to treat multiple myeloma. The drug works against cancer cells partly by impacting the functioning of the immune system. Revlimid sales should continue to rise, bolstered by expanded uses and market share gains. Celgene has attained patent protection for Revlimid through the end of 2026.

Celgene has developed 35 partnerships with small biotech companies developing next-generation cancer drugs. In addition, Celgene continues to purchase small development companies with promising research activities.

In August, Celgene acquired Receptos for $7.2 billion. Receptos’ main drug candidate is Ozanimod, currently in Phase III trials to treat multiple sclerosis, in Phase II trials for ulcerative colitis and Phase I for Crohn’s disease. Celgene predicts Ozanimod will become a blockbuster drug.

Celgene’s fourth-quarter report revealed sales generated by Pomalyst/Imnovid and Otezla soared 29% and 67% respectively from a year ago. Based on the company’s new drugs, multiple research partnerships and new acquisitions, management forecast another banner year in 2017 with earnings per share rising from $2.49 in 2016 to $7.20 in 2017. Analysts are targeting EPS of $8.75 for 2018.

Celgene is among the fastest growing companies in the biotech sector. The company does not pay a dividend, but the balance sheet is strong with $8.0 billion in cash and manageable debt. I expect CELG to climb 51% to reach my Min Sell Price of 188.17 within two years. Buy at 128.72 or below.

IntercontinentalExchange (ICE) Industry: Financial–Electronic Exchange; Very Low Risk; 1.3% Yield; Modern Value Analysis

IntercontinentalExchange (ICE: Current Price 59.41; Max Buy Price 59.94) owns and operates the leading worldwide electronic marketplace for trading futures and over-thecounter (OTC) energy and soft commodities contracts. In November 2013, ICE completed the $11 billion acquisition of NYSE Euronext. The purchase nearly tripled ICE’s revenues and added significant earnings. Cost reductions from NYSE Euronext are ongoing, and should continue to lift earnings during the foreseeable future. More recently, ICE purchased the Singapore Mercantile Exchange with the objective of expanding into Asia.

IntercontinentalExchange purchased Interactive Data for $5.2 billion in December 2015. Interactive offers market data and analytics (business planning software) to mega-data users such as financial institutions. The purchase will continue to add noticeable revenue and EPS in 2017 and 2018. ICE acquired Standard & Poor’s Securities Evaluations division on October 4, and recently acquired McGraw Hill Financial’s Credit Market Analysis segment. The purchases will enable ICE to provide its customers with new data and valuation services.

IntercontinentalExchange is now the leading network of exchanges and clearing houses for financial and commodity markets with 11 exchanges and seven clearing houses. Growing demand for innovative new products for OTC trading and oil futures contracts bodes well for the new ICE. Vigorous transaction and clearing activities will benefit ICE if President-elect Trump eases regulatory guidelines.

IntercontinentalExchange’s fourth quarter sales rose 30% and EPS advanced 8%. The company’s Interactive Data unit added significant revenue. Earnings were hurt by higher expenses from several sources. ICE hiked its quarterly dividend to $0.20 from $0.17, increasing the stock’s yield to 1.3%. Management provided an upbeat forecast for 2017 revenue and earnings. Revenue will likely rise 8% and EPS will advance 12% to $3.07 in 2017. At 21.1 times trailing EPS, ICE shares are a tad high, but I expect the company to announce another favorable acquisition in 2017.

ICE’s balance sheet is very strong with low debt and lots of cash available to fund future needs. I expect ICE shares to advance 29% to my Min Sell Price of 76.77 within 12 to 18 months. Buy at 59.94 or below.

Lowe’s Companies (LOW) Industry: Consumer Discretionary–Home Improvement Retail; Very Low Risk; 1.9% Yield; A-List Dividend Analysis

Lowe’s Companies (LOW: Current Price 81.59; Max Buy Price 83.11) sells

building materials and supplies, lumber, hardware and appliances through more than 2,365 stores in the U.S., Canada and Mexico.

Lowe’s is the world’s second-largest home improvement retailer, with over $65 billion in revenue and is second only to Home Depot’s $99 billion revenue total. The company focuses on retail do-it-yourself customers, do-it-for- me customers who utilize LOW’s installation services, and professional builders and remodelers.

Stores are typically 100,000 square feet in size and include a lawn and garden center, averaging an additional 32,000 square feet. Lowe’s stores stock about 36,000 items, with hundreds of thousands of items available through the company’s special order system.

