While stocks may well trend higher over the rest of the year, it is unlikely the recent remarkable pace higher can last. The easy money and sky-high returns of the earlier recovery may be over. But the party for income investors is still going strong.

You can find yields of 6% or 7% and even higher on stocks with good momentum and a positive outlook over the remainder of the year. These kinds of yields haven’t been around since 2010, when stocks were still depressed from the financial crisis. Those yields didn’t last. And neither will these.

In this issue I highlight a phenomenal stock. It sells at a cheap valuation, has great momentum and a sky-high 7% yield that is not only safe and secure, but the payout is likely to grow at a high rate going forward.

Cabot Dividend Investor 521

Lock in this Huge Yield While it Lasts

Despite the past couple of days, the market indexes are still close to all-time highs. Stocks have soared at an amazing pace over the last year and the past several months. A promising environment of a booming economy complemented by trillions in stimulus still lies ahead. But how much of that wonderful news is already priced in?

While stocks may well trend higher over the rest of the year, it is unlikely the recent remarkable pace higher can last. The easy money and sky-high returns of the earlier recovery may be over. But the party for income investors is still going strong.

You can still find high-yield opportunities that haven’t existed in a decade.

Despite the cyclical stock rally over the last several months, many stocks in the energy and financial sectors are still well below the pre-pandemic prices. In fact, some of the highest yielding stocks on the market still haven’t recovered from the pandemic. And yields are still sky-high.

You can find yields of 6% or 7% and even higher on stocks with good momentum and a positive outlook over the remainder of the year. These kinds of yields haven’t been around since 2010, when stocks were still depressed from the financial crisis. Those yields didn’t last. And neither will these.

The kind of income return still afforded by the current environment is nothing to sneeze at. The benchmark 10-year Treasury bond is still paying just 1.58%. An AAA-rated 20-year municipal bond is paying 1.35%. The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) yields just 2.65%.

Locking in an income return of 6% or 7% in this income-challenged environment is a coup. But the opportunity won’t last much longer. Let’s grab some fat yields while we still can.

In this issue I highlight a phenomenal stock. It sells at a cheap valuation, has great momentum and a 7% yield that is not only safe and secure, but the payout is likely to grow at a high rate going forward.

What to Do Now

The market is changing. And it’s unclear what it will change into.

As earnings season passes, the market is searching for its next obsession. But this is such an unusual environment, it’s hard to tell what’s next.

GDP grew at 6.4% in the first quarter. It is expected to grow far more this quarter. First-quarter earnings were up more than 50% on average over last year’s quarter. That blew away estimates. Earnings are expected to grow 34% for all of 2021. But that may also prove to be an underestimation.

The anticipated booming recovery is coming true. It’s upon us. But there is some weirdness. There isn’t enough supply to keep up with the soaring demand.

The April jobs report was a huge disappointment. It was expected that about a million jobs would be created. But there were only 233,000. The jobs number didn’t miss so badly because employers weren’t willing and able to hire. They were. The problem was that they couldn’t find people to hire. A combination of high unemployment benefits and people at home with kids kept workers away.

There also isn’t enough housing to accommodate demand. The housing market is going crazy. There is currently only a 2.1-month supply of homes—that’s a four-decade low. People would be buying a lot more homes if they could find them. There’s also a chip shortage that’s holding back technology companies, and oil and gas supply remains low amidst soaring demand.

This is different. In recent recessions, there wasn’t enough demand, and too much supply. It’s hard to tell what the modern market will make of this.

One thing seems certain: There will be inflation. A booming economy with trillions of extra dollars in stimulus chasing too few goods must cause inflation. Of course, it remains to be seen if the problems will work themselves out or inflation will become persistent. But there will be more inflation than there has been in a long time, for a while at least.

