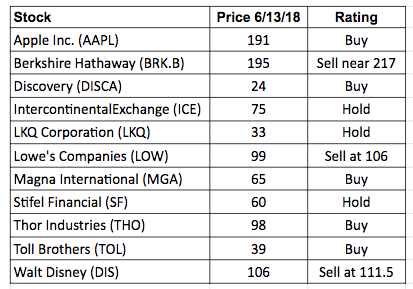

Today’s portfolio changes:

Walt Disney Co. (DIS) moves from Hold to Sell at 111.5.

Last week’s portfolio changes:

Alphabet Cl. C (GOOG) moved from Hold to Sell.

Lowe’s Companies (LOW) moved from Hold to Sell at 106.

Ross Stores (ROST) rose to my price target of 84: Sell.

PORTFOLIO STOCKS

Apple (AAPL – yield 1.5%) manufactures a wide range of popular communication and music devices. Read about Apple’s annual Worldwide Developers Conference in this conference recap from Fortune. Wondering about changes to future iPhones? Read the latest from Gordon Kelly, who’s somehow privy to Apple news ahead of corporate announcements. AAPL is an undervalued growth stock, expected to see EPS increase 24.8% and 15.3% in fiscal 2018 and 2019 (September year-end). The corresponding P/Es are 16.7 and 14.5. AAPL rose to new all-time highs in June, and appears capable of promptly continuing its run-up, barring a disruption in the broader stock market. Buy AAPL now and buy more on pullbacks. Buy.

Berkshire Hathaway Class B (BRK.B) is expected to transition from a year of 55% earnings growth in 2018 to just 7.2% growth in 2019. Berkshire Hathaway owns a 31% stake in USG Corp. (USG), which agreed to a cash buyout offer of $44 per share from Gebr. Knauf KG this week. All shareholders, including Berkshire, will receive a $0.50 special dividend (probably during 2018) and a cash payment of $43.50 per share (targeted for early 2019). Since Berkshire owns approximately 43 million shares of USG, Berkshire will receive approximately $1.9 billion from the transaction. CEO Warren Buffett will likely put that cash to good use, since he’s publicly discussed his desire to make a major corporate acquisition.

The stock seems to be stabilizing, after falling this year, but it is not yet rebounding. If you need to raise cash for other purposes, or for better growth stock investments, use BRK.B as a source of funds. I’ll continue reporting on the stock’s progress until it reaches my price target. Sell near 217.

Discovery Communications (DISCA) is delivering robust free cash flow generation and paying down debt—debt being my one big problem with Discovery. Analysts expect full-year EPS to grow aggressively at 53.7% and 21.9% in 2018 and 2019, with corresponding P/Es of 8.2 and 6.7. Despite the debt, this stock offers incredible value. DISCA rose rapidly in June to short-term price resistance at 24. Don’t be alarmed if we get a quick pullback to 22.5 before DISCA proceeds to 26. I expect the stock to surpass 26 later this year. Buy.

Intercontinental Exchange (ICE – yield 1.3%) operates regulated exchanges and clearinghouses in the commodity and financial markets. ICE is a large-cap growth & income stock that’s overvalued based on its 2019 numbers. ICE began a new run-up into all-time high territory this month. I don’t like owning overvalued stocks, and I’ll be monitoring ICE closely in order to sell soon. Hold.

LKQ Corp. (LKQ) is a distributor of vehicle products in the U.S. and Europe. The first quarter earnings report included news of acquisitions in Tennessee and in Germany, expansion in Western and Eastern Europe, and lower revenue and profit expectations for the full year that do not yet reflect expected benefits from the 2018 German acquisition. Wall Street expects EPS to grow 20.7% and 16.3% in 2018 and 2019. Corresponding P/Es are 14.4 and 12.4, making the stock undervalued. LKQ continues to recover from its recent share price drop, and the price chart is showing strength. There’s upside price resistance at 37. Hold.

