CDW Corp. (CDW) is at the Intersection of Several Major Areas of IT Growth. And CDW Stock Should Benefit.

According to research firm IDC, the expansion of the Internet of Things (IoT), artificial intelligence, cybersecurity sectors, plus the 5G rollout will grow the global information technology industry to $5.2 trillion this year.

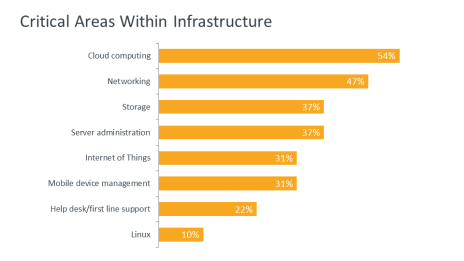

As you can see from the following graph, those areas are on the fastest tracks in the IT industry.

Of that total, 56% will come from hardware, software, and services. And those are the primary products provided by CDW Corporation (CDW), a recent recommendation in my Wall Street’s Best Investments newsletter.

[text_ad]

When it started out, CDW was basically a catalog of hardware: computers, disc drives, and backups. But as contributor Richard Moroney, editor of Dow Theory Forecasts, pointed out, the company—unlike many others that have come and gone—has adapted to the evolving tech marketplace, is growing faster than the industry itself, and now commands more than 5% market share of its global sphere.

Here’s a brief excerpt from Moroney’s report: “We appreciate technology-services provider CDW Corporation’s (CDW) approach to growth; it wants to claim a larger percentage of the pie, while at the same time enlarging the pie itself. Of the roughly $1 trillion spent on technology services each year in the U.S., U.K., and Canada, CDW has the expertise and reach to compete for nearly one-third of the available contracts.

“The company already sells more than 100,000 products in roughly 80 countries and has spent more than $500 million on two acquisitions in the last five years, in part to gain new products and expertise that broaden its addressable market. More acquisitions are likely in the years ahead. Of that addressable market, which the company estimates at $325 billion, CDW commands a market share of just over 5%.”

CDW participates in all the growing arenas in: 1) integrated products in security, mobility, the cloud, virtual reality, and collaboration; 2) hardware—notebooks/mobile devices, network communications, desktop computers, video monitors, enterprise and data storage products, printers, and servers; and 3) software—application suites, security, virtualization, operating systems, and network management.

CDW focuses on customers with more than 5,000 employees, but in all, the company offers more than 100,000 products and services and 1,000-plus brands to more than 250,000 customers in the U.S., U.K. and Canada.

CDW stock has risen more than 67% since the start of 2019, and gathered extra momentum—reaching an all-time high—after the company reported stellar third-quarter results in early November, including a dividend increase (fourth-quarter results are due out this Thursday, February 6). CDW beat analysts’ estimates on both sales and earnings, rising 12% and 20%, respectively.

CDW has grown its earnings 25% per year over the past three years. Earnings of $1.70 per share handily beat analysts’ projections by $0.12 and revenues came in at $4.91 billion, compared to the $4.64 billion estimate. And to top off that great quarter, CDW increased its quarterly dividend by 29%, to $0.38 per share—not bad for a tech company!

Wall Street has been increasing its forecasts for the company’s fourth quarter and now expects CDW to earn $1.48 per share on $4.41 billion in revenues. As its end markets continue to expand, so should the fortunes of CDW Corporation and CDW stock.

[author_ad]

*This post has been updated from an original version.