That’s good for some stocks and bad for others. It’s probably bad for technology. But it’s great for energy. Most energy companies thrive when the price of oil and gas rises. That’s positive for energy stock positions Chevron (CVX) and Valero Energy (VLO). It also tends to be good for financial companies like U.S. Bancorp (USB) and KKR & Co. (KKR) as interest rates rise.

Technology and other growth stocks don’t fare as well as inflation tends to limit growth. On Monday, investors sold technology shares and bought cyclical stocks. Although there is still a better longer-term outlook for technology, many cyclical sectors are booming for the first time in many years.

It could be that investors believe you can get growth from technology anytime, but there is urgency to grab this cyclical rally while it lasts. I’m still mostly bullish on technology because that’s where all the lasting growth is, as we are in a technological revolution. But that sector could get knocked around more in the weeks and possibly months ahead.

We’ve reduced the rating on technology positions Broadcom (AVGO) and Qualcomm (QCOM) until it becomes clear how this post-earnings market will shake out. At the same time, we are increasing our energy exposure by adding ONEOK (OKE) to the portfolio.

Featured SToCK

Buy ONEOK Inc. (OKE)

Yield 7.0%

ONEOK is a large U.S. midstream energy company specializing in natural gas. It owns one of the nation’s premier natural gas liquids (NGLs) systems connecting NGL supply in the Rocky Mountains, midcontinent and Permian regions in key market centers, and also has an extensive network of natural gas gathering, processing, storage and transportation assets. A whopping 10% of U.S. natural gas production uses ONEOK’s infrastructure.

Here are some things to like about the company and stock.

- Investment grade rated debt

- 85% of earnings fee-based

- 25 years of stable and growing dividends

- C corporation structure (generate a 1099 and not a K1)

The market performance has reflected the high quality, or at least it did before the pandemic. In the 10 years prior to the pandemic OKE returned 427%; it returned over 100% in the five years prior. Both were nearly double the market returns over the same period. But energy got crushed during the pandemic as oil and gas demand crashed amidst the lockdowns.

OKE fell more than 75% in the bear market. Although OKE has roughly doubled over the last year and 43% YTD, it’s still more than 30% below the pre-pandemic price. That’s a bargain because, despite the challenges of the pandemic, ONEOK grew earnings 6% in 2020. It also estimates double-digit earnings growth for this year. OKE is still 30% below the pre-pandemic levels with higher earnings ahead of a likely huge energy recovery later this year.

Earnings are resilient because ONEOK operates in the best segments and is well-positioned in the high-growth shale regions. Natural gas is a rapidly growing fuel source that is much cleaner burning than oil or coal. NGL is by far the fastest growing fossil fuel source. In one of the worst years ever for the energy industry, ONEOK’s NGL volumes continued to grow anyway, up 20% from last year’s first quarter. Natural gas transportation volumes also continued to grow last year.

The Dividend

Is that 7% yield too good to be true?

ONEOK has maintained or grown the dividend for more than 25 years. In an extremely challenging 2020, dividends were covered with distributable cash flow by a rock solid 1.2 times. Coverage is likely to get much higher this year. But the main story with the dividend is growth. The energy infrastructure company has grown the payout by a stratospheric average of 54% per year over the last five years.

Unlike most midstream energy companies, OKE is not a master limited partnership. It’s a regular corporation with dividend income taxed at the 15% maximum. It also generates a regular 1099 tax form and not those annoying K1s.

A Superior Midstream Company

Midstream energy companies don’t produce or sell oil and gas. They store and transport it and collect fees for the service. ONEOK also processes natural gas into NGLs. Midstream companies have underperformed the energy rally so far because they don’t benefit from the oil and gas price recovery as much as most energy companies. Plus, they depend more on oil and gas volumes which are still subdued. As well, they are under increasing pressure from the climate-minded new administration.

But ONEOK has unique assets with growing volumes. Plus, they are the most environmentally friendly fossil fuels that should invite less scrutiny. ONEOK is also well-positioned having invested heavily in additional capacity in recent years. They can accommodate strong growth during the recovery without investing much. In fact, capital expenditures are slated to be 70% lower than in 2020.

