After a couple of down years, oil prices are starting to bounce back. And I think I have the perfect small-cap value stock to play the rebound. But first, let’s talk about what’s happening with oil.

Oil Probing 52-Week High: What Does that Mean for Investors?

The price of oil has surged 15% since last Wednesday on news that OPEC reached a six-month deal to cut oil production by 1.2 million barrels a day, beginning on January 1, 2017. The proposed cut is equal to roughly 1% of global production. A multi-day move has since brought the commodity back above $51 per barrel, right up to the level that has acted as resistance twice already in 2016.

The big question for small-cap investors right now is this: Can oil break out and help support a sustained run in oil-related small cap stocks?

The market seems to think so. Investors have been piling into small caps since the news was announced, driving the small-cap energy sector up by 15%. In comparison, the large-cap energy sector is up around 5.5%. While many individual stocks across the market cap spectrum are now overbought, the market appears to be factoring in a sustained oil price of more than 50. Perhaps even north of 60.

Beyond blind hope, what data can help investors buy into the trend with confidence?

OPEC’s Deal: Symbolism or Substance?

For starters, history.

The last three times OPEC cut production—in 1998, 2001 and 2008—the price of oil ground higher in the following months. That helped shares of energy-related stocks.

Second, this appears to be a renewed effort by OPEC to reassert its reputation and relevance by pledging a larger-than-expected cut, while detailing potentially prickly issues with both Iran and Iraq. That could signal that there will be more coordinated efforts in the future.

On the other hand, countries have a history of cheating on past deals, so there’s no reason to believe there won’t be some fudging of the production volumes this time around.

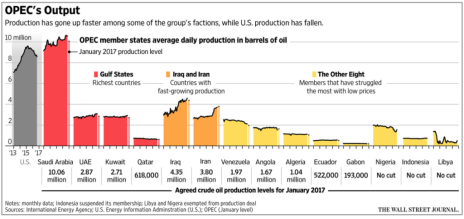

As a point of reference, this handy graphic from The Wall Street Journal shows country-level OPEC production trends over past three years, as well as agreed production levels for January 2017.

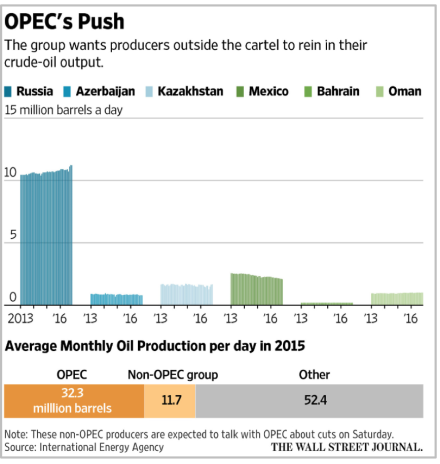

Complicating the deal somewhat is the fact that non-OPEC producing countries need to band together to make production-cut commitments. OPEC is looking for an additional 600,000-barrel-a-day cut, collectively, from Russia, Oman, Bahrain, Azerbaijan, Kazakhstan and Mexico (meaning a total global cut of 1.8 million barrels a day). The image below, also from The Wall Street Journal, shows historical production from these non-OPEC producing countries.

Russia has pledged to gradually cut output by roughly 300,000 barrels a day. But who knows what they’ll really do? We’ll get some clues this Saturday when reps from these non-OPEC producers are expected to meet in Vienna to talk about production cuts. Results of this meeting will likely drive action in oil trading next week.

Ultimately, we won’t know how this all shakes out until production numbers start to get reported in 2017. If everybody complies, the cartel could agree to extend the production cuts at its May 25, 2017 meeting.

Despite the potential for the deal to have more symbolism than substance, its apparent credibility has prompted many analysts to upgrade their ratings on energy stocks, including producers, MLPs and oilfield services/infrastructure plays.

A major factor driving the equity price target upgrades is that OPEC members are looking to attain a price in the $55-to-$60 range. That would change the game for many producing countries that have been clobbered by sub-$50 prices. And in the U.S., that price range would make many wells profitable that previously weren’t, especially now that the industry has become more efficient.

One Small Cap Oil Infrastructure Stock Poised to Double

I don’t think it makes sense to jump whole hog into oil stocks purely because of this potential OPEC deal. If it goes south, so too will many of these stocks, at least in the short-term. That could easily leave investors feeling burned by an incredibly complex and opaque global oil market.

