Today, we are recommending a call center outsourcing company.

At first blush, it doesn’t sound like a sexy opportunity.

But after you learn the details, it quickly becomes a lot more interesting:

- The call center industry is consolidating, and this company would be a perfect acquisition candidate for a several strategic competitors

- Sophisticated private equity investors own 60% of the company will likely run an auction to sell the company within 13 months

- The stock is incredibly cheap on an absolute basis (3.5x FCF) and relative to peers (3.6x EBITDA vs. peers at 10.0x)

All the details are inside this month’s Issue. Enjoy!

Cabot Micro-Cap Insider 421

The Conviction to Hold

Everyone wants to own stocks that go up 100%.

What’s even better than that?

Stocks that go up 5x, 10x or even 100x.

What if you could have predicted Amazon’s success and bought it shortly after its IPO in 1997?

You would be sitting on a 172,400% gain—or a 1,742 bagger!

While everyone is focused on finding these potential 100 baggers, finding them is only half the battle.

The other half is equally as hard: developing the conviction to hold them through their inevitable drawdowns.

According to the Irrelevant Investor, “Amazon has had a double-digit drawdown each year since going public and a 20% drawdown in 16 out of 20 years. The average drawdown is -36% (median is -30%).”

It’s not easy to hold a stock while it pulls back 36%. But the truth is, that will be the case for any major winner.

To earn multi-baggers in your portfolio, you will suffer through the inevitable drawdown.

Why am I talking about Amazon? After all, with a $1.7 trillion market cap, it’s as far from a micro cap as you can get. Nonetheless, I think it’s instructive when considering stocks like Medexus Pharma (MEDXF).

Medexus is up 231% from when I initially recommended it. But it’s down 23% from its all-time high in February.

That is painful—especially because it’s my largest personal position.

Why is it down?

It’s tough to say with 100% certainty.

The only thing that I can think of is that Medexus recently sold 4.6MM shares to fund the treosulphan deal. To incentivize investors to participate in the deal, it offered one warrant (exercisable at 10 per share) for every two shares purchased.

One strategy by institutional investors is to participate in deals like this for the warrants. They just sell the shares that they purchased at around cost (or higher) and keep the warrants, for basically a risk-free potential profit.

More than 4.6 million shares were sold in the offering and 1.5 million shares have traded since then. This dynamic could be pressuring shares.

But at the end of the day, I’m not 100% certain. All I know is the fundamentals look terrific and the stock looks very cheap on an absolute and relative basis.

This gives me to the conviction to hold onto this potential multi-bagger.

Now let’s get into my newest recommendation: Atento SA (ATTO).

New Recommendation

Atento SA: Cheap and Growing with Numerous Catalysts

Company: Atento S.A.

Ticker: ATTO

Price: 22.09

Market Cap: $331 million

Enterprise Value: $696 million

Price Target: 45

Upside: 105%

Recommendation: Buy Under 25

Recommendation Type: Rocket

Executive Summary

Atento is a Latin American customer relationship management (CRM) business that is growing, spews free cash flow, and is an acquisition candidate. It’s majority owned by sophisticated private equity investors who are restricted from selling the company until May 2022. At that time, I expect a sale of the company for more than 100% above Atento’s current price.

Atento Corporation Overview

Atento is a global provider of customer relationship management and business process outsourcing (“CRM BPO”) services.

What exactly does this mean?

In a nutshell, Atento operates outsourced call centers.

It is the #1 player in Latin America for this business.

Forty-three percent of revenue comes from Brazil, 42% comes from other countries in Latin America and the balance of revenue comes from Europe and the Middle East.

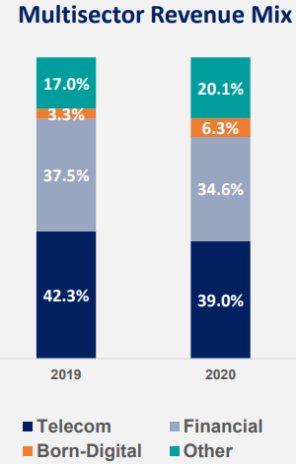

The majority of revenue comes from the financial and telecom sectors, but Atento is growing rapidly with “digital first” companies, as shown below.