The company is poised for solid growth this year as the extra capacity will be able to accommodate additional volumes in the full recovery. But OKE is still selling at valuations well below the five-year averages, as well as the overall market.

With OKE, you get a huge 7% yield that is as safe as any in the industry. There are also very powerful reasons to believe the price will appreciate the rest of this year. This wacky environment is giving us an opportunity to get a super high income with a great chance of high total returns.

ONEOK Inc. (OKE)

Security type: Common Stock

Category: Energy infrastructure

Price: 53.35

52-week range: 23.28-53.96

Yield: 7.04%

Profile: ONEOK is a large U.S. midstream energy company with a vast array of natural gas and natural gas liquids assets.

Positives

- NGL and natural gas volumes are in a secular growth trend.

- Recent expansions will provide the ability to grow earnings without investing more.

- The stock sells at a cheap valuation with good momentum.

Risks

- The company has a fairly high level of debt and payments will hold back earnings growth.

- OKE has a high beta of 1.96 and is not a good down-market stock.

Portfolio at a Glance

| High Yield Tier | ||||||||||||

| Security (Symbol) | Date Added | Price Added | Div Freq. | Indicated Annual Dividend | Yield On Cost | Price on 5/11/21 | Total Return | Current Yield | Div Safety Rating | Div Growth Rating | CDI Opinion | Pos. Size |

| AGNC Investment Corp. | 04-14-21 | 17 | Monthly | 1.44 | 8.5% | 18 | 6% | 7.9% | BUY | 1 | ||

| Enterprise Product Partners (EPD) | 02-25-19 | 28 | Qtr. | 1.80 | 6.40% | 23 | -2% | 7.8% | 8.3 | 7 | BUY | 1 |

| Realty Income (O) | 11-11-20 | 62 | Monthly | 2.81 | 4.5% | 66 | 9% | 4.2% | 9.3 | 9.8 | BUY | 1 |

| STAG Industrial (STAG) | 03-21-18 | 24 | Monthly | 1.45 | 6.0% | 35 | 80% | 4.0% | 5.2 | 5.9 | HOLD | 1/2 |

| Verizon Communications (VZ) | 02-12-20 | 58 | Qtr. | 2.51 | 4.3% | 59 | 9% | 4.2% | 8.6 | 9.2 | HOLD | 1 |

| Current High Yield Tier Totals: | 5.3% | 24.0% | 5.1% | |||||||||

| Dividend Growth Tier | ||||||||||||

| AbbVie (ABBV) | 01-28-19 | 78 | Qtr. | 5.20 | 6.7% | 115 | 70% | 4.5% | 10 | 8.6 | BUY | 2/3 |

| Broadcom Inc. (AVGO) | 01-14-21 | 455 | Qtr. | 14.40 | 3.2% | 440 | -3% | 3.3% | HOLD | 1 | ||

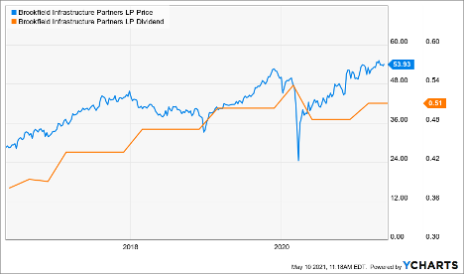

| Brookfield Infrastucture Ptrs (BIP) | 03-26-19 | 41 | Qtr. | 2.04 | 5.0% | 54 | 59% | 3.8% | 6.5 | 8.6 | BUY | 2/3 |

| Chevron Corporation (CVX) | 02-10-21 | 90 | Qtr. | 5.16 | 5.7% | 107 | 20% | 4.9% | HOLD | 1 | ||

