Get this Investor Briefing now, Everything You Need to Know about Marijuana Investing, and you’ll learn why this sector is poised to grow. From how marijuana is becoming legal in many places to specific qualifiers for determining whether you should consider a marijuana stock … from different perspectives to approaching marijuana investing to specific marijuana stocks to consider … and from a proven 4-step method for choosing marijuana stocks to 3 simple rules to follow when investing in marijuana-related companies. Everything You Need to Know about Marijuana Investing is your best guide to fully understanding all the investment opportunities in this sector—and how you can get rich from it!

Smart Investing in Marijuana Stocks

Denny’s Story

I recently met a guy named Denny, who was a guest at my cousin’s house. Denny was wearing a Vietnam veteran’s hat, with three little Purple Heart patches sewn onto the edge—said he did two tours of duty. I told him I was too young; by the time I had a draft number, the war was winding down.

But what we really talked about—the reason we were introduced—was marijuana stocks. Denny said he’s been investing in marijuana stocks for a while, but what he’s really looking forward to is the advent of federal legalization, which he expects in 2022, because he thinks the stocks will really take off then.

Well, he may be right or wrong about the date; no one knows at this point. And when it comes to what the stocks will do, I think the best guide is what’s happened after previous experiences of legalization in both California and Canada. In short, the stocks start climbing as soon as the date is set, and peak when legalization actually takes effect.

Turning to individual stocks, Denny mentioned a marijuana stock that he recently bought that was selling for about three cents a share.

I forget the name.

In fact, I didn’t even try to remember the name.

Denny’s not the only one. Every week I get queries from readers asking about marijuana stocks that are priced under a dollar. And every time, I analyze the chart, tell them what it says, and then suggest that the odds of making money are better in stocks priced above a dollar, like those in my Cabot Marijuana Investor advisory.

What’s wrong with stocks trading under a dollar?

Above all, they’re more volatile, as they tend to have very little (if any) institutional support, and thus are subject to the whims of individual investors. They’re typically thinly traded, which further adds to the volatility. And they’re typically development-stage companies that have a higher risk of failure than larger, more established companies.

“All true,” say the proponents. “But when you win, you win big. And I can buy a thousand shares of those stocks for peanuts.”

The trouble is, however, that when you lose, you lose big, and in penny stocks, you lose frequently.

As for owning a thousand shares, that’s irrelevant; it’s not the number of shares you own that counts, it’s the number of dollars you have invested. I’d rather own one share of a thousand-dollar stock in an uptrend (like AutoZone—AZO) than a thousand shares of a one-dollar stock (like Drone Delivery Canada—TAKOF).

Now, I will admit that when I started Cabot Marijuana Investor in August 2017, buying 10 marijuana stocks, eight of them were priced under $10. There simply weren’t many marijuana stocks trading over $10 then. But none of my recommendations were priced under a dollar.

Now, four-plus years later, the industry has made a lot of progress. Only four of the portfolio’s current 10 stocks are priced under $10. And while the average price of my under-ten-dollar holdings was 4.1 four years ago, today the average price of my under-ten-dollar holdings (not all the same stocks) is 6.3.

In short, the industry is growing up. But it still has a long way to go. And that’s illustrated by Tom’s story.

Tom’s Story

Tom is a social acquaintance here in Salem, Mass. He’s a lawyer for one of the big Boston banks. And we too recently talked about investing in marijuana stocks.

Tom is leery of the drug, and the likely reasons (I’m guessing here) are that he has two teenage children and—I assume—he’s never tried it.

His employer is leery too. According to Tom, marijuana businesses have inquired about using the bank’s services, but after much discussion about the legal ramifications, the bank’s answer was no. They don’t want the risk while the drug is still illegal on the federal level.

Now, they know that by passing up business connected to this fast-growing industry, they’re giving up some potential profits. But the bank’s not hungry. Its business is solid. And it prefers to avoid the risk entirely rather than get involved today. Someday, of course, the bank will happily lend money to marijuana businesses, and its money managers will happily start investing in marijuana stocks. But by then, the industry will have matured further, risk will be lower—and opportunity will be lower too!

