Throw Away Your Eyeglasses

Finding the Next Tesla

The Hottest Stock in Russia

The focus of this article is “Finding the Next Tesla,” but it starts with a story about laser vision correction—for a good reason.

“Throw Away Your Eyeglasses” was the title of our very first article about a stock called Summit Technology, back in July 1988. Summit was a Boston company that my father Carlton had heard about from a local marketing guy. Co-founder David Muller had developed a technology called photorefractive keratotomy (PRK) that could sculpt a person’s cornea with a laser, and thus eliminate the need to wear corrective lenses. And the company had just gotten the go-ahead from the FDA to begin clinical trials.

But we didn’t recommend the stock then. We just told readers we’d be keeping an eye on it. And the reason was that the stock didn’t have positive momentum.

Now, we don’t talk a lot about momentum in these Cabot Wealth Advisories. We tend to use simpler concepts that are understood by most investors.

But positive momentum is a key component of our very successful system of growth investing, and it’s really not that difficult to understand, so I’m going to go over it here, and then return to my story about Summit Technology.

A stock with positive momentum is one that’s been going up faster than the relevant index over a period of 13 weeks or longer. Sure, going up at any rate is good, but if a stock is going up faster than the index, it has more potential to make money faster, and for growth investors, that’s a good thing.

To see momentum, you plot a stock’s price vs. the price of the index, week after week, creating a relative performance (RP) line. If the resulting chart is going sideways, the stock is performing just as well as the index. But if the chart is going up, the stock is performing better than the index. And if it’s been going up over a period of 13 weeks, it has positive momentum!

Stocks with positive momentum that have become big winners for us include Microsoft, eBay, Amazon, Netflix, Apple, Tesla Motors and many more.

So what we did with Summit (BEAM) is follow the company fundamentally, and watch the stock’s performance carefully. Eventually, the stock did develop positive momentum. We recommended buying it in Cabot Market Letter in August 1989.

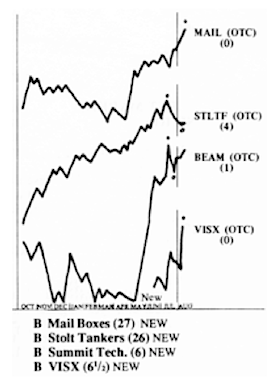

Here’s what the page looked like at the time, showing Summit’s RP line, which was going up rapidly. At the same time, we also bought VISX, a California company that had a similar technology and was doing well, too.

By year-end, we had a 24% profit in Summit, but VISX was a loss, so we sold VISX and held Summit.

And then in 1990, we joined in the clinical trials!

Now, to the average American back in 1990, getting your eyeball shot by a laser was a crazy idea. “You’ll go blind!” was uttered more than once. But we’d been following the science and we were believers, so we seized the opportunity.

First, my brother Rob had one eye lasered, to correct myopia. The procedure was free.

Then I had one eye done, for the same purpose. That was free, too, because it was still part of the clinical trial. For both of us, there followed plenty of free follow-up visits.

In 1991, my father Carlton had one eye done, too, but by then the trials were over and he had to pay.

All three of us, by the way, then lived happily with monovision, where one eye does the close work and one eye does the far work. More than a decade later, however, the effects of aging for all three of us meant we had to start wearing glasses again for some activities. You can delay the effects of aging but you can’t hold them off forever.

By the end of 1991, our profit in Summit was more than 276%, as more and more people realized PRK was a genuine solution to common vision problems and bought the stock. When we finally recommended selling the stock in 1996, after its big run had ended, our profit was 443%.

In time, Summit was acquired by eye care giant Alcon and a newer laser technology, LASIK, came along to supersede PRK.

For a while, you saw billboards advertising increasingly low prices for LASIK, as it swept America,

And today, no one talks about laser eye surgery anymore.

But that “case study” is a good example of the forces I look for when searching for big winners.

First, I want to address a mass market.

Second, I want a strong RP line.

And third, I want skepticism.

With Summit, “You’ll go blind!” was a clear mark of skepticism.

With Amazon, “Barnes & Noble and Borders will kill it,” characterized the great skepticism.

With Netflix, “Blockbuster will kill it” and “DVDs by mail??” marked great skepticism.

And with Tesla, just last year, concerns about the cars’ high price, short range and battery life were just some of the concerns that marked public skepticism.