The transition from big box retailing to on-line shopping has created huge problems for U.S. retailers. Several retailers have declared bankruptcy, and many are closing less profitable stores by the hundreds. Home Depot and Lowe’s are immune from Amazon.com’s success. Home Depot’s and Lowe’s products include lumber, building materials, appliances, power tools, cabinets, carpeting, paint, plants, and garden supplies which are heavy and bulky and can’t be shipped cheaply.

Professional contractors, who account for 30% of Lowe’s sales, prefer to buy what they need in stores, often on short notice. Nonprofessional do-it-yourself customers often want to see and touch products and ask for advice before buying. Lowe’s generates only 4% of its sales online.

Lowe’s management has embarked on an ambitious three-year plan that will include 3% to 3.5% increases in same-store sales, 15% yearly increases in EPS, combined dividends and buybacks equal to 20% of current market value, and a 1.5% increase in the operating profit margin to 11.2%. In comparison, Home Depot’s profit margin is 14%. Home Depot has higher sales per store, reflecting better locations near urban areas and a greater percentage of its sales going to contractors. Lowe’s same-store sales growth has been consistently weaker than Home Depot’s over the past two years.

Lowe’s is seeking to narrow the gap with Home Depot by better serving contractors through increased inventories and adding a senior executive focused on the contractor segment. Contractor business is important because it’s growing more rapidly than the do-it-yourself market, reflecting a growing preference among homeowners for professional renovations. Time constraints in dual-earner households and limited home improvement skills among younger people have created more demand for professional assistance.

Lowe’s sales will likely increase 6% and EPS will climb 16% during the next 12-month period. The housing market and employment and wages should continue to recover, leading to more remodeling projects. Dividends have been increased every year during the past 52 years. During the past 10 years, the rate of increase is 27% per year, including an increase of 25% in 2016. At 20.5 times current EPS and with a dividend yield of 1.9%, LOW shares are very attractive for long-term investors. I expect LOW to climb 16% to reach my Min Sell Price

of 94.78 within a year. Buy at 83.11 or below.

NIKE ‘B’ (NKE) Industry: Consumer Discretionary–Textiles, Apparel & Luxury Goods; Very Low Risk; 1.3% Yield; A-List Dividend Analysis

NIKE (NKE: Current Price 55.04; Max Buy Price 56.65) designs, develops, markets and sells athletic footwear, apparel, equipment and accessories. The company sells to retail accounts, through NIKE-owned retail stores and internet websites, and through a mix of independent distributors and licensees throughout the world. NIKE is the global leader in athletic footwear and apparel with operations in over 160 countries. NIKE’s “swoosh” logo and “just do it” tagline are widely recognized around the world.

The company focuses on sportswear and other products for running, basketball, soccer, men’s and women’s training, sportswear and golf. The company’s portfolio brands include the NIKE Brand, Jordan Brand, Hurley and Converse. NIKE’s association with celebrity athletes, such as Michael Jordan and Roger Federer, and with top professional and college teams ensures top-notch name recognition for the future.

NIKE recorded strong fourth-quarter results but management gave a tepid outlook for sales growth. Sales rose 5% and EPS jumped 24%. Futures orders were down 4% year over year, which disappointed investors. Management said the shift to online shopping is requiring more promotions and larger discounts to attract customers. Also, NIKE is facing stiff competition from Adidas, the German sportswear maker, which is aggressively refocusing its efforts on the North American market. NIKE will refocus on being more innovative, bringing products to market more quickly and increasing direct contact with consumers.

NIKE recently launched new running shoes and has more products in the pipeline. Online sales soared 49% in the most recent quarter. NIKE, though, is losing market share to Under Armour and Adidas who sell more colorful, stylish footwear. NIKE, no doubt, will catch up to the new fashion trends very quickly. The selloff in NIKE shares presents an excellent buying opportunity.

At 23.8 times current EPS, NKE shares are now reasonable. Sales and earnings growth will likely accelerate in 2017 and 2018. The balance sheet is solid, and the dividend has been increased nearly every year by more than 10% during the past decade. I expect NKE to climb 25% to reach my Min Sell Price of 69.02 within one year. Buy at 56.65 or below.

Starbucks (SBUX) Industry: Retail–Restaurants; Very Low Risk; 1.9% Yield; Modern Value Analysis

Starbucks Corp. (SBUX: Current Price 58.32; Max Buy Price 59.67) is the number one roaster and retailer of specialty coffee in the world. The company operates 25,734 stores across 75 countries. In addition to fresh-brewed coffee, offerings include many complementary food items and a selection of premium teas and other beverages, sold mainly in the company’s restaurant stores.