In early 2020 during the peak of the pandemic, Atento violated debt covenants with its lenders (HPS Investments, GIC, and Farallon: the “Lenders”). As a result, Bain had to give up its controlling equity stake to the lenders. HPS now owns a 25% stake in the business while GIC and Farallon own 22% and 15%, respectively.

The lenders are prohibited from selling their shares until May 2022.

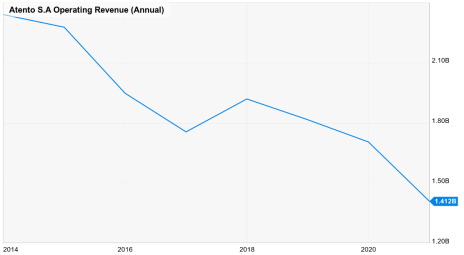

Prior to the Lenders taking over the business, trends at Atento were poor, as shown below.

However, in 2020 the trends improved.

In 2020, revenue declined 17% but actually grew 1.6% in constant currency. EBITDA grew 5% as reported but 23% in constant currency due to strong cost-cutting efforts.

Q4 2020 results were also very strong, as shown below.

This demonstrates underlying strength in the business.

Business Outlook

In 2021, the strong momentum should continue. Management expects mid-single-digit top-line growth and ~160bps of EBITDA margin expansion (the midpoint). This margin guidance translates to 20% EBITDA growth in 2021.

This makes sense given improved momentum should carry forward to 2021 and because the company is well respected in the industry by independent consultants, as shown below.

In 2022 and beyond, revenue and EBITDA growth should continue, driven by a macro recovery as well as increased focus on faster growing industries (Born Digital, Media, Tech, and Health Care).

Insider Ownership and Shareholder Alignment

One thing I always look for is high insider ownership.

In the case of Atento, we are extremely well aligned as HPS Investments, GIC, Farallon and sophisticated private investors own 62% of the company. Institutional investors pay these managers large fees to generate incredible investment returns. As such, they are highly incentivized to generate value for Atento shareholders. We can ride their coattails.

Balance Sheet

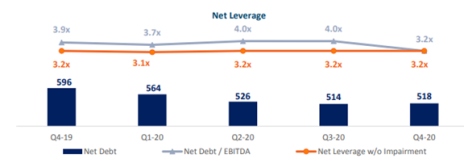

I wouldn’t describe Atento’s balance sheet as strong, but it is manageable. As shown below, Atento has aggressively de-levered its balance sheet and plans to continue doing so going forward.

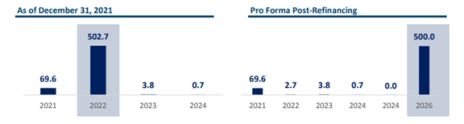

In my opinion, even more important than total leverage is the maturity of that leverage. Atento recently refinanced its leverage facilities so that it doesn’t have any major maturities until 2026.

Acquisition Candidate

I stumbled upon Atento because I’m an investor in another outsource call center business called Concentrix (CNXC). A key part of Concentrix’s strategy is to make acquisitions, and I believe Atento could be a perfect acquisition as the stock is very cheap and the leader in Latin America (an area where Concentrix wants to expand).

While I think Atento would be an excellent acquisition candidate for Concentrix, there are many strategic acquirers that would likely be interested in buying Atento.

Given that the Lenders are trying to maximize their returns, I would expect them to run a process to sell Atento in 2022 once they are able to sell their shares.

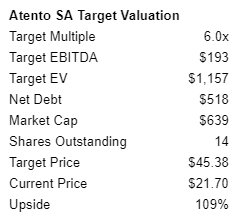

Valuation and Price Target

Atento is cheap on an absolute and relative basis.

