Rising Rates Pressure Gold

Gold is outperforming the major risk assets this year, but remains pressured in the near term by rising bond rates. For reasons explained in this issue, I don’t expect this dynamic to persist for long, however.

Titanium and steelmaking coal remain the top performers right now, with both minerals supported by shrinking availability and increasing demand. Steel is also strong, meanwhile, while copper remains weak.

For now, I continue to recommend that we maintain a mostly defensive stance.

Cabot SX Gold & Metals Advisor Issue: May 10, 2022

Rising Rates Weigh on Gold

Despite a weak start to the second quarter, gold is still outperforming other major financial assets on a year-to-date basis.

The yellow metal has had a much better 2022 compared to risk assets like stocks and junk bonds, with gold prices up 4% YTD, compared to losses of 15% and 9%, respectively, in the S&P 500 and the Bloomberg High Yield Bond Index.

With such a strong relative performance, then, why hasn’t the precious metal attracted more interest among safety-oriented investors? My answer is that gold’s failure to overcome the August 2020 record high at $2,063 an ounce during the last major rally was a psychological blow to the “gold bugs.”

Gold’s March 8 closing high at $2,047 came just a few dollars shy of the all-time peak and likely undermined the confidence of the bulls. It would certainly explain the metal’s disappointing performance in the last eight weeks.

More than any single short-term factor, however, rising interest rates have taken a lot of wind out of gold’s sails. You could argue that the huge rally in the U.S. 10-year Treasury yield, from 1.8% to 3.1%, since early March was simply too much for non-yielding bullion to compete with. Thus, income-focused investors have had every incentive to look beyond gold to the bond market.

The chart below provides a succinct picture of gold’s underperformance versus the 10-year yield. Admittedly, it’s not a pretty one.

Keep in mind that the gold versus 10-year yield ratio is one of gold’s most important leading indicators. Historically, gold’s strongest and most durable upside moves have occurred when this ratio is in a rising trend.

Ultimately, however, gold is a safety asset and is always in high demand when there’s plenty of uncertainty over the economy and the geopolitical outlook—even when rates are rising. And right now, there’s no shortage of worries on either of those two fronts. Because of this I don’t think we should count gold out just yet.

I would also point out that during the 2003-2007 gold bull run, the metal had to complete with rising Treasury yields. I mention this period since there are so many similarities between then and now (especially rising inflation and the threat of war).

Once the dust settles from the latest stock market sell-off, gold should be able to catch a fresh safety bid, if recent history is any guide. Indeed, gold’s strongest performances of the last two decades have followed the immediate aftermath of bear markets in the major indexes (and the Nasdaq just entered one).

Bottom line: The gold bulls should still prevail in spite of rising rates in the intermediate term, though for now the gold market remains too choppy to make any new commitments.

What to Do Now

With inflation likely to persist, not only industrial metals but commodities in general should outperform. One way of playing the bullish trend in natural resources is the Invesco DB Commodity Index Tracking Fund (DBC), an actively traded index ETF which is based on several major commodity futures contracts ranging from metals (including gold, silver and copper) to grains (including corn, wheat and soybeans) to energy products (including oil and natural gas). A combination of strong global demand for farm commodities, exceptionally volatile weather in many food-growing regions around the globe and rising input costs (i.e. fuel and fertilizer) should contribute to rising hard asset prices in the months ahead. Additionally, crude oil prices are expected to remain elevated in the coming year, and for that reason, I expect DBC—which is heavily skewed toward the energy sector—to continue to outperform. Traders recently purchased a conservative position in DBC using a level slightly under 21.50 as the stop-loss on a closing basis. After the 21% rally since our initial entry, I previously suggested taking 50% profit in this position. I also suggest raising the stop at slightly under 26.90 (closing basis) on the remaining position. HOLD A HALF

New Recommendations/ Updates

Can Silver Prevail in a Recession?

Fear is growing among many investors that the global economy is on the cusp of recession, which could be here by next year (if not sooner). If this happens, how might silver perform in such a depressed environment?

The conventional answer is that due to silver’s much higher industrial demand vis-à-vis gold, the white metal would lag gold while the latter presumably benefits more from hedging demand. But a noted metals analyst believes silver could still perform well if the economy stalls.