| Digital Realty Trust (DLR) | 09-09-20 | 147 | Qtr. | 4.64 | 3.2% | 149 | 5% | 3.1% | 6.8 | 10.0 | BUY | 1 |

| Eli Lily and Company (LLY) | 08-12-20 | 152 | Qtr. | 3.40 | 2.2% | 195 | 30% | 1.8% | 10.4 | 8.3 | HOLD | 2/3 |

| KKR & Co. Inc. (KKR) | 03-09-21 | 48 | Qtr. | 0.58 | 1.2% | 57 | 21% | 1.0% | BUY | 1 | ||

| Qualcomm (QCOM) | 11-26-19 | 85 | Qtr. | 2.60 | 3.1% | 128 | 58% | 1.9% | 8.0 | 9.0 | HOLD | 1/3 |

| U.S. Bancorp (USB) | 12-09-20 | 45 | Qtr. | 1.68 | 3.7% | 60 | 36% | 3.1% | HOLD | 1 | ||

| Valero Energy Corp (VLO) | 06-26-19 | 84 | Qtr. | 3.92 | 4.7% | 78 | 4% | 4.9% | 6.4 | 8.6 | HOLD | 1/2 |

| Current Dividend Growth Tier Totals: | 3.9% | 30.0% | 3.2% | |||||||||

| Safe Income Tier | ||||||||||||

| BS 2021 Corp Bond (BSCL) | 08-30-17 | 21 | Monthly | 0.42 | 2.0% | 21 | 8% | 1.8% | 9.0 | 4.0 | HOLD | 1/2 |

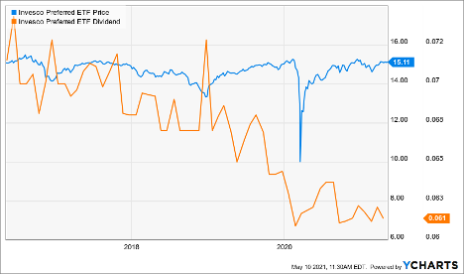

| Invesco Preferred (PGX) | 04-01-14 | 14 | Monthly | 0.74 | 5.3% | 15 | 55% | 5.0% | 6.3 | 1.1 | HOLD | 1/2 |

| NextEra Energy (NEE) | 11-29-18 | 44 | Qtr. | 1.54 | 3.5% | 74 | 79% | 2.1% | 9.4 | 8.0 | BUY | 1/2 |

| Xcel Energy (XEL) | 10-01-14 | 31 | Qtr. | 1.83 | 5.9% | 71 | 192% | 2.5% | 9.5 | 7.0 | BUY | 2/3 |

| Current Safe Income Tier Totals: | 4.2% | 83.5% | 2.9% | |||||||||

Portfolio Updates

April 14

Purchased AGNC Investment Corp. stock (AGNC) - $17.36

April 21

STAG Industrial (STAG) – raised rating from “HOLD” to “BUY”

April 28

Atrial (MO) – SOLD remaining half position

May 5

AbbVie Inc. (ABBV) – raised rating from “HOLD” to “BUY”

Qualcomm Inc. (QCOM) – raised rating from “HOLD” to “BUY”

May 12

Qualcomm Inc. (QCOM) – lowered rating from “BUY” to “HOLD”

Broadcom Inc. (AVGO) – lowered rating for “BUY” to “HOLD”

Purchase ONEOK Inc. (OKE) stock

High Yield Tier

The investments in our High Yield Tier have been chosen for their high current payouts. These investments will often be riskier or have less capital appreciation potential than those in our other two tiers, but they’re appropriate for investors who want to generate maximum income from their portfolios right now.