Investing in Marijuana Stocks: The Profitable (and Legal) Middle Ground

Somewhere between Denny’s penny stocks and the Boston bank’s total avoidance is the middle ground—and that’s where my readers are making money!

In my marijuana portfolio, the average company had revenues of $97.5 million in the most recent quarter, up roughly 100% from the previous year.

Some of these are Canadian companies, but the Canadian companies have slowed considerably since marijuana became legal in Canada nearly two years ago. As a result, a number of U.S. multistate operators (MSOs) are catching up fast, growing both organically (no pun intended) and by acquisition—and eventually, the U.S. companies are expected to dominate.

And not all these companies are selling marijuana. One of my most profitable companies is a Real Estate Investment Trust (REIT) that invests exclusively in properties for the cannabis industry.

Another is a dividend-paying smokeless tobacco company that is diversifying into the cannabis accessories business. Another is focused solely on CBD, the product of the cannabis plant that doesn’t get you high but might treat everything from Alzheimer’s to anorexia, epilepsy to emesis, insomnia to indigestion, osteoporosis to obesity. Bottom line: There are a multitude of ways to profit in the cannabis industry, provided you follow a proven, rational investing system like we use.

Marijuana Investing Today

When I started Cabot Marijuana Investor in August 2017, my timing was perfect. Marijuana stocks were just starting to take off, and my portfolio doubled in just a matter of months.

Now, the timing feels right again.

Why? Well, after that major run-up in the last few months of 2017, marijuana stocks peaked in January 2018. From there, the sector spent the next two years in a downward spiral, with marijuana stocks losing 85% of their value. The sector surged higher at the end of 2020 and into the beginning of 2021, but turned tail quickly. Six months ago, I would have said steer clear. No sense in trying to catch a falling knife, as they say. Recently, however, marijuana stocks have started to find their footing … and yet they’re trading at less than a third of their 2018 peaks.

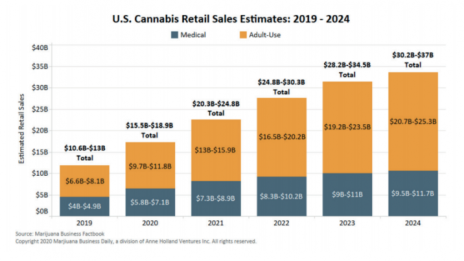

As more states legalize marijuana, U.S. marijuana sales are expected to at least triple by 2024. Having already doubled in the last four years, and with growth expected to accelerate as legalization spreads, the marijuana industry is one of the fastest-growing markets in the country. And yet marijuana stocks, on the heels of a monster, two-year crash that was partly the result of rampant legalization already being priced in, trade at about 31% of where they were more than three years ago.

Thus, over the next several years, I believe marijuana stocks could outpace just about any other growth sector out there.

Which marijuana stocks should you invest in today? For that, simply subscribe to my Cabot Marijuana Investor advisory, where we weathered the two-year marijuana stock sell-off, and now have that average gain of 142%.

Edging Towards Legal

Normally the result of a tug-of-war pitting conservative heartland agriculture interests vs. progressive coastal urbanites, and corporate farms vs. family farms, the current version of the Farm Bill has legalized industrial hemp for the first time in decades, thanks to the pushing of Senate Majority Leader Mitch McConnell, who argued that there will be great economic benefits from legalizing the crop—and putting it under the purview of the U.S. Department of Agriculture rather than the Justice Department.

The Farm Bill

The previous Farm Bill, passed in 2014, started the trend toward legal hemp. It allowed state-regulated, university-affiliated agricultural research programs to grow hemp plants as long as they registered with the Department of Agriculture. But that bill expired in September, and its renewal was held up by disagreements over SNAP (Supplemental Nutrition Assistance Program) as well as a disagreement over forestry practices—a sore spot in the wake of the California fires.

The 2018 Farm Bill is big; it will govern the distribution of $867 billion over the next five years through a wide variety of food and agriculture programs.

To my mind—which admittedly has a bias toward free markets—hemp farmers don’t need help; they just need their product to be legalized so they can give the market what it wants.

