The economy continues to strengthen—rising retail sales, lower jobless claims and steady unemployment. Consequently, it’s no surprise that the broad markets are holding their own. Of course, volatility this year has risen, creating a bit of seesawing in the markets, with the Dow Jones Industrial Average gaining just 1.4% so far in 2018, but sentiment—as you’ll see in our Market Barometer—remains bullish.

Wall Street’s Best Investments 807

[premium_html_toc post_id="154115"]

Mid-Year Top Picks

Congrats to the Top Picks 2018, Mid-Year

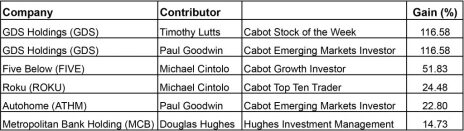

The Dow Jones Industrial Average has gained about 1.4% for the year, which as you can see from our Top Picks table above, doesn’t come close to the gains of the big winners that our contributors selected at the beginning of 2018. And I just have to brag on our Cabot analysts. Out of the top five gainers, our stock pickers took the first four trophies.

Our number one pick, GDS Holdings (GDS), was recommended by both Paul Goodwin, Chief Investment Analyst, Cabot Emerging Markets Investor and Tim Lutts, Chief Investment Analyst, Cabot Stock of the Week. When he recommended the company, Paul said, “GDS has been building data centers and courting big clients since 2009, and it now has nearly 78,000 square meters of data center space in usage (that’s apparently how the industry discusses size/capacity), which is up 59% from a year ago. GDS has over 400 customers for its services, including Alibaba and Tencent Holdings, two of the biggest online companies in China. And the company is adding both capacity and customers at a rapid clip.”

Tim added, “GDS Holdings’ enjoyed revenue growth of 47% in 2015, 42% in 2016 and 56%, 40% and 43% (to $64 million) in the first three quarters of 2017, respectively. The focus here is growth; the profits will come later.

“Very few U.S. investors even know its name and to me, that spells untapped buying power. As long as it’s growing this fast, GDS will never be cheap, but I don’t mind that. I’ll take fast growth over value any day.”

Five Below (FIVE)—our second place winner—was the pick of Mike Cintolo, Chief Investment Analyst, Cabot Growth Investor. Mike commented, “Five Below is probably our favorite retail story from a fundamental perspective, and the stock is strengthening as the weak hands have been worn out over many years and investors head back to the sector. The company is a unique dollar store, offering teen and pre-teen merchandise for $5 or less, including everything from smartphone cases to makeup to sports equipment to books to candy to party supplies.

“The company is boosting its store count by about 20% this year (it had 625 locations at the end of October), with 15% to 20% store growth likely for years to come. Long-term, management believes there’s room for more than 2,000 locations in the U.S. alone! And, as for its products, the company has notched 11 straight years of comparable store growth, and last quarter’s tally (up 8.5%) was one of its strongest in years.”

Mike Cintolo also took third place, with his choice of Roku (ROKU) in his Cabot Top Ten Trader newsletter. Mike had this to say about Roku: “Roku is a direct play on the cord-cutting and TV streaming movement. It makes over-the-top (OTT) TV streaming devices that allow people to access apps such as Netflix, Amazon and Hulu. It also developed an operating system that accesses the same apps, and which comes pre-installed on many smart TVs, including models from Hitachi, Insignia, TCL, Sharp, RCA, Hisense and Philips.

“The stock is moving higher because Q3 results topped estimates by a mile. Revenue was up 40%, while EPS of -$0.10 beat by $0.19. The results also showed the power of Roku’s business model: The company is pulling in tons of users by selling streaming devices and TVs (73% of total revenue and 33% of gross profit) at relatively little profit, then cashing in once they are users of the company’s platform by selling advertising, content distribution services and audience data (27% of total revenue and 67% of gross profit). The best evidence of this phenomenon is that active accounts were up 48% to 11.3 million in the third quarter, while average revenue per user was up 37% to $12.68.

“Analysts expect 2018 revenue growth to hit 30%, while red ink will likely be slashed from -$1.80 in 2017 to -$0.43 in 2018. If management continues to make the right moves, the potential is huge as millions more users use its platform.”

Paul Goodwin also picked our fourth place stock, Autohome (ATHM). “There aren’t many genuinely conservative picks among Chinese stocks, but Autohome is my best guess about a beaten-down company with excellent credentials. China is the biggest, fastest-growing automobile market in the world, and Autohome is the most important website for getting buyers and sellers together. The company’s

“Autohome Mall” is a virtual extension of dealers’ showrooms, a place where car shoppers can browse through a ton of information about cars, specifications, pictures, reviews and consumer feedback.

‘Revenue was up 62% in 2016 and analysts are expecting 21% earnings growth in 2018. ATHM ran from 25 to 68 from January 2017 through August, but has been through the mill for the last four months, falling to as low as 53 in early December. I think 2018 will see a strong recovery and a resumption of the stock’s advance”.

“Our fifth place winner was Metropolitan Bank Holding Corp. (MCB), selected by Doug Hughes of Hughes Investment Management.

“Metropolitan Bank Holding Corp. The company has a book value of $26 and fast growth from Bitcoin—over 100% in deposits and more than 30% in loans, in half a year. Net income is also up 165%, in the third quarter. If you want a bank with a bitcoin play and 50 times cheaper than say, Overstock.com, I believe there is some real value here, since it’s unlike many other Bitcoin plays that have zero earnings or any real prospects to make money. Insiders bought a ton of stock, under $40 a share. If Bitcoin gets mentioned in relation to this bank, the stock could possibly go to $90 to $100, and then we would be out.”

Congratulations to all our contributors!

This issue contains updates on many of our Top Picks, a new mid-year pick, and several additional ideas to consider for your portfolio.

To read the rest of this month’s issue, download the PDF.

THE NEXT Wall Street’s Best Investments will be published August 15, 2018

Neither Cabot Wealth Network nor our employees are compensated by the companies we recommend. Sources of information are believed to be reliable, but are in no way guaranteed to be complete or without error. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on the information assume all risks. © Cabot Wealth Network. Copying and/or electronic transmission of this report is a violation of U.S. copyright law. For the protection of our subscribers, if copyright laws are violated, the subscription will be terminated. To subscribe or for information on our privacy policy, call 978-745-5532, visit www.cabotwealth.com or write to support@cabotwealth.com.