In this Mid-Year Top Picks issue, we feature our top five picks, which averaged 54.85% gains, plus updates on all our Top Picks. Going forward, analysts expect the three industries to grow the fastest in the remainder of the year to be energy, information technology and financials, and we have plenty of ideas in each of those sectors.

Wall Street’s Best Investments 795

[premium_html_toc post_id="136403"]

Top Picks Mid-Year Update

Our 2017 Top Picks issue arrived following one of the most contentious U.S. presidential elections came to a close. Last January, investors spirits were buoyed by the optimism that was pushing the market higher. The promise of considerable corporate—and personal—tax cuts, billions of dollars to spend on infrastructure, and a revamping or repeal of Obamacare looked very attractive to folks who were tiring of the ‘steady-but-sure’ economic recovery.

From a professional’s viewpoint, though, we really had no reason to complain about the markets. After all, from the nadir in March 2009 up through the November 8, 2016 presidential election, the Dow Jones Industrial Average almost tripled—up 11,785 points. That was a tremendous boost to confidence!

But the environment became even better when following the election—through year-end 2016—the Dow rose nearly 8%. And since then—despite no tax cut legislation, no introduction of infrastructure relief and the defeat of the latest healthcare revampment, we’ve seen another gain of 9.4% in the Dow, 9.8% rise in the S&P 500 and 17.3% rise in the Nasdaq—not too shabby!

In reality, you can shuffle all the news stories you want and attain short-term bursts in the markets, but the bottom line for long-term market gains is earnings growth. Following the recession, we saw some tremendous earnings growth, which drove markets higher, but once the rebound stabilized, earnings were so-so, and investors began wondering whether the bull market cycle could continue.

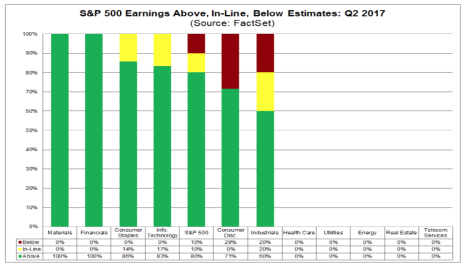

But last quarter, with 75% of the companies in the S&P 500 index beating Wall Street’s earnings estimates—higher than the historical average of 64%—investors regained some confidence.

So, the question is, where do we go from here? Well, so far, the numbers look good. For the second quarter, analysts are expecting 6.8% growth for the companies in the S&P 500 index, with half of the sectors forecasted to see earnings surprises—especially financials.

The top three industries that analysts estimate will grow the fastest are: energy (357.4%, due primarily to unusually low earnings a year ago), information technology (10.5%), with semiconductors expected to see 42% expansion, and financials (8.2%, with insurance at the head of the line, forecasted to grow by 20%.

And more good news: this significant boost to earnings is keeping the market valuations at a reasonable level. Right now, the forward 12-month P/E ratio for the S&P 500 is 17.6. That is higher than the five-year average (15.4), but remains attractive. And that sentiment is borne out by my pulse-of-the market readings, with all three of my indicators: AAII, Investors Intelligence and Timer Digest indicating a continuance of the bull market.

Accompanying the attractive earnings picture is the progress of the economy.

The U.S. unemployment rate remains low at 4.4%, and last week’s labor statistics showed a couple more optimistic signs: hiring increased to 5.5 million folks, up 8.5%, and workers became more confident in finding a new job, as 3.2 million of them quit their current employers, a rise of 7.1%. Housing continues to be positive, with building permits, housing starts and completions all on the rise.

Inflation, as indicated in the CPI, remains very low at just 0.1%. And while the Federal Reserve has raised interest rates a couple of times so far in 2017—and possibly once more before year-end—there’s no sign of over-heating in the economy—a very good environment for additional market growth.

Top Five Picks YTD

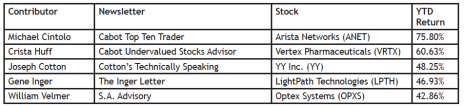

Like the market returns—as you can see in the chart below, the gains from our Top Picks so far in 2017, are stellar! I couldn’t be more pleased to report that our Top Five Picks averaged a stunning 54.85%—almost five times the returns of the Dow Jones Industrial Average!

And I have to say, I am extremely proud of the Cabot team—Michael Cintolo and Crista Huff—the Chief Analysts of Cabot Top Ten Trader and Cabot Undervalued Stock Advisor, respectively—who took first and second places. Their recommendations returned gains of 75.80% and 60.63%, handily beating all the market averages.

Congratulations to all our contributors—you did a fantastic job! I’ve known most of our contributors for years, going back to my previous investment newsletters as well as my work with the Money Show. And, as you know, these folks are the crème de la crème of financial advisors. They have years of expertise, and have proven that their long-term strategies work at very high levels.

Each of these companies exhibits many of the investment criteria that I typically check off when searching for new ideas:

• Innovation

• Operating in an industry

• Exceptional growth

• Tremendous earnings and sales growth

• Active in acquiring important technologies and services

• Low debt and undervalued

And so far this year, those important measures are driving the shares higher.

It’s been a great year, and with the economy continuing to make significant headway, we see no reason why we shouldn’t remain bullish for the remainder of 2017.

