Get this Investor Briefing now, The ABCs of Options Trading, and you’ll learn all about options trading—so you can decide for yourself if this strategy is for you. From debunking myths about options trading to explaining LEAPs … from specific stocks to consider for an options-trading approach to a method for creating yields with covered calls… and from the basics of options-trading for beginners to valuable lessons for the intermediate options trader. The ABCs of Options Trading is your best guide to understanding exactly how options trading works—and whether it fits into your investing strategy.

A Better Way to Profit from Amazon (AMZN)

Growth stocks have been the clear market leaders since the pandemic-induced crash just last year and, in fact, growth stocks have dramatically outperformed value stocks for most of the last 15 years or so.

Inevitably, when certain segments of the market (like FAANG stocks) show these levels of performance, investors start asking whether we’re in a bubble or if there’s one on the horizon. Put another way, are these game-changing technologies creating real value for companies like Amazon (AMZN), and is there a better way to participate in the rally while avoiding the risk of a substantial investment?

I recently bought my daughter an Amazon Echo. She wanted something that would allow her to play music in her room, and unfortunately, the tape decks and CDs from my youth are no longer a preferred sound system. However, I didn’t want to buy her an iPhone or iPad to stream music, as I didn’t want her watching YouTube videos or surfing the internet without adult supervision. Having used her Echo for just a few days, I could not be more impressed. And I’m a bit jealous I don’t have one.

For those not familiar with this new product, an Echo is a small wireless speaker and voice-powered personal assistant that is one of the first commercial applications of artificial intelligence.

What can it do? The better question is what can’t it do?!!

If I want the weather for the day, I simply say, “Alexa, what is the weather for today?” She will respond with a computerized detailed answer. Next, I might ask her to tell me a joke, or how many ounces equal one liter. Essentially, Alexa has the answer to all questions, and can also call you an Uber or order you a pizza. Some have called the Echo “Siri on Steroids.”

AMZN, the producer of the Echo, has done well in the stock market. At the current sky-high stock price, some of my subscribers have reached out to me for bullish options trades to get upside exposure to AMZN. Those savvy readers understand the amazing power of options trading!

Using Options for Low-Cost Equity

A purchase of one call option contract is a bullish position that gives the buyer the right to buy 100 shares of the stock at a set price. For example, if a trader was bullish on fictional stock XYZ that was trading at 18, he could buy one of the 20 strike calls for $2. Because each call option represents 100 shares of the stock, a call purchased for $2 is actually $200.

If stock XYZ were to rally above 20, the trader could choose to exercise his right to buy the stock at 20. So if the XYZ stock price rises, the call’s profit would look almost identical to the stock’s profit. However, if the stock XYZ were to fall, the most the trader could lose is the $200 he paid for this call.

Knowing that buying call options would cost dramatically less than buying the stock, options traders were looking for ways to put on a bullish AMZN position. Instead of paying over $350,000 or so to buy 100 shares of AMZN, I might instead buy one AMZN September 3,500 Call for $197. The $197 call (as I’ve said) is actually $19,700, which is clearly significantly less than the $350,000 needed to buy 100 shares. If AMZN doesn’t move or falls, the most I could possibly lose on the position is the $19,700 I paid for the call.

However, if AMZN were to explode higher, my calls would jump in value. And at any point, I could decide to exercise my right to buy the stock, or simply sell my calls for a profit. (Most options traders typically sell the calls out for the profit and do not take delivery of the stock.)

Other Call-buying Ideas

I could also use this call-buying strategy if I was afraid of buying the top in any hot growth stocks. For example, if I wanted bullish exposure to a stock on a meteoric run—instead of paying $10,000 to buy 100 shares, I could buy one November 95 Call for $18, putting just $1,800 at risk.

Or if I didn’t want to chase another booming growth stock, instead of paying $6,000 for 100 shares, I might buy one January 65 Call for $8, putting just $800 at risk.

Only time will tell if traders should be chasing some of these lesser-known technology stocks, and much of the stock’s performance will likely be tied to whether their groundbreaking technologies will become a part of our daily lives, like so many of Amazon’s services.

However, if you have some doubt, and don’t want to put a great deal of capital at risk, buying call options is a great way to get bullish exposure at a fraction of the cost of buying the stock.

Have you ever gotten into buying call options on high-priced stocks?

Explaining the Archegos Capital Collapse

Most investors are well aware that Wall Street can be a dirty place. Retail investors in particular often come to the conclusion that it’s the little guy that always gets the short end of the stick. That’s not entirely untrue. Retail investors don’t have the same tools and frequently don’t have the same information as the big institutions. While the adage might be that Wall Street “screws” the little guy, what just happened with Archegos Capital shows that it’s not always the little guy that takes a beating.

Earlier this year I noted large put buying in Chinese Internet stocks. For those not familiar, a put buy is a bearish trade, looking for the stock to fall. Below were some of those trades that I am referring to, copy and pasted from my Daily Order Flow list:

March 24, 2021

Buyer of 5,000 IQIYI (IQ) April 20 Puts for $0.57 – Stock at 23.5

Buyer of 2,500 Weibo (WB) April 46 Puts for $0.90 – Stock at 51

Buyer of 8,500 Vipshop (VIPS) April 35 Puts for $1.25 – Stock at 38.4

Buyer of 5,000 JD.com (JD) April 70 Puts for $0.75 – Stock at 79

March 25, 2021

Buyer of 5,000 Tencent Music (TME) April 23/19 Bear Put Spread for $1.05 – Stock at 22

As we later found out many of these stocks were owned by Archegos Capital Management, which was a super discrete “hedge fund” that was forced to liquidate billions of dollars in stock from March 24 to March 26. In those two days of liquidation, it has been reported Archegos lost a whopping $20 billion!

How Morgan Stanley Profited off the Archegos Capital Meltdown

However, that isn’t where this story ends; in fact, this is where it starts to get interesting. As was reported by CNBC …

“Morgan Stanley sold about $5 billion in shares from Archegos’ doomed bets on U.S. media and Chinese tech names to a small group of hedge funds late Thursday, March 25.

“Morgan Stanley had the consent of Archegos to shop around its stock late Thursday, these people said. The bank offered the shares at a discount, telling the hedge funds that they were part of a margin call that could prevent the collapse of an unnamed client.

“But the investment bank had information it didn’t share with the stock buyers: The basket of shares it was selling was merely the opening salvo of an unprecedented wave of tens of billions of dollars in sales by MS and other investment banks starting the very next day.”