The CBD Boom

Right now, what the market wants, is hemp to make cannabidiol, otherwise known as CBD. The oil was already produced in many states by small producers—including Mitch McConnell’s Kentucky—but they only managed it by doing an end-run around federal prohibition, which limited interstate trade and transport of hemp products.

Now that the Farm Bill has passed with hemp legalization intact, it has kicked off a boom in the CBD industry.

In fact, Bethany Gomez, the director of research for the cannabis research firm Brightfield Group, said, “We expect that market to absolutely explode, with sales hitting $22 billion by 2022, which is higher than the U.S. cannabis industry.”

Already, we’ve seen some big moves by leaders in the cannabis industry.

Canopy Growth (CGC), is the king of the fast-growing Canadian marijuana industry at the moment along with Aurora Cannabis (ACB), Cronos Group (CRON) and OrganiGram (OGI).

Charlotte’s Web (CWBHF) is the number one grower of hemp in the U.S, and Cresco Labs (CRLBF), one of the leading vertically integrated U.S. multi-state operators (MSOs).

Turning Point Brands (TPB), based in Louisville, Kentucky, is an old smokeless tobacco company that first diversified into the marijuana accessories business (rolling papers and an online platform for vaping vendors) and is now making multiple inroads into the CBD market.

In short, the hemp-based CBD industry is an increasingly powerful part of the booming cannabis industry.

Legal Marijuana Meets Vermont

As marijuana becomes increasingly legal in both the U.S. and Canada, it makes sense for growth-oriented investors to look for opportunities in the marijuana industry.

Up in Canada, where marijuana is legal nationwide, marijuana businesses are booming. In the U.S., we’re behind. But recreational marijuana is legal in a number of states, as is medical marijuana—and the numbers are going up. The trend is clear.

The Vermont legislature legalized medical marijuana way back in 2004, but it wasn’t until July 2018 that it became legal in the state to own an ounce of marijuana—and to cultivate two plants. So now thousands of Vermonters are doing just that.

And hemp, of course, is legal nationally, so plenty of Vermonters are experimenting with growing that, not only for CBD but also for fiber and soil remediation (hemp loves to suck up heavy metals).

While Vermonters may put their retirement funds in big, national establishments, like Fidelity and TIAA CREF, they don’t want big outside money coming in and disrupting what could be a thriving Vermont cannabis industry.

You see, Vermont likes being small and independent. Vermont has a very successful artisanal food movement—rooted in maple syrup and cheese—and a thriving craft brewery movement, so it makes sense that Vermonters want to grow their own cannabis industry.

Interestingly, one anecdote from Vermont concerns the health of its medical marijuana dispensaries. According to the president of the dispensary, which is owned by publicly traded iAnthus (ITHUF) (though that fact is not publicized), the advent of the grow-your-own law in Vermont marked the beginning of a steady drop in patients as more and more opted for the homegrown route.

You don’t, however, need to live in Vermont to invest in and benefit from this fast-growing industry. Several cannabis-related stocks have achieved one of my favorite fundamental milestones: accelerating revenue growth.

Accelerating revenue growth is a very good indicator of higher prices ahead, because analysts are behind the curve; they just can’t revise their estimates fast enough.

And not all these companies are selling marijuana. For example, Real Estate Investment Trust (REIT) invests exclusively in properties for the cannabis industry. Another is a dividend-paying smokeless tobacco company that is diversifying into the cannabis accessories business. Another is focused solely on CBD, the product of the cannabis plant that doesn’t get you high but might treat everything from Alzheimer’s to anorexia, epilepsy to emesis, insomnia to indigestion, osteoporosis to obesity.

However, institutional investors are still leery of investing in the cannabis industry, mainly because marijuana is still not legal nationally in the U.S., and thus banking can be problematic.

And that means opportunity for you!

If you invest in marijuana and CBD stocks today, you will be getting in ahead of the big institutions, and thus when they finally start buying, their buying will benefit you!

Pick Better Marijuana Stocks in 4 Steps

It looks like legalization is here to stay, and you can love it or hate it, while also taking advantage of the investment climate that offers some interesting possibilities.

With more than 300 marijuana stocks to choose from—and so many that have rapidly risen on the industry hype of the last few years—how does an investor decide which ones to choose?

