Today’s portfolio changes:

Alphabet Cl. C (GOOG) moves from Buy to Hold.

Nautilus (NLS) rose to its target sale price of 14: Sell.

Ross Stores (ROST) moves from Hold to Sell at 84.

Last week’s portfolio changes:

Gentex (GNTX) moved from Buy to Hold.

Williams-Sonoma (WSM) moved from Buy to Hold.

Please send questions and comments to Crista@cabotwealth.com.

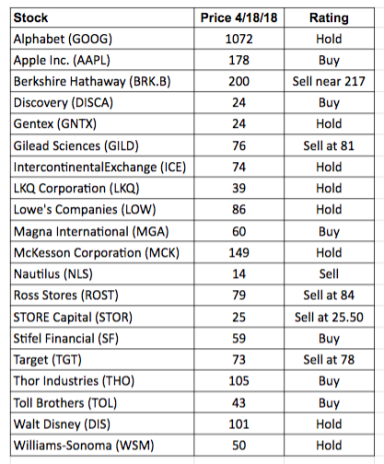

Portfolio Stocks

Alphabet Cl. C (GOOG) – Alphabet is the world’s largest internet company. Revenue is derived from Google’s online ads, with the balance coming from the sale of apps, digital content, services, licensing and hardware. Alphabet is expected to report first quarter EPS of $9.31, within a range of $8.24 to $10.07, on the afternoon of April 23. I will consider GOOG to be fairly valued when it retraces its January high near 1180, at which point I plan to sell due to full valuation. I’m moving GOOG from Buy to Hold today, as it nears my price target. Hold.

Apple (AAPL – yield 1.4%) manufactures a wide range of popular communication and music devices. Apple is an undervalued growth stock, expected to see EPS increase 24.2% in fiscal 2018 (September year-end). The company typically announces a dividend increase in late April. Last year’s increase was 10.5%, and it would not be surprising if this year’s increase is larger because of all that repatriated cash that Apple is now free to bestow upon shareholders. AAPL is rising toward its March high at 182. I expect additional capital gains in 2018. Buy AAPL now. Buy.

Berkshire Hathaway Class B (BRK.B) – Here’s a recent Barron’s article about the potential buyout of USG Corp. (USG), of which Berkshire Hathaway owns a 31% share: Warren Buffett Adds Intrigue to an Unwanted Bid for USG. Gebr Knauf KG, a German producer of building materials, is actively interested in buying USG, against the will of USG’s current board of directors.

Despite consensus earnings estimates increasing last week, the stock is trading at a P/E that’s more than twice as big as the company’s 2019 earnings growth rate. I plan to sell BRK.B near its recent high of 217. There’s room within the current trading range for short-term traders to make 8% profit. The stock could easily continue climbing after a brief pause at 217, so for those of you who want to see how high BRK.B could rise this year, my suggestion is that you use a stop-loss order to protect your downside. Sell near 217.

Discovery Communications (DISCA) – Consensus earnings estimates for Discovery change weekly. Analysts now expect EPS to grow 32.1% and 29.9% in 2018 and 2019, with corresponding P/Es of 9.5 and 7.3. DISCA is a very undervalued aggressive growth stock. (I hate the very high debt ratio.)

The stock is heading back to its January and February high of 26. Once there, I expect the stock to rest a while before proceeding upward. The high debt ratio would inspire me to protect my downside with a stop-loss order, because debt adds risk to the company and its share price. Buy.

Gentex (GNTX – yield 1.8%) manufactures innovative products for automobiles and airlines, and also serves the fire protection industry. Analysts expect Gentex to report first quarter earnings per share of $0.40 on the morning of April 20, within a range of $0.38 - $0.41. Aggressive 2018 earnings growth is expected to give way to single-digit 2019 earnings growth. GNTX rose past short-term price resistance last week and began reaching new all-time highs. I plan on selling the stock after the run-up, in favor of a company with better multi-year earnings growth prospects. Hold.

Gilead Sciences (GILD – yield 3.0%) is expected to see a big drop in profits in 2018, followed by just 2.3% EPS growth in 2019. In addition, debt levels are somewhat high. I see no reason to own this stock. My suggestion is to let GILD rise back to 81, then sell. Falling profits are not conducive to rising share prices. A stop-loss order at 71.50 could be wise. Sell at 81.

Intercontinental Exchange (ICE – yield 1.3%) operates regulated exchanges and clearing houses in the commodity and financial markets. ICE is a large-cap growth & income stock, fairly valued based on the expectation of 20% EPS growth in 2018, but overvalued when factoring in expectations of low-double-digit earnings growth in 2019. The stock rose to new all-time highs in January, then corrected with the broader market. Based on strong 2018 earnings growth, bullish sentiment towards financial stocks and Intercontinental’s record futures trading volumes in the first quarter of 2018, I think ICE is capable of surpassing 76 and reaching new highs again fairly soon. I’ll likely sell the stock thereafter. Hold.