Essentially, Morgan Stanley knew that Archegos was blowing up very fast, didn’t want to take a loss themselves, and was trying to unload the stock on the hedge funds. However, what they didn’t tell these other funds was that the initial 20-50 million shares of IQ, VIPS and TME that were being sold was just the first wave of similar-sized sales. Basically, Morgan Stanley “screwed” these hedge funds as a result of the Archegos Capital meltdown.

Now, where the put buys come into play is another layer to this story.

Judging by the times/dates that the puts above were purchased, it appears either Morgan Stanley, or another fund, caught a whiff of the stock selling that was to come, and started initiating bearish bets against those stocks—therefore “screwing” anyone who was caught buying any of these stocks that were destined to tank.

The big takeaway: Wall Street can be a dirty place, and it’s not always just the little guy that gets beat up by the smart money.

You Can Make Money Off this Popular ETF even as it Falls

After a year of staggering performance in growth and technology (the Nasdaq returned 42% for the year), the recent weakness was largely foreseeable, and the arrival of volatility and selling pressure in tech and growth stocks that had previously been steering the market rally was enough to bring the Nasdaq into correction territory.

It weighed on the markets broadly, but it fell particularly hard on the shoulders of the red-hot ARK Innovation ETF and its founder, Cathie Wood.

ARK is an investment manager with a growing lineup of ETFs that has benefited in a big way from the uptrend in “disruptive technology” stocks such as Tesla (TSLA), Square (SQ) and Zoom (ZM) among others. This success has made Cathie Wood the investing world’s new superstar.

And as these disruptive stocks have outperformed the market, assets under management at ARK skyrocketed from just $3.6 billion a year ago to more than $50 billion recently, according to Bloomberg.

Buy SONO Stock…But Don’t Buy Sonos Audio System

This year for Father’s Day my wife bought me a Sonos Move, which is a wireless speaker that is touted as having brilliant sound with voice and app control. I was thrilled with this gift as our previous wireless speaker was good, but not great.

Unfortunately, while my wife’s gift was very generous, for months we have not been thrilled by the Sonos product—the sound is okay, but the voice and app control features are horrible. I think our Sonos ignores our requests (“play Fleetwood Mac!”) more frequently than our pre-teen daughter (“no, you may not post videos to YouTube!”) does, which is really a high bar to clear. Our experience with the Sonos Move has been so bad that we wish we hadn’t thrown away our five-year-old wireless speaker device.

My Thoughts on SONO Stock

While I hate my Sonos product, I do love the prospect of SONO stock trading higher in the months to come following a blowout earnings report and big stock move higher.

Option activity has been very bullish, targeting nearly every upside strike, in every expiration cycle, including this trade I made:

Buyer of 1,000 Sonos (SONO) January 30 Calls (exp. 2022) for $3.40 – Stock at 21.5

While I think the market looks just okay right now, I do like the way SONO has traded following earnings, as well as the fairly inexpensive options, and am going to take a shot that SONO could be a new earnings season star.

The risks I see in this trade are general market risk, as well as the possibility that the SONO earnings pop could fail. Also, much like Cloudflare (NET), and countless other recent earnings season winners, it is possible that SONO could chop around aimlessly in the days/weeks ahead if the market doesn’t get going.

However, SONO stock has been taking off, breaking above its earnings highs, and I continue to hold half, with the plan to go for the home run on the balance.

And while I anticipate returning our Sonos Move audio system, based on the stock strength and overwhelmingly bullish option activity, I’m hoping to ride SONO stock to even more new highs in 2021.

How I Made Big Money in Peloton Stock

In late May the market had recovered some of its big losses from March, yet there was little trust in the small bounce-back for stocks. However, large hedge funds and institutions had started to buy call options in Peloton (PTON), and I was very intrigued about this somewhat recent IPO, that had mostly chopped around since coming public.

Here was my trade alert from May 28, when PTON stock was trading at 42, to my Cabot Options Trader subscribers detailing why we were buying PTON calls:

- Buy the Peloton (PTON) October 45 Calls (exp. 10/16/2020) for $7 or less.

Peloton (PTON) has been on my radar since the company reported blowout earnings. Since then, despite many ups and downs in the stock, options traders have aggressively bought calls including these trades:

Today - Buyer of 2,100 Peloton (PTON) June 50 Calls for $0.60 — Stock at 42

Today - Buyer of 1,300 Peloton (PTON) June 44 Calls (exp. 6/5) for $1.07 — Stock at 42

5/22 - Buyer of 5,000 Peloton (PTON) June 50 Calls (exp. 6/5) for $1.11 — Stock at 46

5/19 - Buyer of 1,000 Peloton (PTON) January 60 Call (exp. 2022) for $13.15 — Stock at 44.5

This option activity, along with countless other buys, is very intriguing to me.

For those reasons, I am going to add a PTON position to the portfolio.

To execute this trade, you need to:

Buy to Open the October 45 Calls

The most you can lose on this trade is the premium paid, or $700 per call purchased.

A couple weeks later we sold half of our position for an approximate 20% profit. While this sale only half turned out to be a mistake, bigger picture, because I had profits in the bank, it allowed me to get hyper-aggressive with the balance of the position. And aggressive is exactly how I traded this position.

Day after day, week after week, PTON stock rose as more and more traders wrapped their minds around the fact that gyms would be closed for months, and what that meant. In reaction to this development the public was buying Peloton bikes as fast as the company could make them. Higher and higher the stock went.

Finally, just days before our calls were set to expire, with the stock trading at 127, Cabot Options Trader subscribers sold their position for a profit of 1,142%!

If a Cabot Options subscriber had bought only one call, that positions would have made $7,540 per call purchased. If he/she had bought 10 calls, that position would have made $75,400.

And on and on.

So why was I able to hold on to the balance of our call position throughout such a tumultuous year? It’s the system I use.

My Options Trading System, Explained

When I execute a trade, my plan, if all goes right, is to sell half of my position for a 20%-30% profit. Then, with that money in the bank I shoot for the moon with the rest of my position. While singles and doubles are nice, it’s the grand slams that make a year—and a trading career

Having sold half of my position, I then continue to track the stock, as well as how the hedge funds are positioning in the options market. And in the case of PTON, the stock went higher and higher, and options traders continued to buy calls looking for even more gains. For those reasons, I never sold.

That being said, I am not so confident in myself that I didn’t have protection against PTON stock falling. So, when our calls that were originally purchased for $6.60 traded higher and higher, I continued to raise my mental stop on my position. For example, if our calls were trading at $50, I would set a mental stop at $40. And then when the calls gained even more value, and were worth $65, I might raise my stop to $55.

Finally, time ran out on our position, and somewhat bittersweetly we locked in our 1,142% profit. The ride was spectacular, but it was time to say goodbye.

