2020 has been a rough year for many industries. But not cloud computing stocks.

For cloud computing companies, 2020 has been a breakout year of historic proportions. While the cloud had already been on investors’ radar screen for some time, it took this year’s pandemic-related shutdowns to drive home just how critical cloud infrastructure is to the global economy—not to mention the burgeoning work-from-home paradigm.

Not surprisingly, those who were perceptive enough to identify this trend early on were amply rewarded by stellar returns on leading cloud computing stocks over the last several months. On the other hand, investors who may have missed out on this year’s cloud stock blast-off are no doubt kicking themselves for this oversight and perhaps thinking it’s too late to jump aboard the cloud trend.

But not so fast! The prevailing evidence suggests that we’re still in the early innings of a long-term cloud expansion phase. According to industry experts, the cloud computing industry is expected to grow at an annual rate of around 18% between now and 2025. The cloud’s multiple benefits are driving migration away from traditional data storage (including lower storage costs, improved internet speed, and improved cybersecurity).

[text_ad]

This is good news for those who want to add some cloud-related exposure to their portfolios. Here we’ll look at three such cloud leaders which have more upside potential in the months and years ahead.

4 Cloud Computing Stocks, 1 ETF

Let’s start by looking at one of the leading cloud exchange-traded funds, the Global X Cloud Computing ETF (CLOU). This relatively new ETF commenced trading in 2019 and invests in companies which are poised to benefit from the increased adoption of cloud computing technology, including companies whose main business involves Software-as-a-Service (SaaS), Platform-as-a-Service (PaaS) and Infrastructure-as-a-Service (IaaS).

Its holdings encompass IT infrastructure, cloud real estate, manufacturing, consumer discretionary and communication services stocks and provides investors with a wide and varied exposure to some of the most actively traded cloud names in several segments of the broader industry.

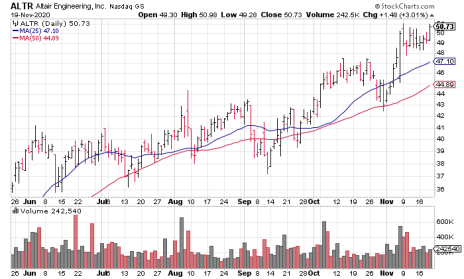

Cloud Computing Stock #1: Altair Engineering (ALTR)

Altair Engineering (ALTR) is one of the older, more established cloud and software names (perhaps best known for its suite of computer-aided design tools). Founded in 1985, it provides cloud-based solutions for product design and engineering, enterprise services, data analytics, IoT and other computing applications. Basically, Altair enjoys a leadership position across many verticals, including manufacturing, pharmaceuticals, financial services and energy, allowing the company to discern rapid changes occurring in several major industries while delivering its cutting-edge software solutions. It uses this knowledge in turn to improve its service and product lines, with an increasing focus on cloud computing.

Altair delivered excellent top- and bottom-line results in the third quarter, beating expectations and guidance. In Q3, the firm also released a beta version of its latest offering, Knowledge Works, which is a cloud-native end-to-end platform for data analytics (which it believes will be a major revenue driver going forward). Altair has an innovative company with a growing new product pipeline for data analytics, which should allow for more growth in 2021 and beyond.

Cloud Computing Stock #2: Alarm.com (ALRM)

The home security market is booming, and the number of U.S. houses with security systems is predicted to nearly double between 2019 and 2024 (from 37 million to 63 million). Alarm.com (ALRM) is a leader in “smart” security, providing remote monitoring and operating systems (hardware and software) for homes and businesses.

The firm works with over 9,000 third-party service vendors (such as ADT) to install and maintain security systems, which are then merged into its cloud-based platform. Its vendors do most of the grunt work, obtaining clients and installing systems, while Alarm handles product development and maintenance. It operates in the Software as a Service (SaaS) space, with roughly 67% of its revenue coming from its SaaS license, and it boasts a 93% revenue renewal rate.

Top-line growth has been impressive, rising at an average annual clip of 25% over the last five years. In the most recent quarter, the firm delivered consensus-beating revenue of $159 million (+24%), along with an 18-cent earnings beat of $0.49 per share. Video camera sales were also a big growth contributor in Q3 (+24%), along with hardware and other sales (+37%) benefitting from its recent acquisition of video surveillance firm OpenEye. All in all, it’s a solid-looking growth story.

Cloud Computing Stock #3: Five9 (FIVN)

Five9 (FIVN) provides cloud-based software for contact centers, helping them cut costs and improve the customer support experience. Its artificial intelligence (AI) software—based on the premise that it’s easier to keep existing customers happy than gain new ones—analyzes real-time calls and provides live assistance to customer agents.

The firm’s latest earnings report underscored another outstanding quarter for Five9, driven by strong execution and product innovation. The company reported record revenue of $112 million (up 34% from a year ago and up 12% sequentially—both records since the firm went public). Enterprise subscription revenue grew 35% in Q3, while earnings of $0.27 per share beat the consensus by nine cents.

Looking ahead, Five9 is focused on increasing average revenue per user by continually increasing its product portfolio. Management is also guiding for a 25% top-line increase in Q4 and raised the midpoint of its annual revenue guidance from $400 to $422 million (a 26% increase). Analysts, moreover, predict top-line growth in the low-to-mid 20% range in the next three quarters. With cloud migration and AI-driven digitization among call centers continuing at a breakneck pace, Five9 is well positioned to maintain its strong growth trend in the years ahead.

If you want more of the best-performing growth stocks right now, I highly recommend subscribing to our Cabot Top Ten Trader advisory, where every week chief analyst Mike Cintolo provides you with 10 of the market’s strongest growth stocks from both a technical and a fundamental perspective.

To learn more, click here.

[author_ad]