If you have not already, I recommend that you read my Cabot Micro-Cap Insider Guide. It will help you get the most out of your Cabot Micro-Cap Insider membership, and make your investing decisions easier and more profitable. It will also explain much of the shorthand we use in Cabot Micro-Cap Insider, and explain our ratings.

If you have any questions about any of my recommendations, I encourage you to reach out to me directly at rich@cabotwealth.com.

Now let’s get into my newest recommendation: Medexus Pharmaceuticals.

Cabot Micro-Cap Insider 520

[premium_html_toc post_id="205215"]

Welcome to Cabot Micro-Cap Insider

Welcome to Cabot Micro-Cap Insider!

If you have not already, I recommend that you read my Cabot Micro-Cap Insider Guide. It will help you get the most out of your Cabot Micro-Cap Insider membership, and make your investing decisions easier and more profitable. It will also explain much of the shorthand we use in Cabot Micro-Cap Insider, and explain our ratings.

If you have any questions about any of my recommendations, I encourage you to reach out to me directly at rich@cabotwealth.com.

Now let’s get into my newest recommendation: Medexus Pharmaceuticals.

New Recommendation

Medexus Pharma: A Specialty Pharma Company Trading at a Massive Discount to Fair Value

Company: Medexus Pharmaceutical

Ticker: MDP.V

Price: 2.51

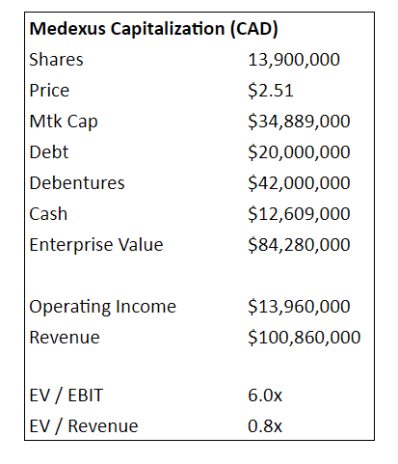

Market Cap: $34.9 million

Enterprise Value: $84.3 million

Price Target: 7.00

Upside: 178%

Recommendation: Buy Under 3.25

Recommendation Type: Rocket

Executive Summary

Medexus Pharma (MDP.V) is a Canadian specialty pharma company that is growing at a rapid clip. Its drugs treat chronic conditions and as a result, its business will have a limited headwinds from COVID-19. It just completed a transformative acquisition which is accretive and has been completely ignored by the market. Pro forma for the acquisition, the stock is trading at an EV/EBIT multiple of 6.0x a large discount to peers at 25.6x and bought back 5% of shares last year. Insiders own 15% of shares outstanding. My price target of 7.00 implies over 100% upside from current levels.

Background

I first learned of Medexus Pharma when it bought a drug called XINITY from Aptevo Therapeutics. I had followed Aptevo closely for years and thought Aptevo was significantly undervalued mainly because it had a drug for hemophilia called XINITY that was growing like crazy. I estimated that the drug was worth $100 million, significantly more than Aptevo’s $25 million market cap at the time.

I knew that Aptevo would have to sell XINITY in order to fund its R&D pipeline. I figured the announcement of the sale of XINITY would be a huge catalyst for Aptevo. Eventually and much to my anticipation, a sale was announced, but I was incredibly disappointed.

Aptevo announced that it had indeed sold XINITY and that it had received “proceeds in excess of $100 million.” But the details of the press release disclosed that the proceeds consisted of an upfront payment of only $30 million. The remaining $70 million of proceeds would be dependent on milestone payments and royalties.

My initial thought was, “Whoever bought this drug got an amazing deal.”

That led me to dig into Medexus Pharmaceuticals.

Medexus Pharma Overview

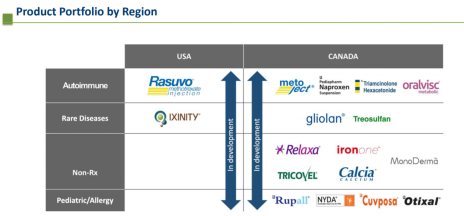

Medexus is a specialty pharma company focused on rheumatology, auto-immune disease, specialty oncology, allergy and pediatric diseases.

The company was initially formed when three companies (Pediapharm, Medexus, and Medac Pharma) merged in October 2018. The logic of merging these three companies together was that fixed costs could be leveraged more effectively.

Medexus focuses on buying and licensing existing drugs. This is an interesting strategy because much of the risk of regulatory approval has been removed. Molecules that are acquired or licensed are well known and often have been launched in other territories. This significantly limits commercial risk.

