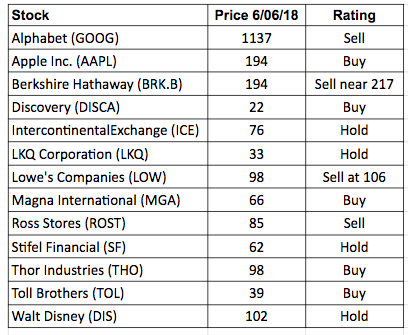

Today’s portfolio changes:

Alphabet Cl. C (GOOG) moves from Hold to Sell.

Lowe’s Companies (LOW) moves from Hold to Sell at 106.

Ross Stores (ROST) rose to my price target of 84: Sell.

Last week’s portfolio changes:

(none)

Please send questions and comments to Crista@CabotWealth.com.

PORTFOLIO STOCKS

Alphabet Cl. C (GOOG) is the world’s largest internet company. Alphabet’s Waymo subsidiary, an autonomous car development company, announced an agreement with Fiat Chrysler on June 1 to add up to 62,000 Chrysler Pacifica Hybrid minivans to Waymo’s self-driving fleet. Consider the possibility that Alphabet might spin off Waymo in order to keep any legal liability associated with autonomous cars attached to Waymo and separated from Alphabet.

In other news, a reorganization of the Global Industry Classification Standard (GICS) will take place between now and September 28. This will affect Alphabet’s stock classification. The telecommunications services sector will be renamed communications services. GOOG will move from the former information technology sector to the new communications services sector. As institutional investors—including mutual funds, EFTs and pension funds—buy or sell GOOG shares as they rebalance the sector allocations of their portfolios, there will be increased volatility in the share price. For example, most ETFs devoted to the information technology sector will be required to sell GOOG, while many ETFs devoted to the communications services sector will be required to buy GOOG. There are far more mutual funds and ETFs devoted to the current information technology sector than there are devoted to the communications services sector. Therefore, there will invariably be far more institutional selling of GOOG in the coming months than there will be buying. The preponderance of selling activity will tend to put downward pressure on the share price.

I was already displeased with Alphabet’s slow earnings growth expected for 2019 vs. its high P/E. Now that serious selling pressure looms from the GICS reorganization, the odds increase that the share price will suffer. My recommendation is that you sell GOOG today. If you’re in love with the stock, there’s a good chance that you will be able to buy it back more cheaply in the coming months. However, I believe that growth stock investors will improve their chances of achieving capital appreciation by moving their money into stocks with higher earnings growth and comparably low P/Es. Sell.

Apple (AAPL – yield 1.5%) manufactures a wide range of popular communication and music devices. At Apple’s annual Worldwide Developers Conference this week, Apple introduced new software and services features and updates. New hardware announcements will likely come in the fall. CEO Tim Cook revealed that App Store revenue is running ahead of analysts’ estimates for the quarter, which will invariably lead to an increase in the full-year consensus earnings estimate. Apple introduced MeMoji, which competes against Snapchat’s Bitmoji tool; an enhanced augmented reality toolkit for its app developers; new features that enhance Apple’s Siri digital assistant, and more.

Revenue and margin increases at Apple Services (Apple Music, the App Store, etc.) are expected to drive corporate growth for years to come. AAPL is an undervalued growth stock, expected to see EPS increase 24.8% and 15.3% in fiscal 2018 and 2019 (September year-end). The corresponding P/Es are 16.8 and 14.6. In recent days, UBS raised their price target for AAPL from 190 to 210, and D.A. Davidson raised their price target from 220 to 230. AAPL rose to new all-time highs in this month, and appears capable of continuing its run-up, barring a disruption in the broader stock market. Buy AAPL now and buy more on pullbacks. Buy.

Berkshire Hathaway Class B (BRK.B) is expected to transition from a year of 55% earnings growth in 2018 to just 7.2% growth in 2019. At this moment, the share price is showing weakness, but it’s too soon to tell if the stock will fall below 190. There are at least three potential share price catalysts on the horizon.

