Get this Investor Briefing now, Growth Investing Strategies that Will Make You Rich, and you’ll learn about strategies that will ensure your financial freedom and security. From the ten rules for making big profits with growth stocks to six ways to pick monster growth stocks … from nine tips for better investing to key indicators a bull market is ahead … and from stocks to buy when volatility sets in to stocks that thrive during a pandemic. Growth Investing Strategies that Will Make You Rich is your best guide to building a fortune so you can live a happy and stress-free life.

3 Alternative Chipmakers that Don’t Use Silicon

Silicon chips have long been a mainstay in all types of electronics, from household appliances, to vehicles, to almost anything that runs on electricity. But higher demands from modern electronics is starting to expose flaws in silicon chips when used in emerging technologies. The problems with silicon have been known for a number of years now and fall into three areas.

One is that silicon is very poor at transmitting light, which means it’s not used for now-commonplace things like LED lights and Blu-ray DVD players. More significantly, silicon doesn’t handle high temperatures well – it becomes physically brittle and inefficient performance-wise, requiring some effort to cool down, like heat sinks, fans and physical location far away from other heat sources. Lastly, silicon chips can now get so small, nearly the size of a red blood cell, that a basic property called electron mobility starts to fail, making it harder to use silicon in higher frequency situations.

I’ll be honest – I don’t know much about electron mobility, but I know enough to trust the scientists who say it’s a bad thing for applications like 5G, EVs and renewable energy – all of which are embracing new raw materials for semiconductors.

There are two emerging materials that we’re seeing increasingly embraced in those industries. One is gallium nitride (GaN), the other is silicon carbide (SiC), which weaves silicon with carbon. There are some differences between them, but they both are better than silicon at heat tolerance – so they can operate in hotter environments – have higher thermal conductivity, which means they are more energy efficient and transfer electricity better, and have better electronic mobility, which means they can be used at higher frequencies and higher voltage.

GaN chips, for instance, have a bandgap triple that of silicon, which make it ideal for high-power applications. SiC chips withstand higher voltages before breaking down than silicon, making it the basis of simpler, faster and more efficient switches and energy storage devices being deployed in solar and wind energy industries. There will always be a place for silicon chips, but it’s increasingly apparent there’s a valuable place for gallium nitride and silicon carbide too. The GaN market is expected to grow 29% annually the next five years, with SiC not far behind at about 19%, according to various forecasts.

3 Semiconductor Stocks That Don’t Use Silicon

#1: Wolfspeed (WOLF)

Wolfspeed (WOLF) focuses on SiC primarily, which its research finds is 13 times more efficient at transferring electricity than silicon. The company also does work with silicon carbide chips built on gallium nitride wafers. Wolfspeed is the company long known as Cree, mainly a U.S. maker of LED lights. Last year the lighting business was sold off to focus on the faster-growing non-silicon chip market. Stripping out the discarded businesses, Wolfspeed generated $526 million in sales in fiscal 2021, ended June. Management is investing heavily to meet a target of tripling sales to $1.5 billion for fiscal 2024, much of which is expected to come from automaker EV production demands. There’s a deal with General Motors, and management has said Ford and Volkswagen have shown interest. In coming years, Wolfspeed says it expects to be selling about $250 to $300 of product into every EV it is included in. Shares have retreated from a recent high of 140 with the market-wide sell-off in growth stocks, but they remain on the correct side of their 200-day moving average, around 110 right now.

#2: Navitas Semiconductor (NVTS)

I’ve highlighted Navitas (NVTS) in Cabot Wealth Daily before, and with good reason – it’s a pure play on GaN chips. Navitas, an Irish-domiciled company based in California, recently went public by SPAC. It focuses on selling gallium nitride chips into EVs, including inverters, the items that regulate electrical current, for battery mechanics and for traction drive systems. Before even considering other design factors, simply using GaN instead of silicon can boost an EV’s range 5% or more. Right now, Navitas sells GaN chips into consumer electronics, like phone chargers, from LG, Lenovo, Amazon and the large China conglomerate Xiaomi. Shares have been volatile, in part because newly public businesses through SPAC mergers tend to need time to find their feet after hedge fund arbitrageurs exit the stock. Still, even after slipping from a high of 20 in November to 11 recently, Navitas is actually one of the best-performing SPAC mergers to hit the market in recent months. It will probably more than double sales this year to $46 million and more than halve its loss per share to 33 cents.

#3: Onsemi (ON)

Onsemi (ON) long was a maker of commodity, “fab filler” silicon chips named ON Semiconductor. The recent name change reflects a new CEO (as of late 2020) and a fresh strategy – to focus on higher-margin, physically larger chips made of SiC it expects to sell into EV systems, renewables, military applications and general auto traffic sensing products such as blind-spot monitoring. Key to the company’s focus is the acquisition and expansion of an East Fishkill, New York, foundry to produce 300-milimeter chips. Onsemi makes its own SiC chips and also can sell any excess 300mm wafers to other, supply-constrained manufacturers. The company has long been a provider of chips to the auto industry, consistently in the top 10 suppliers, offering about 10,000 products. That means its plan to move up the value chain within the automobile has a good shot to succeed. Doing so will also make the business less susceptible to commodity-like price swings of cheap silicon ships, one of management’s goals too. 2022 should put revenue over $7 billion and generate EPS of $3.26.

Shares have eased just slightly of late to 66 from an all-time high of 71, but its chart still shows it to be one of the strongest Greentech stocks around right now.

Do you own any semiconductor stocks in your portfolio? Tell us about them in the comments below.

5 Ways to Invest in the Most Valuable Resource on the Planet

Most readers are probably aware that Harvard alumni make significant contributions to their alma mater. More specifically, alumni have made contributions to the Harvard Endowment Fund that have allowed it to grow to the tune of about $42 Billion. Now, to be fair, this fund has existed in some form or another for nearly four centuries and contributions are frequently earmarked for specific legacy purposes.

That being said, the fund, which was previously managed by famed bond investor Mohamed El-Erian, is widely regarded as some of the smartest money on Wall Street. Following the smart money has a tendency to pay off for investors; so, what is the Harvard Endowment Fund investing in these days?

For the last several years, the fund has invested a portion of that $42 Billion in California vineyard land. Not for the land itself, but for the associated water rights.

Most of us take water for granted. It’s the most abundant resource on the planet after all, and it’s normally cheap – $2 per 1,000 gallons, for the average American. But all I have to do is utter the words “Flint, Michigan” to remind you that not everyone is so fortunate, even here in the U.S.

Globally, 785 million people lack access to clean water; 2.1 billion people don’t have clean drinking water in their homes. Progress has been made, for sure; between 1990 and 2015, 2.6 billion people in developing countries gained access to clean drinking water. But the world’s surging population combined with the effects of global warming—extreme drought in some areas, extreme flooding in others—means water scarcity still affects four out of 10 people.

With clean water becoming an increasingly scarce resource, water is more valuable than it’s been in decades. And so are the companies that supply it.

That’s why water stocks have been among the market’s best performers of late. Just look at the returns of these five water stocks and ETFs over the past two years, all of which have either beaten or matched the 45% return in the S&P 500 during that time:

5 Water Stocks and ETFs to Beat the Market

Global Water Resources (GWRS): +65%

Middlesex Water Company (MSEX): +52%

First Trust Water ETF (FIW): +53%

Invesco Water Resources ETF (PHO): +52%

PowerShares Global Water Portfolio ETF (PIO): +45%

Not all water stocks and ETFs have outperformed, of course. But of the 20 or so that I looked at, only a couple were actually down in the last two years.

The two stocks on this list are water utility companies. Global Water Resources is based in Arizona and provides “Total Water Service” that manages “the entire water cycle by owning and operating the water, wastewater and recycled water utilities within the same geographic areas in order to both conserve water and maximize its total economic and social value,” per the company’s website; Middlesex Water Company owns and operates water utility and wastewater systems in New Jersey, Delaware and Pennsylvania, and has raised its dividend for 48 consecutive years. The other three are ETFs whose holdings include some of the top water stocks from around the world.