It is currently trading at 3.6x forward EBITDA. This is truly a distressed valuation that is usually associated with a company that is on the verge of bankruptcy.

Atento is neither. In contrast, it is growing revenue, earnings and cash flow.

The only knocks against Atento are that it’s illiquid (due to low float) and an emerging market company (with currency risk). While both those risks are valid, the current valuation is too cheap.

Larger Peers, Concentrix (CNXC) and Teleperformance (TLPFY), trade at 12.4x EBITDA and 19x EBITDA, respectively. Even Conduent, which is in the midst of a multi-year turnaround, trades at 6.6x EBITDA.

I believe Atento deserves to trade at 6.0x 2021 EBITDA. This would translate to a 45 price target.

My official rating is Buy under 25.

As always is the case with micro caps, use limits as volume is quite low.

Risks

- Currency Risk. Atento operates in Latin America (over 40% of revenue comes from Brazil) and depreciating currencies (especially BRL) has historically hurt the company’s financial results. While this could certainly continue, this risk is heavily discounted into Atento’s valuation. Further, exposure to Latin America would be complementary (not a concern) to many strategic acquirers.

- Atento has significant debt. Nonetheless, it is a manageable level given the strong cash flow that the business generates and no significant maturities until 2026.

Recommendation Updates

Changes This Week

None

Updates

Aptevo (APVO) continues to be relatively weak. Aptevo reported Q4 2020 quarterly results and announced that it has agreed to sell Ruxience Royalty stream for $35MM up front and milestone payments of up to an additional $32.5MM in 2021, 2022, and 2023. Aptevo did not announce any details on the sale of its IXINITY royalty stream; however, I estimate it is worth $19MM. Aptevo’s enterprise value is $92MM. Counting $67.5MM in payments for Ruxience and $19MM for IXINITY, Aptevo’s pipeline is being valued by the market at $10MM, which seems low considering APVO436 has generated one complete response and another partial response in very difficult to treat AML patients. With regards to Tang’s unsolicited offer, management noted that it couldn’t agree to a non-disclosure agreement and so talks broke down. I still believe Aptevo looks like a great asymmetric bet and believe Tang will follow through with his proxy fight to get Aptevo sold to the highest bidder. Buy under 40. Original Write-up.

BBX Capital (BBXIA) had no news this week. It reported its fourth-quarter results recently. The story remains on track. The most important positive relates to the company’s real estate business. Management wrote in its press release: “Although BBX Capital Real Estate (“BBXRE”) was initially adversely impacted by the COVID-19 pandemic during 2020, it has largely recovered and has to some extent benefited from the recent migration of residents into Florida. We believe that there has been an increase in the demand for single-family and multifamily apartment housing in many of the markets in which BBXRE operates.”

This news is a major positive as the company has over $100MM of fair value invested in real estate primarily in Florida. The company’s Renin subsidiary (which distrubutes building products, including barn doors, closet doors, and stair parts) appears to be performing well and should benefit from a strong economic recovery in 2021.The one negative in the quarter was that the company didn’t buy back any shares despite its $10MM share repurchase authorization. A share buyback would make perfect sense given the stock is trading well below any reasonable estimate of fair value. The investment thesis remains on track and the stock is too cheap trading at 37.5% of book value. Original Write-up Buy under 5.00.

Donnelley Financial Solutions (DFIN) has performed well but had no news this week. Recently, Donnelley reported a solid quarter. Revenue increased 10.5%, beating consensus expectations considerably. The revenue upside was driven by strong capital markets activity (IPOs and SPAC issuance) as well as continued growth of software and tech enabled solutions. Software solutions revenue increased 8% y/y to $54.2MM and now represent 25.8% of total sales. The company also announced the launch of a new software solution for SEC filing and announced a $50MM share repurchase authorization that will replace its current $25MM authorization. All in all, an excellent quarter. Currently, the stock trades at 8.0x free cash flow and 7.3x forward EBITDA. Original Write-up. Buy under 25.00.