AGNC Investment Corp. (AGNC – yield 7.9%) – This high-yielding mortgage REIT is up about a buck since being added to the portfolio in last month’s issue. That’s only about a 5.5% move, but it’s a big monthly advance for a stock like this. It’s really all about the spread, or difference between short- and long-term rates. The spread has consistently increased from 1.3% in March of last year to 2.6% in the first quarter. The company uses leverage and that makes a big difference. The prospects of still higher rates are very strong in the recovery later in the year. BUY

Enterprise Product Partners (EPD – yield 7.8%) – Most of what is true of ONEOK is true for EPD. It may seem like a laggard, but it’s up about 19% YTD. Oil and gas prices are moving higher and energy demand is clearly picking up. As well, demand, and consequently volumes, through Enterprise’s systems are highly likely to increase more as the economy opens up more. The stock is still well below pre-pandemic levels with a rock-solid distribution and a likely rising price. This should be a fantastic income stock for the rest of the year at least. BUY

Realty Income (O – yield 4.2%) – This legendary income stock looks solid too. It finally got a move on as REITs rallied. The market also likes the purchase of VEREIT, which the company says will be accretive to earnings to the tune of 10% in the first year. Although the stock has pulled back over the past week after a breakout move, it still looks strong. This REIT is still well below the pre-pandemic price with higher earnings and booming economic growth looming in the months ahead. BUY

STAG Industrial (STAG – yield 4.0%) – This monthly-paying industrial REIT seems to have everything going for it right now. REITs have made a comeback. The cyclical trade is still very much alive and showing strength. STAG is a cyclical, industrial REIT with not only a sizable portion of e-commerce properties, but with other industrial properties that are in high and increasing demand amidst the economic boom. The good news drove the stock to new highs where it was reduced from a BUY to a HOLD earlier in the month. I expect it to slowly trend higher from here. HOLD

Verizon Communications (VZ – yield 4.2%) – There has been a very positive development for this wireless giant over the last month. Verizon announced it is selling its stake in Yahoo and AOL for $5 billion. The reason I chose Verizon over the competitors was because they weren’t as bogged down with these other businesses and were more of a pure wireless company that could better leverage the 5G opportunity. These telecom forays into content never work out. Now, Verizon is getting rid of the remaining distraction to be still more focused on wireless and 5G. Plus, they’ll get $5 billion. The stock has been acting better since the announcement. I like it. HOLD

Dividend Growth Tier

To be chosen for the Dividend Growth tier, investments must have a strong history of dividend increases and indicate both good potential for and high prioritization of continued dividend growth.

AbbVie (ABBV – yield 4.5%) – The stock is breaking out. ABBV had a huge surge between late October and January and then did something out of character. Instead of pulling back, like it has done after every other surge in recent history, it consolidated at the higher level. Now, it’s on the move again, posting new post-pandemic highs. The technical situation looks great, but there are other positives.

The stock is cheap with a high and safe dividend. It still sells at just 9.3 times forward earnings, compared to 22 times for the S&P and 16.7 times for the healthcare sector. It’s cheap because of lingering concerns of competition for blockbuster drug Humira. But the company is increasingly proving it has new drugs capable of filling the revenue shortfall. BUY

Rating change “BUY” to “HOLD”

Broadcom Inc. (AVGO – yield 3.3%) – As I mentioned above, the current market is moving away from technology. Although this semiconductor and business software giant should be a phenomenal holding as technology proliferates at ever higher rates and 5G enables a host of new technologies, the current situation is precarious. AVGO is 12% below the high and falling. I’m confident in the long-term prospects for AVGO. This company grew revenues 16 times over in the last 11 years and 99.9% of all Internet traffic crosses at least one of their chips. But we’ll hold off buying until this market shakes out. HOLD

Brookfield Infrastructure Partners (BIP – yield 3.8%) – The infrastructure partnership announced fantastic earnings last week. Funds from operations per unit were up 20.8% versus last year’s first quarter as the strengthening global economy lifted volumes across its assets and recent acquisitions came online. This bodes very well for future quarters. The stock had been trending higher very slowly and still remains relatively cheap. It’s a good defensive holding as the market changes personality. BUY