All of them are growing; the two water stocks on this list are expected to grow revenues by an average of 6% in 2021 despite disruptions to business from the ongoing COVID-19 pandemic. That may not sound like much. But up until a year or two ago, most water companies weren’t growing at all.

Like most utility stocks, both of them pay a dividend. And with a possible market correction looming, utilities are a good hedge against possible impending volatility.

The water crisis is clearly on Wall Street’s radar, and the institutions are investing in the push to solve it. As with the coronavirus, let’s hope it is solved—sooner rather than later.

Until then, you can profit by investing in the companies trying to do the solving.

Do you invest in water stocks? Why or why not?

The One Thing Keeping Silver Prices Down

Although silver has maintained relative strength versus gold and appears to be in the process of establishing a bottom, the white metal remains below its key (25- and 50-day) moving averages.

Unfortunately, this bottoming process is being accompanied by overenthusiastic retail investor sentiment, which is concerning from a contrarian perspective. Notably, bullish retail sentiment may be depressing short interest and preventing the possibility that a bull raid and accompanying short squeeze could drive the price significantly higher in the near term.

Another near-term concern is in the physical bullion market, where a growing number of Reddit-inspired small investors are snapping up bullion coins in the hopes of galvanizing a massive short-covering event.

The basis of the movement is a Reddit community called Wall Street Silver, and its members call themselves “silver stackers,” or “apes”—an insider reference to the movie Planet of the Apes.

Who are the Silver Stackers?

Many within this community believe that by purchasing as many bars and coins as they can, they can collectively run up silver prices by 100% or even 1,000%, “to the point where they can call the shots against the so-called bullion banks, the large financial institutions which lead trade in precious metals,” in the words of a recent Reuters article.

How much of an impact these Reddit community members are having on physical bullion supply is certainly questionable. But I don’t like seeing this much bullish retail trader sentiment for silver in a time in which the U.S. dollar (in which silver is priced) has been strengthening.

Ideally, traders should become more bearish as prices fall, not the other way around.

While there are times when even the retail crowd can end up correctly buying near a market low, in most cases, when the crowd starts buying physical silver hand-over-fist like the silver stackers have, they’re usually premature in their optimism. For this reason, I am avoiding making any buy recommendations in the silver ETFs right now in my Sector Xpress Gold & Metals Advisor newsletter until we see definite technical evidence that the market has been fully cleared of selling pressure and is ripe for another extended rally.

At any rate, we’ll know the bottom is in for the latest internal correction when the silver price surges above its key moving averages, as mentioned earlier.

Fundamentally, however, nothing has changed to alter silver’s positive longer-term outlook. Indeed, a growing number of industry experts believe silver could go as high as $50 in the year ahead if the White House’s renewable energy plan is fully implemented. This would have the effect of increasing silver demand for use in electric vehicles (EV), solar panels and other alt-energy applications in which the metal is widely utilized.

Additional anticipated uses for silver in the foreseeable future include the continued 5G wireless network rollout. For these reasons, I expect that silver’s recent woes will prove to be but a temporary setback in the face of a bull market that should be able to regain traction at some point in the coming months.

Be on the Lookout for a Silver Rebound

My observation is that purely emotion-driven price declines are reversed fairly quickly. So, if I’m correct that June’s silver market slam was primarily a news-driven event courtesy of the silver stackers (and not fundamental in nature), then we should see silver hitting bottom in the near future. Assuming this happens, we could soon have another trading opportunity in silver.

If and when that happens, I will recommend the best silver stocks and ETFs to buy to play the rebound in my Sector Xpress Gold & Metals Advisor newsletter, where I already have a portfolio full of other precious metals investing plays.

Do you own any silver stocks or ETFs in your portfolio? Tell us about them in the comments below!

3 ETFs to Hedge Against Rising Inflation

If you’re worried about excessive federal spending and a loose money supply you may be considering investment decisions to offset inflationary pressures. We’re already seeing higher food and commodity costs, and interest rates are steadily creeping higher. It’s imperative to know which assets tend to outperform in an inflationary environment, for doing so can drastically improve your investment returns and protect you from inflation’s ravages.

Fueling the trend toward inflation has been the U.S. Federal Reserve allowing the M2 money supply to increase at an historic rate since the pandemic started. Since last March, M2 has soared by nearly 30% to over $4.2 trillion. This amounts to annualized growth of around 15%, which far exceeds the 6.5% annualized rate of past decades.

Economist Scott Grannis points out that the U.S. public has been hoarding most of the M2 money increase in the form of bank savings and deposit accounts (likely due to pandemic-related worries). He estimates that M2 is currently over $2 trillion above its long-term growth trend, which amounts to an extra 12% increase in the amount of money the public would normally hold. Says Grannis:

“If the public decides to reduce its cash holdings relative to income, this ‘extra’ M2 could fuel a 12% increase in inflation over the next few years.”

Inflation’s bite is also being felt in many areas, but perhaps none more significant right now than the housing market. The huge demand for housing, coupled with diminished inventories, has priced out many prospective homebuyers. But lumber prices, which soared 400% between March 2020 and March 2021, are another example of how inflation is impacting an important segment of the economy.

Commenting on this development, real estate expert Robert Campbell observed:

“The National Association of Home Builders (NAHB) said that soaring lumber prices had added $24,400 to the cost of a new home—which may help to explain this: After New Home Sales hit a 14-year high in August 2020, the number of new homes sold has fallen by 26.7% through February 2021.”

In view of this, let’s take a look at three ETFs that should appreciate as commodity prices increase.

Hedging ETF #1

The first (and arguably best) way to take advantage of higher commodity prices is to own shares of a commodity-focused ETF. The Invesco DB Commodity Index Tracking Fund (DBC) is one way of having exposure to commodities without having to own the physical assets involved. The fund is designed to track changes in a diversified commodity index (heavily weighted toward energy prices) and is designed for investors who want a cost-effective and convenient way to invest in commodity futures.

Hedging ETF #2

Another way to hedge against an increase in inflation is by owning silver. The white metal provides excellent diversification of an equity portfolio since it is weakly correlated to stocks, and is only moderately correlated to other commodities. One of the most actively traded silver-tracking ETFs is the iShares Silver Trust (SLV). It has been consolidating for several months, but if the inflation rate accelerates this year, I expect SLV to outperform other inflation-sensitive assets.

Hedging ETF #3

A worthwhile consideration for bond investors is the iShares TIPS Bond ETF (TIP). This fund holds Treasury inflation-protected securities (TIPS), which are indexed to inflation and is designed to outperform an aggregate bond index when inflation is increasing.

One point to remember is that it’s important not to commit too much of your portfolio to the hedge, which is designed to partially offset adverse performance of your underlying investment. A portfolio that’s over-hedged runs the risk of counteracting the underlying investments when they’re performing as intended.

What strategies are you considering if inflation arrives as feared?

QuantumScape Stock Looks Like a Better Version of This Former High Riser

The recent rise of QuantumScape (QS) calls to mind another company that offered similarly revolutionary technology nearly three decades ago. Both promise (or promised) to bring to market new energy storage solutions to help power the electric vehicle industry.

The Emergence of Alternative Automotive Power Sources

Way back in 1993, a company named Ballard Power came public, trading under the symbol BLDP. Ballard’s business, as some readers know, was (and still is) fuel cells, which generate electricity from hydrogen through chemical reactions and can be used to power vehicles. BLDP’s lowest price that month, adjusted for subsequent splits, was slightly over a dollar a share. Seven years later, during the 2000 market top, the stock hit 150!

Here’s a chart published just before that peak (a shade reminiscent of the recent peak in GameStop (GME)).

But as we all know, 2000 was a major market top, and BLDP investors were hit especially hard; the stock was trading below a dollar by 2012. Since then, it’s been working its way higher, and it’s done especially well in recent years, as investors have jumped into all kinds of new energy stocks. Trading at 15 today, however, BLDP is still well off that old 2000 high, and the simple reason is that the dreams that investors had back in the 1990s—dreams that fueled the massive advance—simply haven’t materialized. Reality did not conform to expectations.

Yes, Ballard Power has a real business today, which brought in $29.6 million in the latest quarter. But Ballard still doesn’t have earnings. And the simple reason is that management chose to follow the “wrong” path.