But since I recommended TSLA last December in Cabot Stock of the Month, the stock is up 538%. The bull market has helped, but the biggest factor has been the rapid evaporation of skepticism about Tesla, as the car has received rave reviews from all quarters and the old automakers struggle to catch up.

I’m not looking to sell TSLA yet; momentum is still positive. But I am looking, as always, for the next big winner, and you’ll read more on that below.

Coincidentally, I was in Amsterdam on vacation recently, and learned that some 7,000 eye doctors were in town for the annual meeting of the European Society of Cataract & Refractive Surgeons (ESCRS).

One night at dinner (in the restaurant Lion Noir), my wife and I found ourselves sitting next to three of them—from Scotland, Slovenia and Sweden.

So I told them my Summit Technology story. I learned that one of them had known the other co-founder of Summit. And I learned that PRK is still more practical than LASIK for the doctor from Slovenia.

Then they told me about the next big thing in eye surgery.

It’s made by Simovision, a Belgian company started by a man named Allan Gazzi.

It’s a multifocal diffractive intraocular lens (IOL) named Presbysmart Plus, aimed at presbyopic, myopic and hyperopic patients who do not want to wear glasses.

And it’s the first diffractive IOL with a power accuracy of 0.01.D.

But you can’t invest in it yet, because the company is still private. And even if it were public, I wouldn’t recommend it if it didn’t have positive momentum. Finally, even if it were public and had positive momentum, I wouldn’t expect it to be a huge winner because there’s no widespread skepticism about the technology.

So where might we find the next Tesla? Or, to put it another way, in what industry do we find widespread skepticism combined with a big potential mass market?

One possibility is the airline industry, where public perception is so low that it must be near bottom. If I could find an airline with positive momentum and great growth prospects, I’d be very interested.

Another possibility is China. Growth prospects are very high there and public perception is still low, and there are a number of strong stocks today in Paul Goodwin’s Cabot China & Emerging Markets Report. Get more details here.

But the one candidate I have today is a Russian company. Few people in the U.S. have a positive opinion of Russia, yet I can see the country’s status rising on the world stage, as its actions enabled Obama to find a non-violent solution to the Syrian chemical weapons problem, and as the country’s sheltering of Edward Snowden strikes a blow against intrusive NSA practices while defending the rights of the individual. It’s a script even Hollywood might have rejected a year ago, but it’s reality, and if this is the beginning of a long trend toward improved perception, it might provide fuel for a huge advance of today’s featured stock, which is Yandex (YNDX).

Here’s what Chief Analyst Mike Cintolo wrote about Yandex just last week in Cabot Top Ten Trader.

“Sometimes a stock’s popularity can be explained by its company’s unique product or service or some technological innovation. But with Yandex, the product is quite familiar and the secret is location, location, location. Yandex provides online search services to Internet users in Russia (97% of users), Ukraine, Kazakhstan, Belarus and Turkey. As Russia, which has just 53.3% Internet penetration, is undergoing a steady build-out of service, the Russian economy is also thriving, increasing demand for advertising opportunities. Yandex, with a 62.2% share of Internet searches (up from 60.5% a year ago), has a dominant position in Russian search, well ahead of Google’s 26% share. Yandex gets roughly 90% of its revenue from text-based advertising, and revenue growth from 2010 to 2012 has been 45%, 62% and 41%, respectively. “The Google of Russia” is enjoying its position in a fast-developing market, and its auxiliary services like the Yandex.money payment system make it a nice package.”

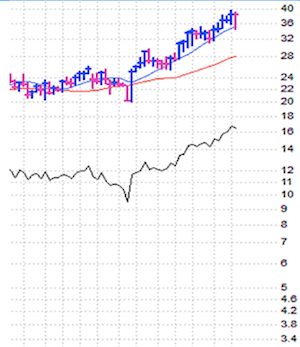

Here’s the chart, with the price action on top and the Relative Performance (RP) action under that. The stock clearly has positive momentum.

So, you could just buy YNDX here. But there’s one near-term risk to that; the company will release Q3 results on October 24. And there’s one longer-term risk as well; even if you happen to buy right, you’ll still be lacking expert sell advice. For that you’ll want to get on Mike’s regular list, and the first step to that is clicking here.

Yours in pursuit of wisdom and wealth,

Timothy Lutts

Chief Analyst, Cabot Stock of the Week

[author_ad]