Jeff Christian, managing partner at CPM Group, said that while silver would see less industrial use in a recession, it would likely “rise sharply” due to increased safety demand. That’s because silver historically tends to follow gold higher “moving into a recession and into the early portion of a recession,” he told Kitco.

His assessment of silver outperforming in a depressed economy was affirmed by the last major global recession in 2008-09, which was also preceded by a prolonged period of rising commodity prices (much like the present time).

Particularly worth noting, Christian observed that much of the money flowing into the U.S. dollar from overseas is for the purpose of investing in Treasuries, because “they have a higher yield than their competition.”

His analysis agrees with mine that this trend will likely continue since the greenback is being bolstered by higher interest rates and because foreign nations are in worse shape than the U.S., leaving the dollar as the de facto currency of last resort.

But we’re also both in agreement that gold and the dollar can appreciate in value simultaneously in an environment of fear (like the one we’re now in).

“The reality,” he said “is that two-thirds of the time, gold doesn’t trade opposite the dollar.”

What to Do Now

From a short-term strategic perspective, however, silver isn’t yet ready to commence its next sustained rally. Accordingly, no new silver ETF purchases are recommended. WAIT

A Contrarian Signal for Copper

If you’re an investor with a contrarian bent like me, you’ll surely shake your head at the timing of Invesco’s latest commodity-related ETF launch.

The new fund’s name isn’t easy on the memory—it’s called the Invesco Electric Vehicle Metals Commodity Strategy No. K-1 ETF (EVMT)—but it’s reputed to be the world’s first commodity fund based on the shift away from traditional fuels.

The ETF’s holdings will include futures contracts and other financial products that track the prices of metals, including copper, cobalt, aluminum, iron ore, nickel and zinc. These metals are of course widely used in EVs and other alternative energy applications.

What distinguishes the new Invesco fund from other ETFs that invest in EVs is that the EVMT will hold assets directly tied to metals prices instead of the stocks of battery producers and metals producers. But what I find most interesting is the timing of the new ETF’s unveiling.

EVMT commenced trading on April 27 at an initial price of 30.50. It then promptly fell to almost 28 in the next seven trading days—a loss of 8% in its short lifetime. Granted, there’s nothing terribly unusual about a stock or ETF falling in the immediate aftermath of its debut. But the fact that this heavily copper-focused fund (27% of total assets) was introduced shortly after the peak in the copper price is eye-opening.

One could almost surmise that the fund’s introduction was a belated response to the semi-mania conditions that prevailed in the copper market through much of 2020 through early 2022. If that’s indeed the case, the timing of the fund’s introduction could represent a significant intermediate-term top for the copper market (based on the contrarian principle).

I’ll admit that contrarianism doesn’t always work when it comes to timing the market. But whenever major Wall Street institutions are trying to capitalize on a well-established trend, being a contrarian usually pays off. For that reason, I’m a little leery about copper’s latest attempt at establishing a bottom above the $4.20 per ton level.

That said, I’ll be closely watching the copper price from here for signs that it may indeed be bottoming out. We’ll need to see a series of higher lows established before we can make that determination, however, so for now a defensive posture is still warranted.

Sentiment considerations aside, world’s leading copper consumer China remains a key driver for the market right now. And the latest economic data out of China showed factory activity fell for a second straight month to its lowest since February 2020 as Covid-related lockdowns remained in place in Shanghai.

What to Do Now

In view of the above-mentioned factors, our copper-focused portfolio remains in an all-cash position. We’ll wait for a confirmed bottom in the copper price before initiating a new trading position in our favorite copper ETF. WAIT

Steel, Met Coal Prices Hang Tough

Steel remains virtually the only area of strength in an industrial metals market otherwise beset by selling pressure.

Despite contracting manufacturing activity in China, President Xi Jinping’s recent pledge to support the economy by introducing a series of stimulus packages for pandemic-impacted industries has put a floor on steel prices. China’s government also pledged to support the beleaguered real estate sector, which provided additional optimism for the steel industry.