Back in the ‘90s, when BLDP was strong, the road to success appeared obvious. Fuel cells would one day power most of the world’s vehicles, generating abundant electricity from non-polluting and renewable energy sources.

What “Everyone Knew” was Wrong

The logic behind this conclusion was simple. The only other remotely possible energy source was batteries, and batteries, as everyone knew back then, were simply too heavy. It was a fact—and easy to believe for anyone who had carried a standard 12-volt automotive battery around.

But the common wisdom was wrong, as became clear in 2008 when Tesla began producing its battery-powered Roadster.

Ballard’s website today will tell you that Ballard products and technology have powered vehicles (mainly buses and trucks) that have driven more than 75 million kilometers (mainly in China). That sounds like a big number. But those miles haven’t brought big revenues to Ballard. And today, those 75 million kilometers (47 million miles) are dwarfed by the miles that Tesla vehicles have driven (estimated at 23 billion a year ago).

But this column isn’t about Tesla (TSLA). TSLA was a great stock to own in 2020 when it grew sevenfold, but now it’s in a well-deserved cooling-off period. The darn stock is just too popular.

The Hope of QuantumScape Stock

What I want to spotlight today is QuantumScape (QS), a company that is working on some breakthrough electric vehicle battery technology.

Current lithium-ion batteries, for all the progress made over the past 20 years, are still heavy, expensive to produce, don’t last all that long and take considerable time to recharge. QuantumScape believes they will soon be rendered obsolete by solid-state batteries, which have dramatically greater energy density than today’s lithium-ion batteries.

QuantumScape’s solid-state batteries promise not only greater energy density (more power per pound), which means greater range, but also superior reliability and a longer life than their lithium-ion cousins. In addition, they’re also capable of charging to 80% in as little as 15 minutes, half the time needed by the fastest Tesla Supercharger.

QuantumScape at this point has seen no revenues; the company has nothing to sell yet. But it does have a serious investor. In 2020, Volkswagen invested $300 million in QuantumScape, securing 20% equity ownership of the company. Furthermore, on the board of directors are John Doerr and JB Straubel, two men with great track records of launching winners.

As for QuantumScape stock, it is definitely not unknown today.

QS had a great run in late 2020 when the retail investing crowd (fueled by Robinhood and Reddit) piled into electric vehicle stocks. QS stock ran from 11 to 132 in just two months!

But whenever I see a chart with a parabolic advance like that, I know that there’s a big decline somewhere ahead, and with QS we’ve had it. Since bottoming at 40 in early February, the stock twice more tested 40 (the third time was after announcing an offering of 10 million shares), and is now finding a bottom near 30. The longer this bottom lasts, the greater the odds that the next big move will be up.

Now, I don’t think there’s any urgency about investing in QS. Bottoms take time, and if the broad market weakens, it’s possible that QuantumScape stock will fall below 30. But if it does hold up here, and if the stock strengthens, the odds are very good that this stock will be the automotive energy success story that Ballard Power wasn’t.

Do you believe solid-state batteries are the power storage solution of the future?

Invest in these Commodities to Protect Against Inflation Concerns

The federal government has pumped trillions of dollars into the economy via massive relief bills and may be poised to invest trillions more in infrastructure. This massive cash and liquidity injection, coupled with ongoing low interest rates from the Federal Reserve is raising concerns among many investors that we’ll begin to see inflation rear its ugly head.

If you’re one of those investors that is concerned about the impact of inflation on your portfolio, there are a number of measures you can take to protect yourself.

Perhaps the best inflation signal, and hedge, is via a commodity ETF or stock. Commodities are starting to move after a 10-year bear market.

Goldman Sachs points out that while the energy-heavy S&P GSCI Commodity Index has surged from its April 2020 low, its total return has been minus-60% over the past decade against a 263% total return for the S&P 500 index.

No question, natural resources like energy, metals, and agriculture are back in vogue, and perhaps everyone should get on board.

5 Commodity ETFs and 1 Stock to Consider

Institutional investors and university endowments like Harvard’s and Yale’s have long had some investment in commodities to diversify their holdings and hedge risks. Individual investors may now want to do the same and increase their commodity exposure to 5%-10% or more of their portfolios.

For example, platinum prices have neared their highest level in six years, driven by concerns about inflation and a sharp rally in financial markets that has powered assets, from stocks to oil and bitcoin, higher.

Most actively traded platinum futures have risen about 17% so far in 2021 to $1,259 a troy ounce, outperforming most other precious metals. Since last March, platinum prices have more than doubled. ETFs backed by platinum owned 3.9 million troy ounces of the metal at the end of January, up from 3.4 million a year earlier, according to the World Platinum Investment Council.

A direct play on platinum is the Aberdeen Standard Physical Platinum ETF (PPLT).

Next, take a commodity like copper, so critical to the electrification of the grid because it conducts electricity. With electric vehicles taking off, it is worth noting that electric cars need four times as much copper as internal-combustion engines. In addition, onshore wind farms are four times as copper intensive per megawatt as traditional power plants.

A great copper play may be Freeport-McMoRan (FCX), which derives about 80% of its revenue from copper mines located all over the world. Keep in mind that developing a new copper mine can take as long as a decade, not to mention substantial capital.

Of course, the traditional way to hedge inflation is by investing in gold, though a new-age investor now might prefer a cryptocurrency, which they often refer to as “digital gold.” Popular gold ETFs include the SPDR Gold Shares (GLD), with $70 billion in gold bullion assets, and the iShares Gold Trust (IAU). Also, silver prices are in a sharp uptrend and you can capture this trend with the iShares Silver Trust (SLV).

Finally, a simple, shotgun investment vehicle could be the Invesco DB Commodity Index Tracking Fund (DBC), which allocates about 55% of its portfolio to energy, with the other 45% divided between metals and agriculture.

As you can see, there are a number of ways to gain exposure to the world of commodities, via either a commodity ETF or stock. I suggest you add some of the above ideas to your portfolio.

Do you invest in commodities, and if so, what’s your preferred investment vehicle?

My Two Favorite Energy Stocks Today

Given the state of today’s housing market it may seem strange to look just a little over a decade in the rear-view mirror and revisit the subprime mortgage crisis, widespread housing price crash and the Great Recession. If you were an investor at the time you likely remember the wild volatility and significant daily losses that were unlike anything we’d seen in years and which wouldn’t be replicated until the pandemic sell-off just last year.

And while the broader equity markets rebounded at a reasonable pace (the Dow and S&P 500 reached pre-crisis levels in 5-6 years, Nasdaq in a little over 3), a few sectors languished and traded sideways for years. When these events arise they may seem unique, but students of the market know that the sectors and companies may change but the song remains the same. An ignored and neglected sector inevitably becomes a potentially profitable turnaround target.

Back in 2011, that turnaround situation was housing, which had been declining for six years and saw many stocks completely fall apart—Lennar (LEN), a major homebuilder, fell as much as 95% from its highs (the ultimate bottom was in 2008) and even in 2011 was still sitting 82% off that all-time high. But it (and the sector as a whole) began to change character and business showed signs of picking up, which allowed homebuilders to enjoy a solid run during the next year or so.

Today, we’re seeing a similar situation play out with traditional energy stocks – whether it’s explorers (down 89% from mid 2014 through October of last year) or service firms (down more than 90%), the entire group went through the wringer for many years due to debt worries, falling prices, imploding demand and the like.

But similar to homebuilder stocks years ago, that caused a change in the sector’s thinking—whereas oil companies were all about new basins and production growth a few years ago, today most have slashed expenses, are growing output at a manageable pace and, now that prices are rising, should spin off mountains of free cash flow. Throw in positive momentum on the chart (the sector has been outperforming the market for more than four months, the longest stretch of time in years) and we think there’s opportunity here, especially after the next pullback in the group.

If you want to keep it simple, there’s nothing wrong with just owning a broad ETF—we prefer the SPDR Oil & Gas Fund (XOP), which focuses on explorers and isn’t too concentrated (top holdings are 3% to 5% of the fund) in mega-cap stocks. Like most names in the group, the fund has come alive since November and is under extreme accumulation.