Dorchester Minerals LP (DMLP) continues to look attractive. While oil has pulled back recently it’s still above $55/barrel and the company will generate substantial dividends at this price level. In 2020, the company generated $39.4MM of free cash flow. Given the pandemic, we can view this free cash flow generation as a trough. As such, DMLP is trading at 12.4x trough free cash flow. This is an extraordinarily cheap multiple for such a high-quality royalty business. Original Write-up. Buy under 15.00.

FlexShopper (FPAY) recently reported an excellent quarter but has pulled back. In the quarter, revenue increased by 25.3%, beating consensus by 4%. Adjusted EBITDA increased by 136% to $2.6MM. And better yet, new originations increased 26.5%, which implies that revenue and earnings growth for 2021 should be very strong. I continue to like FlexShopper. It is a rapidly growing company in the virtual lease-to-own market. Despite rapid growth and margin expansion, it is only trading at 6.5x 2021 earnings. Importantly, the Chairman of FlexShopper owns over 20% of the company and has recently been buying in the open market. My 12-month price target for FlexShopper is 4.70. Original Write-up. Buy under 3.00.

Greystone Logistics (GLGI) had been strong despite no news. The company reported a relatively disappointing quarter in January. Nevertheless, I still have long-term conviction in it. Revenue declined by 20% in the quarter. The biggest challenge that Greystone currently has is meeting demand from its customer base. As a result, one of the company’s customers (a major beer company) gave notice that it will be diversifying purchases of case pallets between Greystone and another vendor. Greystone will continue to be the sole provider for the keg pallets. Greystone believes that it will not have a material impact on its financials. On the one hand, a 20% decline in revenue is worse than I had anticipated. But on the positive side, net income increased by 187%. How is that possible? The big driver was a strong improvement in the company’s gross margin. It increased from 11.0% last year to 19.9% in the most recent quarter. Greystone has been investing in improving its manufacturing efficiency and clearly that has paid off. The gross margin expansion is even more impressive given that revenue declined. Usually, gross margins shrink as revenue shrinks given diseconomies of scale. The key question in my mind is: Will revenue ever start growing again? I have high conviction that it will. From 2016 to 2020, revenue grew at a compound annual growth rate of 30.4%. Once vaccines are broadly distributed and Greystone has its workforce back up to full capacity, the company should start growing quickly again. In the most recent quarter, the company generated $0.03 of EPS or $0.12 on an annualized basis. Thus, the stock is trading at a P/E of 10.1x. This represents a good value for a company with such a strong long-term growth outlook. Original Write-up. Buy under 1.10.

HopTo Inc (HPTO) recently filed its 10-k to disclose Q4 earnings. Revenue increased 6% y/y to $0.8MM. For the full year, revenue grew 3%. While not a blow-out quarter, it is a positive nonetheless. Insiders own a significant stake in the company and have an incentive to grow revenue and earnings to increase value. I believe HPTO is worth ~0.80 per share. The stock is currently trading at an EV/EBIT multiple of 6.5x. This is way too cheap. To put it in perspective, the software and Internet industry trades at an average EV/EBIT multiple of over 50x. Original Write-up. Buy under 0.55.

IDT Corporation (IDT) has performed well since reporting strong earnings recently. Consolidated revenue increased by 5%. National Retail Solutions (NRS), BOSS Revolution Money Transfer, and net2phone-UCaaS subscription revenues increased by 151%, 73% and 36%, respectively. In particular, NRS’ growth of 151% was incredibly impressive. NRS deployed 1,300 billable POS terminals during the quarter, increasing its network to 13,700 terminals, and had 3,800 active payment processing merchant accounts as of January 31. IDT believes that the market for NRS’ point of sale terminals is 100,000. On a sum-of-the-parts basis (which I think is the right way to view this name given IDT’s propensity to sell and spin off its assets), the stock is worth 34. Original Write-up. Buy under 23.50.