LKQ Corp. (LKQ) is a distributor of vehicle products in the U.S. and Europe. LKQ is expected to report first quarter earnings per share of $0.59 on the morning of April 26, within a range of $0.57 to $0.66. Consensus estimates show strong full-year 2018 EPS growth of 25.0% slowing down to 10.2% growth in 2019. LKQ is overvalued based on 2019 numbers. The stock is rising toward its January all-time high at 43.50. Hold.

Lowes Companies (LOW – yield 1.9%) – Consensus estimates project strong earnings growth of 24.8% in 2019 (January year-end), followed by 12.4% EPS growth in 2020. The stock is undervalued based on this year’s numbers, but fairly valued based on next year’s numbers. The long-term debt-to-capitalization ratio is higher than I would prefer at 68%. There’s 12% upside as LOW returns to short-term price resistance at 97. I would not be surprised to see LOW rise past 90 this month. If next year’s earnings estimates improve, I’ll encourage shareholders to continue holding LOW for a retracement of January’s high near 107. Hold.

Magna International (MGA – yield 2.2%) is a Canadian global automotive supplier. MGA is an undervalued mid-cap growth stock. MGA broke through short-term price resistance last week, and began reaching new all-time highs. Sometimes a stock has one more brief pullback after the breakout, before the run-up kicks into gear. Buy MGA now and buy more on pullbacks. Buy.

McKesson Corporation (MCK – yield 0.9%) is neither a growth stock nor an undervalued stock. CNBC reported that Amazon.com (AMZN) backed away from its plan to sell drug supplies to hospitals, thereby causing drug distribution and drugstore company stocks to rally. MCK traded as high as 176 in January, then suffered as healthcare stocks bore the brunt of the 2018 stock market correction. My recommendation is that current shareholders hold their MCK shares, and plan to exit when the stock gets closer to its January highs. Hold.

Nautilus (NLS) – I’m removing the stock from the portfolio today because it reached my target sale price of 14. Sell.

Ross Stores (ROST – yield 1.1%) is expected to see a year of strong earnings growth, followed by moderate earnings growth in fiscal 2020 (January year-end). I don’t want to be holding the stock later this year when investors begin to notice that the stock is overvalued based on 2020 EPS projections. My recommendation is that shareholders sell ROST at 84 when the stock retraces its January high. Sell at 84.

STORE Capital Corp. (STOR – yield 4.9%) is a real estate investment trust (REIT). REITs don’t fit my investment model because they don’t offer reasonable and consistent opportunities for capital gains, yet they’re subject to a variety of risks such as fluctuations in interest rates and real estate values. The stock is trading between 25 and 26, where it last traded in December 2017. My suggestion is that growth & income investors sell STOR at 25.50 and reinvest the principal into stocks that offer both dividends and attractive earnings growth. Sell at 25.50.

Stifel Financial (SF – yield 0.8%) is expected to see EPS grow 24.6% and 12.7% in 2018 and 2019, with corresponding P/Es of 12.0 and 10.6. There’s 16% upside as SF eventually retraces its 2018 high at 68. Buy.

Target (TGT – yield 3.4%) – Analysts expect EPS to grow 11.9% and 3.4% in fiscal 2019 and 2020 (January year-end), with the latter number being slow enough that it will ultimately inhibit share price growth. My recommendation is that investors sell the stock as it approaches its January high of 78, in favor of a company with multi-year, double-digit earnings growth. Sell at 78.

Thor Industries (THO – yield 1.4%) is a maker of recreational vehicles. THO is a very attractive and undervalued growth stock. The fundamentals are outstanding at this company. Consensus estimates point toward EPS growing 29.5% and 18.3% in 2018 and 2019 (July year-end). The P/E ratios are low in comparison to the earnings growth rates, at 11.5 and 9.7. In addition, the long-term debt-to-capitalization ratio is very low at 4.4%.

The stock experienced an exaggerated run-up in 2017, peaked at all-time highs in January, then fell for several months with the correction in the broader market. THO is not yet ready to rise, but there’s 48% upside as THO gradually returns to its January high of 156. Buy.

Toll Brothers (TOL – yield 0.7%), like most of its peers, is experiencing a cycle of very strong earnings growth. Profits are expected to rise 41.0% in fiscal 2018 (October year-end), then slow to 9.4% growth in 2019. The price chart has been weak. There’s 20% upside as TOL heads back to its January high of 52, where I will likely sell due to full valuation. Buy.

Walt Disney Co. (DIS yield – 1.7%) – Disney had no profit growth in fiscal 2017 (September year-end), and is now expected to see profits grow 20.7% and 8.1% in 2018 and 2019. The stock is overvalued based on 2019 numbers. Disney shares have traded sideways for over three years. There’s 10% upside as DIS retraces its January high near 112. Hold.

Williams-Sonoma (WSM – yield 3.5%) – Attractive 2019 earnings growth will give way to low single-digit growth in 2020 (January year-end). I plan to sell when the stock reaches short-term price resistance at 55 in the coming months. Hold.