My Two Favorite Energy Stocks Today

As for individual stocks, two of our favorite names are Diamondback Energy (FANG) and Pioneer Natural Resources (PXD)—two good-sized explorers that have two things in common that are attracting big investors.

The first is that both were on the offensive even during the prolonged industry bust and last year’s pandemic. Diamondback just completed a buyout of Guidon (from a private equity firm) and will soon finish its purchase of QEP Resources, which together will net them 80,000 acres in the Midland basin. Pioneer, meanwhile, just completed its takeover of Parsley Energy, which many said had some of the best acreage in the Permian Basin when it was a standalone outfit.

The second factor is even more important—after years of downtimes, these (and others) explorers have shifted their focus. Instead of taking on tons of debt and expanding production at all costs, these operators have cut costs, boosted efficiencies and, now that prices and demand are back up, are beginning to throw off tons of cash. In 2021, Diamondback is aiming to keep production relatively flat, but believes it will produce $4 per share of free cash flow (after CapEx) even at $40 oil. At $60 oil, that figure should be north of $7.50 per share!

Pioneer is on a similar track—its breakeven oil price is in the high $20s, it cranked out $689 million of free cash flow last year and sees $2 billion of free cash flow this year (more than $9 per share) at $55 oil. (Current oil prices are in the mid-$60s, though usually these firms collect a bit less than the market price.)

Both FANG and PXD have had huge runs since the November cyclical stock blastoff (FANG has been down just three of the past 17 weeks!) that look like the initial leg up of a new bull phase. (Interestingly, the initial housing stock advance lasted 18 weeks before chopping around for a while.)

We wouldn’t chase energy stocks up here, but the next pullback into support will probably offer some tempting opportunities if the overall market is still holding up.

What’s your favorite energy play for the sector turnaround?

These 5 Wall Street Bets Stocks Actually Have Staying Power

Whether you’re an avid trader, a novice investor, or just read the news, you no doubt learned about the Reddit trading craze in which a group of individual investors, many trading on Robinhood, identified heavily shorted companies and began buying up shares. Stocks like GameStop (GME), AMC Entertainment (AMC) and BlackBerry (BB) rapidly reached all-time highs and just as rapidly gave back most of those gains.

GME and AMC still top the list of “trending stocks” on Reddit’s Wall Street Bets page and have recouped some of those losses, but are still trading roughly 50% below those January highs. Most retail investors that bought in during the frenzy ended up losing money; only investors that bought in advance of the rally, or after the shares corrected likely profited off the trades. But there are other “trending” stocks on the thread that are not only still performing well now, but have been for quite some time.

The following five stocks all made the top 20 on the Wall Street Bets trending page. All of them are either trading within a reasonable range of their all-time highs, or trading well above their 200-day moving averages. And all of them have posted market-beating returns in the past 12 months.

Here are five Reddit stocks that look well positioned for the long haul:

5 Reddit Stocks with a Shelf Life

Digital Turbine (APPS)

Millennials love apps, so why not invest in a stock with the same ticker symbol?! In reality, Reddit users’ fascination with APPS goes much deeper than that, and with good reason: the company provides apps for mobile phones and is, in fact, the only company imbedded in the Android operating system to allow for app downloading. With 6,000 apps being added per day to the Android platform, that’s an enormous – and growing – customer base, with big-name clients such as Netflix and Amazon.

With earnings expected to more than triple this year, and sales expected to more than double, there’s a whole lot to like about Digital Turbine. The valuation is high, and the stock has become super volatile of late, but you can’t argue with the performance over the last year.

Dycom Industries (DY)

Dycom supplies skilled workers for the telecommunications service provider industry. The sales growth is modest (1.4% expected this year), but the earnings growth is enticing (16.8% estimated). And obviously the returns have been quite impressive over the past year, with the stock stair-stepping higher for some time. Still, it’s unclear why Reddit users are so infatuated with this small-cap stock.

First Majestic Silver Corp (AG)

Silver stocks and ETFs have attracted the Reddit crowd’s wandering eye of late, none more so than this Mexican-based silver miner. Most of the stock’s gains in the last year came during the mad rush in late January, as AG peaked at 22 before crashing to 16 in the first week of February. It’s been up and down since, but is still holding nicely above its 200-day moving average. I’d wait for this one to stabilize before attempting to buy.

Palantir Technologies (PLTR)

Big data is big business these days, and Palantir is a software company that specializes in big data analytics. It’s growing like a weed: sales are expected to expand 35% this year, and earnings per share are expected to rise a whopping 700% (from 2 cents to 16 cents). PLTR came public in late September and is up over 100% since, despite a big pullback in February and mostly sideways trading in March. Having built a base for most of the last month, a breakout to the upside could be forthcoming if growth stocks continue to get their act together.

But as a recent IPO in a high-growth, tech-based industry, it’s easy to see why Palantir appeals to the Reddit crowd.

MSC Industrial Direct (MSM)

MSC is one of the largest industrial equipment distributors in the U.S., providing metalworking and other tools. With the Biden administration making improving America’s infrastructure one of its primary objectives, it’s no coincidence most of MSM’s gains have come since the November election. Right around 52-week highs, and with only modest volatility (1.06 beta), MSM looks buyable right here.

Did you trade in any of the Reddit “meme stocks” and what was your experience?

Why the GameStop Fiasco was Actually a Good Thing

When GameStop (GME) stock went to the moon, I wasn’t surprised, in fact, I was amused to see that the market had evolved one more mechanism for creating a bubble.

As is typical of many bubbles, the buyers who pushed up GME stock were young and extremely risk-tolerant. They were not focused on building healthy retirement accounts. They were trading for quick big profits. And they were not particularly experienced; in fact, many have probably never experienced a down market. This I’ve seen before.

But what was new about the GameStop Affair was that many of these buyers had found a community through their trading activities, as social media increasingly has filled the gap that restrictions on real-world socializing have created. They can’t go to a bar. They can’t go to sporting events. And they can’t even bet on the many sporting events that have been cancelled in the last 10 months. So they’re betting on stocks, and reveling in the community that stock trading has enabled.

To top it off, the aspect of targeting the fat-cats who run hedge funds added an aspect of vigilante justice to the mix—and further inflamed the spirits of the participants, who at that point had adopted some of the characteristics of a mob.

But then trading was shut down temporarily in the hottest stocks (for rational reasons), the young traders cried foul, and the result of that (this was really unexpected!) was that Senator Ted Cruz and Representative Alexandria Ocasio-Cortez agreed that the government should get involved to fix the problem.

I disagree. I don’t see a problem at all.

The Great Thing About Investing

The great thing about investing is that anyone can do it. All you need is some money. In that way, it’s sort of like driving a boat in most U.S. states. There’s no licensing requirement at all. If you can buy a boat or convince somebody to lend or rent you a boat, you can be captain.

But as professional boaters know, some of those captains-for-a-day can do really stupid things.

The solution to that problem is fairly simple; it starts with education.

And education is the solution to the conditions that created the GameStop Affair, too, and all the other bubbles this crowd will create.

Now, I’m not so clueless that I think these beginners, some of whom have lost a good chunk of money very quickly, will realize that their own actions are the major reason for their losses, and that becoming better educated about investing is part of the remedy. It’s easier to blame others.

But for those that do see the value of education, I have three books to recommend, all focused to some extent on the phenomenon of crowd psychology that was so evident last week and that throughout history has always played a major part in the creation of market tops and bottoms.

- First is The Art of Contrary Thinking, by Humphrey Neill, published in 1954, in which we find the classic line, “When everybody thinks alike, everyone is likely to be wrong.”

- Second, from 1896, is Gustave Le Bon’s The Crowd, A Study of the Popular Mind, which includes this: “The masses have never thirsted after truth …Whoever can supply them with illusions is easily their master; whoever attempts to destroy their illusions is always their victim.”

- And third, going way back to 1841, is Charles MacKay’s Extraordinary Popular Delusions and the Madness of Crowds, where we find the quote, “Men, it has been well said, think in herds; it will be seen that they go mad in herds, while they only recover their senses slowly, and one by one.”