Starbucks also sells packed coffee and tea products as well as a variety of ready-todrink beverages and single-serve coffee and tea products to grocery, warehouse clubs and specialty retail stores. In addition to its Starbucks Coffee brand, it also sells goods and services under the Teavana, Seattle’s Best Coffee, and La Boulange brand names.

Starbucks’ loyalty cards are gaining popularity. The company has 12.9 million active members in the U.S. under My Starbucks Rewards loyalty program, which has evolved into one of the most important business boosters at the company. Starbucks also has more than eight million reward members in China.

Starbucks is introducing many technology innovations to strengthen its brand, improve efficiency and increase profitability. Starbucks’ mobile app is one of the most widely used mobile payment apps in the U.S. with over 20 million mobile app users.

Starbucks recently launched its Mobile Order & Pay service nationally and currently processes more than eight million mobile orders every month. The company announced it will introduce nitro cold brew coffee in stores, to capitalize on the explosive growth in iced coffee drinks. The company expects cold coffee sales to double in the next three years.

Starbucks posted disappointing fourth quarter results. Sales advanced 7% and EPS rose 13% while same-store sales increased 3%. Mobile Order and Pay represented 7% of U.S. transactions in the quarter, up from 3% in the prior year. However, the additional mobile orders caused long lines at pick-up counters and drove some customers away. The company is making good progress in fixing the problem. Starbucks opened 649 net new stores in the quarter.

At 28.9 times current EPS, SBUX shares are not cheap, but sales and earnings growth will likely continue to advance at a steady, rapid pace. The balance sheet is solid, and the dividend has been increased every year by more than 20% since the initial payment in 2010. I expect the company’s stock price to climb 30% to reach my Min Sell Price of 75.99 within 12 to 18 months. Buy at 59.67 or below.

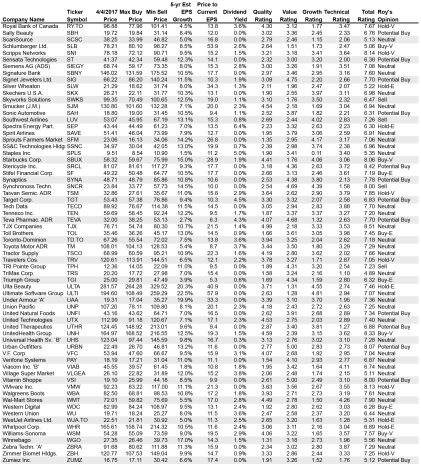

Hold and Sell Recommendations

The table below includes my Hold and Sell Opinions for securities recommended in previous Cabot Value issues but have transitioned out of the Model. The Hold recommendations remain excellent investments. You should continue to hold these stocks and ETFs until the selection reaches its Min Sell Price, at which time I will issue a sell alert in a Special Buletin. I will also issue a sell alert when a disappointing performance or adverse condition affects any company or ETF. The stocks recommended to be sold in prior issues are not included in the table.

My Buy recommendations (including Risk Ratings) for the March Model are listed above.

Sells: No Sell changes.

Other Changes Since Last Issue:

Celgene (CELG) Hold to Buy.

Pipeline and new drugs look very promising.

Danaher (DHR) Buy to Hold.

Removed to make room for stocks with better growth prospects.

Home Depot (HD) Buy to Hold.

Removed to make room for Lowe’s.

Model Performance

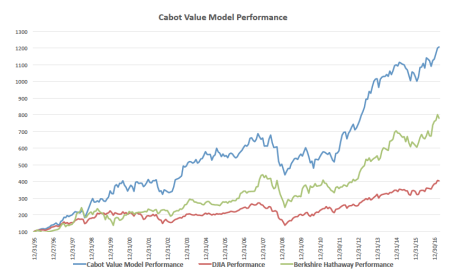

Performance calculations for the Cabot Value Model include all Buy-rated and all Hold-rated stocks.

The Cabot Value Model advanced 0.61% in March, compared to a decline of 0.72% for the Dow Jones Industrial Average. The Model gained 6.37% during the first quarter of 2017 compared to an increase of 4.56% for the Dow.

The Cabot Value Model was first published in my Cabot Benjamin Graham Value Investor 14 years ago. During the ensuing 14 years, the Model has increased 249.1% compared to increases of 132.3% for the Dow and 152.3% for the Standard & Poor’s 500 Index. All performance numbers do not include dividends.