How did I celebrate my success, and the greatest options trade of my career? I hopped on my Peloton bike, had a 25-year-old female fitness instructor yell at me to push myself harder as sweat poured off my head, and smiled at one of the few bright spots in a tumultuous year.

How to Make Money on SPCE, NKLA and XOM Using LEAPS

What will you remember about 2020 the most? For me, there’s no question that 2020 will forever be remembered for the coronavirus and the impact it had on the economy and our collective psyche. In the stock market, this year will also be remembered for cutting-edge companies potentially changing our world and rising to prominence, and the slow death of many companies/stocks that had been leaders for decades. And a great way to get bullish exposure to both new and old stocks is through longer dated options called LEAPS.

Calls/puts that are more than a year from their expiration date are referred to as LEAPS (Long-Term Equity Anticipation Securities). LEAP options are most commonly used in two situations:

- Young stocks that could be boom or bust in the future

- Stocks that have been hit hard, but the trader/buyer is looking for a longer-term turnaround

That isn’t to say that LEAPS don’t work in “normal” stocks, such as Apple (AAPL) or Microsoft (MSFT). But longer-term turnaround stocks are very popular with LEAPS. Which brings me to Virgin Galactic (SPCE).

Considering LEAP Options in Virgin Galactic (SPCE)

SPCE rose dramatically two weeks ago following an aggressive stock initiation from Bank of America, with the headliner of the research note theorizing that the stock could double. Here is some of that analysis:

“While Virgin Galactic is not yet operational, the company is gearing up to begin serving customers in early 2021. We believe SPCE’s growth potential is unparalleled vs. our coverage and the current nascent stages of the company provide investors with a unique entry point into the stock.”

There is a lot to unpack in that upgrade.

On the one hand, Bank of America thinks the stock could double.

On the other hand, “Virgin Galactic is not yet operational.”

This uncertainty, but with the potential for big stock gains, is almost a perfect situation for call options if we wanted to get involved. Why? Calls give us unlimited upside potential, but with limited risk. And LEAPS give us exposure to a stock on a longer time frame.

With this in mind, if I wanted to execute a LEAP call buy in SPCE I might target the January 25 Calls (expiring 1/21/2022) for $8.

This call buy would give me bullish exposure to SPCE for well over a year, and the most I could possibly lose on this trade is the premium paid, or $800 per call purchased if the stock were to close below 25.

This $800 risked in the LEAP buy is a dramatic discount in comparison to buying 100 shares at 22 per share, or a capital outlay of $2,200.

LEAP Options in Nikola (NKLA)

Similarly, we could execute a LEAP call buy in Nikola (NKLA), which has been called a cutting-edge technology company—and a complete fraud. And while I won’t get into the weeds as to which of these claims is true, if I wanted to play a positive stock outcome, I might execute this trade:

Buy to Open the NKLA January 25 call (expiring 1/21/2022) for $13

Much like the SPCE trade, the most I could possibly lose on this trade is the premium paid, or $1,300 per call purchased if NKLA were to close below 25 in January of 2022.

LEAP Options in Exxon Mobil (XOM)

Switching gears from hot technology stocks to potential turnaround plays, if I wanted to execute a bullish trade in Exxon Mobil (XOM), which has been a total stock disaster the last several years, I might look to execute this LEAP call buy targeting a move higher by 2023:

Buy to Open the XOM January 35 call (expiring 1/20/23) for $6

This LEAP buy would give me two years of bullish exposure to a potential turnaround in XOM stock, with the most we can possibly lose being the premium paid, or $600 per call purchased.

SPCE, NKLA and XOM couldn’t be more different in terms of the stage at which they are in their company’s history, or investors’ perception of them. How they will perform over the next year or two is truly anyone’s guess. However, with the awesome power of LEAP options we can get bullish exposure to each, at a fraction of the cost of buying the stock outright.

Peloton (PTON) and Purple Innovations (PRPL) are Hot. I Know First-Hand Why

Sleep and exercise. They’re two of the most important things we all need more of, and that offer us long-term benefits -- maybe even in the stock market.

As I’m sure you’ve noticed, the coronavirus pandemic has changed all of our lives, as well as our buying habits, perhaps forever. Take for example two of my family’s purchases in the last month.

Recently my wife decided she won’t be going back to the gym through the winter, so we bought a Peloton (PTON).

Also, we desperately needed a bed, and instead of going to a traditional mattress store to lie on beds to test them out in the showroom, we ordered a new bed online via Purple Innovations (PRPL).

Here are our experiences with both …

My Peloton Purchase (PTON)

Keeping my wife sane through the Covid-19 pandemic, especially as school starts again and we will be working and educating, is critical right now. And my wife is happiest when she can burn energy through working out.

Unfortunately, our gym where she used to take spin class is now closed for the foreseeable future. Because of that we started to look for a Peloton, as many of her friends raved about their experience with the interactive in-home bike.

Turns out we were not alone in looking for a Peloton as the company’s website told us that we would need to wait 10-plus weeks before one would be delivered to our home due to high demand.

Fortunately, we were able to find a brand new Peloton for sale in our neighborhood and quickly bought the (gulp) $2,400 bike. While the $2,400 was a hard pill to swallow, plus the $40-a-month subscription, big picture, my wife loves it, my kids ride it to burn energy and I’ve even taken a couple of classes.

Do I love the Peloton bike? It’s okay. I prefer to play two hours of tennis against a tough opponent to get my exercise, but my wife LOVES it. And as the old saying goes, “Happy Wife, Happy Life.”

And while I don’t love riding a stationary bike, what I do love is the fact that I own PTON calls that I bought when Peloton stock was trading at 42. Now, two months later, the stock is trading at 70 and the calls are at a profit of over 300%!

My Purple Innovations Purchase (PRPL)

Moving on to our second Covid-related purchase: our new bed.

For years my wife has complained that our bed needed to be replaced, as there were lumps. I never had a problem with it as I can sleep anywhere. However, circling back to the “Happy Wife, Happy Life” motto … we decided to look into the mattress store disruptors, such as Purple Innovations (PRPL).

Purple, much like its privately held peers Leesa and Casper, are online mattress companies that offer a wide range of bed and bedding choices. Having done some research online, and talked to friends – and with the 30-day money back guarantee putting our minds at ease – we felt comfortable making the mattress purchase sight unseen.

So do we like it?

Two weeks after our purchase the bed was delivered on time to our door in a box, we easily opened it up, have slept on it for 30 days, and my wife loves it (unlike with the Peloton, I won’t be sharing any pictures of me lying in our bed).

