In my Daily Alerts for my Wall Street’s Best newsletters, I often point out when an analyst initiates coverage or changes coverage or price targets on one of our contributor’s recommendations. I do that so that my subscribers are aware of what others in the investment community are saying about their stocks. But analyst upgrades (or downgrades) should be considered the beginning of your research—not the final catalyst that makes you buy—or sell—a stock.

There are a few reasons why you can’t depend 100% on analyst recommendations, including:

Analysts are Predisposed to Highly Recommend the Companies that Bring Business to their Firms

Although the Sarbanes-Oxley Act in 2002 added additional regulations on investment firms, and their underwriting and research departments, investors must make sure that they investigate a brokerage’s relationship with the company for whom they are issuing an investment rating. That’s because a firm that is underwriting a securities issue for a company may not be as objective as you may like.

[text_ad use_post='129620']

Analyst Recommendations aren’t all that Accurate

Many studies have proven this, and the latest one I saw was a 2017 project from researchers at Saïd Business School, University of Oxford, Universita Bocconi and IGIER, Brown University, and Harvard University. The study found that over the period from 1981 to 2016, the top 10% of highly-rated stocks performed worse than the 10% lowest-rated stocks.

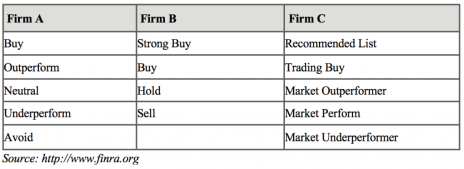

Does Outperform Mean Buy?

Not necessarily. A few years ago, FINRA tried to make sense of the ratings and put together this chart:

Consequently, you can’t just depend upon analysts’ ratings. However, analyst research can be incredibly helpful. Wall Street analysts generally do extensive research on the companies and industries they review, and investors can glean comprehensive information and insight on the fundamentals of the companies and sectors they rate.

And that’s a great starting point for your own research. When I decide to research a company or sector, I always check the analyst ratings, and review their reports, when possible. From there, I put the stock through my own rating system, investigating its fundamental characteristics—debt levels, cash flow, and valuation, as well as technical factors, such as trading volume, relative strength, and its moving averages.

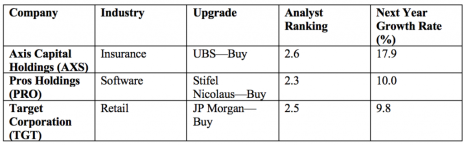

3 Analyst Upgrades

I recently looked at analyst upgrades for about 25 companies, and I found three that I believe are worth additional research.

Their fundamentals look interesting, and their technical parameters point to rising shares in the near term.

But as always, these analyst upgrades are meant to be a starting point for your research to determine if any of these stocks are suitable for your portfolio, so roll up your sleeves, and get started!

Now, if you want more recommendations, you can subscribe to my Wall Street’s Best Investments newsletter - a compilation of the best stock recommendations from some of the top analysts in the country - by clicking here.

[author_ad]