The Cabot Value Model was also used extensively by investment advisors since 1995, and has outperformed the Dow Jones Industrial Average by a wide margin during those past 21 years. Since inception on 12/31/95, the Cabot Value Model has provided an impressive return of 1,106.4% compared to a return of 678.3% for Warren Buffett’s Berkshire Hathaway! During the same 21-year period, the Dow has gained just 303.8%.

The Cabot Value Model performance includes the performance results of the Modern Value Model for the period from 12/31/95 to 11/30/02. Performance for the period from 11/30/02 to 3/3/14 was derived from the average monthly performance of the Classic Value Model and Modern Value Model, weighted equally.

Beginning March 3, 2014, the Cabot Value Model includes buy recommendations derived from the Modern Value and the A-List Dividend analyses. Performance calculations for the Cabot Value Model now include all Buy-rated and all Hold-rated stocks. Prior to March 3, 2014, performance calculations included only stocks contained in the Model.

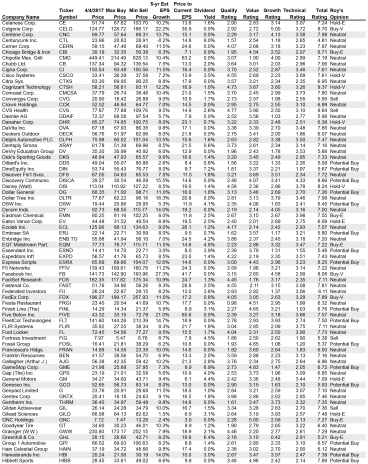

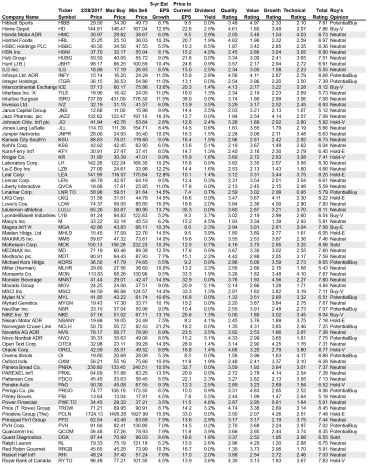

Top 275 Value Stocks

Following are the highest rated Top 275 Value Stocks in the Benjamin Graham database. Use the Top 275 to look up data and ratings for stocks you already own or in which you have an interest. The table is also available on the Google cloud as an interactive, real-time worksheet. The maximum rating for Quality, Value, Growth and Technical is 5.00, which is best. The maximum Total Rating is 10.00, also the best.

Explanation of terminology for the Roy’s Opinion column:

Buy-V: Cabot Value Model stocks recommended to be purchased.

Buy-E: Cabot Enterprising Model stocks recommended to be purchased.

Potential Buy: Stocks with the possibility to be recommended. Their current prices are below their Maximum Buy Prices.

Hold-V: Cabot Value Model stocks recommended to be held until Roy issues a sell alert or the stock reaches its Minimum Sell Price.

Hold-E: Cabot Enterprising Model stocks recommended to be held until Roy issues a sell alert or the stock reaches its Minimum Sell Price.

Sell: Stocks recommended to be sold.

Neutral: Interesting stocks in Roy’s database but not sufficiently researched to form an opinion.

[premium_html_footer]

Send questions or comments to roy@cabotwealth.com.

Cabot Benjamin Graham Value Investor • 176 North Street, Salem, MA 01970 • www.cabotwealth.com

Cabot Benjamin Graham Value Investor is published by Cabot Wealth Network, independent publisher of investment advice since 1970. Neither Cabot Wealth Network nor our employees are compensated by the companies we recommend. Sources of information are believed to be reliable, but are in no way guaranteed to be complete or without error. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on the information assume all risks. © Cabot Wealth Network. Copying and/or electronic transmission of this report is a violation of U.S. copyright law. For the protection of our subscribers, if copyright laws are violated, the subscription will be terminated. To subscribe or for information on our privacy policy, call 978-745-5532, visit https://cabotwealth.com// or write to support@cabotwealth.com

THE NEXT Cabot Benjamin Graham Value Investor WILL BE PUBLISHED MAY 4, 2017

We appreciate your feedback on this issue. Follow the link below to complete our subscriber satisfaction survey: Go to: www.surveymonkey.com/bengrahamsurvey

[/premium_html_footer]