And my wife must not be the only person who is enjoying Purple mattresses, as the stock is up 185% year-to-date, and traders have been aggressively buying upside calls looking for more gains in the stock on earnings later this month.

Will my family never return to a gym or mattress store again in our lives? I doubt that. But there is no doubt that these “stay-at-home” companies like Peloton and Purple Innovations now have their feet in the door with my family, and the American consumer in general.

Debunking 5 Options Trading Myths

It is true that options are risky if you don’t know what you’re doing. But with a little education on the subject, options trading can be as safe as you want it to be. When done right, the whole point of options is to reduce risk.

Myth #1: Options Trading is Risky

Options are all about probabilities, which enable you to choose your level of risk in a trade. For example, if you want to play it safe and hit “singles”—i.e., go for modest returns that eventually add up if you string enough of them together—you can choose a trade that has an 80% probability of success.

If you’re willing to take on more risk by going for home runs even if it increases the chance that you’ll swing and miss, you can reduce your probability of success in exchange for a much bigger payoff.

So really, the notion that options trading is risky is only part myth. Options trading can be risky … but only for the uninitiated.

Myth #2: Options Trading is Complex

It’s true that trading options is more complex than buying and selling stocks. Options comes with its own vernacular—covered calls, selling puts, the strike price, iron condors, etc.—and that requires some getting used to. But it’s not like learning how to split the atom. Like most things, options can be learned easily if you’re willing to put in just a little bit of time.

Once learned, the options-trading process will quickly become second nature. You don’t have to be a seasoned professional to trade options. There are plenty of self-directed investors who picked it up and now trade options regularly. You can too.

Myth 3: You Need a lot of Money to Trade Options

Not really. For most trades, you don’t need more than $1,000 in capital. And why is this? Because the most powerful factor of options is the leverage you get when buying calls and puts. For example, instead of paying $5,000 to buy 100 shares of stock XYZ, with options you can pay $200, and have the same upside potential as if you had bought the stock.

But whether you have $1,000 or $100,000, you should plan on allocating between 2% and 5% to each trade. By not risking too much on any one trade, and with the awesome potential of the leverage that options allows, you should theoretically get more mileage—and hopefully more profits—from your options money than you would if you invested that money in 10 stocks.

Myth 4: Options Require a Bull Market

Not necessarily. Through the magic of puts, you can still profit even when the market begins to fall. In traditional investing, the average investor can’t outright short the market by selling stocks or indexes short because of the unlimited upside risk. However, puts allow options traders to gain bearish exposure at a fraction of the cost. A put purchase is used when a decline in the price of the underlying stock or ETF is expected.

For example, if you expect stock XYZ to fall, you could buy a put at a specific strike price with unlimited potential for profits. The maximum loss on the trade is the amount of premium paid.

For example, the purchase of the XYZ 100 put for $1 would only risk the $1 paid. If the stock were to close at $100 or above at expiration, the put would expire worthless, and your loss would be limited to the $1. However, if the stock were to go below $99, the holder of this put would make $100 per contract purchased per point below $99. By purchasing puts, you can take advantage of a down market with low-risk, high-reward trades.

Myth 5: You Can Only Trade Options on Stocks You Already Own

Wrong. The beauty of options trading is that you’re not limited to the stocks already in your portfolio. An option is a contract that conveys to its holder the right, but not the obligation, to buy (in the case of a call) or sell (in the case of a put) shares of the underlying security at a specified price (the strike price) on or before a given date (expiration day).

The advantage of trading options is that, unlike buying stocks, you can define your risk ahead of time.

When you buy an individual stock, you put a relatively large chunk of capital to work, which exposes you to the occasional bombshell, whether it’s a bad earnings report, a big drop in the market or a random company-specific event that brings out the sellers.

Options, on the other hand, give you the opportunity to get exposure with limited capital. If you know what you’re doing, you can make trades that have a 60%, 70% or even 80% probability of success. And options allow you to be more aggressive too—you can take on more risk to potentially earn a bigger return.

And your risks are clearly defined ahead of time in a way that’s impossible to duplicate through pure stock trading.

How To Hedge Your Portfolio Against a Second Wave of Coronavirus

There’s nothing like a warm, sunny day to trigger the desire to get outdoors and share a laugh with your friends. Of course, these days that means a keeping at least six feet apart as you enjoy a beverage and watch the clouds roll by.

Recently, over “social distanced” drinks with a couple of my friends, one successful businessman in my group said to me, “The economy is a mess, why shouldn’t I take all my money out of the stock market just in case there is a second wave of coronavirus?”

I get my friend’s concern. Thirty-eight million Americans are unemployed, the global supply chain is a mess, business and vacation travel aren’t coming back anytime soon, many restaurants will never come back, and neither I nor my dog can get a haircut!

And on top of that, two of the most successful investors of all time spoke quite negatively about the stock market. Here was what these legends said:

Stanley Druckenmiller: Risk/reward in stocks is the worst he’s seen.

David Tepper: This is the second-most overvalued stock market he’s ever seen, behind only 1999.

And with all those negatives lined up somehow the Nasdaq is hovering around all-time highs! How is this even possible?!?!

What’s with the mixed messages in the stock market?

My working theory about the resilience of the market is based on two factors:

- The Federal Reserve has essentially said, “we got this,” and will continue to flush the system with so much liquidity that the economy will be able to survive this economic tsunami.

- Traders and investors believe that the best of the best in science and technology will figure out testing and a vaccine sooner than expected.

That being said, I 100% would understand if my friend wanted to sell his stock holdings, raise cash and wait out a second wave of coronavirus that could decimate our economy.

Don’t let your portfolio suffer the economic setbacks of coronavirus

However, as I told my friend, you don’t necessarily need to sell your stocks, as there is an options strategy that can hedge his portfolio against another deep market sell-off … and that strategy is buying put options.

During a spout of market volatility, I recommended to subscribers of my Cabot Options Trader and Cabot Options Trader Pro advisories that we buy our first market puts in months, as my trading signals were beginning to flash warning signs. This recommendation was well timed, as the S&P 500 promptly fell 3% after my recommendation (sometimes it’s better to be lucky than good).

If you are unfamiliar with puts, here is a definition and graph of a generic put buy:

A put purchase is used when a decline in the price of the underlying asset is expected.

This strategy is the purchase of a put at a specific strike price with unlimited potential for profits. The maximum loss on this trade is the amount of premium paid.

For example, the purchase of the XYZ 100 put for $1 would only risk the $1 paid. If the stock were to close at $100 or above at expiration, the put would expire worthless.

If the stock were to go below $99, the holder of this put would make $100 per contract purchased per point below $99.