Chevron Corp. (CVX – yield 4.9%) – CVX remained in the portfolio even after the huge surge earlier this year because of the likelihood that the energy rally had more to go. It appears renewed again. After consolidating for about six weeks, CVX has risen about 10% is the last couple of weeks and is on the cusp of a new post-pandemic high ahead of an increasingly bullish environment for energy. A booming economy and inflation should play right into Chevron’s hands. HOLD

Digital Realty Trust (DLR – yield 3.1%) – After going nowhere for a year, this data center REIT is finally getting some traction. It’s up over 15% since early March and isn’t that far from the high. The stock also got a bump from positive first-quarter earnings. The specialty REIT grew year over year earnings (as reflected by core funds from operations) by 9%, and the REIT also raised guidance for the year. This is a very low beta stock with good momentum. It’s an excellent holding in the portfolio as the market gets more unpredictable. BUY

Eli Lilly and Company (LLY – yield 1.8%) – Despite the recent earnings disappointment, LLY has moved over 8% higher in the last couple of weeks. It did announce it is selling its Covid-19 treatment in India, which should offset some of what held back earnings last quarter. The stock has looked quite strong through the recent market volatility. Lilly is one of the very best big pharma companies with a spectacular pipeline. And the stock has a history of pulling back after a big surge. You should get further rewarded by being patient with LLY. HOLD

KKR & Co. Inc. (KKR – yield 1.0%) – This alternative investment wealth management company stock has pulled back a little bit after a big surge since late February. But the financial sector continues to be in favor and looking strong ahead of the full recovery in the months ahead. More market volatility might actually help KKR as well as more institutions opt out of the stock and bond markets and into alternative investments. It may consolidate for a while longer but the rest of the year should be kind to this stock. BUY

Rating change “BUY” to “HOLD”

Qualcomm Inc. (QCOM – yield 1.9%) – The stock got hit worse than the overall technology sector over the past couple of days. Semiconductor stocks are under pressure as Taiwan Semiconductor Manufacturing, the world’s largest chip maker, reported a 13.8% revenue decline in April from March because of supply issues. The Semiconductor Index (SOX) fell 4.7% yesterday on the news. As well, Apple reported that it plans to make its own 5G smartphone chips as early as 2023.

Despite a fantastic recent quarter that overcame the chip shortages, investors are less certain what to expect going forward after Taiwan Semi’s report. The Apple thing was always in the cards, and the 2023 timeline is precarious, but it piled on at the worst time. The market is uncertain as it searches for direction after earnings. To be cautious, we will reduce QCOM back to a HOLD for now despite having upgraded it last week before these developments. HOLD

Rating change “BUY” to “HOLD”

U.S. Bancorp (USB – yield 3.1%) – USB seems to trend relentlessly higher in a great environment for banks. The economy is starting to boom and interest rates will likely move higher. The stock recently touched a new 52-week high and is back to the pre-pandemic levels. USB has returned a whopping 36% since being added to the portfolio just a few months ago. The stock could consolidate around this important resistance level. It’s still worth holding because it’s one of the very best banks in a great banking environment and benefits more than other large banks from rising interest rates. But it has moved out of the buy range. HOLD

Valero Energy Corp. (VLO – yield 4.9%) – The same general dynamic that I mentioned about CVX applies to this refiner stock, except to a larger degree. It pulled back more during the consolidation and then had a big 17.5% move higher in the past couple of weeks. It pulled back again in the past few days, partially affected by the pipeline hack. But the uptrend is renewing as the cyclical trade is getting reaffirmed ahead of the full recovery. VLO appears poised to move beyond the old post-pandemic highs in the near future. HOLD

Safe Income Tier

The Safe Income tier of our portfolio holds long-term positions in high-quality stocks and other investments that generate steady income with minimal volatility and low risk. These positions are appropriate for all investors, but are meant to be held for the long term, primarily for income—don’t buy these thinking you’ll double your money in a year.