In the U.S., booming demand for construction and heavy equipment, plus a rebound in the automotive industry, has provided steel with plenty of demand. And in spite of higher costs associated with the Russia/Ukraine war, steel company executives report that buoyant steel prices have allowed them to post consensus-beating profits in this year’s first quarter.

Following a decline in purchases and prices in late 2021, both Steel Dynamics (STLD) and Cleveland-Cliffs (CLF) said steel sales are surging, according to the Wall Street Journal, while Nucor’s Q1 sheet steel production volume was on the upswing against during the quarter. WSJ reported that Nucor has responded by increasing production after previously curtailing its mills’ output earlier this year for maintenance.

Elsewhere, Reuters is reporting that Saudi Arabia’s Ministry of Industry and Mineral Resources has secured $6 billion for a steel plate mill complex and EV battery metals plant as part of a much bigger mining sector investment plan.

The plan includes a $4 billion steel plate mill complex for the shipbuilding, oil and gas, construction and defense sectors and a “green” flat steel complex for the automotive, food packaging, machinery and equipment, and other industrial sectors, according to Reuters.

Meanwhile, higher steel prices have prompted Warrior Met Coal (HCC) to restart a steelmaking coal mine in Alabama. Warrior Met plans to spend up to $700 million over the next five years to develop its Blue Creek mine, according to Mining.com, including around $45 million this year.

On the metallurgical coal front, Reuters also notes that big miners like Australia are facing huge demand for met coal from nations across the European Union (EU) ahead of an August ban on Russian coal imports.

“Asian coal importers are expected to join the scramble for alternative sources of the fuel as the EU sanction on Russia looms,” said Reuters. The increased demand is helping to keep not only steel, but steelmaking coal prices strong, which favors the stocks in our steel-focused portfolio (see below).

What to Do Now

Natural Resource Partners (NRP) is a master limited partnership engaged in owning and managing a diversified portfolio of mineral reserve properties, including coal and other natural resources (mainly gas and timber). Approximately 65% of the firm’s coal royalty revenues and around 45% of coal royalty sales volumes were derived from metallurgical coal in the latest quarter, making the stock a good proxy for steel demand. Management is sanguine about the year-ahead outlook, with plans to generate even more “robust” free cash flow in the coming months while paying down debt and solidifying its capital structure. The company also recently declared a 45-cent per share quarterly dividend (4% yield). Participants recently purchased a conservative position in NRP, and after a 10% rally, I recommended selling a half and raising the stop on the remaining position to slightly under 34.50. I now suggest raising the stop a bit higher to slightly under 43 (closing basis) where the 50-day line comes into play. HOLD A HALF

Lithium Supply/Demand Still Favorable

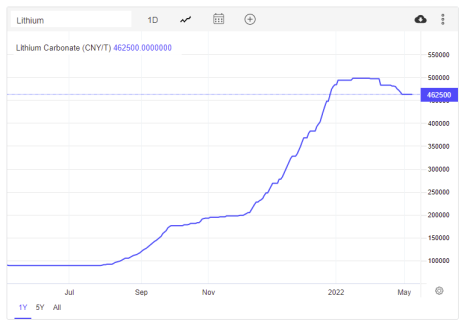

Lithium carbonate prices in China dropped to their lowest level in two months on increasing supply and lower demand. Nonetheless, lithium is up 70% for the year to date and is close to its previous record high set in March.

Analysts see the global lithium supply rising after the Chinese Ministry of Industry and Information Technology called for steady supply and higher output from smelters and miners, while also calling for more lithium ore extraction.

The latest production numbers revealed that China’s lithium output jumped 42% in March from a year ago and 41% from the prior month, according to Trading Economics. Adding to the supply-related pressure, China’s Covid-related lockdowns also weighed on prices.

The longer-term outlook for the battery metal remains bullish, however, based mainly on booming global demand for electric vehicles. Data from China showed that after rising 157% to just over three million vehicles in 2021, EV sales are expected to exceed five million in 2022 which, if realized, would be a 56% increase.

In related news, one of the world’s top miners, BHP Group (BHP), said it has no plans to add to tightening global lithium supplies by mining the metal.

BHP told Bloomberg that the low-cost lithium deposits from places like Chile and Argentina are a “deterrent” for the company, which has committed to minimizing the use of continental water in drought-impacted Chile.

