Insurance Stocks Have Been on Fire This Month. Take Advantage of the Momentum with this Little-Known Mid Cap.

After a year of stagnant share prices, stocks within the investment and insurance industry are suddenly rising rapidly. That’s because a long-ignored cycle of strong revenue and profit growth is finally coming to light, sparked by excitement over fourth-quarter 2019 earnings reports. In recent days, we’ve seen very bullish share price action with Ameriprise Financial (AMP), Brighthouse Financial (BHF) and Lincoln National (LNC). It’s not too late for investors to grab one more excellent insurance stock before they, too, report fourth-quarter results that will probably be greeted with a similar level of enthusiasm by Wall Street.

Athene Holdings Ltd. (ATH) is an insurance company whose primary businesses are annuities and the reinsurance of retirement products. The company has $144.2 billion in assets, and is domiciled in Bermuda.

[text_ad]

Last fall, Athene entered into a strategic relationship with Apollo Global Management, Inc. (APO), in which Apollo acquired partial ownership of Athene. Apollo is an alternative investment manager that focuses on private equity, credit and real estate. The company can provide a broader investment universe for Athene, delivering additional revenue sources for Athene and diversifying Apollo’s asset base. Apollo was my number one growth and income stock pick for 2019, delivering in excess of a 100% total return to investors. Upon the completion of the Apollo transaction, Athene converted to a single-class share structure, which increases the stock’s eligibility to be included in stock market indexes and broadens investor appeal.

Wall Street analysts expect Athene to report fourth-quarter earnings per share (EPS) of $1.68, within a range of $1.61-$1.78, on the morning of February 18. Full-year 2019 results are expected to deliver $6.46 EPS, a 10.8% increase over last year’s $5.82 per share. Profits are then expected to grow another 13.9% in 2020, yet the price/earnings ratio (P/E) is quite low at 6.3.

Athene operates with a conservative focus on downside protection, providing investors with a lower-risk growth stock opportunity. It carries an A rating from three major rating agencies. And the company is actively expanding their retail, reinsurance and institutional product distribution platforms.

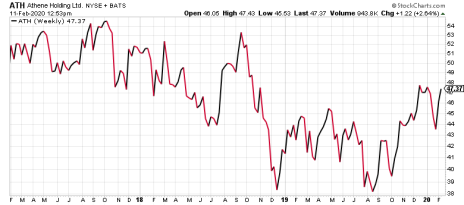

This mid-cap stock traded between 37-46 throughout 2019, then began rising in December 2019. The recent range of 43-48 appears to be a temporary trading range during an uptrend. ATH is currently valued at an approximate 9% discount to adjusted book value, which was $50.74 as of September 2019.

The stock has upside price resistance in the 52-54 area, where it last traded in 2018. Growth stock and momentum investors should buy ATH now, prior to the earnings report, to potentially capitalize on current bullish price action among insurance stocks.

[author_ad]