Russell Reconstitution: Hard to Game; Fun to Follow

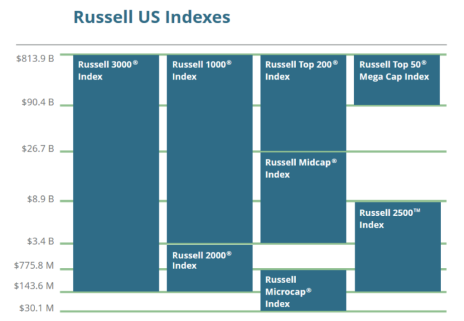

Every year, FTSE Russell reconstitutes its indexes so that as markets evolve, they maintain accurate representation of the desired asset class. For a variety of reasons, a lot of small-cap investors are interested in the Russell reconstitution. The main interest seems to be that they believe there are trading opportunities in those small caps that are added to and/or subtracted from the two smallest indexes, the Russell 2000 Small Cap Index, and the Russell Microcap Index. New additions to those indexes are often deemed good small cap stocks to buy.

Truth be told, if your goal is to make a quick buck, there are easier ways. It requires a ton of time, energy and luck to successfully trade the event. While addition to an index does drive some fund purchases, studies have shown the short-term effects to be relatively muted following reconstitutions.

That said, I do find the list of new additions provides a nice starting point to uncover fresh ideas for longer-term investments. Many stocks that are added to the Russell 2000 Small Cap and Russell Microcap indexes are quality companies that will benefit from the added attention joining a Russell index provides. But buying them purely because they were added to an index shouldn’t be the main motivation. It’s far more important that they have great business models, terrific products and/or services and talented management teams. Those are the keys to sustainable growth.

[text_ad]

There are a number of noteworthy takeaways from this year’s Russell 2000 Small Cap index reconstitution.

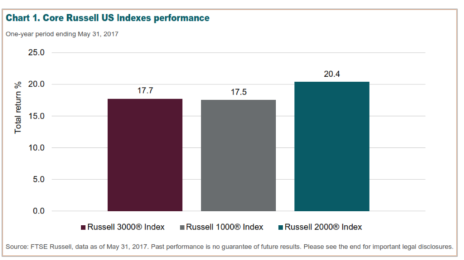

First, small caps generated the best return over the last year, rising by 20.4%, versus 17.5% for mid cap stocks and 17.7% for large caps.

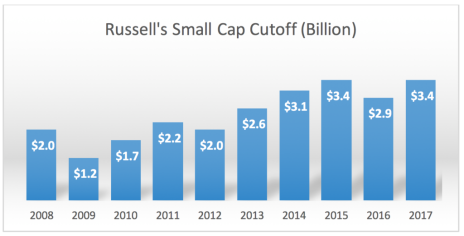

Second, Russell’s threshold for what’s considered a small cap continues to increase. Last year, the cutoff was $2.9 billion. Anything under that was considered a small cap. This year, the cutoff has gone up to $3.4 billion. In 1984, the cutoff was just $250 million!

Personally, I think anything with a market cap much over $2 billion is getting a little large to be a true small cap (I’m not implying that small-cap investors should then sell, I’m just referring to a very loose definition). But given the shrinking universe of publicly traded stocks in general, the dearth of IPOs in recent years and strong stock market performance, small-cap indexes are having to bump up their thresholds.

And to be fair, the max market cap is just the threshold and not representative of the entire index. For that, it’s best to look at the mean market cap. This year, the dollar weighted average market cap in the Russell 2000 Small Cap Index has gone up to $2 billion, from $1.7 billion a year ago.

Lastly, there were relatively few new additions to the index this year. Since 2006, the Russell 2000 small-cap index has averaged 12.3% annual turnover. That works out to around 233 stocks being replaced each year. This year, only 137 stocks left the Russell 2000 Small Cap Index.

3 New Russell Stocks to Put on Your Radar

I looked at the new Russell 2000 Small Cap and Russell Microcap Index additions to see what was new, and pulled out around a dozen names that are interesting from both a story and stock performance perspective. In addition to the annual Russell reconstitution event, I also included recent IPOs that were added back in March (IPOs are added quarterly).

Here are three small cap stocks to buy:

Small Cap Stock to Buy #1: REV Group (REVG)

REV Group is one of several recent IPOs added to the Russell 2000 back in March as part of the quarterly IPO addition schedule. Given its $1.7 billion market cap, 0.7% dividend and expected 2017 revenue and EPS growth rates of around 20% and 13%, respectively, it’s likely to be more attractive to relatively conservative investors than those pursuing massive capital gains.