I always examine the reasons our contributors give for their picks to see what’s working. So, let’s take a look back and see what the folks who chose the Top Five Picks said about their choices at the beginning of the year.

Arista Networks (ANET 156)

From Michael Cintolo, Cabot Top Ten Trader

Arista Networks (ANET), in many ways, looks like the next Cisco. It has an expertise in cloud computing and data center switching technologies, which is helping it to consistently grab market share from legacy players that don’t have the cheaper/better/faster offerings of Arista.

Indeed, in the high-speed data center switching market, Arista’s market share is up to 15% (from 7% three years ago), while Cisco’s is now 53% (down from 71% three years ago). And there’s every sign that trend will continue in the quarters and years ahead.

Growth-wise, we love Arista’s solid sales and earnings growth going back years. Sales have risen 35%, 37% and 33% during the past three quarters, while earnings growth accelerated from 36% to 37% to 41%. And aftertax profit margins of 20% or so reveal a very healthy business.

Long-term, it looks like ANET has just emerged from a big, two-year, post-IPO base, with shares finally topping their 2014 high in late-November. I think Arista’s bottom line could surprise on the upside, attracting more and more big investors and driving the stock higher.

Vertex Pharmaceuticals (VRTX 132)

From Crista Huff, Cabot Undervalued Stocks Advisor

Vertex Pharmaceuticals (VRTX) is a biotech company, prominent for its world-leading treatments for cystic fibrosis. Vertex is expected to outperform its peers in earnings growth through 2020. Despite only one barely profitable year between 2006 and 2015,

Vertex is expected to report 2016 earnings per share of $0.77, and $2.27 in 2017 (December year-end), reflecting 195% earnings growth in 2017. This aggressive growth stock has a 2017 price/earnings ratio of 34.

VRTX did a lot of sideways trading in 2016 between 75 and 103. Buy it while it’s cheap. If VRTX retraces its 2015 high of 141 this year, that’s a potential capital gain of about 75%!

YY Inc. (YY 67)

From Joseph Cotton, Cotton’s Technically Speaking

YY Inc. is a Chinese social media internet company that offers a community social platform and live streaming services, which engages users in online group activities through voice, text and videos. Unaudited third quarter results showed a 40.3% increase in net revenues of $313.4 million and net income increased 155% to $60 million over third quarter 2015 results. The current year’s earnings estimate is $3.73 per share and $4.80 for next year.

The stock is currently selling at a PE ratio of about 11. But we think it is substantially undervalued and should be trading at least at 15 times 2016 earnings, which would be $55.

For 2017, if earnings estimates are correct, the stock should be trading at least at $72 (15 x $4.80). Hopefully, it will trade at 20 times earnings, which is still below the PE Ratios of its peers.

LightPath Technologies (LPTH 2.69)

From Gene Inger, The Inger Letter

LightPath Technologies (LPTH) seems in turnaround mode; having just completed an acquisition which further should transform an overlooked (gem?) global competitor in optical and infrared, plus thermal imaging. Still micro-cap, but we think not for long (if it moves above 5, you might attract institutional interest).

Notably, both Orlando-based LightPath and its newly-acquired wholly-owned ISP Optics (New York and Latvia) produce all military and U.S. defense items in the USA.

The company basically doubled its revenue with small dilution, and the shares are trading not far from 52-week lows. It’s viewed as an undervalued play already turned around after flat-lining for years.

It’s clearly a speculation, but we’re at improved performance and prospects without recent price gain, yet. Extrapolating reasonable growth—a double from the 1.50 area shouldn’t be difficult later this year ‘if’ LPTH and market conditions allow evolving growth and optimism. Thus, the intent is to hold it, rather than trade it.

Optex Systems (OPXS 0.98)

From William Velmer, S.A. Advisory

Optex Systems (OPXS) primarily manufactures optical sighting systems and assemblies for DOD. The rebuilding and upgrading of our War Machine and our allies around the world will dramatically create strong revenue and earnings growth during the next administration.

Fiscal 2016 revenue exploded to $17 million from $13 million, and losses narrowed from operations to only $200 thousand. Estimated revenue for fiscal 2017 is anticipated to reach $25 million and net .20/share, based upon 10 million fully diluted shares outstanding.

The current book value is over $1.00, little debt and all preferred shares have been converted. With tax selling finished and institutional selling over because of poor support from recent 08/16 IPO, the shares of OPXS have been slaughtered and remain even more compelling as our continued stock pick for 2017.

We rate OPXS with our strongest buy rating for short/long term capital gains.

To read the rest of this month’s issue, download the PDF.

THE NEXT Wall Street’s Best Investments WILL BE PUBLISHED August 16, 2017

Neither Cabot Wealth Network nor our employees are compensated by the companies we recommend. Sources of information are believed to be reliable, but are in no way guaranteed to be complete or without error. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on the information assume all risks. © Cabot Wealth Network. Copying and/or electronic transmission of this report is a violation of U.S. copyright law. For the protection of our subscribers, if copyright laws are violated, the subscription will be terminated. To subscribe or for information on our privacy policy, call 978-745-5532, visit www.cabotwealth.com or write to support@cabotwealth.com.