What to Do Now

Sigma Lithium (SGML) is a Canadian company that develops, through its subsidiary Sigma Mineraao S.A., hard rock lithium deposits in the Americas. Sigma’s properties are located in Brazil’s Minas Gerais State in the municipalities of Aracuai and Itinga, and the company holds nearly 30 mineral rights in four properties spread over 120 miles, including nine past-producing lithium mines. Participants on March 22 bought a conservative position in SGML using an initial stop-loss slightly under 10.50 (closing basis). Last month, I suggested taking 50% profit in this stock after it rallied 14% from our initial entry point. I also recommended raising the stop-loss in the remaining position to slightly under 15 on a closing basis. We were stopped out of this position on May 9 when this level was violated. SELL

Titanium Prices on the Rise

The international price of titanium rose 55 percent in the first quarter from a year earlier, which is benefiting companies that mine the metal as well as titanium product makers.

Strong demand for the titanium minerals ilmenite, rutile and zircon have been the main drivers behind the bull market, according to the Kenya Business Daily.

The newspaper quoted the CEO of Kenya’s Base Titanium, a major domestic producer, as saying: “Demand for imported ilmenite as a feedstock for Chinese titanium dioxide pigment producers, particularly from the company’s customers, again exceeded supply resulting in significant price gains.”

Base Titanium went on to state that in spite of the “very high price environment,” ilmenite supply from traditional sources hasn’t been able to keep pace with demand and markets conditions are “very tight.”

Base Resources added that the conflict in Ukraine should “significantly” disrupt the supply of Ukrainian mineral sands, further supporting the high prices.

Meanwhile in the U.S., chemical giant Chemours (CC), which also produces titanium-based products, reported having trouble securing titanium supplies. The company also said its titanium technologies segment (mainly serving the automotive and aerospace industries and a big part of the firm’s sales) saw revenue increase 28% to nearly $1 billion in Q1, despite difficulties obtaining ore, with volume rising 6% and pricing up 24%.

What to Do Now

Kronos Worldwide (KRO) is a leader in the production of titanium dioxide pigments, the world’s primary pigment for providing whiteness, brightness and opacity (used in two-thirds of all pigments). In Q1, the company reported another solid, consensus-beating quarter. Revenue of $563 million was 21% higher from a year ago, while per-share earnings of 50 cents beat estimates by 23 cents, driven by higher titanium dioxide prices. Titanium dioxide segment profit was a whopping 129% higher, due to higher selling prices and higher sales volumes. Going forward, analysts see sales rising 9% and earnings soaring 23% for 2022, which will likely prove conservative. A 5% dividend yield ties a bow on this package. Participants recently purchased a conservative position in KRO using a stop-loss slightly under 14.75 on a closing basis. I now recommend raising the stop to slightly under 15.10. BUY A HALF

Current Portfolio

| Stock | Price Bought | Date Bought | Price on 5/9/22 | Profit | Rating |

| Invesco Commodity Tracker (DBC) | 22.35 | 2/1/22 | 28.3 | 27% | Hold a Half |

| Kronos Worldwide (KRO) | 15.25 | 4/12/22 | 15.3 | 0% | Buy a Half |

| Natural Resource Partners (NRP) | 34.75 | 1/16/22 | 49.75 | 43% | Hold a Half |

| Sigma Lithium (SGML) | 13 | 3/22/22 | 14.2 | 9% | Sell |

Buy means purchase a position at or around current prices.

Buy a Quarter/Half means allocate less of your portfolio to a position than you normally would (due to risk factors).

Hold means maintain existing position; don’t add to it by buying more, but don’t sell.

Sell means to liquidate the entire (or remaining) position.

Sell a Quarter/Half means take partial profits, either 25% or 50%.

The next Cabot SX Gold & Metals Advisor issue will be published on May 24, 2022.

Analyst Bio

Clif Droke

Clif Droke is Chief Analyst of Cabot SX Gold & Metals. For over 20 years, he has worked as a writer, analyst and editor of several market-oriented advisory services and has written several books on technical trading in the stock market, including “Channel Buster: How to Trade the Most Profitable Chart Pattern” and “The Stock Market Cycles.”