It’s on my radar because it ticks many of the boxes that are in favor now. It’s an industrial stock, it pays a dividend and it offers reasonable growth. The business is essentially a roll-up of 29 brands of specialty vehicles and after-market parts. Think of things like fire trucks, buses, ambulances, street sweepers and RVs. If you want to host a killer touch-a-truck event for the neighborhood kids, give REV Group a call.

The best-selling segments are currently Fire & Emergency (up 23.4% in Q2) and Recreation (up 31.6% in Q2), while the Commercial segment has been contracting (down 9.5% in Q2). I should note that Recreation carries lower profit margins, so there is some tradeoff on the bottom line there. Expect the company to focus on rolling in more acquisitions over the years and focusing on improving margins once these are part of the REV family.

Shares are up nicely from the IPO, but mostly due to the first days’ trading jump. Since then, the trend is basically sideways, with a number of peaks and valleys. Lockup expiration is July 26, and since there’s no convincing trend in the stock yet, I suggest monitoring REV Group for now, and potentially buying after the stock is a little more established.

Small Cap Stock to Buy #2: ImmunoGen (IMGN)

Immunogen used to have a share price up in the teens but a few missteps and removal from some biotech ETFs drove the share price down below 2 late last year. The $655 million market cap company is now on the comeback trail, is trading over 7, and is in both the Russell 2000 and Russell Microcap Indexes.

It’s a clinical-stage biotech company developing cancer therapies based on its proprietary antibody drug conjugates (ADC) technology, which is used in Roche’s Kadcyla (for breast cancer) drug, as well as in development programs with partners Amgen, Bayer, Lilly, Novartis, Sanofi and Takeda. The current focus is on its ovarian cancer candidate, mirvetuximab soravtansine, which is in a Phase 3 monotherapy trial, as well as four combination therapy Phase 1/ 2 trials. The data looks promising, but you never know until a drug candidate is cleared by the FDA (and maybe not even then).

ImmunoGen generated around $60 million in revenue last year, mostly from license, milestone and royalty payments, so this isn’t purely a speculative biotech stock. Still, analysts see revenues declining by around 16% this year, and the company losing around $1.42 per share. Given that a lot of the money flowing in is banking on success in the Phase 3 trial, it would be wise to review (and at least somewhat understand) the science behind the stock before jumping in. Also, take a look at the license/royalty payment schedules. The six-month chart looks constructive.

Small Cap Stock to Buy #3: Tucows (TCX)

Tucows has been on a nice run with shares of the internet services stock rising more than 100% over the last 12 months. The Toronto, Canada-based small cap provides a number of services to customers in the U.S, Canada and Germany. Services include two wholesale domain providers (Open SRS and Enom), cell phone service (Ting Mobile), internet service (Ting Internet) and self-service domain management (Hover).

The $590 million market cap company has done a very good job controlling costs over the years and has been gaining scale with its products, most notably in the domain name registration space after acquiring eNom from the Rightside Group (NAME) earlier this year. That $83.5 million acquisition made Tucows the second largest domain registrar in the world, and will drive most of the 70% expected revenue growth this year. Even putting the eNom acquisition aside, this company has a compelling profile given that annual revenue and EPS growth have averaged 14% and 49%, respectively, over the past six years, and that the company has repurchased 50% of outstanding shares since the beginning of 2007 (who does that!?). It’s a compelling stock, not least because it trades at only 15-times 2018 expected earnings of $3.61.

One More New Russell 2000 Small Cap Stock to Buy

I find these three small caps compelling for widely different reasons. REV Group is a relatively conservative investment that offers modest organic growth, with larger growth opportunities coming through acquisitions. ImmunoGen is a far riskier investment, and its future will rise and fall based on drug approvals/denials. And Tucows, which is my favorite of the three, is a steadily growing software provider that, contrary to many small caps, is reducing its share count (which helps drive EPS growth).

At the moment, none of these three small caps is in Cabot Small-Cap Confidential, so I haven’t officially endorsed one as my favorite new Russell 2000 stock just yet. That honor goes to a stock that was added to the index during the 2016 Russell Reconstitution. I began following it after the addition brought it to my attention, and just last week I decided it was a good candidate due to rapid revenue growth (over 50%), a very specialized product (medical implants) and a huge market opportunity relative to the company’s market cap. Plus, the chart looks great to me.

If you’re interested in learning more about this opportunity, grab a subscription to Cabot Small-Cap Confidential right now. Our open positions are beating the Russell 2000 Index by an average of 22%! And I expect our newest addition will help extend that lead.

[author_ad]