As for how this coronavirus situation will play out over the long term, and the impact it will have on the market, it’s truly anyone’s guess. However, with put options my friend and all investors can continue to maintain their portfolios with the knowledge that they are hedged just in case the market gets hit by a wave of declines.

Should You Worry About Negative Oil Prices?

At the end of April, crude oil plummeted to $-37 per barrel, meaning producers would PAY traders to take oil off their hands. It’s the first time in history the price has turned negative for an oil futures contract. How can a barrel of oil be worth less than zero, you might ask?

Before I get into my explanation, which I’ve gathered from some hedge fund associates in that space, I want to note this disclaimer: I am not an oil trader and I am not an expert in this field. However, the possible reason given for this historic move is similar to something that goes on in my world, options trading. This is what I mean …

Let’s say I sell one put option on stock XYZ at the 10 strike. If XYZ stock falls below 10 on expiration, I have two choices. The first is to buy back that put and take a loss. The second is to let myself get assigned, and take ownership of 100 shares of XYZ stock at 10, which would cost me $1,000. Either scenario is fine as I can take a loss, or take ownership of the stock.

Now let’s move to the oil futures scenario, and to answer my own question from earlier…

How Can a Barrel of Oil Be Worth Less than Zero?

The day prices hit -$37 per barrel and set off alarms, it was the expiration of the May West Texas Intermediate crude futures. And if hedge fund ABC is long futures that would require them to take delivery of 500,000 barrels of crude, and they don’t have the mechanism to receive and store that oil, they would need to sell at ANY price, as they literally can’t take delivery. And as the price dropped—no matter the price—this hedge fund HAD to sell. That’s one reason producers would get paid to take oil off the hands of traders.

The other explanation for how oil can trade for negative-$37 per barrel is tied to the global economic slowdown. With most of the world under stay-at-home orders or quarantine, airplanes fly less frequently and global industry grinds to a halt, and there simply is not enough demand for the supply.

And as storage facilities and tankers for oil near capacity, the question becomes whether this negative price situation is a short blip on the radar.

How to Profit from Negative Oil Prices

This could lead to major reverberations throughout the oil and financial markets as bankruptcies and job losses in the oil sector could become a real issue for an already weak economy.

And while I am not trying to be overly negative, if this oil situation is concerning to you, or if you simply are looking for a hedge for your portfolio, one options trading idea is the S&P 500 ETF (SPY) September 280 Put for around $25.

But this is a fast-developing situation, and the stock market is holding up fairly well given this unprecedented move in oil prices. Also, most oil stocks held up fairly well as industry leaders such as Exxon Mobil (XOM), Chevron (CVX), Halliburton (HAL) etc., were down only marginally, and some were even up.

In a world in which once-in-a-lifetime events have become the norm, this oil situation is just another wild card for the economy and the stock market that we need to keep our eyes on.

Signs the 2020 Bear Market May Be Over

Timing in trading, and in life, is rarely perfect. Take, for example, my family: Several weeks ago we started a major kitchen remodeling that involved blowing up our current kitchen and moving the laundry room upstairs. This was no easy project but with the kids at school all day, and in sports after school, we really don’t spend tons of time roaming the house and mostly stick to our respective offices during the work day.

Fast forward a couple weeks and we are in the midst of a global pandemic! Our home is a construction site, the kids are at home all day every day, and 10 workers are in our house from 7:30 a.m. until 5 p.m. In essence, the Mintz family is locked in our house, while work crews come in and out. It’s far from an ideal situation in the age of coronavirus.

I compare working with kids at home with kitchen renovations going on to juggling with chainsaws, while blindfolded, on a tightrope, with an unseen virus possibly floating around our hallways and on our handrails, light switches and door handles.

Our timing on this project could NOT have been worse!

Finally, however, the project is done, and as of now no member of my family caught the coronavirus (knocking on the largest piece of wood I can find)!

Somewhat similarly, the stock market and the global economy have been going through a complete nightmare as global economic activity has grinded to a halt. This, along with the unknown of when it will re-start, caused the S&P 500 to fall nearly 35% in just over a month.

Since the lows in late March the market has bounced back nearly 15%, which has caused many to ask, “Is the 2020 bear market over?”

First off, let me be clear: The coronavirus pandemic is an unprecedented situation. And because of that, NO one knows how it will play out. Warren Buffett doesn’t know. Neither does Carl Icahn, Bill Ackman or any other famous investor you could name. In fact, if you listened to enough of these famed traders you would likely get a 50/50 split on their opinions as to whether the market is headed higher or lower.

That being said, for the time being (subject to change very quickly) I do think market conditions are improving. Here is some of what I mean:

The Chicago Board of Options Volatility Index (VIX), also known as the Fear Index, has dropped from 75 to 45, which is like being reduced from the fear of swimming with great white sharks while bleeding to merely swimming in a vicious riptide. Fear is still out there, but not the total panic of a couple weeks ago.

Daily trading activity has become more normalized.

And lastly, my watch list of stocks that are attracting bullish option activity combined with a strong stock chart, which is my best signal for stock strength, has been growing nearly every day since the March 23 bottom.

Lastly, I have been encouraged by the market’s reaction to bad news. Remember, the market and the economy don’t move in tandem. In fact, oftentimes the market sells off months before a recession, and then rebounds before the economy booms. In essence, typically the stock market gets ahead of big economic moves.

A perfect example of this was recently when the U.S. reported its highest weekly unemployment claim number of all time … QUADRUPLING the second-worst number in history! And how did the market respond? The Dow rose 1,300 points that day as this bad news, which nearly all traders had been expecting, had already been priced in during the previous month’s decline.

That said, despite potentially slowing rates of coronavirus cases this week, clearly we aren’t yet out of the woods in terms of people getting sick and our economy getting back in gear. And because of this, a re-test of the market’s lows could seriously dent the bull case.

However, going forward I would recommend not being too focused on rising virus figures and bad economic data, as this is unfortunately expected. Instead, I would limit your focus to the action in leading stocks, as well as option activity, to get a feel for whether the 2020 bear market is over.

Don’t Waste 10 Minutes: Why You Shouldn’t Worry About Gloomy Headlines

My job as a trader is to be aware of the news, but not be consumed by it. As legendary mutual fund manager Peter Lynch once said, “If you spend more than 13 minutes analyzing economic and market forecasts, you’ve wasted 10 minutes.”

The news can be daunting, but bigger picture the indexes are near all-time highs and many leading stocks are reporting spectacular earnings and breaking out to the upside. So if I wanted to ignore the news headlines, and bet on the market and these growth stocks moving higher, how might I get inexpensive upside exposure?

