Wait a Second. GPRO Stock Soared 20%?

GoPro (GPRO) is one of those stocks that always draws a lot of attention. GPRO stock did so when it was soaring in early 2014, when it was crashing later that same year, and again when it was crashing in late 2015. It’s even drawn eyeballs over the last two years when the stock hasn’t done much at all, other than mount a failed rally on the back of high hopes for last year’s new product launches.

Given its popularity, it’s not surprising that there was a flurry of articles covering GPRO stock when shares jumped 20% following last Thursday’s surprise earnings beat. In a minute, I’ll get into the earnings report and why the stock rallied so much. I’ll also give you my opinion on whether or not you can make money by buying GPRO stock now.

But first, let’s talk a little about GoPro and what I think could make the company great once again (assuming it was great before it began flailing post-IPO).

How GoPro Can Be Great Again

[text_ad use_post='129618']

GoPro started out as a hardware company that had a really neat and innovative product. Sure, the market for action cameras is somewhat limited, but that didn’t become an issue until the company went public. After the GPRO stock IPO, there was more pressure to show a growing addressable market, push revenue and EPS growth, etc. And that seemed to shift the company’s focus to creating an entertainment unit, creating media relationships and figuring out ways to leverage all the content created on the cameras.

The problem was that amateur video footage doesn’t have much value unless you have a personal relationship with the people on camera. And the company then failed to do what it had started out doing, which was innovating on the product development front. At least, that’s my interpretation of what happened.

Lost in the shuffle was GoPro’s ability to expand its user base to people like me, who could have been customers by now—and could be on their second or third camera.

I’m relatively adventurous. I ski. I surf. I mountain bike. I fish. I have kids. I’m in an older age bracket (over 40) that I suspect GoPro has trouble penetrating. And I try to document many activities with my iPhone, but it’s pretty annoying to do so. The risk of destroying an expensive cell phone is relatively high, so I don’t use it that much. A GoPro seems like a good thing for me, but I still don’t have one.

Why not? And why did I return the one my wife bought me for Christmas? GoPro, listen up!

The answer is simple. Because, as much as I’d like to capture more picture and video footage of activities in my life, I don’t want to feel like a tool while doing so.

tool: (n) [toooooooooool]

- One who lacks the mental capacity to know he is being used. A fool.

- An un-cool person. A loser.

- Someone whose ego far exceeds his talent, intelligence and likeability.

There are a lot of people who like the idea of a GoPro, but feel like I do. Our desire to avoid looking toolish wearing GoPros is stronger than our desire to capture the footage.

I believe this has stopped not just me, but tens of thousands of other potential buyers from taking the step that, in my opinion, could help turn GoPro back into a great investment. Implied in my reasoning is that if GoPro could pull us into the fold, it will have become a great company by significantly expanding its user base through product innovation.

Before I get a lot of angry emails, let me clear up one thing. I’m not saying that everybody that wears a GoPro is a tool. I’m sure some are and some aren’t. A lot of people feel fine wearing one. More power to them. A ton of kids have GoPros, and they all get a pass because, hey, they’re kids.

But from conversations that I’ve had with a lot of other people that do the same activities I do, the main hesitation isn’t video quality, desire to capture content, cost, etc. It’s all about not wanting to wear a big accessory that sticks out like a sore thumb.

I have no formal market research to back up this assertion. And I don’t know the precise number of potential customers GoPro is missing out on. But I think it’s a very, very significant number.

I also think it’s not an unsurmountable challenge to get me and people that feel like me to buy one. It’s just a matter of innovating on the form factor front.

In plain English, that means changing the size and shape of the camera so that it’s not so obvious while being worn. I don’t want to look like a peacock while skiing or mountain biking. I’m not going to hold a camera in my mouth while surfing, drill into my board to mount it, wear what looks like a laser tag vest to hold it in front of my body, or hold it in one hand while paddling with the other (I’m just not that good a surfer!). I think the head strap accessory GoPro makes is good for a lot of low impact activities and ends up looking like a headlamp, but the reality is these are the times when my iPhone works well enough.

Even though GoPro made progress shrinking the form factor with the Session (far right in this image), the ice cube sized camera is still too big. There’s just no way it’s going to happen.

I’ve spent the last couple of years thinking that innovation on the form factor front is such an obvious way to grow sales that GoPro is working on solutions.

But I could be wrong. If I am, and the engineers don’t have files full of drawings and technical specs, I want to make a few suggestions and point to specific examples on the market that GoPro should be working toward (in my head I’m shouting, “Aren’t they doing this stuff already!?).

The first idea is to incorporate the camera into helmets. GoPro could design their own (probably the best route), or partner with leading helmet manufactures in biking, skiing, motocross, auto racing and other markets. Given that we’re all wearing helmets for all these activities anyway, this represents a very low hurdle for those of us who don’t want the helmet-mounted accessory.

I’m sure there are technical challenges to overcome, like where do you put the battery, how do you adjust the angle, what about durability, safety, etc. But these seem surmountable, especially for what should be an innovative company that created the action camera category.

I did a quick web search and came across a small company in California pursuing this design. It’s called C-Preme, and it has a couple of subsidiaries, Bult and Video Head, that make helmets with integrated cameras. I don’t know anything about it, but the concept seems like a natural fit for GoPro.

Another idea is to incorporate the camera into goggles. Again, we already wear them for a lot of activities (skiing, diving, motocross), so it’s not a big deal to buy a pair with a camera, assuming it functions just as well as other alternatives. There are various versions of this on the market right now that you can buy on Amazon, including a number from a company named Liquid Image. I have no idea if they’re any good.

