It was a great month for the markets, with the Dow Jones Industrial Average gaining more than 1,400 points. The economy remains sound; housing prices have mitigated somewhat; unemployment is healthy; and consumers are still confident.

That’s a nice setting for our Top Picks issue. Our contributors—so far in 2019—have had a banner year.

I have to brag a bit here about our Cabot contributors, as they took the top three spots!

But, seriously, the thriving market—and some good stock picking—served us well.

Wall Street’s Best Dividend Stocks 322

[premium_html_toc post_id="180862"]

Congrats to the Top Picks 2019, Mid-Year

Congratulations to our Top Picks for 2019! We’re halfway through the year, and the markets are doing great—and so are our Top Picks! The Dow Jones Industrial Average has gained 11.8%; the S&P 500 is up 14.3%, and the NASDAQ has returned 16.1%.

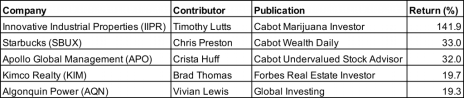

Meanwhile, our Top Picks have left the broader averages in the dust, especially our Top 5, featured in the table above.

Our best-performing stock was Innovative Industrial Properties, Inc. (IIPR), a marijuana Real Estate Investment Trust, chosen by our own Tim Lutts, chief analyst for Cabot Marijuana Investor. And Tim’s pick ‘smoked’ out everyone, gaining 141.9%.

This is what he had to say about IIPR at the beginning of the year:

“The cannabis industry is the fastest-growing industry in the U.S. While the stocks in the industry are notoriously volatile, IIPR is far less volatile, while still holding the promise of great growth.

“IIPR has eleven properties in nine states (Arizona, Colorado, Illinois, Maryland, Massachusetts, Michigan, Minnesota, New York and Pennsylvania), totaling more than a million rentable square feet. All properties are currently leased with a weighted-average remaining lease term of approximately 14.7 years.

Analysts are projecting earnings of $1.97 per share in 2019. And the stock is currently on a normal correction, having pulled back 24% from its November high. I like it both for the year ahead and longer-term.”

Coming in second, with a 33% return, is Starbucks Corporation (SBUX), picked by Chris Preston, chief analyst, Cabot Wealth Daily. In his recommendation, Chris noted, “Coffee drinkers don’t care about market corrections. Perhaps that’s why Starbucks has come through the worst market correction in a decade not only unscathed, but in a better position (+10%) than it was when the downslide started in October. A big fiscal fourth-quarter earnings report in early November sent the stock gapping up from 58 to 68 in a week, thanks to much-better-than-expected same-store sales, spurred in part by the recently introduced late afternoon “happy hour” deals. SBUX looks buyable below monthlong resistance at 67. Any push above that level, especially if the market offers a tailwind instead of a headwind, and the stock could zoom past record highs.”

Our third place winner is Apollo Global Management, LLC (APO) picked by Crista, Huff, chief analyst, Cabot Undervalued Stocks Advisor. In January, Crista said, “Apollo Global Management, LLC is an alternative investment company. APO is a mid-cap stock with a market capitalization of $4.9 billion. As the share price suffered during the recent market downturn, the current dividend yield rose, making the prospect of owning APO shares more compelling for both individual and institutional investors. In late December, Tiger Global Management reported a purchase of 1.1 million APO shares at an approximate cost of $26 million. APO is a great choice for income investors and growth stock investors.”

Brad Thomas, editor, Forbes Real Estate Investor, chose Kimco Realty Corporation (KIM). Brad noted, “Kimco Realty Corporation is a “moat-worthy” pick, a leading best-in-class open-air shopping center REIT of 450 properties, 78 million leasable square feet, primarily in the top 20 U.S. markets, providing 80% ABR (annual base rent); those markets project a population growth of 6.3 million within the next 5 years. Q3-18 pro-rata occupancy was 95.8%; small shop occupancy 98.8% (record high).

“Among its holdings, Kimco’s Pentagon Center mixed-use tower has topped off and begins pre-leasing apartments in 2019. The redevelopment’s Phase I is diagonally across from Amazon’s new Northern Virginia headquarters, completed just in time to meet the oncoming demand.

“Kimco also owns 9.74% of private grocer, Albertsons, itself expecting over $1.0 billion in free cash flow over the coming year, which could help support a 2019 IPO (an estimated $500 million in “untapped” value for Kimco).”

And in 5th place is Algonquin Power & Utilities Corp. (AQN), recommended by Vivian Lewis, editor of Global Investing. Vivian wrote, “Canada has long been more green-minded than the USA. Algonquin Power & Utilities Corp. (AQN) is beloved by Canadian analysts because of a border hop side-effect: earnings in greenbacks as well as loonies. The lure for me is its Liberty Power non-regulated renewables line with a power generation capacity of 957 megawatts, representing about 20% of total capacity. Eventually there will be $7.5 bn of new investments in 2019-2023, so $2.2 bn will be for renewables. AQN forecasts the new businesses will produce a compound annual [earnings] growth rate of 10%.

“The most recent addition to this was the purchase of Enbridge’s New Brunswick gas, the first AQN Canada gas distribution business. AQN is growing its renewables business also in Latin America. These moves make AQN a North American leader in renewable power from hydro, thermal, wind, and solar, water distribution, and waste-water collection. The company expects CAGR to rise 10% over the next 5 years. Green from green!

Great job! Congratulations to all our contributors. Here are a few mid-year updates, as well as some new additions for your review.

To read the rest of this month’s issue, download the PDF.

The next Wall Street’s Best Dividend Stocks issue will be published on July 31, 2019

Neither Cabot Wealth Network nor our employees are compensated by the companies we recommend. Sources of information are believed to be reliable, but are in no way guaranteed to be complete or without error. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on the information assume all risks. © Cabot Wealth Network. Copying and/or electronic transmission of this report is a violation of U.S. copyright law. For the protection of our subscribers, if copyright laws are violated, the subscription will be terminated. To subscribe or for information on our privacy policy, call 978-745-5532, visit www.cabotwealth.com or write to support@cabotwealth.com.