One way is to buy Call Options on the Nasdaq ETF (QQQ). Trades have unlimited upside potential, just like a stock purchase, but at a fraction of the cost. And if you’re really worried, you could hedge by buying puts to protect against a market decline.

Because I can’t possibly know what you have in your portfolio, I’ll base the strategy on the SPDR S&P 500 ETF (SPY), which corresponds to the price and yield performance of the S&P 500 Index.

The truest hedge if you owned 1,000 shares of the SPY would be to buy 10 puts against it. If the SPY were to drop below your puts’ strike price, you could simply exercise your puts, and you would be out of your entire stock position. The upside to this strategy is that you do not cap your potential profit if the SPY price continues to rise.

For instance, you could buy 10 puts for $10.

If the SPY were to drop below price, you would exercise your puts, and you would be taken out of your SPY stock position. However, you have to pay $10, or $10,000, for this insurance. But with the CBOE Volatility Index (VIX) at historically low levels, this insurance is extremely cheap based on historical prices.

Despite the talking heads on TV constantly focusing on the negatives, and social media posts breathlessly forecasting the end of the world, the resiliency of the stock market and leading stocks tells me that while we should be aware of the headlines, now is not the time to panic.

Maybe the market wobbles of the past several months aren’t an early sign of the apocalypse, buy a buying opportunity.

Generating Income When Interest Rates Are Low

In 2019, interest rates were cut for the first time in a decade. Central bankers across the globe are hinting that they too are ready to cut rates if needed. Because of this monetary policy, it’s still a challenge for savers to create yield. That said, there is an alternative way to create yield against your stock holdings: sell covered calls.

A covered call is an options trading strategy in which the trader holds a long position in a stock and sells a call option on the same stock in an attempt to generate income. This is a VERY conservative strategy. For example, if I owned 100 shares of Snap (SNAP) I could sell one call against my 100 shares. And when I sell that call I collect a premium (essentially collecting an insurance premium).

In fact, if you’d been selling covered calls against our Snap (SNAP) stock position, you’d be creating yields of over 3% month after month. In this low interest rate environment, the ability to create yield of 3% every month is a home run!

How Do I Determine Which Strike I Should Sell Against My SNAP Stock Position?

There isn’t a surefire answer for each situation. But I will show you my general thought process. These are the questions I ask myself (in this order) for choosing a strike price to sell:

- At what price am I willing to sell the stock? If I am willing to sell SNAP at 17, then I would sell the 17 strike. If I am willing to sell the stock at 18, then I would sell the 18 strike.

- Is the market stable? If the market is stable, and trending higher, then I am more likely to sell a call further away from the current stock price. However, if the market is weak, I might sell a call at the 17 strike closer to the stock price, as this sale would net me a much bigger premium/insurance policy.

- Is this a trade that you hope will make a small premium quickly? If so, sell a short-term option as it will lose its value very fast.

At the end of the day the #1 criteria above is most important. If you set a price target, and sell at that strike, then you have made a choice that you can live with. And you will have picked up a nice yield in the meantime.

Invest Like a Hedge Fund

How Bull Risk Reversals Attempt a Rare Win-Win Scenario in Investing

In layman’s terms, option calls and puts are bets on whether a stock is going to rise or fall. A call is a bet that the stock will rise, and a put is a bet that the stock will fall.

Whenever my proprietary options screener alerts me to a trader buying 10,000 calls and risking many millions of dollars, my alarm bells go off. Who is buying these calls, and why is he taking such a big position? Does he have insider information?

Warren Buffett, Carl Icahn and Bill Ackman are just a few of the many hedge funds and institutions known for using options to build positions, and when I see a stock that is having consistent and large options trades, I take notice. You’ll see the bulls actively buying calls nearly every day looking for a stock to move higher.

And while straight call purchases are bullish, the trade structure that I find to be the biggest tell of the conviction these hedge funds have in a stock is an option trade called a “bull risk reversal.”

Bull risk reversals are a favorite tool for sophisticated hedge funds and are just about the most bullish trade you can execute using options because both components of the trade benefit if the stock heads higher: both the call buy is bullish and the put sale is bullish.

And what makes these trades so profitable (if they work) is that the premium collected via the put sale often pays for the premium paid for the call purchase.

Bull Risk Reversals Explained

Here’s how bull risk reversals work.

A bull risk reversal is typically used when a rise in the price of the underlying asset is expected. The strategy usually involves the sale of an out-of-the-money put and the purchase of an out-of-the-money call. The trade has unlimited profit potential to the upside and extreme loss potential to the downside.

For example, a January 20/25 bull risk reversal for a $1 credit would be:

- Sale of January 20 Puts, and

- Buy of January 25 Calls.

If the stock stays between 20 and 25, the trader collects the $1 credit.

If the stock goes to 20 or below, the trader will be forced to buy the stock at 20.

If the stock goes to 25 or above, the trader will exercise his right to buy the stock or simply sell his call for a profit.

This is one of the rare win-win scenarios that investors are always reaching for, but rarely obtain. At its worst, the strategy minimizes loss.

3 Lessons for the Intermediate Options Trader

One of my favorite components of my role as Chief Analyst of Cabot Options Trader is working with beginner options traders. Very quickly they come to realize that you don’t need to be a rocket scientist to learn to trade options, and with my assistance these subscribers realize that options should be a part of every investor’s trading playbook.

And once I have worked with a beginner options trader at Cabot Options Trader, they can choose to graduate to Cabot Options Trader Pro, where I teach about and execute more advanced strategies such as Long Straddles, Iron Condors and Protective Puts.

Not familiar with those strategies, or how to execute them? Let’s get into each:

Long Straddle

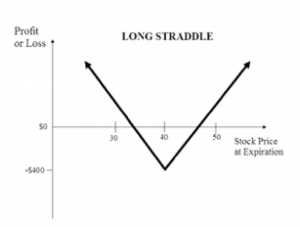

A straddle is a good options strategy to pursue if a trader believes that a stock’s price will move significantly, but is unsure of which direction.

To purchase a straddle, a trader buys a long position in both a call and put with the same strike price and expiration date.

For example:

Stock XYZ is trading at 40

If you were to buy a straddle on stock XYZ, you would simultaneously do the following:

Buy the XYZ December 40 Call

Buy the XYZ December 40 Put

For a total debit of $4

If the stock were to close at 40 on the December expiration, you will lose $4 as both the call and put would expire worthless.

If the stock were to close at 36 or 44, you will break even.

If the stock were to go below 36 or above 44, you will make one dollar for every dollar the stock moves outside of 36 or 44.

