This month’s Cabot Enterprising Model contains 16 companies that offer you a mix of low- and moderate-risk stocks to add to your portfolio. In the issue, I feature five stocks, including one new stock that holds great promise.

Ben Graham Enterprising 273E

Benjamin Graham is called The Father of Value Investing. His influence has inspired many successful investors, including Warren Buffett.

[premium_html_toc post_id="132886"]

Time and Patience

Many stocks have backed off from their peak prices reached in early March, despite strong economic news and high consumer confidence. However, news regarding Syria, Russia and North Korea has taken center stage and has become troublesome.

Large growth companies are holding up very well, including Alphabet, Amazon and Facebook. Value stocks performed very well in November and December, but the Trump rally has fizzled for value stocks lately.

Value investors are waiting for the Trump administration to turn promises into action. Relaxed regulations, tax reform and new infrastructure spending will bolster stock prices. Investors will need patience. Time will tell.

If President Trump fails to win any battles in Congress, stock prices could slide. However, I expect satisfactory results to emerge later this year and 2018. Until then, the stock market will meander along.

The new stock in this month’s Cabot Enterprising Model is a company embarking on a new journey. Tech Data (TECD) recently purchased Avnet’s Technologies Solutions business and the move could become a game-changer. Tech Data’s sales and earnings will likely soar during the next several years and now is an ideal time to buy TECD before the rocket launches.

“Successful Investing takes time, discipline and patience. No matter how great the talent or effort, some things just take time. —Warren Buffett

Cabot Enterprising Model

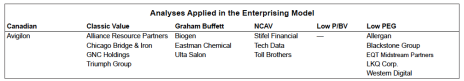

My Enterprising Model is composed of 16 stocks, which I have selected by using one of six analyses. The analyses I utilize are Undervalued Canadian, Classic Value, Graham Buffett, Low NCAV, Low P/BV and Low PEG. The Model is well diversified, represents many industry sectors, and is composed of stocks of undervalued companies that are expected to produce consistent growth. The analysis used to select the each Enterprising Model stock is included in each summary and in the Analyses table below. For additional details, please email me at roy@cabotwealth.com.

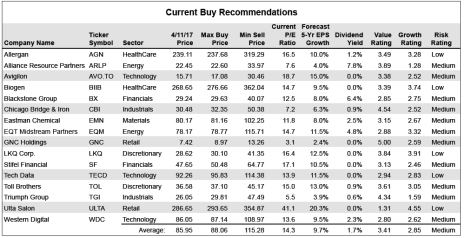

Usually stocks in the Enterprising Model are purchased at their current prices, but because of the current stock market volatility, I now recommend that Enterprising Model stocks be purchased at or below my Maximum Buy Price. Enterprising Model stocks should still be sold at their Minimum Sell Prices. For an explanation of how my Max and Min Prices are calculated, you may email me at roy@cabotwealth.com.

Model Buy Recommendations

The Enterprising Model on page 3 contains 16 stocks with two new stocks: Tech Data (TECD) and Ulta Salon (ULTA). Two stocks transition out of the Model: Greenhill (GHL) and Magna International (MGA).

Greenhill and Magna are now listed on page 7 in the table of Hold and Sell Recommendations. These two stocks remain excellent investments, and should continue to be held. Keep your “Hold” stocks until your selection reaches its Min Sell Price, at which time I will issue a sell alert by email, in the Value Investor or Enterprising issues or in the Weekly Update. I will also indicate that you should sell when a disappointing performance or adverse condition affects any company.

All stocks in the Enterprising Model are now recommended to be purchased at or below their Max Buy Prices—the same as Cabot Value Model stocks. Enterprising Model stocks should be sold when they achieve my Min Sell Price.

Because I use six different analyses to find stocks for the growth-oriented Enterprising Model, these stocks are quite different from the stocks in my conservative Cabot Value Model. I base my choices for Enterprising stocks on favorable shorter-term market and sector trends and find a variety of stocks in many sectors. In addition, I have not applied my defensive risk allocation, which I apply to my Cabot Value Model, because the objective of the Enterprising Model is to provide choices to help you diversify your portfolio. Enterprising Model stocks carry more risk than Cabot Value Model stocks.

Prices indicated in the Enterprising Model are the closing prices on April 11, 2017.