Invesco BulletShares 2021 Corporate Bond ETF (BSCL – yield 1.8%) – This short-term bond fund is a safe port. It’s especially rewarding to own this during time of market uncertainty and volatility. It doesn’t yield much but it’s decent relative to other safe investments in this market. It also comes as advertised. HOLD

Invesco Preferred ETF (PGX – yield 5.0%) – This preferred stock ETF is much less volatile than the stock market while providing a big yield. It also adds diversification as preferred stock performance is historically not correlated to the stock and bond markets. Since falling sharply in the worst of the bear market, the fund price has recovered to pre-pandemic levels and then leveled off. It should continue to be a solid holding from here, even with interest rates rising. HOLD

NextEra Energy (NEE – yield 2.1%) – This combination regulated and alternative energy utility stock had a nice rebound from the recent lows until the middle of April. It has since pulled back again. It appears to be a more sustained bout of weakness than previously expected. It’s a rare departure from the normal uptrend ahead of a very promising environment for alternative energy stocks. Washington will likely not only offer tax breaks and other goodies but should make the sector stand out to investors. Plus, everything that was true about the company when it was flying high is still true. BUY

Xcel Energy (XEL – yield 2.5%) – The smaller regulated and alternative energy utility reported first-quarter earnings that handily beat consensus expectations for both earnings and revenue on a strong rebound from the electric and natural gas segments amidst the rebounding economy. This stock sold off more than NEE but has rebounded first. It’s had a 22% move higher since being upgraded in late February. It’s still below the post-pandemic highs and should move beyond in the near future. BUY

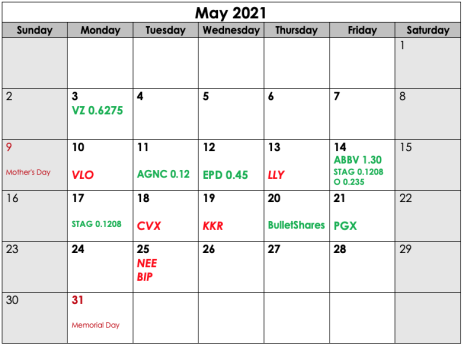

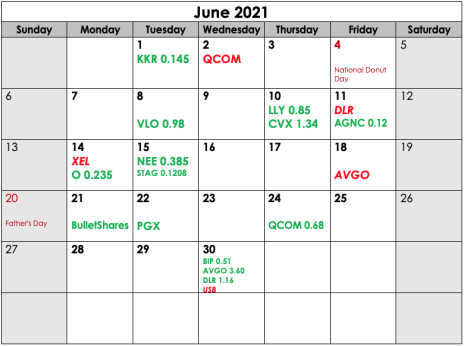

Dividend Calendar

Ex-Dividend Dates are in RED and italics. Dividend Payments Dates are in GREEN. Confirmed dates are in bold, all other dates are estimated. See the Guide to Cabot Dividend Investor for an explanation of how dates estimated.

The next Cabot Dividend Investor issue will be published on June 9, 2021.

Cabot Wealth Network

Publishing independent investment advice since 1970.

President & CEO: Ed Coburn

Chief Investment Strategist: Timothy Lutts

Cabot Heritage Corporation, doing business as Cabot Wealth Network

176 North Street, PO Box 2049, Salem, MA 01970 USA

800-326-8826 | support@cabotwealth.com | CabotWealth.com

Copyright © 2021. All rights reserved. Copying or electronic transmission of this information without permission is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. Disclosures: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to our publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Employees of Cabot Wealth Network may own some of the stocks recommended by our advisory services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: are made in regular issues, updates, or alerts by email and on the private subscriber website. Performance: Subscribers should apply loss limits based on their own personal purchase prices.

Subscribers agree to adhere to all terms and conditions which can be found on CabotWealth.com and are subject to change. Violations will result in termination of all subscriptions without refund in addition to any civil and criminal penalties available under the law.