While the Dow Jones Industrial Average has gained some 700 points since our last issue, our contributors and advisors, in general, remain bullish, as you can see from our Advisor Sentiment Barometer.

Wall Street’s Best Investments 794

[premium_html_toc post_id="135376"]

Market Views

Still Room to Rise

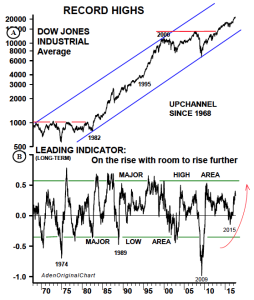

As you can see, the leading indicator for the Dow Industrials still has room to rise further before it reaches the “major high area.” This means there’s more upside to come, and this will probably coincide with more “buyer’s excitement.” And if buyers then get frenzied, we could see stocks soar to levels most people aren’t expecting.

Remember, stocks often overshoot during bull markets and as this upmove keeps gaining momentum, it has all the ingredients for an upside surprise. Continue to enjoy the ride for as long as it lasts.

Mary Anne & Pamela Aden, The Aden Forecast, www.adenforecast.com, 305-395-6141, June 14, 2017

More Rally to Come

Despite the recent volatility and the pullback in the tech stocks, our outlook for stocks remains positive. The NYSE advance-decline line made a new high Friday, new lows are minimal, and new highs expand nicely on the rallies. Participation has improved with smaller- and mid-sized stocks playing catch up while growth maintains its leadership role. In short, the US stock market seems to be calmly working its way higher despite the madness in the news. In fact, I think that the ‘mini tech wreck’ will be good for the market as a whole, as it will get investors to turn their attention to other sectors, groups and stocks.

John Bollinger, The Bollinger Band Letter, www.bollingerbands.com, 310-798-8855, June 12, 2017

Ditto...

The Dow Industrials outperformed last week with a gain of 0.5%. The chart is at record highs and strength should continue. Given that momentum, the 14-day RSI can still climb further.

Medium-term breadth, the % 30-week moving average, maintains its recovery off trendline support. Friday saw internal expansion, adding confidence in the rally.

John Gray, Investors Intelligence, www.investorsintelligence.com, 914-632- 0422, June 19, 2017

To read the rest of this month’s issue, download the PDF.

THE NEXT Wall Street’s Best Investments WILL BE PUBLISHED July 19, 2017

Neither Cabot Wealth Network nor our employees are compensated by the companies we recommend. Sources of information are believed to be reliable, but are in no way guaranteed to be complete or without error. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on the information assume all risks. © Cabot Wealth Network. Copying and/or electronic transmission of this report is a violation of U.S. copyright law. For the protection of our subscribers, if copyright laws are violated, the subscription will be terminated. To subscribe or for information on our privacy policy, call 978-745-5532, visit www.cabotwealth.com or write to support@cabotwealth.com.