Prices indicated in the Enterprising Model are the closing prices on April 11, 2017.

Allergan (AGN) Industry: HealthCare–Pharmaceutical Drugs; Low Risk; 1.2% Yield; Low PEG Ratio Analysis

Allergan Corp. (AGN: Current Price 239.11; Max Buy Price 237.68) is a leading manufacturer of generic drugs. The company’s goal is to create difficult to produce off-patent drugs. Allergan (formerly Actavis) has grown rapidly in recent years by acquiring large companies within the pharmaceutical sector.

During the third quarter, Allergan completed the sale of its global generic drug business to Teva. Allergan received $33.4 billion cash plus 100 million shares of Teva. Management has already begun to use its new cash hoard by paying down debt, buying back stock and purchasing six small businesses. The company acquired Tobira Therapeutics, a biopharmaceutical company that develops therapies for liver diseases, in a deal worth as much as $1.7 billion. Tobira’s products focus on a common liver disease, known as NASH, which is associated with obesity and type-2 diabetes. NASH can lead to liver cancer or liver failure and affects 5% of the U.S. population.

Allergan also purchased Akarna Therapeutics for $50 million. Akarna is also developing treatments for NASH. In addition, Allergan acquired biotechnology company Vitae Pharmaceuticals for $639 million, in a move aimed at strengthening the drugmaker’s skin-care product line.

Sales will likely advance 7% and EPS (earnings per share) will climb 13% to $16.33 in the 12 months ending March 30, 2018. Allergan has nine product launches planned in 2017. Management forecast strong sales and earnings in 2017. Allergan will buy Zeltiq Aesthetics, the maker of fat-reducing treatments, for $2.3 billion. The deal is scheduled to close in the second half of 2017 and will add noticeable sales and earnings in 2018.

With a price to earnings ratio (P/E) of 16.5 times current EPS and a PEG ratio of 1.48, AGN shares are undervalued. I calculate PEG by dividing the current P/E of 16.5 by the sum of the forecast five-year EPS growth rate (10.0%) and dividend yield (1.2%).

I expect AGN to rise 34% and reach my Min Sell Price of 319.29 within one to two years. Buy at 237.68 or below.

Chicago Bridge & Iron (CBI) Industry: Industrials–Construction & Engineering; Medium Risk; 0.9% Yield; Classic Value Analysis

Chicago Bridge & Iron (CBI: Current Price 30.48; Max Buy Price 32.35) provides specialty engineering, procurement and construction services to customers in the energy infrastructure market throughout the world. The company also provides diversified engineering and construction to government entities. The company was founded in 1889 and is headquartered in The Hague, Netherlands.

Chicago Bridge & Iron operates through four segments: Engineering and Construction, Fabrication Services, Technology and Capital Services. The Engineering and Construction segment (the company’s largest division) provides engineering, procurement, construction and maintenance of energy infrastructure facilities.

Chicago Bridge & Iron is expanding market share in the high-growth energy infrastructure business, developing new LNG (liquefied natural gas) and export facilities, expanding existing import terminals, and enhancing refining and processing capacity of energy companies. The company also seeks growth through selective acquisitions.

Chicago Bridge has built a strong backlog of projects which will provide decent sales growth despite volatile oil prices. Growth in emerging regions and an expanded presence in the energy area following the 2013 acquisition of Shaw Group also offer growth opportunities.

CBI’s customers are delaying engineering and construction projects until President Trump’s new policies begin to receive Congressional approval. Management forecasts a substantial increase in new contracts in the second half of 2017, which is good news for the company’s future. Exxon will begin several new projects in the U.S. before the end of 2017, which bodes well for CBI’s large energy division. Sales will likely decline 7% in 2017, but solid growth could return in 2018 if President Trump’s infrastructure spending program is enacted. EPS dropped 25% in 2016, but will probably fall less than 5% in 2017.

Chicago Bridge & Iron will divest its Capital Services business and use the sale proceeds to reduce debt. A stronger balance sheet will enable the company to bid for larger contracts in the future.

At only 7.2 times current EPS and with a small dividend yield of 0.9%, CBI shares are clearly undervalued. The company maintains a solid balance sheet. CBI will likely climb 65% to my Min Sell Price of 50.38 during the next two years. Buy at 32.35 or below.

