Many people dream of wining the lottery, but the world is full of stories of people who won the lottery and then ruined their lives. A large lump sum of money is too much for most people to handle.

Much healthier, both financially and emotionally, is a regular income.

Today there are many ways to get a regular income. Traditional sources include a paycheck, planned withdrawals from savings accounts, company pension plans, CDs, bonds, social security, real estate, preferred stocks and dividend-paying common stocks.

The highest paying dividend stocks offer the best rewards of all, particularly if your timing is right.

Happily, at Cabot we have several expert analysts who recommend some of the highest paying dividend stocks in their portfolios!

How high are these dividends?

[text_ad]

Bearing in mind that the S&P 500 yields 2% today, I’m going to restrict my discussion today to high dividend stocks that pay 50% more than that, 3.0% or better. And there are lots of them!

In fact, in Cabot Benjamin Graham Value Investor alone, our senior value analyst Roy Ward has a table labeled Top 275 Value Stocks. Of those 275 stocks, 61 stocks yield 3.0% or more!

34 of these stocks yield 4.0% or more.

18 of these stocks yield 5.0% or more.

And 9 of these stocks yield 6.0% or more.

And these are not risky stocks, these are high-quality value stocks. That makes them some of the best dividend stocks you can buy!

Two of these stocks are large Canadian banks. They yield 4.2% and 4.3%.

Several of them are utilities, serving the telecom and energy industries. They yield 5.0%, 6.3% and 8.0%.

Several more are in the investment and insurance industries. They yield 4.3% and 7.2%.

Now, interestingly, steering his readers to the highest paying dividend stocks is not Roy’s main goal. Roy’s main goal is to bring his readers capital appreciation, achieved by buying quality stocks at bargain prices, and he’s done a great job of it.

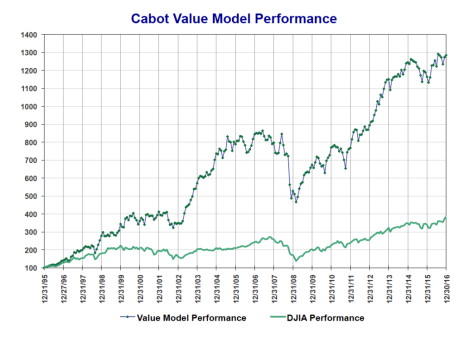

In fact, in the 14 years that Cabot Benjamin Graham Value Investor has been published, its Model Portfolio has increased 271.6% compared to increases of 122.1% for the Dow and 139.1% for the S&P 500. And these performance numbers don’t include dividends.

Over the longer term, Roy’s performance is even better.

Since inception on 12/31/95, the Cabot Value Model has provided an impressive return of 1,184.2% compared to a return of 660.5% for Warren Buffett’s Berkshire Hathaway. During the same period, the Dow gained just 286.2%.

So if you follow the exact advice Roy provides in the Model Portfolio, you’ll get great investment results, but you won’t always get dividends. Some of Roy’s stocks will pay dividends—and some of those dividends will be quite large—but some will pay no dividends at all.

Note: Roy’s system is built on the teachings of Benjamin Graham, the man who taught Warren Buffett about value investing, so in the long run, this system is golden!

But what if your main goal is dividends?

Then by all means, you should focus like a laser on Cabot Dividend Investor.

Cabot Dividend Investor, guided by my middle child Chloe Lutts Jensen (who’s smarter than me), brings its readers a more focused selection of the best dividend-paying stocks. Today there are a total of 16 dividend-paying stocks in Chloe’s portfolio, divided into High Yield, Dividend Growth and Safe Income.

Safe Income needs no explanation. It’s what you buy when you want steady income (currently averaging 3.0%) and little risk.

The Dividend Growth category is a more intriguing group; it’s where you find stocks that are yielding an average of 2.2% today (similar to the S&P 500), but that are likely to grow in the years ahead.

Ideally, you buy these Dividend Growth stocks today, and a few years down the road, you’re not only looking at capital appreciation, you’re also looking at dividends (based on your original cost) of 3%, 4% or 5%! It’s the best of both words!

To subscribe, click here.