Yes, these books are old, but the main lesson in every one rings as true today as it did when published.

Crowds of People Tend to Behave Irrationally.

Our modern society has made tremendous technological advances, but crowds of people still do very stupid things.

But What About GameStop?

The bubble is deflating. The stock will probably see periods of revival, but the prospects for the year ahead are dim.

Personally, I’m staying away. The Madness of Crowds is not for me.

In the meantime, the good news is that we are still in a bull market and there are hundreds of other healthy stocks that are quite worthy of your investment dollars.

The good news is that if our representatives in Washington do enact some legislation that protects individual investors—which is likely given the current Democratic leadership in Washington—it will encourage more new investors to invest in the stock market.

The good news is that after a long period of low levels of individual stock ownership, a new pro-individual investor movement might lead a lot of people to become more educated and intelligent about their investing practices. (I give credit to Robinhood for making investing—or at least trading—attractive to young people, but they did a terrible job educating them.)

What did you learn from the GameStop fiasco?

3 Materials Stocks (and One ETF) to Buy Now

The materials sector includes firms which mine, develop and process raw materials used in a wide swath of industries (including fertilizers, plastics, paper, metals and concrete). As such, having exposure to these companies is an indirect play on the commodities bull market.

Materials stocks are in great shape, as are natural resources in general. They should receive a boost from continued U.S. economic stimulus measures (and subsequent weakening of the U.S. dollar). Moreover, a China-led global economic recovery looks to be an even bigger boon for the sector, given China’s voracious demand for industrial commodities.

As essential industries, the companies that mine and manufacture basic materials are far less likely to be impacted by economic headwinds or Covid-related shutdowns. Having some portfolio exposure to stocks in this sector could therefore be considered as a safety hedge against volatility in the more economically sensitive areas of the broad market.

3 Materials Stocks (and One ETF) to Buy

One of the easiest ways to establish a position in this sector is by owning a sector-relevant ETF. My favorite one is the Materials Select Sector SPDR Fund (XLB), which seeks to provide investment results that correspond to the price and yield performance of the S&P Materials Select Sector Index. Having a position in XLB provides investors with exposure to a diverse spectrum of basic industries, including commodity and specialty chemicals, packaging and containers, construction materials and specialty mining.

Huntsman Corp. (HUN) manufactures chemicals, including polyurethanes, adhesives and performance products for consumers and industrial customers (including GE, Chevron, Procter & Gamble and BMW).

Management sees demand improving and fundamentals well intact heading into 2021—especially for its construction segment (which includes insulation). The company’s auto business is also on the rebound and showing positive trends, along with nearly all its other end markets. Huntsman also believes it is well positioned to benefit from anticipated demand in the global insulation market (its single biggest market and likely one of its highest-growth markets in the coming years).

Owens Corning (OC) is a well-known name in the building materials space. It provides building products for residential, commercial and industrial customers, including reinforcement materials for automobiles, rail cars and shipping containers.

The company’s prospects for 2021 are good. Moreover, the stock trades on just 10 times its current free cash flow and nine times its forward earnings before interest, tax, depreciation, and amortization (EBITDA). Analysts estimate that Owens Corning is poised to generate between $600 and $700 million in free cash flow annually in the coming years. All told, it’s an attractive company.

Rio Tinto PLC (RIO) explores, develops and mines a diverse range of mineral resources, including aluminum, iron ore, copper and diamonds. It also produces several energy-related assets, such as uranium, and has exposure to industrial minerals like borax, titanium dioxide and salt.

Increasing demand for industrial metals from the world’s largest commodity consumer, China, is expected to boost Rio Tinto’s prospects in the coming year, as that nation accounts for a substantial part of the company’s sales. What’s more, analysts expect Rio’s diamonds, energy and minerals businesses to get a boost from a stronger global economy going forward. Rio is also a steady and generous dividend payer, which is icing on an already delectable cake.

Old vs. New Automakers: Which Should You Invest in Today?

Electric vehicle stocks were hot in 2020, as growing numbers of investors came to recognize the major shift going on in the industry, both in the U.S. and abroad. Then, the year kicked off with President Biden signing an executive order that the federal government would only buy electrical vehicles made 50% or more in the US by union workers—although those cars don’t exist yet. Tesla (TSLA) is close, they just aren’t unionized (yet).

Further below, I have a list of electric vehicle stocks that might deserve a spot in your investment portfolio. But first let’s take a look at the established big players, to see if any of them have a chance.

The Old Automakers

Ford (F) has seen quarterly revenue fall from $41.8 billion to $37.5 billion over the last two years, but that’s not bad considering the pandemic. And Ford has a chance in the electric car race. Coming this year is its all-electric Ford Mustang, which will actually be a four-door crossover that looks nothing like any previous Mustang, and coming next year is the electric F-150 pickup that will likely be a big seller. As for the stock, it’s rallied from 4 to 9 since the March bottom, but is still an underperformer in this group. The only saving grace is a dividend yield of 6.9%, but there’s no telling how long that will last.

General Motors (GM) has seen quarterly revenue fall from $38.4 billion to $35.5 billion over the last two years (similar to Ford’s slowdown), but GM has a more aggressive plan to go electric, aiming to spend $20 billion by 2025 to launch a range of EVs powered by new low-cost, lithium-ion Ultium batteries (predicted to reduce battery cell costs to under $100 per kilowatt-hour) while selling off underperforming assets around the globe (like a factory in Russia). Then there’s GMC’s newly unveiled all-electric Hummer truck, billed as the world’s first all-electric “super truck” (first year production is already pre-sold).

Toyota (TM) was the most valuable automaker in the world until last summer, in part because of its leadership in the hybrid car market. But while Toyota was working on making electricity from fuel cells, Tesla was selling cars running on batteries, and the result was that Tesla blew past Toyota in the market capitalization race last summer without even blinking. Like most of the big old automakers, Toyota suffered in the pandemic; quarterly revenues fell from $71.1 billion to $64.2 billion over the past two years. But TM doesn’t look bad, all things considered. The stock has recently hit all-time highs.

Daimler (DDAIF) saw quarterly revenues slip from $53.3 billion to $47.2 billion over the past two years, but the company is definitely heading in the right direction technically; it sold off its fuel cell assets and is now intent on catching up to Tesla by focusing on electric vehicles. In 2021, Mercedes will offer the EQS, a battery-powered counterpart to its S-class sedans, for over $100,000, and following that will come a wide range of models.

Volkswagen (VWAGY) had the best results of the big old automakers over the past two years; revenues dipped only slightly, from $70 billion per quarter to $69.6 billion. Valuation-wise, it’s still cheap, with a price/sales ratio of 0.12, and technically, its rally from 10 at the March bottom to a recent high of 21 is decent. Also, VW is actually selling electric cars in the U.S.—in small numbers.

BMW (BMWYY) is the only one of the old German automakers that has actually grown over the past two years; revenues are up from $25.2 billion per quarter to $30.8 billion. But it wasn’t because of electric cars. After an early start with the i3 and i8 in 2014, BMW retreated to the hybrid world and won’t market a pure electric car until 2025. As for the stock, despite having risen from 14 at the March bottom to a recent high of 30, it’s still not expensive; its price/sales ratio is just 0.47—and the dividend of 2.2% adds a little sweetener.

Honda (HMC) is not big enough to buy someone, so someone will probably buy it. Not that Honda is doing badly. Revenues have only dipped a bit over the past two years from $36.6 billion in a quarter to $34.6 billion. But there’s no momentum here, and no electric future, given that Honda also went down the fuel cell road. The stock has rallied from 20 at the March bottom to a recent high of 30, and that means it’s a real underperformer.

Subaru (FUJHY) is the smallest of the Japanese automakers, and the good news is that its revenues have grown over the past two years, from $6.9 billion per quarter to $7.2 billion. The bad news is the stock is quite soft, having rallied only 25% from its March low to its recent high. Subaru has no electric car offerings today but is hoping to partner with Toyota to make some.

