The Dow Jones Industrial Average continues its upward trend, gaining about 900 points since our last issue, helped by another great quarter of corporate earnings. With 81% of the companies in the S&P 500 index reporting, 80% beat earnings estimates and 74% surpassed sales forecasts. Those are the highest numbers since FactSet began reporting in Q3 2008.

Wall Street’s Best Dividend Stocks 311

[premium_html_toc post_id="155714"]

Market Views

Long-Term Trend Remains Up

The overall market remains in decent shape, with the longer-term trend firmly up, though the intermediate-term trend is a bit iffy. But there remains a ton of rotation and crosscurrents in the market, with many (but not all) growth stocks getting hit and money flowing into some more cyclical and defensive areas.

Thus, you shouldn’t be super defensive, but it’s best to pick your spots, honor your stops and focus on names that have recently seen a bunch of buying.

Michael Cintolo, Cabot Top Ten Trader, www.cabotwealth.com, 978-745-5532, August 6, 2018

Watch the Oscillator

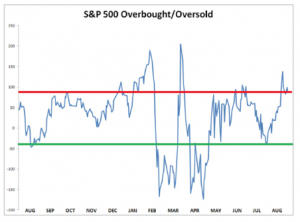

While the market doesn’t have anything to fear in the way of a crash there is still no denying that the market is vulnerable to at least some selling in the immediate term. The 20-day price oscillator for the S&P has been reflecting a drastically “overbought” market condition. This can be discerned by examining the following chart exhibit, which shows the 20-day oscillator at one of its most “overbought” readings of the year to date. As long as this indicator reflects an overheated market condition, the S&P 500 could easily see some downside in the days ahead. Until this indicator shows improvement, investors should be prepared for a potentially bumpy ride in the near term.

On a strategic note, investors should continue to maintain intermediate-to-longer-term bullish exposure to the stock market via ETFs and outperforming individual stocks in strong sectors, most notably the retail sector. I also recommend raising of stop losses on existing long positions among the actively traded tech and Internet names, as well as taking profits in stocks and ETFs which have already had impressive upside moves.

Cliff Droke, Momentum Strategies Report, www.cliffdroke.com, 707-282-5594, August 4, 2018

Moving Higher, but Don’t Forget Stops

Last week, the market (the DOW) was able to keep from closing below the critical 25,250 level and moved up strongly on Friday. We believe that the market is headed substantially higher because it came out of a Head & Shoulders Reversal pattern, tested the neckline on Thursday and moved back up on Friday. We would still continue to have stop loss orders 10% below the market in view of the North Korea situation.

Joseph Cotton, Cotton’s Technically Speaking, www.cottonstocks.net, 727-289-4436, August 6, 2018

To read the rest of this month’s issue, download the PDF.

The next Wall Street’s Best Dividend Stocks issue will be published on September 12, 2018

Neither Cabot Wealth Network nor our employees are compensated by the companies we recommend. Sources of information are believed to be reliable, but are in no way guaranteed to be complete or without error. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on the information assume all risks. © Cabot Wealth Network. Copying and/or electronic transmission of this report is a violation of U.S. copyright law. For the protection of our subscribers, if copyright laws are violated, the subscription will be terminated. To subscribe or for information on our privacy policy, call 978-745-5532, visit www.cabotwealth.com or write to support@cabotwealth.com.