• The Berkshire Hathaway Reinsurance Group contributed 24% of Berkshire Hathaway’s revenue in 2017. The property & casualty insurance business is doing well in 2018, and most participants are raising rates this year. Insurance stocks have not, for the most part, reacted yet to that good and profitable news.

• Berkshire Hathaway owns a 31% stake in USG Corp. (USG), which is currently in talks to potentially be acquired by Gebr. Knauf KG. Such a transaction would likely increase the value of Berkshire’s assets or deliver a large cash infusion upon the completion of any M&A activity.

• In 2018, Berkshire CEO Warren Buffett has publicly discussed his desire to make a major acquisition. He expressed an interest in airlines, and specifically mentioned Southwest Airlines (LUV).

If you need to raise cash for other purposes, or for better growth stock investments, use BRK.B as a source of funds. I’ll continue reporting on the stock’s progress until it reaches my price target. Sell near 217.

Discovery Communications (DISCA) is delivering robust free cash flow generation and paying down debt—debt being my one big problem with Discovery. Despite the debt, this stock offers incredible value: Analysts expect full-year EPS to grow aggressively at 53.7% and 22.6% in 2018 and 2019, with corresponding P/Es of 7.5 and 6.1. This week, Pivotal Research Group raised their rating on DISCA from hold to buy and raised their price target from 24 to 28. DISCA is trading between 21 and 26 this year, and currently rising from the bottom of the trading range. Buy DISCA now for a potential 10% short-term profit, or hold it for additional capital appreciation over the next six to 18 months. Buy.

Intercontinental Exchange (ICE – yield 1.3%) operates regulated exchanges and clearing houses in the commodity and financial markets. ICE is a large-cap growth & income stock that’s overvalued based on its 2019 numbers. The stock surged this week as the NASDAQ reached new highs, indicating that U.S. stock market bullishness will lead to higher trading volumes and higher profits for Intercontinental Exchange. I don’t anticipate that an unexpected increase in trading profits will compensate for the high P/E. Yesterday, ICE began a new run-up into all-time high territory. I don’t like owning overvalued stocks, and I’ll be monitoring ICE closely in order to sell soon. Hold.

LKQ Corp. (LKQ) is a distributor of vehicle products in the U.S. and Europe. The firm’s first quarter report included news of acquisitions in Tennessee and in Germany, expansion in Western and Eastern Europe, and lower revenue and profit expectations for the full year that do not yet reflect expected benefits from the 2018 German acquisition. Earnings estimates rose last week. Wall Street now expects EPS to grow 20.7% and 16.7% in 2018 and 2019. Corresponding P/Es are 14.4 and 12.4, making the stock undervalued. LKQ continues to recover from its recent share price drop, although a pullback into the low 30’s would be a normal part of the recovery process. There’s upside price resistance at 37. Hold.

Lowe’s Companies (LOW – yield 2.0%) – The stock rose in late May on news that former 12-year Home Depot (HD) executive and current JC Penney (JCP) CEO Marvin Ellison will be the new CEO at Lowe’s. Then on June 4, CFO Marshall Croom announced that he will be retiring from Lowe’s. (I imagine the Mr. Ellison had a replacement in mind for Mr. Croom, thus encouraging Mr. Croom’s retirement decision.) On June 1, Lowe’s announced a 17% increase in the quarterly dividend, from $0.41 to $0.48 per share. Consensus estimates project strong full-year earnings growth of 24.1% in fiscal 2019 (January year-end), followed by 12.3% EPS growth in 2020. The stock is overvalued based on next year’s numbers and the long-term debt-to-capitalization ratio is high at 69%, so there are reasons to be cautious. LOW is rising toward January’s high near 107, at which point I recommend investors sell in favor of an undervalued growth stock, in order to lower portfolio risk. Sell at 106.

Magna International (MGA – yield 2.0%) is a Canadian global automotive supplier. MGA is an undervalued mid-cap growth & income stock. Earnings estimates continue to rise. Analysts now expect EPS to grow 18.3% and 9.4% in 2018 and 2019. The corresponding P/Es are 9.4 and 8.6. MGA rose to a new all-time high in May, and appears ready to continue rising. Buy.