Designing a camera that’s an improvement for surfing is more challenging. You could integrate one into various locations in a wetsuit. Surfers wear hoods in cold water, or there could be room on a shoulder or chest. For warm water applications, a lot of surfers wear rash guards on their upper halves, and, like a wetsuit, a small camera could be incorporated into the fabric on the shoulder. It would probably have to stick out some, but not as much as current designs. Cables might be necessary to allow for a battery back in an unobtrusive location like around the waist (heated wetsuits on the market use this approach).

These are just a couple of ideas. Clever engineers might be able to make one camera that could work in helmets, goggles, wetsuits and other pieces of equipment. It seems worth the effort. In addition to expanding the market for the cameras, there are also tons of potential accessory sales that would align with GoPro’s current sales strategy.

Should You Consider Buying GPRO Stock Now?

Let’s move on to what GoPro actually did in Q2, and why the stock jumped almost 20% last Friday.

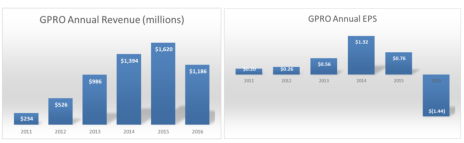

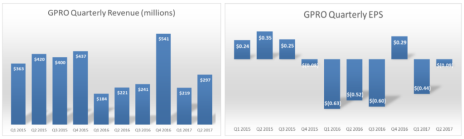

The main two reasons were that revenue of $297 million beat by $27 million (a 10% beat), and EPS of -$0.09 beat by $0.16. Both were significant beats and represented big percentage-based improvements; revenue was up 34% while EPS was up 83% (albeit still in negative territory, but let’s not be overly critical). Here’s what the charts of quarterly revenue and EPS look like.

Other contributing factors were that channel inventories appear to be back to normal (meaning retailers aren’t sitting on boxes of unsold cameras), the new HERO6 camera is reportedly on track for launch this quarter (we don’t know what the form factor is), the new QuikStories software (integrates easily with smartphones with ready-to-share videos) appears to be popular, global sell-thru was up 18% and sales on Amazon Prime Day were very strong.

The high-end Fusion 5.2K spherical camera also sounds like an exciting new product. And the Karma drone might finally be selling a few units (though still less than 10% of revenue), and is launching overseas.

Management has said it’s trying to do fewer things better. One of the central parts of its growth strategy is to go back to its roots and focus on delivering better products and services to its target market, which includes a lot of consumers who are already GoPro enthusiasts. Within this strategic re-focus, I think there’s room for serious innovation on the form factor front, including some of the ideas I just talked about.

“While we are building experienced sharing products and solutions for a much larger addressable market, we feel that the easiest way to gain momentum and the appropriate way, frankly, is to market these improved solutions to our existing community, our existing customer base and lookalike customers, consumers who fit a GoPro customer profile, but haven’t yet purchased from us.” – Nick Woodman, GoPro CEO, Q2 2017 earnings call

Another key element of GoPro’s strategy is to push integration with smartphones so that GoPro devices function like extensions of a smartphone, capturing content that can then be quickly and easily edited, then distributed to contacts and social media sites via all the popular smartphone apps. This makes sense, for now. But within a few years, I think GoPro needs to offer cameras that can connect directly to cellular networks. This would be a big step forward and remove a lot of integration challenges. Apple (AAPL) is working on this very thing with upcoming Apple Watch models. If they can do it in such a small device, GoPro should be able to too.

(Just a side note here: people love to speculate that GoPro will eventually get acquired by somebody like Apple, Amazon (AMZN) or Google (GOOG). Having its devices well integrated with smartphones seems like a step in the right direction, given the importance of hardware and software integration.)

Management guided for 25% revenue growth in Q3 (plus or minus 5%) and EPS of -$0.06 (plus or minus $0.05). Both these numbers are well above consensus estimates, which had projected around 15% revenue growth and EPS of -$0.12.

Another notable strategy from the conference call was that management is saying it plans to constrain inventory for late in the year (i.e., Q4). The idea is to avoid excess inventory, preferably forgoing some potential sales, delivering a profit and being well-positioned for 2018. This strategy makes sense and seems to be the trend with outdoor product companies with high customer loyalty (good luck buying a Patagonia jacket in your size and a good color in December or January!).

The bottom line is that GoPro is guiding for low single-digit revenue growth in 2017. That implies there will be zero revenue growth in Q4 (it had a monster Q4 in 2016 when the company was flooded with inventory). I have to believe that surpassing guidance is almost a gimme. At this point, we all know the company has to under-promise and over-deliver.

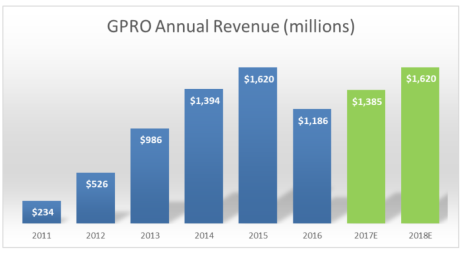

Let’s assume management is allowing plenty of room to beat. Revenue growth could be 30% (to $313 million) in Q3 2017, and 3% in Q4 2017 (to $557 million). This implies 2017 revenue growth of 17% ($1.39 billion). And if you go with the same 17% growth rate in 2018, you get to $1.62 billion in sales. This gets you back to GoPro’s revenue in 2015 (not coincidentally, since I worked the numbers this way!). Presumably, with its reined-in cost structure, EPS would be back in the black, and possibly even above the 2015 level of $0.76.

This might be an overly bullish scenario for GPRO stock. But it doesn’t seem impossible. And frankly, I’d be surprised if management hasn’t talked about how it can accomplish this very goal. It would mean three years to get back “on track.” Which, if management is capable, should be doable.

[author_ad]