Our contributors remain bullish, but cautious. This month’s Spotlight Stock is a Master Limited Partnership that’s primarily an asset manager, and its holdings are increasingly energy investments. The company is growing at double-digit rates and currently yields 5.35%.

Wall Street’s Best Dividend Stocks 302

[premium_html_toc post_id="141182"]

Market Views

Still Positive

In the final analysis, while there are definitely a couple of cracks in the stock market’s wall of worry that bear watching in the coming weeks, the weight of technical and fundamental evidence remains positive.

When the bull market has lost its health and vigor, the market itself will provide us with the clues. Until it does, traders should continue to lean bullish and avoid the temptation to time the stock market’s next major top.

Cliff Droke, Momentum Strategies Report, www.cliffdroke.com, 707-282-5594, November 6, 2017

Short- and Medium-Term Bullish

NASDAQ 100 closed last week +1.3% making new price and relative highs. Information Technology +0.9% makes new price and relative highs; Metals & Mining -0.8% tests relative lows. Our outlook remains moderately short-term bullish and medium-term bullish, but monitor potential corrections.

John Gray, Investors Intelligence, www.investorsintelligence.com, 914-632-0422, November 6, 2017

Market Breadth Thins

Bespoke Investment Group analysts report that the S&P 500 needs just six more calendar days to cross the 500-day mark without a 5% pullback, and just seven days to break a record for the longest streak ever without a 3% pullback.

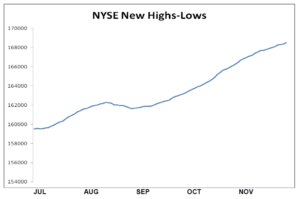

While markets made new highs this week, the action outside of energy and tech was uninspiring. Might just be a pause, but the thinning of market breadth could turn out to be a bad omen. The number of stocks trading over their 50-day moving average fell to 66%, which is relatively weak for a bull cycle.

Weakest sectors for breadth are consumer staples, consumer discretionary and telecom. Health care and industrials are also weakening. It’s weird to see consumer-oriented sectors on the ropes when surveys show consumer confidence is strong and unemployment is near record lows.

After its powerful move this month, technology stocks now account for 24.5% of the market cap of the S&P 500, which is 10 percentage points more than the next sector, financials. Bespoke analysts report that tech’s weighting is nine percentage points above its long-term average. Health care is the only other sector whose weight is above its long-term average. This is a yellow flag for bulls, as market cap weighting in the benchmark index regresses to the mean over time. Based on this analysis alone, we should see a least some swing back into favor for energy, telecom and consumer staples in the next few months.

Jon Markman, Strategic Advantage, www.markmancapital.net, November 6, 2017

To read the rest of this month’s issue, download the PDF.

The Next Wall Street’s Best Dividend Stocks Will Be Published December 13, 2017

Neither Cabot Wealth Network nor our employees are compensated by the companies we recommend. Sources of information are believed to be reliable, but are in no way guaranteed to be complete or without error. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on the information assume all risks. © Cabot Wealth Network. Copying and/or electronic transmission of this report is a violation of U.S. copyright law. For the protection of our subscribers, if copyright laws are violated, the subscription will be terminated. To subscribe or for information on our privacy policy, call 978-745-5532, visit www.cabotwealth.com or write to support@cabotwealth.com.