Like any investment, analyzing the fundamentals is the key. Here are a few considerations:

1. Look for long-term investments. Sure, there are plenty of nano- and micro-cap cannabis companies that could be 10-baggers, but many will just disappear, leaving the investor empty-handed. And certainly, those kinds of companies can be a lot of fun to invest in, but make sure they are relegated to the speculative portion of your portfolio. Then, concentrate on companies that you think will be the long-term winners for the rest of your holdings. Here are a few large- and small-cap companies now in the pot business.

2. Consider already-established companies where marijuana is—so far—a sideline, and not the entire focus. These businesses aren’t relying on just cannabis to make their fortunes. Their stocks tend to be larger cap, with less volatility, and they have long track records. We’ve already seen boom and bust in the cannabis market, and most of the stocks were the smaller, marijuana-focused companies.

3. Consider an ETF of marijuana stocks. This is a great way to add a few cannabis stocks to your portfolio while diversifying your risk. Ones that come to mind are ETFMG Alternative Harvest (MJ), Teucrium Emerging Medical Agriculture Index Fund (MEDA), and Horizons Marijuana Life Sciences Index ETF (HMLSF) (HMMJ in Canada).

4. Look outside the U.S.—to countries that haven’t had a big run-up in marijuana stocks. Canada and several European countries have legalized marijuana to some extent, for recreational and medical purposes. South America has also opened up its acceptance of weed.

This is just the beginning of a new global investing cycle for marijuana stocks—the right time at the right place to get a ‘taste.’

Marijuana Stock Investing 101

Marijuana—or cannabis, to use the all-encompassing term—is the fastest-growing industry in America. Marijuana stocks are growing even faster.

It’s not hard to understand why. Canada has legalized the drug nationally, and since the switch in that country was flipped, companies in Canada have been struggling to find enough marijuana supply for the booming legal market.

Here in the U.S., federal marijuana law hasn’t changed yet, but state by state, legalization is progressing, and hemp is now legal nationwide, which has been a boon to the CBD industry.

It’s easy to want to dive in and buy, but when evaluating marijuana stocks, I like to use four principal factors:

Growth

Growth is first. If a company isn’t growing revenues at a very good pace, it doesn’t warrant my attention. Business is booming, so if a prospect is not growing revenues at a rate of at least 100%, I probably won’t consider it.

Story

Story is second. I need to see a story that tells me 1) that this company can grow fast and become one of the long-term winners in the industry or 2) that this company, while it isn’t growing fast, has a rock-solid defensive position that will enable its stock to resist the occasional big correction in the sector.

Chart

Chart is third on this list, though it could easily be first. The movement of the chart reflects everything that investors know about the company and its prospects, so if the chart doesn’t tell me that investors’ perceptions of the company are improving, I’m not buying, regardless of the story.

Value

Value is definitely last in this list when it comes to marijuana stocks. These companies are growing so fast—and so few have real earnings—that traditional valuation metrics are next to useless. So I look at relative valuations in the group, looking at the price/sales ratio (PSR) of each stock, and that has been helpful.

I suggest investing in smaller, less-popular stocks that are going up. Some of these are Canadian companies, some are headquartered in the U.S., but all of them are growing fast and the majority are still not as popular (overvalued) as the big Canadian producers.

This Marijuana ETF is My Top Pick for 2021

I’m extremely bullish on an entire sector for next year: marijuana stocks. And the best way to gain access to that sector is via the ETFMG Alternative Harvest ETF (MJ).

Marijuana stocks have nearly tripled in the last ten months. And while many other growth sectors have risen fast since the February/March coronavirus market crash, cannabis stocks are advancing faster than most—and yet are still trading at less than half their peak values from three years ago.

Did momentum in the cannabis sector slow down during these last three years? No!

Retail sales of medical and recreational cannabis in the U.S. are expected to top $15 billion this year, which would be a 40% improvement from 2019 and a 50% improvement from 2018. In the next four years, legal marijuana sales in the U.S. are expected to triple. And those estimates came before Arizona, Montana, New Jersey and South Dakota all voted to legalize recreational marijuana use on Election Day last month.

