One of the Cabot Benjamin Graham Value Investor subscribers asked me about a few stocks that were formerly in this portfolio, so here’s an update on those stocks.

Celgene (CELG) has attractive earnings growth and low price/earnings ratios (P/Es). But there’s one huge problem, and that’s the long-term debt ratio, which stands at 80%. It’s not reasonable to expect a company and its stock to thrive when the company is strangled by debt and interest payments. Celgene’s price chart is extremely bearish, which means it’s going to fall further. Sell CELG immediately and reinvest into a financially strong company with a bullish price chart, in order to vastly improve your opportunity to recoup any capital that you lost with this stock. SELL.

DaVita Inc. (DVA) ) is experiencing aggressive earnings growth with low price/earnings ratios (P/Es), and that’s definitely a good thing. But one of the reasons that the P/Es are low is because the long-term debt-to-capitalization ratio is quite high at 60.7%. When companies pile on the debt, it increases shareholders’ risk, because the company has to funnel so much money toward debt and interest payments that it can’t use its free cash flow for more productive business purposes.

If you own DVA, consider selling in favor of an undervalued growth stock that has a stronger balance sheet, thereby lowering the risk associated with stock investing.

The stock ran up from 54 in November 2017 to 80 in January 2018, a 48% gain in a scant two months. When you have ridiculously lucky capital appreciation like that, it would be extraordinarily wise to use stop-loss order to protect your principal, because stocks with outsized price run-ups almost always subsequently experience outsized price corrections.

At this point, DVA appears to have begun a slow recovery from its large share price drop in 2018. There’s upside resistance near 72. If I owned DVA, I would put in a sell order at 70, because that’s the best reasonable price I think I could get out of the stock in the next few months. Sell at 70.

Zimmer Biomet Holdings (ZBH) – Earnings per share are projected to fall 4.5% in 2018 and to rise 5.0% in 2019. Those numbers are completely lackluster, and will not provide the impetus for longer-term capital appreciation. I would sell ZBH and reinvest my principal in an undervalued growth stock with a bullish price chart, in order to maximize my chance to grow my capital.

The price chart for ZBH does not exhibit a stable trading pattern. I think the most reasonable upside on the stock in the near-term is 120, and you can protect your downside with a stop-loss order at 113.5. Sell at 120.

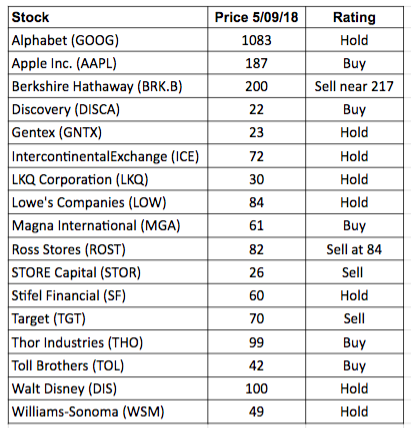

Today’s portfolio changes:

Sell STORE Capital (STOR).

Stifel (SF) moves from Buy to Hold.

Sell Target (TGT).

Last week’s portfolio changes:

Sell Gilead Sciences (GILD).

Sell McKesson (MCK).

Please send questions and comments to Crista@CabotWealth.com.

Portfolio Stocks

Alphabet Cl. A (GOOG) is the world’s largest internet company. Revenue is derived from Google’s online ads, with the balance coming from the sale of apps, digital content, services, licensing and hardware. Analysts expect Alphabet’s EPS to grow 37.5% and 7.1% in 2018 and 2019. I’ve been wary of Alphabet’s growth and value profile for 2019, and apparently I’m not alone. At his annual shareholder meeting this past weekend, Berkshire Hathaway CEO Warren Buffett concurred. Per a report by The New York Times, “[Buffett] said he was unable to conclude that at Alphabet’s present prices, its ‘prospects were far better than the prices indicated.’ ” I plan to sell GOOG at the top of its steady trading range at 1,180 if 2019 earnings projections don’t rise toward the mid-double-digits. There’s room for traders to buy below 1,080 and make 10% profit as the stock returns to 1,190. Hold.

Apple (AAPL – yield 1.6%) manufactures a wide range of popular communication and music devices. The company slightly surpassed revenue and profit expectations in its second quarter, increased the quarterly dividend from $0.63 to $0.73, and plans to repurchase another $100 billion of its common stock. It should be noted that Warren Buffett’s Berkshire Hathaway (BRK) is Apple’s largest shareholder. Buffett began buying AAPL only two years ago, and now owns $40.7 billion of the stock, amounting to 5% of Apple’s outstanding shares. Buffett approves of Apple’s new repurchase authorization.

