In quarantine, people around the world are playing more video games than ever before. And these gaming stocks are benefitting.

Video games have become an integral part of American culture, appealing to children and adults alike. The companies that produce and market video games are doing exceptionally good business this year—particularly in light of recent shutdowns—and the industry is growing faster than any other form of entertainment. In this article, we’ll look at some video game makers that stand to benefit from the forward momentum.

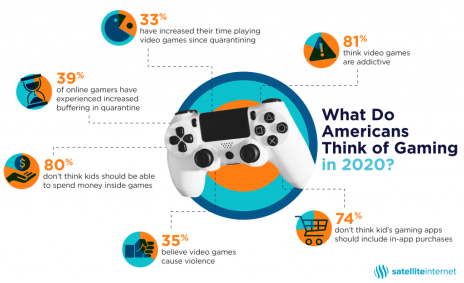

Gaming stocks have performed quite well during the coronavirus lockdowns as millions of people sitting at home, some with not much to do, diverted themselves by playing video and online games. In fact, one-third of Americans have increased their video game playing time since quarantines began this year, according to a survey by Satelliteinternet.com.

Source: Satelliteinternet.com

What’s more, according to gaming industry expert and Wedbush Securities analyst Michael Pachter, shelter-in-place has driven gaming engagement up by 40% or more in the key markets affected (primarily U.S., secondarily Western Europe). And these trends are widely expected to continue in the coming years.

[text_ad]

Indeed, video games are big business, amounting to a roughly $20 billion a year industry in the U.S. Globally, the industry encompasses an estimated 2.7 billion gamers who will spend $160 billion on games this year alone. Analysts further predict video game revenue will grow to $230 billion by 2022, with the U.S. maintaining its lead as the world’s biggest gaming market.

Illustrative of the rapid growth in gaming companies, the Wedbush ETFMG Video Game Tech ETF (GAMR) was created in 2016 to track companies that include video game software developers, publishers, platform providers and gaming accessories makers. The ETF, which is up 65% since March, has shown persistent relative strength when compared to most major industry groups. And with an uncertain timeframe for economies completely re-opening, gaming tech companies are likely to continue beating the market averages for some time.

A technical observation is in order. Although gaming stocks have had an excellent run since bottoming in March, the fact that the average video game stock (as reflected by GAMR) has remained above its key 25-day trend line for four months without a single meaningful dip below it suggests that gaming stocks may be vulnerable to a corrective pullback. (It’s unusual for any stock or industry group to show this much persistent strength with barely a decline for four straight months.)

Thus, the following video game stocks should be considered for purchase only after the next meaningful market pullback. With that proviso in mind, here are three gaming stocks that I think will continue to show relative strength in the coming months.

3 Gaming Stocks to Buy on Dips

Gaming Stock #1: Nvidia (NVDA)

NVIDIA Corp. (NVDA) designs graphics processing units for the gaming market, as well as semiconductor chips for the mobile computing and automotive market. Reflecting the surge in gaming during quarantines, the firm’s overall Q1 top line increased 39%, with gaming revenue growing 27% year-over-year. Even more impressive was NVIDIA’s per-share earnings, which soared 130% to $1.47. Management guided for a 42% increase in revenue in Q2, in line with analysts’ expectations, while per-share earnings are expected to increase almost 60%.

Management noted that during the pandemic there was a 50% rise in gaming hours played on the company’s GeForce platform, which was driven by more people playing as well as by more gameplay per user. Additionally, gaming laptop revenue accelerated to its fastest growth in six quarters. With many states in the process of either shutting down again or contemplating partial lockdowns, demand for NVIDIA’s gaming units isn’t likely to diminish anytime soon. Earnings are expected August 6.

Gaming Stock #2: Sea Limited (SE)

Online sales and gaming in Southeast Asia are still underpenetrated and represent a huge market opportunity, especially in COVID’s wake. Singapore-based Sea Limited (SE) is filling this void by transforming the e-commerce, financial services and entertainment landscape in that region, as well as in Taiwan and Latin America. While the firm also engages in e-retailing and offers financial services, its online gaming (Garena) segment has been compared to Activision.

Garena, which mainly distributes games from third-party developers in Southeast Asia, and it’s also a global game publisher. (Its first mobile game, Free Fire, was released in 2017 and topped Google play store and Apple iOS charts in Latin America and Asia.) Segment revenue rose 30% in Q1 to a record-breaking $512 million—driven by strong growth in both active (+48%) and paying (+73%) users of the platform. Looking ahead, analysts see revenue in the 50% - 60% range in the next three quarters. Add to that favorable demographics in its target markets and Sea looks to have a healthy growth trajectory ahead.

Gaming Stock #3: Take-Two Interactive Software (TTWO)

Take-Two Interactive Software (TTWO) publishes some of the most popular titles among hard-core veteran gamers, including Grand Theft Auto, Red Dead Redemption and NBA 2K. Take-Two expects net bookings in its fiscal first quarter to range from $800 to $850 million, up 93% from a year ago as the gaming industry surge continues. The increase is based on anticipated growth in several of its leading portfolio titles (including Grand Theft Auto Online, Grand Theft Auto V and the Borderlands franchise). Management also projected recurrent consumer spending to grow by approximately 75% in the latest quarter.

Analysts, meanwhile, expect a 100% increase in Take-Two’s top line when it reports earnings today (August 3) and further expect earnings-per-share of $1.60 (from last quarter’s $1.50). The firm also boasts a $2.5 billion cash position and an attractive debt-to-equity ratio.

With video game playing time almost certain to increase in the coming months and years, game publishers and distributors are poised to maintain their position among the market’s leading industry groups. The companies mentioned here, while technically vulnerable to profit-taking in the near-term, should nonetheless be able to benefit from this bullish longer-term trend.

If you want the best-performing growth stocks right now, I highly recommend subscribing to our Cabot Top Ten Trader advisory, where every Monday chief analyst Mike Cintolo provides you with 10 of the market’s strongest growth stocks from both a technical and a fundamental perspective.

To learn more, click here.

[author_ad]