[text_ad]

But for investors with a long-term outlook who have been interested in increasing exposure to oil-related small caps anyway, the deal is one more reason to act sooner rather than later. Yes, it has pushed many oil stocks to overbought levels. But the way to balance that is by adjusting the size of your purchases and averaging in (as always), not buying an entire position all at once. One sensible strategy could be to add a little this week, then wait until after this Saturday’s meeting to decide if it makes sense to add a little more.

One easy way small cap investors can play the trend is to buy the PowerShares S&P SmallCap Energy ETF (PSCE). The ETF was already doing well in 2016, rising from a low of 11 in January to over 21 this week. The OPEC deal has pushed many top holdings, including PDC Energy (PDCE), US Silica (SLCA) and Helix Energy Solutions (HLX), to 52-week highs.

For those looking to move way down the market cap curve to an under-covered small cap value stock that could do far better in the years ahead, I have one in mind.

This is how I described the company to Cabot Small-Cap Confidential subscribers:

“If you appreciate staying comfortable in the extreme temperatures of summer and winter, you’ll like this company. It’s a manufacturer of a space-age insulation that has been used by NASA for years. And its products are beginning to be used here on earth in applications ranging from subsea oil drilling to high altitude mountaineering.

“Most of its current revenue comes from the $3 billion energy infrastructure market. The insulation is currently made in blanket form, typically in 5 ft. wide by 3 ft. diameter rolls, with standard thicknesses ranging from 5 to 10 millimeters (0.2 to 0.4 inches). The blanket form contributes to fast installation around pipes and fittings, and can be cut on-site using standard cutting tools. The blankets can also be used in extreme temperatures, ranging from -200°C to 650°C (-328°F to 1202°F). They help reduce energy consumption, save operating costs and protect workers.

“Its insulation is used by 24 of the world’s 25 largest refining companies, and by 20 of the world’s 20 largest petrochemical companies. [It is] used in several Canadian oil sands facilities, in subsea oil and gas projects around the world, in natural gas and LNG facilities and by gas, coal, nuclear, hydro and solar power generating facilities. Well known clients include ExxonMobil, ConocoPhillips, Chevron, Petrobras, Total and Shell.”

This small cap value stock currently has a price under 5.00, it’s a micro-cap, and it’s in recovery mode. Management is working to ramp up production volumes—on U.S. soil—as the oil infrastructure markets seek to rebound from two years of depressed building activity. Part of the recovery story hinges on filling recently completed manufacturing lines, and building a second manufacturing plant. That second project was put on hold last month as oil plunged from 52 to 42 in just two weeks.

This is what I wrote to Cabot Small-Cap Confidential subscribers about that event:

“[Redacted] has decided to hold off starting construction on the [redacted] manufacturing expansion project until it gets a better handle on forward demand. I think this makes sense given that [Redacted] can still grow revenue by 25% with the capacity it has at its current plant. Why take on debt (it currently has none) to build capacity until the market is ready? Management is being smart about maintaining a strong balance sheet. [Redacted] has been expanding its markets to LNG, district energy, and building materials, so isn’t taking the energy downturn sitting down. But the bottom line is that it’s still largely tied to oil prices, which are low, and have fallen over 14% (from 52.00 to 44.70) over the past couple of weeks. The company’s outlook…reflects the reality that this remains a recovery play, and we need to keep treating it as such.”

Now that OPEC has a deal to cut production and support is building to get (and keep) the price of oil above $55, I suspect this small-cap oil stock’s management team is considering breaking ground on their second manufacturing plant sooner rather than later. If they announce as much, I expect an overnight move in the stock in the magnitude of 10% to 15%. That should mark the beginning of a more sustained uptrend in the stock, which has the potential to double in 2017 if OPEC’s deal sticks and oil stays above $55.

I want to be clear that this small cap value stock is only appropriate for risk-tolerant investors since it’s a recovery play. If energy-related infrastructure projects don’t pick up over the next couple of years, it probably won’t do very well. And it hasn’t yet announced that it will re-start the process of its big manufacturing expansion. But if the market is right that the next two years will see money pouring back into oil-related projects, then this little stock should pay off. It has the potential to double if things go well. And I think the downside is relatively limited at the moment.

If you want to get in early, consider subscribing to Cabot Small-Cap Confidential today.