Medexus’ strategy has paid off as revenue grew strongly in 2019 by 130%.

The company’s three largest drugs products are:

- Metoject (Canada) is a unique formulation of methotrexate designed to treat rheumatoid arthritis and psoriasis.

- Growing 122% y/y and has full reimbursement.

- Strong growth expected to continue.

- Rasuvo (US) is the same molecule as Metoject but with a new name for the US market. Approved to treat rheumatoid arthritis, juvenile arthritis, and psoriasis

- Growing at 14% y/y despite having launched 4 years ago.

- Rupall (Canada) is used to treat seasonal and year-round allergies. It’s growing at 68% as physicians switch patients from generic antihistamines or OTC products to Rupall.

Even though the company has grown strongly, it was still not at scale in 2019.

It has a full sales team in Canada and the United States, but the US sales team was only selling one product, Rasuvo.

That all changed when Medexus acquired XINITY from Aptevo.

Business Outlook

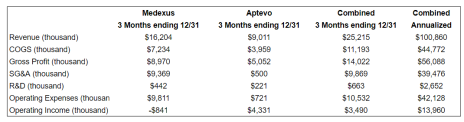

The beauty of the XINITY acquisition is that Medexus acquired a drug for an upfront payment of $30 million that is growing at 40% and generating $14.0 million of gross profit on an annualized basis. Medexus will have to bear the R&D expenses for XINITY (ongoing pediatric trial) which annualizes to $884,000. It hired 5 sales professionals from Aptevo whose salary and benefits conservatively annualize to ~$2 million in additional operating costs according to Medexus.

But these are the only costs that Medexus will have to add to support XINITY.

As a result, Medexus transforms from a company that was generating slightly negative operating earnings to an extremely profitable company. As shown below, assuming no growth, Medexus is currently generating ~$14 million in operating earnings on an annualized basis.

On a pro forma basis (adding in XINITY), revenue is currently growing at 88%. Therefore, profitability will increase with growth as fixed costs are leveraged.

XINITY is a drug for hemophilia that is indicated in adults and children older than 12 for hemophilia B for control and prevention of bleeding episodes.

Most of the other hemophilia drugs are long acting. Long acting hemophilia drugs are convenient because patients only have to inject themselves every three days instead of daily. However, these patients can only be active on the days that they inject themselves when the drug is at its strongest.

Hemophilia patients who want to be active everyday can opt to use XINITY which is injected every day. XINITY occupies a niche position ($32.4 million in 2019 sales) in a large market (US hemophilia B market in the US is worth $734 million).

Nonetheless, its growth outlook is robust.

Currently, a pediatric study is ongoing to gain XINITY approval for children younger than 12. This represents 33% of the hemophilia market. With approval, XINITY’s market will increase by 50%.

Further, XINITY is only approved in the US. Medexus will launch the drug in Canada and license it in other parts of the world. This strategy should provide growth for many years to come.

Additionally, Medexus will look to creatively acquire and license more drugs in the future.

Medexus is also relatively well positioned in the current macro environment. ~80% of sales treat chronic conditions. As a result, patients cannot skip their medications. While growth may slow a bit given sales reps can’t visit doctors in person, I’m still expecting sales to grow organically in 2020 as sales reps can meet virtually.

Valuation and Price Target

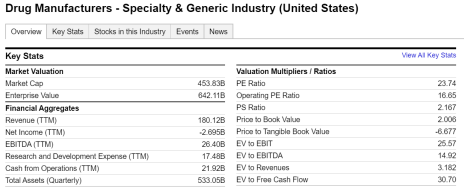

As shown below, specialty pharma companies trade at an EV/revenue multiple of 3.1x and an EV/EBIT multiple of 25.6x.

In contrast, Medexus is trading at an EV/revenue multiple of 0.8x and an EV/EBIT multiple of 6.0x.

Assuming a 1.5x revenue multiple, Medexus deserves to trade at a stock price of 7.00. Note this valuation uses current annualized revenue (it should grow significantly in 2020) and a valuation that is a 50% discount to public peers.

One other appealing aspect of Medexus is that its management team and board of directors appear to be good capital allocators. The XINITY deal structure was very impressive and in 2019, the company bought back 779,800 shares (~5% of shares outstanding).

This shows me that the management team isn’t pursuing growth for growth’s sake, but instead pursuing capital allocation decisions that will increase per share value.