Here is a graph depicting the Profit and Loss of a Long Straddle:

Now that we know what buying a straddle means, I want to talk about why this might not be the best strategy for this situation.

In general, the reason is that the market does a great job of pricing options. For example, a slow moving utility stock’s calls and puts are very inexpensive as the stock is unlikely to move dramatically. Conversely, a high-flying growth stock’s options will be much more expensive as the stock is more likely to be volatile.

Similarly, ahead of earnings, or trade talks this week, the options market raises the price of options so that traders can’t buy cheap insurance for a big move.

Only very rarely are options prices extremely mispriced ahead of an event. And for that reason, buying a straddle, in an attempt to play a big market move today/tomorrow, is far from a sure thing.

Iron Condors

While the name Iron Condor may be foreign to you, it’s a risk-defined options strategy that is a great way to create yield. It is a strategy that has a high probability of success, allowing for a modest profit with enough room for error. Also, it’s meant to be a directionally neutral trade.

Essentially, Iron Condors are a strategy that will profit if a stock stays within a defined trading range. And the profits can be substantial.

For example, in August of 2019 salesforce.com (CRM) had just released a strong earnings report, and saw its stock rise from 148 to 152. And because the earnings/major news had passed, I felt that the odds favored CRM trading mostly sideways for the next couple of months.

With that in mind I sold an Iron Condor betting that CRM would not fall from 152 to 130 or below (a 15% decline), or rise to 170 or above (a rise of 11%). If my trade was right, I could make a yield of 21% in two months.

Here is a trade alert I sent to Cabot Options Trader Pro subscribers in late August targeting salesforce.com (CRM):

My Salesforce.com Iron Condor Trade

Iron Condor: Sell the salesforce.com (CRM) October 130/125 Bull Put Spreads and the October 170/175 Bear Call Spreads for $0.87 or more.

Option volatility remains high in the market due to the recent wild swings for the indexes. Today I am going to execute an Iron Condor in salesforce.com (CRM), which just recently reported strong earnings, that will sell this elevated volatility.

To execute this trade, you need to:

Sell to Open the October 130 Put,

Buy to Open the October 125 Put,

Sell to Open the October 170 Call, and

Buy to Open the October 175 Call

The most you can make on this trade is the premium collected, or $87 per iron condor (a yield of 21% in two months’ time) if CRM were to close between 130 and 170 on October expiration.

The most you can lose on this trade is $413 per Iron Condor if CRM were to close below 125 or above 175 on October expiration.

Essentially we are selling insurance that CRM will not move lower by 15% or higher by 11%.

So how did that trade work out?

A couple weeks later we closed the Iron Condor for a profit of 12.75%.

But why did we not collect the full 21% that I had hoped to gain?

The answer is that my Options Scanner had started to pick up on unusual call buying targeting a big move higher in CRM. And because of that, I felt that the 12.75% profit was enough, and then flipped into a CRM call buy!

Protective Puts

A protective put is used when a trader is bullish on a stock he is buying or already owns, but is wary of the stock’s short-term future. It is used as a means to protect unrealized gains, while giving the trader continued upside potential.

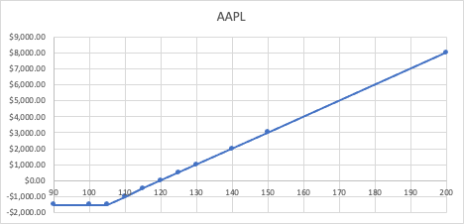

For example, theoretically in September of last year I wanted to buy 100 shares of Apple (AAPL) at 110. This is how I would have implemented the strategy.

First, I would buy my 100 shares.

Second, I would Buy to Open one AAPL January 105 Put for $10.

The total cash outlay for the put is actually $1,000 because each put represents 100 shares. That $1,000 is the insurance policy I took out on my stock position, and will protect my 100 shares if AAPL were to take a much bigger fall. Here’s a graph of the stock position combined with the put purchased:

In essence, I would have bought an insurance policy that would protect me for four months from a big fall.

If AAPL fell, my losses were stopped at 105, which is the strike price of the put that I bought.

At 105 or below, I have the right, but not obligation, to exercise my put, which would take me out of my AAPL stock position. I would likely exercise this right to sell my stock at 105 if AAPL had fallen precipitously lower.

However, to the upside, my potential gains are unlimited!

While I don’t love paying for insurance/puts, given the recent dramatic drop in countless market leaders, this strategy is a great way to protect my stock holding while maintaining upside potential.

How to Know Your Options

To most investors, volatility is a four-letter word! Of course, we love it when the market goes up, but give us just one down day and we begin to panic, envisioning all our worldly assets going down the drain.

But there is one category of investing that most investors often ignore, an investing technique that can help smooth the market’s volatility—and, at the same time, offer you an opportunity to profit during those up—and down—periods. That technique is Options investing.

Now, before you go back to burying your head beneath your pillows at the mention of this topic, let me just say this: Options are not for everyone, but if you hear me out, you may just find that options might be just the investment you need to boost your portfolio returns.

Options provide a chance to turn small investments into large profits by employing simple leverage—limiting your risk yet offering almost unlimited gains.

What’s more—because you can limit your risk, investing in options can actually be less risky than buying stocks.

So, let’s take the mystery right out of options and begin with some simple definitions.

Two Primary Types of Options

An option gives you the right—not the obligation—to participate in a future transaction on some underlying security. There are basically two types of options:

Call options give you the right to buy an investment at a predetermined price and are designed to profit from rising values. The downside is this: If you’re wrong—and the price of the underlying shares goes down instead of up—you lose the money you paid for the option. But the good news is: you have no obligation or liability beyond your initial investment. However, if you’re right and the price of the underlying shares rise, you are in a position to make a profit. This, in effect, leverages a very small amount of money that could turn into a large sum.

Put options give you the right to sell an investment at a predetermined price in order to profit from falling values. Think of them as working in reverse from call options. If the underlying shares decline, as you expected, you have the opportunity to profit from that decline. But if the price of the underlying shares unexpectedly rises, then your option just becomes worthless and you have lost only the price you paid for the option.

If there is no profit, you just let your option expire worthless. The profit potential is virtually unlimited, because you choose when—at what price level of the underlying stock—to exercise the option. But, most importantly, your potential loss is always absolutely limited to the amount you invest—not a penny more.

You can purchase most call and put options in large quantities. They’re traded on regulated exchanges, with low commissions and tremendous potential. In addition to individual stocks, you can also buy options on stock indexes—including the Dow Jones Industrial Average, the S&P 500, and the NASDAQ 100.