EQT Midstream Partners (EQM) Industry: Energy–Oil & Gas Storage & Transportation; Medium Risk; 4.8% Yield; Low PEG Ratio Analysis

EQT Midstream Partners LP (EQM: Current Price 78.17; Max Buy Price 78.77) owns, operates, acquires and develops midstream assets in the Appalachian Basin. Midstream assets include the processing, storing, transporting and marketing of oil, natural gas and natural gas liquids. EQT Midstream operates through two segments: Transmission and Storage, and Gathering Systems. The company was founded in January 2012 and is headquartered in Pittsburgh, Pennsylvania.

EQT Midstream’s operations are primarily focused in southwestern Pennsylvania and northern West Virginia, a strategic location in the core of the natural gas shale areas known as the Marcellus and Utica Shales. This same region is also the primary operating area of EQT Corp., EQM’s general partner and largest customer. EQT Corp. accounts for 73% of EQM’s revenue. Based on its strategically located assets and its working relationship with EQT Corp., EQM has become a leading Appalachian Basin midstream energy company.

EQT Midstream is expanding access to existing and adjacent markets. The company is constructing the Ohio Valley Connector, a 37-mile pipeline extending the company’s transmission and storage system from northern West Virginia to Clarington, Ohio. The system will interconnect with the Rockies Express Pipeline and may interconnect with other pipelines. EQM will transport 650 billion Btu per day of natural gas for the next 20 years.

Sales will likely advance 15% and EPS will rise 7% to $5.68 in 2017. Management expects rapid growth in 2017, which could receive a boost from the Trump administration if pipeline construction restrictions are loosened. With a price to earnings ratio (P/E) of 14.7 times current EPS and a PEG ratio of 0.90, EQM shares are clearly undervalued. I calculate PEG by dividing the current P/E of 14.7 by the sum of the forecast five-year EPS growth rate (11.5%) and dividend yield (4.8%).

EQT Midstream has increased its quarterly dividend 18 times during the past five years. I expect EQM shares to rise 48% and reach my Min Sell Price of 115.71 within two years. Buy at 78.77 or below.

Tech Data (TECD) Industry: Information Technology–Technology Distributor; Low Risk; No Dividend; Price to NCAV Ratio Analysis

Tech Data (TECD: Current Price 92.26; Max Buy Price 95.83) is one of the world’s largest wholesalers and distributors of microcomputer hardware and software products to resellers, retailers and direct marketers.

Tech Data’s products include computer peripherals, security systems, consumer electronics, digital signage and mobile hardware. The company manages inventories to maintain sufficient quantities to achieve high order fill rates while attempting to stock only those products in high demand with a rapid turnover rate.

Tech Data’s recent acquisition of Avnet’s Technology Solutions segment for $2.3 billion will vastly broaden the company’s ability to deliver tech products to major businesses. Tech Data is a leading distributor of such products as laptops, tablets and printers, while the Avnet segment excels in storage, network servers and other data center products.

The significantly larger Tech Data will attract companies like Cisco, with huge appetites for tech products, with a much wider product menu under one roof. Tech Data will have new ways to cross-sell and deepen its relationships with major client companies. The Avnet purchase will also improve Tech Data’s position in Asian markets, and provide opportunities to save $50 million in 2017 and $100 million in 2018.

Sales will likely climb 21% during the next 12 months ending after increasing 5% in the prior 12 months. EPS will jump 36% to $9.05 after advancing 3% in the previous 12-month period.

TECD shares sell at 13.9 times current EPS, and the company maintains a solid balance sheet.

Net current asset value per share (NCAV) is 47.15, and Tech Data’s share price to NCAV is 1.96 which indicates TECD shares are undervalued. Net current asset value is calculated by subtracting all liabilities from current assets and dividing the result by the number of shares outstanding. My calculations do not include the impact of the Avnet purchase, which was finalized on February 27, 2017.

I expect TECD to rise 24% to my Min Sell Price of 114.38 within 12 to 18 months. Buy at 95.83 or below.

Ulta Salon (ULTA) Industry: Retail–Specialty Stores; Low Risk; No Dividend; Graham-Buffett Analysis

Ulta Salon, Cosmetics & Fragrance (ULTA: Current Price 286.65; Max Buy Price 293.65) is the largest beauty retailer in the U.S. The company provides one-stop shopping for 21,000 prestige, mass market and salon products and services. Ulta offers affordable indulgence to its customers by combining the product breadth, value and convenience of a beauty superstore with the distinctive environment and experience of a specialty salon.

