Happy New Year! It was a great year for the markets with the DJIA gaining 22.3%, the S&P 500 up 28.9%, and the Nasdaq rose 35.2%. But it was even a better year for us! Our Top 5 Picks for 2019 averaged returns of 131%! William Velmer of S.A. Advisory was our big winner. His stock idea gained an astonishing 332%!

Congratulations to all our contributors. And 2020 looks just as promising. Employment is healthy and so is the housing market. Economists are calling for several rate decreases, which should continue to help housing. And as you can see in our Advisor Sentiment Barometer, the investment world remains very bullish.

More details in the issue.

Wall Street’s Best Investments 825

[premium_html_toc post_id="195682"]

Congratulations to the Top Picks of 2019!

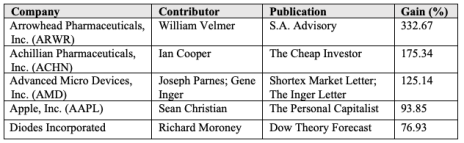

Our contributors did a stellar job for you last year. As you can see from the table below, our Top 5 Picks averaged 131% gains! And the rest were pretty good, too.

Last year, the markets recovered all that they lost in 2018—plus a lot more! The Dow Jones Industrial Average gained 22.3%; the S&P 500 was up 28.9%; and Nasdaq beat them all, turning in a 35.2% return.

William Velmer, editor of S.A. Advisory, was our big winner. He recently updated his view on ARWR, noting: “The company develops medicines that treat intractable diseases by silencing the genes that cause them. During 2019 the company has been very successful in various treatments and currently has various test drugs in FDA phases. Recently, ARWR raised $270 million in 2-3 days. The company is now in a new league for research, development and new drug therapy. From WSB January 2019 stock pick of year publication, “we believe because of all milestones that will be met during 2019, that the share price could easily double or triple!” Well, ARWR is currently trading around $65. During 2020, ARWR has the potential to trade at $100.00/sh.” That sure sounds like good new to me!

Ian Cooper, editor of The Cheap Investor, came in second place. When he recommended ACHN last January, he said, “We like ACHN because the company has several products in FDA Trials, collaboration agreements with pharmaceutical companies and a large amount of cash. We think positive FDA news could move the stock price up to the $3-5 level.” And he was right—ACHN traded at $6.03 by the end of 2019.

The bronze medal is a tie, going to Joseph Parnes, editor of Shortex Market Letter and Gene Inger, editor of The Inger Letter. Here are Joseph’s comments when he recommended AMD: “Chipmaker Advanced Micro Devices has benefited from its graphic processing units (GPUs) and has made significant inroads in its cloud data processors for Amazon’s Web Services (AWS) and Microsoft’s Azure. AMD is posing a significant challenge to Intel (INTC) with its data center’s chips, due to AMD’s single socket boards and lower prices, which is a plus in the current memory market environment. Reversal to challenge its primary resistance at (18-19) and secondary resistance at (22-23).” AMD plowed through that resistance and ended the year at $45.86 per share.

Gene Inger said in his July update, “While we do believe an investor could have taken a little off-the table as it doubled to 32 from our 16-17 buy-zone (yes, a 100% gain in 6 months), we believe after consolidation, higher prices will be seen in 2020.” He recently added, “Last year’s ‘Pick of the Year’ Advanced Micro Devices became the best-performing stock in the S&P, as well as the Nasdaq 100 (about a triple from our selection in the 16-17 buy-zone and now in the middle 40’s); we humbly look at an extended market with a degree of respect.”

In fourth place, Sean Christian, editor of The Personal Capitalist, in his July update, commented, “We continue to believe Apple can sustainably grow revenues and earnings per share. Services continue to grow, and innovation is accelerated. Innovation should grow to 30% of revenues and 46% gross profit by 2023.” Absolutely; Apple had a stellar performance in 2019, closing the year out at a price of $293.65.

Richard Moroney, editor of Dow Theory Forecasts, chose Diodes, Incorporated, and came in fifth. When he recommended the stock, he noted, “Diodes Incorporated (DIOD) is an integrated global manufacturer serving the electronics, industrial, and communications markets. The company operates 21 global locations, selling more than 25,000 products to an

expansive customer base. Despite operating in a highly cyclical industry, Diodes has delivered 26 consecutive years of profitability. The stock’s trailing P/E ratio of 15 stands near its lowest

level since 2011 and well below its industry average of 20. The stock, earning a Value score of 81, is rated a “Best Buy”. He chose well, as Diodes ended the year at a price of $56.37.

Congratulations and a big thanks to all our contributors!

And now, let’s take a look at the great variety of companies that our contributors have chosen for their Top Picks for 2020.

To read the rest of this month’s issue, download the PDF .

The next Wall Street’s Best Investments issue will be published on February 20, 2020.

Cabot Wealth Network

Publishing independent investment advice since 1970.

CEO & Chief Investment Strategist: Timothy Lutts

President & Publisher: Ed Coburn

176 North Street, PO Box 2049, Salem, MA 01970 USA

800-326-8826 | support@cabotwealth.com | CabotWealth.com

Copyright © 2020. All rights reserved. Copying or electronic transmission of this information is a violation of copyright law. For the protection of our subscribers, copyright violations will result in immediate termination of all subscriptions without refund. No Conflicts: Cabot Wealth Network exists to serve you, our readers. We derive 100% of our revenue, or close to it, from selling subscriptions to its publications. Neither Cabot Wealth Network nor our employees are compensated in any way by the companies whose stocks we recommend or providers of associated financial services. Disclaimer: Sources of information are believed to be reliable but they are not guaranteed to be complete or error-free. Recommendations, opinions or suggestions are given with the understanding that subscribers acting on information assume all risks involved.