FiatChrysler (FCAU) has no electric cars, but just last year announced that it will build an electric Ram pickup truck. Before then, though, it’s going to merge with Peugeot. The good news here, aside from the merger, is that the stock is cheap, with a price/sales ratio of 0.29, and revenue growth was actually up over the past two years, from $27.5 billion per quarter to $30.3 billion. As for the stock, it’s up from 6 at the March bottom to a recent high of 19, a rather impressive recovery.

Nissan (NSANY) has been making electric cars for 10 years. Nissan hasn’t parlayed that early start in the electric vehicle world into any kind of success. Quarterly revenues have fallen from $27.8 billion to $18.2 billion over the last two years, and the company has lost money in the past three quarters. As for the stock, it’s rallied from 6 to 10 since the March bottom, but remains in a long-term downtrend.

Tata Motors (TTM) has now owned the Jaguar and Land Rover brands for 12 years—but the past two years have been rough at the company (which also sells plenty of cheaper, more utilitarian vehicles in India), with revenues falling from $12.6 billion per quarter to $7.4 billion. Both of the company’s iconic brands have dabbled in electric models, but the world has barely noticed. Still, the stock is cheap, selling at a price/sales ratio of 0.30—and the stock is up from 4 at the bottom to a recent high of 13, rather strong.

The New Electric Vehicle Stocks

Tesla (TSLA) is the company that every automaker is trying to emulate today in some way. In 2020, the company delivered nearly 500,000 vehicles, up 36% from the year before. Over the past two years, quarterly revenues have swelled from $7.2 billion to $8.8 billion. Earnings continue to boom. And the company continues to raise cash, which enables the production of new Gigafactories (in Austin, Berlin and China), which will enable continued production growth. So fundamentally, all is well at the company. The problem for me lies with the stock, which is up more than 2,000% from its 2019 low and more than 700% since the start of 2020. The result is a market capitalization of $700 billion and a price/sales ratio of 25, which is a sign of how much investors love this stock today. And as all investors know, stocks bottom when they are least loved, and top when they are most loved. I’m not saying it should be sold; I also know that trends can go farther than expected. Those who have owned Tesla stock since late 2011 know the trend has been very good to them. So for long-term investors with big profits, my rating today is still hold.

Nio (NIO) makes “premium smart electric vehicles” for the Chinese market. Quarterly revenues have grown from $500 million to $666 million over the past two years, and even though there are no profits yet, the company has a market capitalization of $150 billion, a sign of very great expectations. (That’s a price/sales ratio of 82, even higher than Tesla’s!) As for the stock, it was very hot through the second half of 2020, hitting a peak of 57 in late December and correcting minimally since.

BYD (BYDDF) is the number two Chinese automaker by market capitalization ($81 billion) but number one by revenues; quarterly revenues over the past two years have grown from $4.8 billion to $5.4 billion. The company’s vehicles include internal combustion and hybrid vehicles, but there’s no question the company is pushing hard to serve the market for electric cars. And the market likes what it sees, as the stock is very strong, and the price/sales ratio is just 5, fairly reasonable in this group.

Li Auto (LI) is young; the company only started making electric cars in China in late 2019. But by the end of 2020, it had delivered 30,000 vehicles, and third-quarter revenues were $370 million, signifying a good fast start. With a market cap of $29 billion, LI is pricy, but the chart is healthy, currently on a normal correction after hitting a high of 48 two weeks ago.

Xpeng (XPEV) started before LI but has made slower progress, which is one reason the stock is cheaper, with a market capitalization of “only” $18 billion. That’s a price/sales ratio of 33; third-quarter revenues were $293 million. The chart is young—only public since August—but it’s healthy, currently on a normal pullback after hitting a high of 75 in late November.

Workhorse (WKHS) was born from an old GM business unit, taken over by Navistar, and then acquired by AMP Electric Vehicles, which changed the name. The company is currently manufacturing electric delivery vans (in small quantities) in partnership with Ryder (and others) at a plant in Indiana. With a market capitalization of $2.8 billion and a positive chart, it’s clear that expectations are high.

Nikola (NKLA) is a Utah startup with dreams of building electric semi-trucks powered by hydrogen fuel cells. The company has no revenues yet, but the stock has a market cap of $6.3 billion, indicating great expectations. Technically, however, the stock is a disaster, down 83% since its June peak as several potential deals have collapsed.

Lordstown Motors (RIDE) plans to use an old GM factory to build light duty electric trucks for fleet owners, emphasizing the lower maintenance costs of electric vehicles. With a market capitalization of $3.5 million, but no revenues, it’s one more sign of the great expectations in this segment. The chart shows a process of consolidation around 20 in recent months.

The Smaller Electric Vehicle Stocks

Fisker (FSR) is led by Henrik Fisker, who has a legacy of designing strikingly beautiful vehicles (for BMW, among others). But out on his own, while he’s produced some very expensive cars, he’s not yet made a profit at it, nor quite succeeded (yet) in making cars in volumes to serve the mass market. Now he’s promised the Fisker Ocean, an SUV that’s billed as “The World’s Most Sustainable Vehicle,” featuring a solar roof, recycled carpeting and vegan interior among other attractions. With no production yet and no revenues, the market capitalization of $1.1 billion tells us investors are expecting good things. The chart is moderately healthy, and not overinflated like so many in this group.

Greenpower Motor (GP) is a Canadian company focused on the electric bus market. Revenues have grown from $2.5 million to $2.8 million over the past two years. The market capitalization is $590 million, and the chart is strong.

ElectraMeccanica (SOLO) has a market capitalization of just $550 million, so we’re in small-cap stock territory here—and we’re talking about a small electric car as well. In fact, the Solo seats only one person—and has only three wheels! Currently imported from China, the Solo’s price is $18,500, but the company’s plan is to open an assembly plant in either Arizona or Tennessee—and drop prices as scale grows. The chart is actually healthy, currently on a normal correction after hitting a high of 13 in November.

Canoo (GOEV) is a Los Angeles-based company with dreams of vehicle membership instead of ownership, fashion-forward urban vehicles and multi-purpose electric delivery vehicles—but there are no revenues yet. From my east coast perch, it appears that Canoo risks letting style take precedence over substance. A market capitalization of $440 million tells us there’s some market interest.

Electric Vehicle Stocks to Buy Now

This is a great sector to invest in, as revolutionary developments challenge the old guard of the industry. But I don’t think there’s any hurry to invest; I think it’s wise to look for good set-ups, like pullbacks to 50-day moving averages and solid bases. And what electric vehicle stocks would I focus on this year?

My first picks are the four Chinese stocks, NIO, BYDDF, LI and XPEV. They’re all growing and they’ve got a big hungry market to serve.

But I would also consider WKHS, RIDE and GP, which are focused on the booming commercial electric vehicle market in America.

These 3 Indicators Will Tell You Where the Market is Headed Next

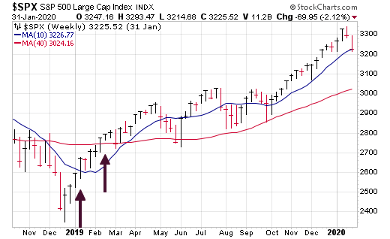

So far in 2021, the market is volatile, both for the major indexes and individual stocks. In what could be a tricky time, I wanted to relay three market indicators I’m keeping a close eye on. Besides big down days in the market, they should provide some insight as to whether the market is changing character—or if the buyers are actually pushing their advantage.

#1: Aggression Index

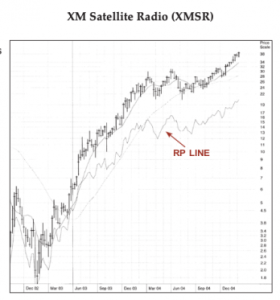

I’ve become more and more fond of our Aggression Index over time, as it gives a background view of whether big investors are putting money to work in growth stocks, or whether they’re hunting for safety. The Aggression Index is simply the relative performance (ratio) of the Nasdaq (growth) to the SPDR Consumer Staples Fund (XLP). Up means growth-y names are outperforming, down means that safe toilet paper, cigarette and toothpaste sellers are in favor.

So far, the Index is acting encouragingly—it actually went sideways from early July through mid-November before resuming its post-pandemic advance. And it’s still in a firm uptrend today despite some hiccups this week.