Liberated Syndication announced this week that it will be making another acquisition. This time, it will buy Glow, a podcast monetization platform. Financial terms of the transaction were not disclosed. The more interesting acquisition was announced a few weeks ago when Libsyn announced that it will acquire AdvertiseCast, an independent, podcast advertising company. The combination of Libsyn’s 75,000 podcasts with AdvertiseCast’s advertising capabilities should result in accelerating revenue growth going forward. Last year, AdvertiseCast grew revenue 45% to $12MM and has scaled profitably since launched in 2016 with no outside investment. Under the terms of the transaction, Libsyn will pay $30MM ($18MM in cash, $10MM in newly issued Libsyn shares, and $2MM in earnouts). Libsyn will issue $25MM of stock to pay for the deal in a PIPE transaction, which will be led by Camac Partners. The transaction is expected to close in Q2 2020. The acquisition looks like a steal. Libsyn is paying 2.5x revenue for a podcast advertising business that is growing 45% per year and profitable. With the acquisition, podcast revenue growth will increase from 11.1% to 26.2%. Total company growth increases from 5.0% to 17.5%. Original Write-up. Buy under 5.00.

MamaMancini’s Holding (MMMB) is performing very well. We originally recommended the stock last summer and for a long time it didn’t really do anything. The stock moved slightly up but didn’t make any large moves. It wasn’t as exciting as some of our other fast-moving micro-cap recommendations. But we stuck with the stock because it had solid fundamentals (good revenue and earnings growth), a strong balance sheet, and reasonable valuation. And our patience is starting to pay off. After treading water for a while, the stock looks like it’s breaking out. Not a ton has changed from a fundamental perspective. Recently, the company announced that it appointed Managing Partner from Alta Fox Capital, Connor Haley, as a member of the board. This is a major positive as it suggests that Alta Fox Capital (the firm has excellent performance) will remain a shareholder for the long term. MamaMancini’s is in the process of uplisting to the Nasdaq, but that isn’t really new news. The company did recently announce that it is looking to make bolt-on acquisitions of companies with $12MM to $20MM of sales and positive EBITDA. Any acquisition will be complementary to the company’s current portfolio of products and will be immediately accretive. Given strong performance and a cheap valuation, I recently increased my buy limit to 2.50. My 12-month price target is 3.80, which is driven by an estimated price-to-earnings multiple of 20x on expected fiscal 2021 earnings of $0.19. Original Write-up. Buy under 2.50.

Medexus Pharma (MEDXF) has been a little weak, but it remains our highest conviction idea. I expect Medexus to announce that it will be uplisted to the Nasdaq very soon and this could be a nice catalyst to see the stock continue its upward march. Medexus remains my highest conviction idea and largest personal holding. Management believes its current drug portfolio (including recently licensed Treosulfan) has peak sales potential of $350MM to $400MM CAD. Assuming the company can trade at 3x this revenue estimate (the company will execute additional licensing deals so I expect revenue to ultimately grow even higher) in line with slower-growing peers, MEDXF would trade at ~24 per share, implying significant upside from here. Original Write-up. Buy under 8.00.

NamSys Inc. (NMYSF) recently reported positive full-year results. In the fiscal year, revenue increased 15% to $4.7MM. Free cash flow increased 34% to $1.9MM. Namsys is attractively valued, trading at 15.3x free cash flow. The biggest news remains that the company recently announced that it has terminated its long-term incentive plan. The plan was originally put in place in the mid-2010s to incentivize the team to help transition NamSys’ software from on-premise to a cloud-based offering. However, the long-term incentive plan had no limit as participants in the bonus plan are entitled to 15% of the value of the company, no matter how high it’s valued. The payout for the termination of the bonus plan will be made in cash and stock. This is a major positive as it will increase the company’s earnings growth rate going forward. Further, it’s possible that this announcement could be a prelude to a sale of the company. Despite historically growing revenue and earnings at a compound annual growth rate of 20%+, the stock only trades at 15.3x free cash flow. It has a pristine balance sheet with significant cash and no debt, and insiders own more than 40% of the company, ensuring strong alignment. Original Write-up. Buy under 0.80.