In other words, momentum in the legal marijuana industry never waned in the last three years. Now, it’s clearly accelerating. And as the pandemic and accompanying social distancing and lockdowns rage on, people will be consuming more cannabis products in the coming year, not less. All of that bodes well for marijuana stocks.

Why Buy the Alternative Harvest ETF (MJ)?

I could give you one or two cannabis stocks with good charts and call it a day. Indeed, industry leaders Canopy Growth (CGC), Aphria (APHA) and GW Pharmaceuticals (GWPH) are all up. But why not buy an ETF that tracks the price of all the best marijuana stocks—those three stocks are the Alternative Harvest ETF’s top three holdings.

With marijuana ETFs, you take on less risk than if you try and pick one or two marijuana stocks. Because the industry is still in its adolescence, individual companies can be unpredictable and, as a result, volatile. If you pick the wrong cannabis stock, it can do damage to your portfolio. However, by picking a basket of marijuana stocks, at a time when the group as a whole is priced nearly 60% below its peak from three years ago despite the prospect of tripling sales by 2024, you’re betting on the marijuana sector as a whole, not just one stock.

And the Alternative Harvest ETF – the first marijuana ETF in the U.S., and the largest—gives you the safest, most reliable access to this exploding industry.

The Alternative Harvest ETF (MJ) is down for the year, but up more than 60% since March. I’m betting it won’t be down again in 2021; I think it will be way up. This a great entry point into what I believe will be the hottest industry next year – and beyond.

Which Small-Cap Marijuana Stocks are Worth the Risk?

Investors looking to take advantage of an improving marijuana legalization outlook in both the U.S. and Canada have to carefully navigate not only legal uncertainty but also the hurdles of investing in companies without the support of large institutional investors.

That institutional interest and the accompanying large-scale buying is what provides the lion’s share of support for stocks as well as the momentum to drive share prices higher. However, growth-oriented investors can still find opportunity in the marijuana space, including in the difficult-to-navigate small-cap realm.

In Canada, where marijuana has been legal nationwide since October 2018, the industry is farther ahead, by some measures. But as I write, producers are still recovering from a period where supply exceeded demand, prices fell, and companies dumped assets at fire sale prices to recover liquidity and “right-size” their businesses.

In the U.S., we’re behind Canada on the legal front. But medical marijuana is legal in 36 states while recreational (or adult-use) marijuana is now legal in 19 states—and the numbers are going up. And the advantage of our state-by-state legalization process is that we’ve avoided the one big problem that beset the Canadian market. Instead, we have 36 small markets that are each working to find the best way forward. And some of those markets aren’t that small; California’s population is slightly larger than Canada’s!

Still, the federal government is a big part of the equation, and in the long run, everyone in the industry is working toward the day that full legalization enables free interstate commerce of marijuana—or at least as free as that of the alcohol industry, which is still limited by state laws set up long ago.

How we’ll get there is still unknown. The first national step came in the Farm Bill of 2018, which made hemp legal nationwide, and thus gave a boost to the CBD market. But for true nationwide marijuana sales to begin, we need to see at least two more measures pass.

One is the SAFE Banking Act, which would protect banks that service state-legal cannabis businesses from being penalized by federal regulators.

The other is the STATES Act, which would recognize at the federal level the legalization of cannabis in states that have legalized it through their legislatures or citizen initiative.

Without a doubt, federal legalization will come, but if you wait until then, the best investment opportunities will be gone. Smart investors are making money now.

However, there are real risks.

The Risk of Investing in Low-priced Marijuana Stocks

Most marijuana stocks are low-priced, and low-priced stocks tend to be riskier, for several common reasons. In the case of marijuana stocks, it’s because most of the businesses are young, have inexperienced managements, little or no institutional sponsorship, and in many cases, the stocks are thinly traded. Every one of these factors raises the risk profile of these stocks. (A very rough rule of thumb is that the lower the price, the higher the risk.)

Additionally, because marijuana is still illegal under federal law in the U.S., most institutions won’t invest in these stocks—and that leaves them more susceptible to the emotions of individual investors!

On the other hand, if you get on board one of the companies early and it becomes one of the leaders of the industry years down the road, the profits could be huge—and that’s why the industry is worth a look, even at this early stage.