Share repurchases serve to provide price support, and also to push the share price upwards. Therefore, shareholders have less downside risk with AAPL than they do with most other stocks. Apple is an undervalued growth stock, now expected to see EPS increase 24.9% and 15.2% in fiscal 2018 and 2019 (September year-end). The corresponding P/Es are 16.2 and 14.0. (Earnings estimates for 2018 through 2020 have been consistently increasing.)

The market was relatively shocked at Apple’s quarterly success and announcements, and the stock rose to a new all-time high. It’s common that when stocks break out of trading ranges, they pull back once more for a brief period of time before commencing a new run-up. Buy AAPL now and buy more on pullbacks. Buy.

Berkshire Hathaway Class B (BRK.B) reported first-quarter non-GAAP earnings per share of $3,214.67 on May 5, beating the consensus estimate of $3,115.57. Berkshire will transition from a year of over 50% earnings growth in 2018 to just 7.6% growth in 2019. There’s room within the 2018 trading range for short-term traders to buy now and make 10% profit as the stock returns to 217. Sell near 217.

Discovery Communications (DISCA) reported first-quarter earnings per share of $0.53 yesterday, when the market expected $0.42. Revenue of $2.31 billion beat the consensus estimate of $2.18 billion. Importantly, the company is delivering robust free cash flow generation and paying down debt—debt being my one big problem with Discovery. I love the aggressive earnings growth, the shockingly low P/E and the price chart, which indicates potential for excellent short-term and medium-term price appreciation. Analysts expect full-year EPS to grow 42.6% and 24.4% in 2018 and 2019, with corresponding P/Es of 8.5 and 6.8. (Earnings projections will likely increase, subsequent to this week’s quarterly results.) The stock is trading between 21 and 26 this year. The high debt ratio would inspire me to protect my downside with a stop-loss order, because debt adds risk to the company and its share price. Buy.

Gentex (GNTX – yield 2.0%) manufactures innovative products for automobiles and airlines, and also serves the fire protection industry. Full-year EPS are expected to rise 31.0% and 8.3% in 2018 and 2019. The 2018 P/E is 13.4. I plan on selling on the next run-up to 24, due to slow 2019 earnings growth prospects. That run-up could take place in the coming weeks. Hold.

Intercontinental Exchange (ICE – yield 1.3%) operates regulated exchanges and clearing houses in the commodity and financial markets. The company reported first-quarter earnings per share of $0.90 last week, above the estimated range of $0.86 to $0.89. ICE is a large-cap growth & income stock that’s overvalued based on its 2019 price/earnings ratio. The stock rose to new all-time highs in January, then corrected with the broader market. Based on strong 2018 earnings growth, bullish sentiment towards financial stocks and Intercontinental’s record futures trading volumes in the first quarter of 2018, I think ICE is capable of surpassing 76 and reaching new highs again fairly soon. I’ll likely sell the stock thereafter. Hold.

LKQ Corp. (LKQ) is a distributor of vehicle products in the U.S. and Europe. LKQ reported first-quarter earnings per share of $0.55 when the market was expecting $0.59. Revenue of $2.72 billion beat all analysts’ estimates. In that first quarter, LKQ acquired an aftermarket radiator and related products distributor in Tennessee. LKQ’s European operations opened one branch in Western Europe and four branches in Eastern Europe. The company lowered its full-year guidance for revenue, earnings, cash flow and capital expenditure figures (see chart within press release). Full-year projections do not include any results for the pending $1.77 billion acquisition of Germany’s Stahlgruber Otto Gruber AG, which may be completed in the first half of 2018.

Consensus earnings estimates were revised downward to reflect full-year 2018 EPS growth of 18.1% and 12.2%. The stock fell down to support levels that were established in the first half of 2017. I would estimate that the Stahlgruber acquisition will add to revenue and earnings estimates, and that the share price will eventually reflect a more true valuation of the company. Do not expect a quick rebound. Hold.

Lowe’s Companies (LOW – yield 1.9%) – Consensus estimates project strong earnings growth of 24.4% in 2019 (January year-end), followed by 12.5% EPS growth in 2020. The stock is undervalued based on this year’s numbers, but fairly valued based on next year’s numbers. The long-term debt-to-capitalization ratio is higher than I would prefer at 68%. Watch for Lowe’s to announce its annual dividend increase somewhere between Memorial Day weekend and the first week in June. Lowe’s increased its dividend payout by 17% to 28% in each of the last four years. The current quarterly payout is $0.41 per share.

The share price is beginning its recovery from the correction in the broader market, followed by an ugly April for housing-related stocks. There’s 15% upside as LOW returns to short-term price resistance at 97. If next year’s earnings estimates improve, I’ll encourage shareholders to continue holding LOW for a retracement of January’s high near 107. Hold.