Technically, our Aggression Index is positive as long as the ratio is above its longer-term 40-week line (it’s a longer-term indicator), which isn’t close to being threatened. But in the near-term, I’ll be looking to see if the Index cracks its 25-day line or (more important) its 50-day line, which could happen if the Nasdaq sags or XLP really ramps up—which would be a sign that big investors are ringing the register on growth stocks.

#2: Stocks Hitting New Lows

One of the underpinnings of the latest upmove has been the tremendously positive breadth of the market, as cyclical stocks have kicked into gear—in fact, we received a couple of blastoff-type green lights soon after the November election, including the Three Day Thrust rule (three straight days of at least 1.5% gains in the S&P 500) and our New High Buy signals (basically the greatest level of new highs on the Nasdaq in at least two years), both of which portend good things down the road.

Not surprisingly, such strength from the broad market has kept the number of stocks hitting new lows at minuscule levels—new lows on the NYSE (our old Two-Second Indicator) have come in at 10 or less since early November, while the Nasdaq’s new lows did a similar disappearing act (24 or fewer during the same time).

Looking ahead, I’ll be watching to see how these figures react in relation to the overall market—if the indexes pull in but new lows remain very tame, it’s probably a sign that the selling pressures won’t persist. On the other end of the spectrum, if new lows really expand (especially if the indexes are falling), it would be a heads up that the selling pressures are broadening to more nooks and crannies of the market. So far, so good.

#3: Monitor Early-Stage and Recent Breakouts

This is a bit more nuanced, but it’s probably the most important one. Even if I don’t own many leaders (and because I run a concentrated portfolio, I won’t own them all), I like to keep track of many that have recently (past couple of months) gotten going from fresh launching pads—their action (good or bad) usually goes a long way toward telling you about the health of the underlying market. Here are a handful to keep an eye on, though I watch around a dozen or so.

Applied Materials (AMAT) isn’t a go-go growth stock, but it’s one of the leaders in the chip equipment space, where many stocks (including AMAT) broke free from long-term bases in November. Right now, AMAT is on a good-looking, early-stage consolidation—it “should” be a decent buy in or around here (though it might futz around a bit more). Conversely, a decisive break below the 50-day line (now nearing 80) would be a bad sign.

Floor & Décor (FND) is one of my favorite names in the housing/construction space, and like AMAT, it’s on a reasonable consolidation (pulled back for a few days and snapped higher since) after marching to new highs near 100. A move back into the mid/upper 80s would be a yellow flag, while obviously new highs would be bullish.

PayPal (PYPL) isn’t the most powerful leader, but this was a recent breakout (including a bullish volume cluster in November) and has held up well so far. A break back to 210 or so would be a borderline failure in the intermediate term.

Peloton (PTON) is not early stage, of course, as the original breakout occurred around 37 last May. That said, it’s clearly one of the major leaders of this bull market and actually hit new price and RP highs recently before pulling back. Right here, it looks fine (possibly even buyable), but a drop into the low 120s (giving up the recent move) would be bearish.

Frankly, while I wouldn’t be jumping into four stocks right now, nibbling on a couple of these seems like a decent risk-reward bet. But my bigger point is, even if you never own a share of them, watching the action of these and some other leaders will be among your best market clues in the weeks ahead.

8 Ways to Uncover the Best Growth Stocks

With the market at record highs, and a lot of “what ifs” regarding the year ahead, it’s worth taking a moment to think critically about what investments we should buy and hold over the coming year.

The high-level checklist I use below to find winning growth stocks is not complicated, nor is it perfect. But it serves its purpose, which is to work as a first line of defense as I screen stocks. Let’s get into each line item in the checklist:

1. Find Big Ideas That are Part of Big Trends

There are a zillion trends out there that seem attractive. But it’s the really big and durable trends that you need exposure to when enacting a buy and hold strategy to build long-term wealth. Current examples include cloud computing, personalized health care, data security and clean energy. Really big trends are so big there are many ways to play them. That translates into lots of stocks, which means investors can buy several to play different angles of the trend and retain the freedom to make an occasional mistake without doing outsized damage to their portfolio.

2. Look for Revenue Growth Above 20%

Growth is a must-have for a young company, especially these days, and the more the better. Beyond the obvious that revenue growth shows demand for products and solutions, growth companies are sure to raise capital through equity raises and convertible debt offerings to fuel even more growth. This can become a self-fulling prophecy in which a higher share price allows more capital raises with less dilution. The key is that the pace of that growth needs to be enough to overcome the dilutive impact of such capital raises and keep investor confidence high.

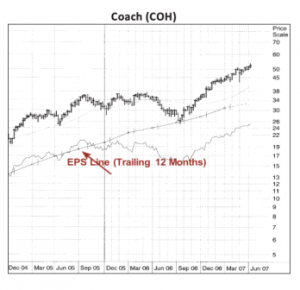

3. Look for Earnings Growth Above 20%

It should also go without saying that EPS growth is necessary. Attractive early-stage growth stocks don’t need to be profitable. But they do need to be trending meaningfully in the right direction, even if there is the occasional quarter (or year) where EPS growth is down due to investments, acquisitions, pandemics or other short-term reasons. Earnings growth that’s faster than revenue growth is a plus as it shows the business has leverage to increase profitability as it gains scale.

4. Seek a Strong Chart (But Not Too Strong)

This seems like an obvious statement, but I still get tons of emails from subscribers wondering if an ailing stock is a “deal.” No! Sure, there are always examples of a banged-up stock that pops on an earnings report, new initiative or takeover. But what are the chances you can identify these opportunities with any regularity? Life doesn’t need to be that difficult, and enacting an investing strategy focused on turnaround stocks is a very different game than the one I play. Buying on a pullback or a dip when the longer-term trendlines are still up is fine. But don’t try to be a hero. The same is true on the flipside. While there are examples when buying on strength makes sense, “strength” is a relative term. A stock that’s gone parabolic and appears detached from the public information supporting the directional change requires that investors dig quite a bit deeper to make sure they understand the risks, and potential opportunity, of buying on such strength.

5. Invest in Companies with Good Business Models

Big Trends and Big Ideas are great. But a company is only going to start gushing cash if management has developed and implemented a rational business model to seize the opportunity. The hard part for investors is that understanding a company’s business model takes time, and not all have the time or attention span to do that work. This is where an advisory service can be helpful so investors can focus on the opportunities and not do so much homework.

6. Look for Repeatable Positive Events and Catalysts

Pick any stock and you can figure out at least one potential reason for it to go up (and down). But management teams running early-stage growth stocks can’t build sustainable growth around one potential growth catalyst. They need several, and they need a constant supply of fresh ideas that they can execute on within a reasonable time frame. Examples include new products that resonate with the market and help drive deeper, more profitable relationships with customers. Also, pay attention to acquisitions that make sense, are aligned with the business model, are integrated relatively smoothly and represent a more efficient way to acquire technology and talent than building from within.

7. Try Not to Sell Too Early

It’s incredibly hard to hold on to stocks for the long term. That’s especially true when talking about early-stage growth stocks because a lot of them go through meaningful corrections, then take off again. That’s why it’s so important to focus on everything I’ve just said, from big trends to business model, to durability and scarcity premium. No single thing defines a great early-stage growth stock; it’s the sum total of many smaller things that matters, and which will give you the confidence to stick with it.

8. Have Your Own Opinion AND Seek Help

Investors are responsible for their own actions. You can read research reports from the best numbers guy or strategic thinker out there. But it’s your cash and your future. Be a skeptic, understand that even the best companies in the world are less than perfect. Your opinion of a stock’s potential is what brings the entire stock selection process full circle.

At the same time, most of us need help to find winning growth stocks, vetting them, and following along as a company matures. For those that are able, paying a few bucks to work with somebody that has a stock selection process that resonates and kicks out intriguing opportunities can be well worth it.

Can You Invest in Any of these Zero Emissions Companies?

Late last year, 28 companies, both public and private, joined forces to create ZETA, the Zero Emission Transportation Association.

The aim of this association: to push for 100% electric vehicle sales in the U.S. by 2030.