In 2020, the company will generate significant free cash flow, and I wouldn’t be surprised if it used the excess cash to buy back stock, if its valuation remains depressed.

There are two ways to buy Medexus. You can either buy it on the Canadian exchange under the ticker MDP.V (quoted in Canadian dollars) or buy it in the United States under the ticker PDDPF (quoted in US dollars). My price target for MDP.V of 7.00 is in Canadian dollars while my price target for PDDPF of 5.00 is quoted in US dollars. To get from my Canadian price target to my American price target, I divided 7.00 by the current Canadian dollar to US dollar exchange rate of 1.4.

My rating for MDP.V is Buy Under 3.25. My rating for PDDPF is Buy under 2.32.

Risks

- Concentrated Revenue. The majority of revenue is generated from the sale of four products: Metoject, Rasuvo, Rupall, and XINITY.

- The outlook for all four products looks quite strong, and I expect Medexus to further diversify through creatively structured acquisitions and licensing deals

- Medexus has $50 million in net debt or roughly 5x current annualized EBIT.

- Convertible debentures represent the majority of the debt ($42 million). They are an attractive form of debt as they are unsecured and convertible into common equity at a significantly higher price ($6.30).

- The remaining debt was provided by Midcap Financial, an affiliate of Apollo. Typically, Midcap is able to extract rather egregious terms when it loans money. In this case, terms are attractive. Midcap is loaning Medexus $20 million under an asset backed facility that charges an interest rate of one month LIBOR plus 3.95% subject to a LIBOR floor of 1.50%. In the current environment, I’m amazing that Medexus was able to negotiate such attractive financing. The fact that Midcap offered such an attractive financing package speaks highly to Medexus’ low credit risk.

Recommendation Updates

Changes This Week

Recro Pharma (REPH) moves to Hold

Riviera Resources (RVRA) Change from Buy Under 3.00 to Buy Under 2.25 (adjusted for 0.75 distribution)

Updates

Hopto Inc (HPTO) is a fast-growing software company trading at a dirt-cheap valuation. There has been no news since my inaugural issue. I did have a chance to speak recently with a patent expert who personally knows Jonathan Skeels, CEO of HPTO. While he has no knowledge of Hopto’s patent portfolio (Hopto has 39 patents that it is trying to sell) he was generally bearish on intellectual property noting it is expensive and time intensive to monetize software patents. Nonetheless, HPTO is well positioned given that its GO-Global software enables office workers to work remotely, which is especially attractive in the current environment. Since I issued my BUY under 0.45 rating, the stock has appreciated from 0.39 to 0.53. As such, my current rating is HOLD. If the stock drops back to 0.44 or lower, my recommendation will change back to BUY. HOLD

Earnings Date: Not yet announced.

P10 Holdings (PIOE) reported earnings on Thursday, April 30th. Revenue grew 8% y/y due to additional fund raising by RCP Advisors. Cash earnings stayed flat y/y at $0.04 although that was due to costs related to acquiring Five Points and almost acquiring another private equity manager. RCP Advisors noted it has already raised $165 million of additional capital commitments for its private equity funds. It will launch two more funds this year and Five Points will also begin a new fundraise. Excluding one-time costs, PIOE will generate $0.27 in cash earnings in 2020. As such, PIOE is trading at 7.7x 2020 free cash flow. This is too cheap a valuation for a company that has sticky revenue, high margins, and strong growth potential. The investment case is on track. BUY Under 2.25

Recro Pharma (REPH) reported earnings this week. Unfortunately, management decreased annual revenue guidance to $80-85 million, down from original guidance of $98-100 million. 2020 EBITDA guidance decreased to $26-30 million from $42 million.

The reduction in guidance is a result of the following:

- Increased competition from Mylan, a competitor to Recro customer, Teva.

- Recro manufactures a product called Verapamil for Teva. In 2019, Verapamil demand was very strong as Mylan, which also manufactured the product, was out of the market due to quality control issues at its plant. However, Mylan has regained ~50% market share faster than anticipated in 2020.

- Slower than expected new business growth, which REPH believes is primarily attributable to COVID-19.

- Management had previously anticipated that new business activity would offset headwinds from Mylan coming back into the market. However, COVID-19 has slowed customer access and resulted in some customers and prospects pulling back due to concerns about availability of development funding, timing of clinical trials, etc.

- Notifications by two customers of discontinuations for two commercial product lines, which resulted in a decrease of approximately $4 million on previous 2020 revenue guidance and is estimated to have an annual impact to 2021 revenue of approximately $7 million to $8 million.