Before we get into examples, let’s define a few more terms:

I mentioned exercise price a moment ago. Another name for it is strike price. And it is the specified price on an options contract at which the contract may be exercised, or simply the price at which the option lets you buy or sell the underlying stock or stock index.

For example, a call option on XYZ stock with a strike price of 70 gives you the right to buy 100 shares of XYZ at a price of $70. Similarly, a put option on XYZ with a strike price of 70 gives you the right to sell 100 shares at $70.

The strike price is fixed in the options contract—for the life of the option—no matter what happens to the actual price of the underlying stock. The strike price is crucial, as it sets the risk and reward potential of an options trade. Risk and reward (along with the cost of the option) can be adjusted by choosing among a wide range of strike prices.

The expiration date is when the option expires. As with the strike price, traders can adjust their risk/reward and the cost of the option itself by selecting a different expiration date. All options expire on the third Friday of the named expiration month. Therefore, a Jan 20 call option would expire on the 3rd Friday of January (unless Friday is a holiday, then the expiration date is the Thursday before). The 20 refers to the strike price; in this case, $20.

The premium is the price you pay for the option. An expensive option has a high premium; a cheap one has a low premium. The price, or premium, of an option is usually quoted per underlying share. However, a stock option contract controls 100 shares of the underlying stock. For example, an option quoted at $2 is equal to a value of $200 for the contract ($2 times 100 shares).

A few more terms you will frequently hear when discussing options:

With a call option, at the money means the market price of the underlying shares is equal to the option’s strike price. Consequently, you are in a money neutral position—no profit or loss. If your options are in the money, the price of the underlying shares has surpassed the strike price—a potential profit situation. If they are out of the money, the price of the underlying shares is now lower than the strike price, so you no longer are holding a profitable option contract.

For example, you think the shares of XYZ Company are going up, and you want to take advantage of that rise without purchasing the shares themselves. Instead, you buy a Jul 20 call option, for $5. That allows you to buy 100 shares of XYZ at a strike price of $20, through the third Friday of July—no matter how low or high the shares trade. Of course, if they go lower, you wouldn’t want to exercise the option. But… if those shares are trading above $20 by that date, you are in the money! Let’s say they are trading at $30 by the date of expiration. So, you buy them at $20 ($20 x 100 shares = $2,000), sell them at $40 ($40 x 100 shares = $4,000), deduct the $5 you paid for the option ($5 x 100 shares = $500), and you have a profit of:

$4,000 - 2,000 – 500 = $1,500 = Your Profit

Of course, if the share price never gets to $20 (out of the money), you’ve spent $500 on a worthless options contract. And that is your total downside, even if the price of the underlying shares goes south of their original price. If, instead, you had purchased the actual shares, any rise past the original purchase price would be your profit (less commissions), but if the shares declined past that price, you could be holding a much larger loss than the $500 you would have spent by purchasing a worthless call option.

How Options are Priced

Anyone interested in trading options needs to be familiar with how options are priced and why the premium changes.

The option price, or premium, consists of two primary elements:

Intrinsic Value is simply whether the option is in the money or out of the money, terms I defined earlier. Intrinsic value is the relationship between the option’s exercise or strike price and the current price of the underlying security. Generally, an option that you can make money on now (in the money) will have a higher premium than one that is currently out of the money.

Time value is the amount of money that you are willing to pay for the option over and above the intrinsic value, prior to its expiration date. You might pay this if you thought the value of the option would increase because of a favorable change in the price of the underlying security. Generally, the longer the time period before the expiration date, the greater the time value (as you have more time for the price of the shares to increase or decrease, depending on the type of option you purchased).

Additionally, there are two more factors that influence the premium:

Volatility of the underlying security. Difficult to quantify, but very often significant, the volatility, or uncertainty in the price of the underlying security, will make the option premium rise, as investors who expect fluctuations in the share price demand to be paid for that risk or uncertainty.

Dividends and risk-free interest rate. Not generally a major influence on premium prices, but this ‘cost of carry’ is an opportunity cost, or a return that you may be passing up by not investing in alternative investments like Treasury Bills or dividend-paying stocks.

Option Strategies

Now, let’s talk some options strategies. In my ‘in the money’ definition, I gave you an example of buying a call option, the right to purchase 100 shares of a stock—an option you would purchase if you were bullish on the underlying stock.

Next, let’s look at buying a put option, the right to sell 100 shares of a stock—an option you would purchase if you were bearish on the underlying stock. Here’s how it works:

Let’s take our earlier call option example and reverse it. Now you buy a Jul 20 put option, for $5, so you pay a premium of $500 ($5 x 100 shares). If the shares fall below $20 by the third Friday of July (the option’s expiration date), you are ‘in the money’ and if you are far enough in the money to recover your initial $500 outlay + some, you would want to exercise your option.

Let’s say the shares have fallen to $10. You then buy them for $1,000 ($10 x 100), then sell them for $2,000 ($20 x 100), deduct your initial $500 outlay, and your profit is: $500, or $2,000 - $1,000 - $500 = $500 = Your Profit

Buying calls and puts are the most popular option strategies and can bring substantial profits, even to novice options traders. But there are scores of additional options strategies being utilized daily in the markets—many of which are extremely complex and should be plied by only the most experienced of traders. Consequently, I’ll leave their exploration to you, but caution you not to try for the home runs before you learn the basics through trial and error—and hopefully, profitable experiments.

There is one more options strategy that has caught on with the masses that I want to tell you about. It’s called covered call writing.

In a covered call, you sell the right to buy stock that you already own. For example, you purchase 100 shares of stock for $15 a share. Right away, you write a covered call option at a strike price of $20, for a premium of $2. You immediately earn $200 ($2 x 100).

If the shares don’t go above $20 before the expiration date, the option buyer doesn’t exercise his option, and you have netted a cool $200. Of course, if the share price declines below the initial $15 you paid, you are sitting with a loss, if you continue to hold them.

However, if the share price zooms up to $30, your option buyer is going to exercise his right to buy them, and he—instead of you—is going to reap the reward of that $10 per share climb (minus the $200 he paid to you for the option). This would be your downside, or opportunity cost. But you’ve still earned the $200 premium, so you can’t cry too much.

Covered call writing has become very popular, but it is not the risk-free strategy many advisors often tout. Remember, you own the shares, so you are still subject to the risk of those shares declining below your original purchase price.

I hope that you now feel a little more comfortable with options and can at least see their potential for adding a little oomph to your portfolio. I encourage you to learn more and would recommend that you visit these websites to further your education:

Chicago Board of Exchange (CBOE):

https://www.cboe.com/education/education-main

NASDAQ:

https://www.nasdaq.com/investing/options-guide/