Lowe’s Companies (LOW – yield 1.9%) – On June 1, Lowe’s announced a 17% increase in the quarterly dividend, from $0.41 to $0.48. Consensus estimates project strong full-year earnings growth of 24.1% in fiscal 2019 (January year-end), followed by 12.3% EPS growth in 2020. The stock is overvalued based on 2019 earnings, and the long-term debt-to-capitalization ratio is high at 69%, so there’s lots of reason to be cautious. LOW is rising toward January’s high near 107, at which point I recommend investors sell in favor of an undervalued growth stock, in order to lower portfolio risk. Sell at 106.

Magna International (MGA – yield 2.0%) is a Canadian global automotive supplier. MGA is an undervalued mid-cap growth & income stock. Analysts expect EPS to grow 18.1% and 9.2% in 2018 and 2019. The corresponding P/Es are 9.2 and 8.5. MGA rose to a new all-time high in May, and could continue rising in the near term. Buy.

Stifel Financial (SF – yield 0.8%) – The stock is fairly valued based on 2019 numbers. SF is ratcheting toward its 2018 high near 68, where I plan to sell. Hold.

Thor Industries (THO – yield 1.5%) is a maker of recreational vehicles. Forbes published a bullish report on RV stocks yesterday, saying, “improving consumer confidence and RV sales to younger buyers appear to have re-ignited these stocks and a full blown rally may be afoot.”

In the wake of the recent third quarter earnings report, Wall Street analysts lowered their earnings estimates for Thor due to price increases in raw materials and commodity-based components, as well as higher warranty costs. THO is an undervalued growth stock with outstanding fundamentals. The market expects EPS to grow 23.6% and 14.8% in 2018 and 2019 (July year-end). The P/E ratios are low in comparison to the earnings growth rates, at 11.3 and 9.8. In addition, the long-term debt-to-capitalization ratio is very low at 4.1%. The stock gave back all the gains this year from its big 2017 run-up—and that’s a great reason to use stop-loss orders! THO is showing signs that it wants to rise, but it’s a little too early to know for sure. If you want an undervalued growth stock with a low debt burden and a dividend, THO is a great candidate. Buy.

Toll Brothers (TOL – yield 1.1%) – Investors’ fears that Fed rate hikes will put a damper on the housing market pushed homebuilder stocks down yesterday. Despite those fears, Wall Street expects Toll Brothers’ profits to rise 40.4% in fiscal 2018 (October year-end) and 9.2% in 2019. Corresponding P/Es are 8.7 and 8.0. The stock is not ready to rebound from this year’s decline in the share price. If you have patience, hold TOL, and accumulate shares while the stock is cheap. Buy.

Walt Disney Co. (DIS yield – 1.5%) – Comcast (CMCSA) came through with a $65 billion all-cash offer to buy most of the assets of Twenty First Century Fox (FOXA), including British satellite broadcaster Sky. The offer far exceeds Disney’s $52.4 billion all-stock offer. Disney has the ability to leverage its balance sheet further in order to counter a Comcast offer for the Fox assets, and we’ll probably know within days whether Disney will step forward to outbid Comcast. In other recent news, the 2018 reorganization of the Global Industry Classification Standard (GICS) will cause Disney stock to move from the consumer discretionary sector to the new communications services sector. Increased institutional transactions in Disney stock could cause volatility in the share price in the coming months.

The market expects Disney’s EPS to grow 24.4% and 8.3% in 2018 and 2019 (September year-end). With a 2019 price/earnings ratio (P/E) of 13.8, the stock is overvalued vs. its EPS growth rate. In order to lower portfolio risk, I routinely sell overvalued stocks and reinvest the capital into undervalued stocks like Apple (AAPL) and Discovery Communications (DISCA). Now that DIS is finally rising from its 2018 lows toward its January high of 112, I’m changing my recommendation from Hold to Sell at 111.5. Sell at 111.5.