P10 Holdings filed its 10-K and issued its annual letter to shareholders. It is always a great read and quick (only three pages). In the letter, Co-CEOs Robert Alpert and Clark Webb lay out high level guidance for P10 Holdings financial outlook. The business currently has $12.7 billion in assets under management and charges ~1.00% on average for its management fee. The business should generate 55% to 60% EBITDA margins. Taxes and interest payments currently amount to $18.4MM per year. After doing the basic algebra (assuming a 55% EBITDA margin), I determined that the business is currently on track to generate ~$70MM of EBITDA and $51MM of free cash flow. As such, it’s trading at 12.9x EBITDA and 12.1x free cash flow. This isn’t dirt cheap, but it is very reasonable for such a well-positioned company with organic growth and additional acquisition opportunities. It’s closest (albeit larger) peer is Hamilton Lane (HLNE), which trades at 31.9x EBITDA and 21.3x free cash flow. My official rating is Hold Half, but I may eventually switch my rating back to Buy given how well the business is positioned. Original Write-up. Hold Half.

U.S. Neurological Holdings (USNU) filed its 10-K to report Q4 earnings. In the quarter, revenue grew 55% due to a strong snap back of demand. For the full year, revenue grew 3% which is impressive given the pandemic. In 2020, the company generated EPS of $0.07. As such, it is trading at a P/E of 4.9x. It also has $2.0MM ($0.26 per share) of cash on its balance sheet and no debt. U.S. Neurological Holdings operates as a holding company in the United States. It is engaged in providing medical treatment and diagnostic services that include stereotactic radiosurgery centers, utilizing gamma knife technology, and it holds interests in radiological treatment facilities. Original Write-up. Buy under 0.25.

Watch List

FitLife Brands (FTLF) sells nutritional products for health-conscious consumers. It is a name that we have monitored for a while and continues to perform well. In the most recent quarter, revenue increased 61%! Yet it only trades at 5x earnings. The one area of concern is that 75% of sales go to GNC, which recently declared bankruptcy. Nonetheless, FitLife’s resilience during the pandemic has been amazing.

Truxton Corp (TRUX) is a Nashville-based private bank and trust business. It recently announced it is paying a $2 special dividend and initiating a $5MM share repurchase authorization. The company has grown very nicely yet only trades at a P/E of 12.5x.

Meridian Corp (MRBK) is a Pennsylvania-based commercial bank that has performed very well. It has benefitted from refinancing activity and will see earnings decline in 2021. However, the stock trades at just 6x earnings and has consistently generated a positive ROE. Financials are looking increasingly attractive in a world with rising interest rates, especially given cheap valuations.

The next Cabot Micro-Cap Insider issue will be published on May 12, 2021.

Cabot Wealth Network

Publishing independent investment advice since 1970.

President & CEO: Ed Coburn

Chairman & Chief Investment Strategist: Timothy Lutts

176 North Street, PO Box 2049, Salem, MA 01970 USA

800-326-8826 | support@cabotwealth.com | CabotWealth.com

Copyright © 2021. All rights reserved. Copying or electronic transmission of this information is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. No Conflicts: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to its publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: All recommendations are made in regular issues or email alerts or updates and posted on the private subscriber web page. Performance: The performance of this portfolio is determined using the midpoint of the high and low on the day following the recommendation. Cabot’s policy is to sell any stock that shows a loss of 20% in a bull market or 15% in a bear market from the original purchase price, calculated using the current closing price. Subscribers should apply loss limits based on their own personal purchase prices.