So, here we go, with profiles of eight low-priced marijuana stocks, all priced under $10 a share. I begin with the company that has the highest market capitalization—meaning investors in general perceive it as the best investment—and work my way down the list from there.

8 Low-Priced Marijuana Stocks

Cronos Group (CRON)

Price 7.3

Market capitalization $2.74 billion

Average Trading Volume/day 2,785,000 shares

Toronto-based Cronos Group sells marijuana products in Canada and Israel, and hemp-derived CBD products in the U.S. Brands include Spinach, Lord Jones, and Peace Naturals. The latest quarter saw revenues of $12.6 million, up 50% from the year before.

High Tide (HITI)

Price 6.4

Market capitalization $324 million

Average Trading Volume/day 400,000 shares

Calgary-based High Tide has a suite of companies in the marijuana industry: a major retail chain, a global manufacturer, and a major accessories e-commerce platform (Grasscity.com) that is frequented by 20 million consumers a year. Equally important, revenues have grown every quarter in recent years; most recently up 99% from the year before to $40.9 million.

Planet 13 Holdings (PLNHF)

Price 6

Market capitalization $1.18 billion

Average Trading Volume/day 400,000 shares

Based in Las Vegas, Planet 13 operates a mega-sized marijuana store and entertainment center just off the Strip and opened its second superstore in July 2021 in Santa Ana California. Plus, the company grows its own product, which it also distributes to more than 40 retailers in Nevada. The latest quarter saw revenues of $23.8 million, up 42% from the year before.

4Front Ventures (FFNTF)

Price 1.1

Market capitalization $827 million

Average Trading Volume/day 560,000 shares

Phoenix-based 4Front is a vertically integrated multistate operator (MSO) with operations in California, Illinois, Massachusetts, Michigan and Washington. It’s small, but it’s growing. In the latest quarter, revenues were $23.0 million, up 82% from the year before.

Charlotte’s Web (CWBHF)

Price 3.2

Market capitalization $440 million

Average Trading Volume/day 235,000 shares

Boulder-based Charlotte’s Web was the leading CBD seller in the U.S. in the wake of hemp legalization, but the stuff is so easy to grow that competition quickly arose and the company’s revenues have been essentially flat since ($23.4 million in the latest quarter). However, the stock’s price has fallen from 25 to below 4, and it’s been building a base in this region for over a year.

Valens Company (VLNCF)

Price 1.8

Market capitalization $305 million

Average Trading Volume/day 237,000 shares

Based in Kelowna, British Columbia, Valens specializes in extraction services, transforming cannabis into crude oil, refined oil and also white labeling both. Management believes that consumer will increasingly favor manufactured products (capsules, tinctures, vapes, beverages, concentrates edibles and topicals) over flower and is ready to be a leading provider of those services. And Valens just acquired Green Roads, the second largest U.S. CBD company (behind Charlotte’s Web). In the latest quarter, revenues were $20 million.

Marimed (MRMD)

Price 0.8

Market capitalization $261 million

Average Trading Volume/day 925,000 shares

Based in Newton, Massachusetts, Marimed is a small multistate operator with operations in five states (Illinois, Massachusetts, Delaware, Maryland and Nevada). It’s growing (revenues of $24.6 million in the latest quarter), it’s profitable (EPS of a penny a share for each of the past three quarters) and it’s a lot cheaper than it used to be, when the stock was at 5.8 in late 2018.

IM Cannabis (IMCC)

Price 4.9

Market capitalization $326 million

Average Trading Volume/day 106,000 shares

With operations in Israel and Europe as well as Canada, Vancouver-based IM Cannabis is focused on medical-grade cannabis, aiming eventually to supply a large number of European countries with cannabis from Canada and Israel. The latest quarter saw revenues of $8.8 million (a new high) and earnings of three cents a share.

Which Low-priced Marijuana Stock Should I Buy?

When you’re dealing with low-priced stocks, diversification is critical, so I wouldn’t buy one, I’d buy a bunch, leaning toward the more successful companies at the top of the list.

However, I’d also check out the latest charts, and focus on stocks in uptrends not downtrends.

Are there any low-priced marijuana stocks that you like right now? Share your picks in the comments.