- Due to the disappointing 2020 guidance, the stock fell to 5.08 and is trading at an EV/2020 EBITDA multiple of 7.8x.

This appears to me to be an over-reaction as the stock is trading at a trough valuation on trough earnings. A normalized valuation would be ~15x EBITDA and normalized EBITDA would be $50 million, significantly higher than current 2020 guidance. Looking out a few years, the stock should trade at a significantly higher price.

Given COVID-19 headwinds, I took down my price target down to 13.00 which corresponds to a 15.0x EV/2020 EBITDA multiple, a 25% discount to public peer Catalent.

While my price target still implies significant upside longer term, I believe REPH will be in “purgatory” for at least the next couple of quarters given COVID-19 headwinds.

As such, I changed my BUY rating to HOLD.

Riviera Resources (RVRA) recently paid a $0.75 distribution. The distribution continues the trend of management returning capital to shareholders through share repurchases and special dividends. RVRA continues to be an attractive long term holding. It has no debt and is generating positive free cash flow. Further, it has a very valuable asset in its Blue Mountain midstream business. Once the energy market turns (and it always eventually does), Riviera will be well positioned to benefit. I’m changing my rating from Buy Under 3.00 to Buy Under 2.25 (adjusted for 0.75 distribution) BUY Under 2.25

U.S. Neurological Holdings (USNU) operates as a holding company in the United States. It is engaged in providing medical treatment and diagnostic services that include stereotactic radiosurgery centers, utilizing gamma knife technology, and holds interests in radiological treatment facilities. There has been no news this week. Since I issued by BUY under 0.20 rating, the stock has appreciated from 0.14 to 0.23. As such, my current rating is HOLD. If the stock drops back to 0.19 or lower, my recommendation will change back to BUY under 0.20. HOLD

Earnings Date: Not yet announced.

Watch List

I currently have one watch list company: Dorchester Minerals (DMLP). DMPL is an oil and gas royalty company that pays out all its of its earnings to its shareholders. It has no debt and so has no risk of bankruptcy. The lowest quarterly distribution that DMLP has made over the past 10 years was $0.15 in 2016 (the last time energy prices were depressed). At DMLP’s current price, it’s trading at a trough yield of 5.4%. I will continue to research this name and may recommend it in a future issue.

Recommendation RATINGS

| Stock | Price Bought | Date Bought | Price 5/12/20 | Profit | Rating |

| Hopto Inc (HPTO) | 0.39 | 4/28/20 | 0.53 | 36% | Hold |

| Medexus Pharma (MPD.V) | New | — | 2.51 | — | Buy under 3.25 |

| P10 Holdings (PIOE) | 1.98 | 4/28/20 | 2.07 | 5% | Buy under 2.25 |

| Recro Pharma (REPH) | 8.16 | 4/28/20 | 4.88 | -40% | Hold |

| Riviera Resources (RVRA) | 2.60 | 4/28/20 | 2.55 | -2% | Buy under 2.25 |

| U.S. Neurological Holdings (USNU) | 0.14 | 4/28/20 | 0.23 | 64% | Hold |

Please email me at rich@cabotwealth.com with any questions or comments about any of our stocks, or anything else on your mind.

Glossary

Buy means accumulate shares at or around the current price.

Hold means just that; hold what you have. Don’t buy, or sell, shares.

Sell means the original reasons for buying the stock no longer apply, and I recommend exiting the position.

Sell a Half means it’s time to take partial profits. Sell half (or whatever portion feels right to you) to lock in a gain, and hold on to the rest until another ratings change is issued.

The next Cabot Micro-Cap Insider issue will be published on June 10, 2020.

Cabot Wealth Network

Publishing independent investment advice since 1970.

CEO & Chief Investment Strategist: Timothy Lutts

President & Publisher: Ed Coburn

176 North Street, PO Box 2049, Salem, MA 01970 USA

800-326-8826 | support@cabotwealth.com | CabotWealth.com

Copyright © 2020. All rights reserved. Copying or electronic transmission of this information is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. No Conflicts: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to its publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved. Buy/Sell Recommendations: All recommendations are made in regular issues or email alerts or updates and posted on the private subscriber web page. Performance: The performance of this portfolio is determined using the midpoint of the high and low on the day following the recommendation. Cabot’s policy is to sell any stock that shows a loss of 20% in a bull market or 15% in a bear market from the original purchase price, calculated using the current closing price. Subscribers should apply loss limits based on their own personal purchase prices.