Ross Stores (ROST – yield 1.1%) – This overvalued stock rose to my price target of 84 this week. If you want to gamble that it will continue rising, it might be wise to use a stop-loss order. Sell.

Stifel Financial (SF – yield 0.8%) – The stock is fairly valued based on 2019 numbers, and the stock is actively rising. I plan to sell when SF rallies back to its 2018 high near 68. Hold.

Thor Industries (THO – yield 1.5%) is a maker of recreational vehicles. Thor announced a strong third quarter yesterday, with sales and income reaching record levels. Third quarter earnings per share of $2.53 narrowly missed the consensus estimate of $2.58. Revenue of $2.25 billion came in on target with the consensus expectation of $2.24 billion. The company is “experiencing inflationary price increases in certain raw material and commodity-based components due in large part to the headwinds created by the announcement and implementation of the steel and aluminum tariffs and other regulatory actions, as well as higher warranty costs.”

Comments by CEO Bob Martin were bullish for the current and future production years at Thor. “Overall, the RV industry fundamentals remain strong and are supported by high consumer confidence rates, favorable employment trends, adequate availability of credit at historically low rates and a healthy housing market.”

THO is an undervalued growth stock with outstanding fundamentals. The market expects EPS to grow 28.6% and 16.9% in 2018 and 2019 (July year-end). The P/E ratios are low in comparison to the earnings growth rates, at 10.6 and 9.1. In addition, the long-term debt-to-capitalization ratio is very low at 4.4%. The stock gave back all the gains this year from its big 2017 run-up—and that’s a great reason to use stop-loss orders! THO is not ready to rebound yet, but if you want an undervalued growth stock with a low debt burden and a dividend, THO is a great candidate. Buy.

Toll Brothers (TOL – yield 1.1%) – Full-year profits are expected to rise 40.4% in fiscal 2018 (October year-end), then slow to 9.2% growth in 2019. Corresponding P/Es are 8.8 and 8.1. TOL is undervalued and earnings growth is strong. The stock is not ready to rebound from this year’s decline in the share price. If you have patience, hold TOL. If you’re more of a momentum investor, consider selling TOL and buying PulteGroup (PHM), which is featured in Cabot Undervalued Stocks Advisor. Pulte is a homebuilder with strong multi-year earnings growth projections, and its share price has begun rising from the lows that most homebuilder stocks recently experienced. Buy.

Walt Disney Co. (DIS yield – 1.6%) – In developing news, Comcast (CMCSA) is expected to one-up Disney’s $52.4 billion all-stock offer to buy most of the assets of Twenty First Century Fox (FOXA), including British satellite broadcaster Sky. Although Comcast has not finalized its offer, they made their intent public so that Disney shareholders don’t rush into a decision to go with Disney’s offer. Rupert Murdoch is a 17% shareholder in FOXA, and the primary target of Comcast’s embrace. Disney has the ability to leverage its balance sheet further in order to counter whatever price Comcast is willing to pay for the Fox assets.

In other news, a reorganization of the Global Industry Classification Standard (GICS) will take place between now and September 28. This will affect Walt Disney’s stock classification. The telecommunications services sector will be renamed communications services. DIS will move from the consumer discretionary sector to the new communications services sector. As institutional investors – including mutual funds, EFTs and pension funds – buy or sell DIS shares during portfolio sector rebalancing, there will be increased volatility in the share price. For example, most ETFs devoted to the consumer discretionary sector will be required to sell DIS, while many ETFs devoted to the communications services sector will be required to buy DIS. If there are more funds in one sector than there are in the other, this will invariably cause an imbalance of buying vs. selling, and could affect the share price for several months.

The market expects Disney’s EPS to grow 24.4% and 8.3% in 2018 and 2019 (September year-end). With a 2019 price/earnings ratio (P/E) of 13.2, the stock is overvalued vs. its EPS growth rate. Disney shares have traded sideways for over three years. I’m hoping to sell near their January high of 112. Hold.