That’s an ambitious goal, to be sure. But as Tesla’s Elon Musk has shown, ambitious goals can be achieved, particularly when they bring progress. And in this case, it helps that they align (roughly) with the interests of the political party in power.

ZETA’s individual goals include:

- Outcome-driven consumer EV incentives. These include point-of-sale consumer incentives to buy electric and incentives to retire gasoline-powered cars early.

- Emissions/performance standards enabling full electrification by 2030. Emission targets have long been an effective legislative tool; they’re well understood by consumers and they enable markets to find solutions.

- Infrastructure investments. This would be mainly federal investment in charging infrastructure.

- Domestic manufacturing. For the jobs, obviously.

Now, some of these companies in ZETA are private, so you can’t invest in them yet, and some of them are big stodgy utilities, only attractive if you’re looking for dividends, but a handful have great potential to thrive as ZETA work towards its goal—and even to become the next Tesla!

So let’s take a look at the list.

The ZETA Companies

ABB (ABB) — Formerly known as ASEA Brown Bovieri and based in Switzerland, the company is a global leader in the power business and related technologies, with roughly 110,000 employees in more than 100 countries. It pays a 2.5% dividend, but it’s not growing.

Albemarle Corporation (ALB) — Based in North Carolina., it’s the world’s largest producer of lithium, and its stock is strong!

Arrival— Based in the U.K. and bankrolled by Hyundai and Kia, Arrival is preparing to manufacture commercial electric vans and busses—and to go public soon via a SPAC.

ChargePoint — Not yet public, but working on it, California-based ChargePoint provides access to a network of over 100,000 electric vehicle chargers in 14 countries with an integrated suite of hardware and software. I’ve used ChargePoint numerous times.

Consolidated Edison (ED) – The big New York, New Jersey and Pennsylvania electric utility, ConEd is not really growing but its dividend is 4.1%.

Copper Development Association — A trade association of the copper industry, it aims to influence policy, not make money.

Duke Energy (DUK) — Based in North Carolina, it’s a big electric utility, not really growing, but you get a dividend of 4.1%.

Edison International (EIX) — Another electric utility, based in California, it’s also not really growing but it also pays a dividend of 4.1%.

Enel X — Based in Rome and operating globally, the privately held company, previously known as EnerNOC, is focused on applying solutions resulting from digital transformation to the energy sector (like charging stations). From my brief research, I’d say it appears to be the opposite of Tesla from a management perspective, with no real leader and a plethora of committees.

EVBox — Based in Amsterdam this privately held company operates a network of more than 150,000 charging stations across more than 70 countries and appears to be growing fast.

EVgo — Based in New York (and a division of LS Power), this privately held company is focused on providing fast chargers to the public market; it currently operates more than 800 in 34 states. I’ve used its slower Level 2 EVgo chargers, but it’s been a few years.

Ioneer — Not yet in operation, this mining and development company plans to extract lithium carbonate and boric acid from its mine in Nevada and become a globally significant source of both lithium and boron.

Li-Cycle — Based in Ontario, this privately held company is the largest lithium-ion battery recycler in North America—and growing.

Lordstown Motors (RIDE) — With a market cap of $4 billion, Lordstown is far from Tesla territory, but it has good potential as management plans to use the old GM factory in Lordstown, Ohio to build light duty electric trucks for fleet owners, emphasizing the lower maintenance costs of electric vehicles. The stock is strong.

Lucid Motors — Based in California, privately held Lucid is targeting Tesla’s flagship Model S sedan with its high performance Lucid Air sedan and the early results are very impressive, with a price, $69,900, that’s close to Tesla’s. You can’t buy one yet, but you can pre-order a vehicle to be built at the company’s just-completed factory in Arizona.

Piedmont Lithium — Based in North Carolina, this privately held company is focused on the development of its mine—in an area where two major lithium mines operated from the 1950s to the 1990s.

PG&E Corporation (PCG) — San Francisco-based Pacific Gas & Electric is still growing, but it isn’t currently paying a dividend; a judge ruled that the company should use the money to cut down trees instead (to reduce fire risk).

Proterra — Based in California, this privately held company has sold more than 1,000 electric buses over the past decade to more than 45 customers in over 20 states, but the competition is now heating up.

Redwood Materials – Headquartered in Nevada, and led by Tesla co-founder JB Straubel, Redwood has big plans to tackle (and profit from) the imminent challenge of recycling millions of batteries.

Rivian — Bankrolled by nearly $3 billion invested by the likes of Ford, T.Rowe Price and Amazon (which has ordered 10,000 electric vans), Rivian is based in California, but has a manufacturing plant in Illinois, where it will make expensive (starting at $67,5000) pickup trucks and SUVs. You can pre-order now.

Siemens — The German power generation and transmission giant isn’t growing but it has a yield of 3.6%.

Southern Company (SO) —Based in Atlanta, this utility is actually still growing, and it yields 4.2%—so if you’re going to invest in one of these utilities, this is the one.

SRP — Shorthand for Salt River Project, it’s the electrical utility for the Phoenix Metropolitan area, and it’s pushed hard for electrification of its own fleet of vehicles in recent years.

Tesla — The king of the hill today, Tesla is not only the leading producer of electric cars globally, it also has the best network for charging during long-distance travel (as long as you’re driving a Tesla), a growing solar power division, a growing battery operation, and plans to break into the semi truck market. But with a market capitalization of $550 billion, a very high profile thanks to the S&P 500 inclusion, and a YTD gain of well over 500%, it’s due for a rest.

Vistra (VST) — This Texas utility is still growing, and it yields 2.9%.

Volta — An investment company focused on battery and energy storage innovation, this Illinois organization excels at enabling cross-sector collaboration among a variety of stakeholders.

Uber (UBER) — As Uber grows, experts expect its services (delivering both people and meals) to increasingly be provided by electric cars, and eventually self-driving cars—and its stock is strong!

WAVE — An acronym of Wireless Advanced Vehicle Electrification, this company embeds inductive power transfer pads in roadways, so vehicles can recharge on the move. Today it has commercial deployments in six locations.

All told, this list of ZETA members is impressive, representing companies large and small, all of whom should benefit as battery-powered vehicles go increasingly mainstream and eventually account for the majority of vehicles sold. As for investments, among the public companies in the group, the best investments today for investors looking for big long-term gains look like Albemarle (ALB), Lordstown Motors (RIDE) and Uber (UBER).

4 Ways to Invest in the Surge in Base Metals Demand

If you’ve been looking at the global base metals market, you’re likely noticing that the automotive and construction industries are in full rebound. There’s rising demand and tightening supplies for the materials used in these (and other) industries.

One industry that is a heavy consumer of metals is the electric vehicle (EV) market.

Among the metals most commonly used in EV production are copper, lithium, nickel and steel. The latter is the starting point for EV manufacturing and is increasingly used instead of aluminum for the production of the vehicle’s body and chassis (though aluminum remains a key material for battery production due to its lower weight).

The four investments we’re recommending below that that align each, are:

- Steel: VanEck Vectors Steel ETF (SLX)

- Copper: United States Copper Index Fund (CPER)

- Lithium: Global X Lithium & Battery Tech ETF (LIT)

- Nickel: iPath Series B Bloomberg Nickel Subindex Total Return (JJN)

Indeed, steel production is on the upswing again after mill closures caused by COVID-related shutdowns in 2020. According to the Wall Street Journal, “Steelmakers are straining to keep up with resurgent orders from U.S. manufacturers, just months after preparing for a long, pandemic-driven slump in steel demand.” And automakers are a big reason for the increased demand, which has pushed steel prices significantly higher.

Investing in Steel with VanEck Vectors Steel ETF (SLX)

To give you some idea of just how “hot” the steel market is right now, the price for benchmark hot-rolled steel is $850/ton, well above the pre-pandemic level of $570 in March before the nationwide shutdowns began. One way to participate in the steel bull market is through the VanEck Vectors Steel ETF (SLX), which seeks to replicate the price and yield performance of the NYSE Arca Steel Index (STEEL)—and which in turn is intended to track the performance of companies involved in the steel sector.