Ulta offers cosmetics, fragrance, haircare, skincare, bath and body products, and salon styling tools, as well as salon haircare products. Ulta also offers men’s skincare, haircare and fragrance products, and a full-service salon in all of its stores. The company operates 974 stores in 48 states after opening 25 stores in the latest quarter.

During the 12 months ended January 31, Ulta’s sales surged 25% and EPS jumped 33%, bolstered by same-store sales growth of 6.6% and e-commerce sales growth of 63%. Sales and earnings growth has accelerated during the past couple of quarters. Sales will likely increase 19% and EPS will jump 22% to $8.50 during the next 12 months ending April 30, 2018. New store openings and new store sales could propel sales and earnings higher.

ULTA shares are not cheap, but earnings growth of 40% per year during the past five years justifies the current P/E of 41.1. The company’s 31% return on equity makes the stock attractive to investors like Warren Buffett. ULTA will likely rise 24% to my Min Sell Price of 354.87 within 12 months. Buy at 293.65 or below.

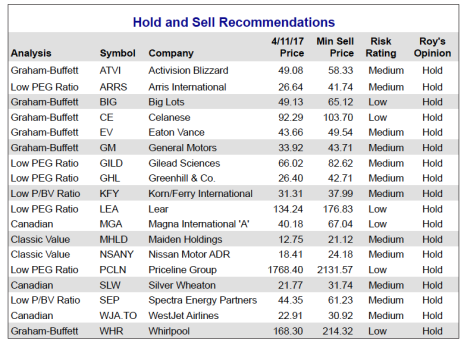

Hold and Sell Recommendations

The stocks in the table below were previously recommended in the Cabot Enterprising Model and I now recommended that you hold them until their prices rise to my Min Sell Prices.

Sell Changes

No new sell recommendations.

Buy and Hold Changes

I have three new changes:

Greenhill & Co. (GHL) Buy to Hold. Earnings could slip in 2017, but the dividend is safe.

Magna International (MGA) Buy to Hold. The growth in car sales has stalled in the U.S., but consumer confidence remains high.

Ulta Salon (ULTA) Hold to Buy. The stock’s recent consolidation presents an unusual buying opportunity.

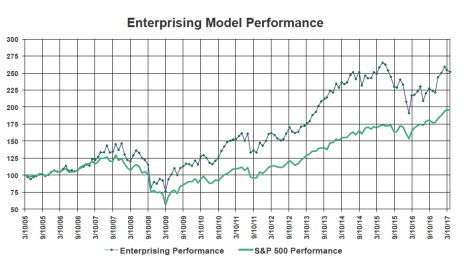

Enterprising Model Performance

During the five weeks ended April 11 2017, the Enterprising Model declined 1.1% compared to an decrease of 0.62% for the S&P 500 Index. Performance was dragged down by Greenhill and Maiden Holdings.

The Model is up 15.4% during the past 12 months compared to an increase of 15.1% for the S&P 500. During the past five years, the Model has advanced 58.4% compared to an increase of 71.8% for the S&P 500.

Since inception on March 10, 2005, the Enterprising Model has provided an impressive return of 151.7% compared to a return of 95.0% for the S&P 500 Index.

[premium_html_footer]

Send questions or comments to roy@cabotwealth.com.

Cabot Benjamin Graham Value Investor • 176 North Street, Salem, MA 01970 • www.cabotwealth.com

Cabot Benjamin Graham Value Investor is published by Cabot Wealth Network, independent publisher of investment advice since 1970. Neither Cabot Wealth Network nor our employees are compensated by the companies we recommend. Sources of information are believed to be reliable, but are in no way guaranteed to be complete or without error. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on the information assume all risks. © Cabot Wealth Network. Copying and/or electronic transmission of this report is a violation of U.S. copyright law. For the protection of our subscribers, if copyright laws are violated, the subscription will be terminated. To subscribe or for information on our privacy policy, call 978-745-5532, visit https://cabotwealth.com// or write to support@cabotwealth.com

We appreciate your feedback on this issue. Follow the link below to complete our subscriber satisfaction survey: Go to: www.surveymonkey.com/bengrahamsurvey

[/premium_html_footer]