Magna International (MGA – yield 2.2%) is a Canadian global automotive supplier. Magna is expected to report first-quarter earnings per share of $1.69 on May 10, within a range of $1.57 and $1.81. MGA is an undervalued mid-cap growth & income stock. MGA broke through short-term price resistance in April and rose to a new all-time high at 61, followed by a quick pullback and recovery. As long as the May 10 earnings report meets or beats the market’s expectations, I expect an immediate run-up to commence. Buy MGA now. Buy.

Ross Stores (ROST – yield 1.1%) – There’s nothing particularly compelling about next year’s earnings growth or valuation at Ross Stores. I’m planning to sell ROST when the stock retraces its January high, which could happen quite soon. It would be a little unusual for the stock to blow past 84 and begin a new run-up. My suggestion is that you put in a limit order to sell at 84, in case the stock only touches upon 84 briefly before pulling back. Sell at 84.

STORE Capital Corp. (STOR – yield 4.7%) is a real estate investment trust (REIT). REITs don’t fit my investment model because they don’t offer reasonable and consistent opportunities for capital gains, yet they’re subject to a variety of risks such as fluctuations in interest rates and real estate values. STOR finally surpassed my target sell price of 25.50 in recent days, and I’m therefore removing it from the portfolio. If you want to hold on and see how high it might climb in this current run-up, I suggest that you use a tight stop-loss order so that you don’t watch the stock give back all its gains when it pulls back below 26. Sell.

Stifel Financial (SF – yield 0.8%) – Analysts continue to tweak their earnings estimates for Stifel in the wake of a very successful first quarter. The company is now expected to see full-year EPS grow 28.3% and 10.2% in 2018 and 2019, with corresponding P/Es of 11.9 and 10.8. At this point, the stock is fairly valued based on 2019 numbers. I’m therefore moving SF from Buy to Hold, with the current intention of selling when the stock retraces its 2018 high at 68. (There’s still room for traders to buy below 62 and make 10% profit in the short-term, presuming that the stock reaches 68 soon.) Hold.

Target (TGT – yield 3.5%) – Analysts expect Target’s 2020 EPS to grow just 3.2% (January year-end). The stock is languishing in a trading range, with no earnings momentum to spark a run-up in the share price. My recommendation is that investors sell TGT and reinvest in a stock with a strong earnings growth prognosis. Most financial stocks are also low within their trading ranges, yet many of them offer significant earnings growth in the coming years. Consider moving from TGT to a financial stock. Sell.

Thor Industries (THO – yield 1.5%) is a maker of recreational vehicles. THO is an undervalued growth stock with outstanding fundamentals. The market expects EPS to grow 29.6% and 18.9% in 2018 and 2019 (July year-end). The P/E ratios are low in comparison to the earnings growth rates, at 10.8 and 9.1. In addition, the long-term debt-to-capitalization ratio is very low at 4.4%.

The stock experienced an exaggerated run-up in 2017, peaked at new all-time highs in January, then fell for several months with the correction in the broader market. I’m sure that rising oil prices are causing investors to worry that higher gasoline prices will affect Thor’s revenue and profits. Thus far, earnings projections remain strong and stable. The stock is undervalued, although the price chart is not steady, and the stock could fall further before it eventually rises. Buy.

Toll Brothers (TOL – yield 0.7%) is expected to report second-quarter earnings per share of $0.76 on the morning of May 22, within a range of $0.73 and $0.83. Toll Brothers, like most of its homebuilding peers, is experiencing a cycle of very strong earnings growth. Profits are expected to rise 39.7% in fiscal 2018 (October year-end), then slow to 11.5% growth in 2019, although the 2019 number has been slowly improving. Homebuilder share prices were weak in the first quarter, and most have not begun their recovery. There’s 22% upside as TOL heads back to its January high of 52, where I will consider selling if the 2019 earnings outlook doesn’t bump up further. Buy.

Walt Disney Co. (DIS yield – 1.7%) reported second-quarter revenue and profits this week that surpassed all analysts’ estimates. Full-year earnings estimates rose a fraction immediately afterward, and will likely rise a bit more in the coming week as analysts rework their numbers for Disney. At this point, the market expects EPS to grow 21.2% and 8.1% in 2018 and 2019 (September year-end). With a 2019 price/earnings ratio (P/E) of 13.4, the stock is overvalued, although it’s common for popular stocks like Disney and Coco-Cola (KO) to carry high P/Es. Disney shares have traded sideways for over three years. Investors who buy below 102 can earn 10% short-term profit as the stock returns to its January high of 112. Hold.

Williams-Sonoma (WSM – yield 3.5%) – Attractive 2019 earnings growth will give way to low single-digit growth in 2020 (January year-end). I plan to sell when the stock reaches short-term price resistance at 55 in the coming months. Hold.