Today, I have a mid-cap stock recommendation for you from the one industry that should benefit most from the return of investor interest now that we’re in the midst of a full-on bull market. But first, I have a question: What took investors so long?!

Most Investors Missed the Post-Election Rally

The S&P 500 is up 11.5% since election day in November. Wow! Are you thrilled with your capital gains?

Unfortunately, for many people, the answer is probably “no, because most of my cash was on the sidelines, or invested in bonds.” Ouch.

[text_ad]

How do I know that you may have missed the market’s run-up? I know this because one mutual fund company that I follow had net equity asset inflows in February for the first time since the beginning of the stock market’s current bull run. That means while the market was rising in November, December and January, more money was withdrawn from equity mutual funds than was invested into equity mutual funds!

You might be scratching your head at that statement, wondering why investors would have been pulling money out of equity investments while the market was clearly rising. All I can tell you is that I have learned over the decades that the crowd is notoriously wrong in just about all areas of life. That’s why I tell investors that when you begin to run into people who are enthusiastically talking about their stock investments at the office, the supermarket and Cub Scout meetings, it’s time to sell. I’m not remotely joking.

It is rare for an investor to have the wisdom and fortitude to buy low and sell high. Most people tend to do the opposite, unfortunately. I’m not implying that we’re at a market top; I’m simply pointing out that investors were unable to see that an upturn in the stock market was long overdue.

But you’re in luck! First of all, U.S. stock markets are way overdue for a big year … and 11% is not “a big year.” In fact, what we’ve seen so far is just the beginning, judging from history.

You see, the stock market tends to rise 20% to 30% in two out of every five years. And in the other three years, it invariably treads water with low-to-average returns or has a negative year. (Hint: the bigger the returns on the up years, the bigger the fall on the negative years. So if you want a rule of thumb about market timing, don’t switch from stocks to cash until after the market has a one-year return of over 20%—and even that might be too cautious, but it sure as heck beats being in cash at the beginning of a bull market.)

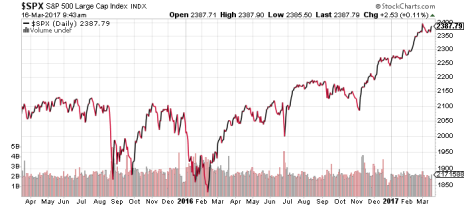

Want more proof that the market is overdue for a big year or two? Look at this two-year chart of the S&P 500 index. You can see that the market rose to a level of about 2,100 to 2,125 on the S&P 500, then had a correction, over and over again, for about 18 months. It didn’t begin to peek its head over 2,125 until July 2016. The S&P 500 has risen a nice amount since then, but nowhere near as high as it will go if we’re finally going to have a 20% to 30% run-up.

What kinds of companies benefit from rising stock markets and investors’ interest in making money from stocks? The answer is: asset managers and wealth managers. So let’s look at an excellent mid-cap stock in that sector, so that we can capitalize on the company’s successes.

Ameriprise Financial (AMP): An Undervalued Mid-Cap Stock

Ameriprise Financial (AMP) is a financial services company, offering insurance products (life, home & auto insurance and annuities), asset management (investment advice and investment products) and wealth management services (brokerage and banking services) to retail and institutional clients.

Ameriprise was spun off from American Express in 2005 under the direction of its current CEO, James Cracchiolo. The company then doubled its size in 2010 when it acquired Columbia Management’s long-term asset management business from Bank of America.

In addition to benefiting from investors’ interest in equity investing, the company stands to benefit from increases in interest rates, U.S. income tax reform and an aging population that’s focused on retirement planning. All of these trends are contributing to Ameriprise’s profit growth, as are the company’s margin expansion and excellent expense control.

Wall Street consensus estimates project Ameriprise’s earnings per share (EPS) to grow from $8.48 in 2016 to $10.61 and $12.01 in 2017 and 2018, representing earnings growth rates of 25.1% and 13.2% in 2017 and 2018. Those are great earnings growth rates!

AMP is an undervalued stock, which we can easily determine by comparing earnings growth and dividend yield—currently 2.3%—to the price/earnings ratios. Right now, the P/Es are quite low: 12.6 and 11.1 based on 2017 and 2018 EPS.

And by the way, the company has been increasing its dividend annually during its April dividend announcement. Your dividend yield is probably going to rise a month from now!

AMP is a mid-cap stock. Financial institutions own 85% of the shares, which means that professional investors view AMP to be a very attractive investment.

The company consistently repurchases its stock, buying back 8.5% of shares in 2016, and a total of 24% of shares since January 2013. What’s more, analysts expect Ameriprise to repurchase another 5% or more of outstanding common shares in both 2017 and 2018.

All the major U.S. stock market indexes are experiencing orderly pullbacks right now. (This is good news because the farther the market climbs without resting, the bigger the pullback when it finally arrives.) While we’ve seen bigger price corrections in basic industry, construction and energy stocks this year, we’ve only seen small pullbacks in financial stocks. That tells investors that there’s strong market sentiment propping up financial stocks. Therefore, financial stocks are most likely to break past recent ceilings the moment that the market begins rising again. I frankly expect that to happen immediately.

As you can see in the stock chart, AMP just completed a two-year price correction, and began rising above previous upside price resistance in February. Nobody has missed the price breakout!

This mid-cap stock is appropriate for growth and income investors, value investors and momentum investors. I expect AMP to deliver good results to investors in 2017, with both capital gains and a dividend increase. Buy AMP now, before its next run-up begins!

[author_ad]