Last week, Cabot published a Special Report featuring 10 of the best small-cap cloud computing stocks to buy now. In the report, I wrote broadly about the cloud software market and the opportunity for investors. And I discussed 10 high-potential small-cap cloud software stocks.

But I don’t get into details about how larger software companies are executing their cloud-based growth strategies.

This is what I want to discuss today, since I think it helps illustrate how powerful the SaaS trend is. I also want to reveal three large-cap cloud software stocks to buy.

The Future IS Cloud Software

Cloud computing is changing the world. It is empowering digital transformations, enabling new generations of connected technologies, and changing how people live their lives. It’s not a stretch to say that on-premise software is dead, and cloud software is the future.

It is also powering massive growth in companies across sectors. On average, subscription software companies are expected to grow revenue by over 20% in 2018. That includes a lot of stocks, many of which will grow far faster. Growth rates in the 30%, 50% and 80% range aren’t unheard of.

For investors who like to keep things simple, I believe there are large-cap cloud software stocks you can buy now and hold forever. Here are three at the top of my list.

[text_ad]

3 Large-Cap Cloud Software Stocks to Buy and Hold

Large-Cap Cloud Software Stock #1: Microsoft (MSFT)

Microsoft doesn’t need much of an introduction. The $730 billion market cap company has been around for over four decades and most people are somewhat familiar with what the company is all about.

As you likely know, Microsoft reports results from three divisions; (1) Productivity and Business Processes (30% of revenue, up 25% last quarter), (2) Intelligent Cloud (27% of revenue, up 15% last quarter), and (3) More Personal Computing (42% of revenue, up 2% last quarter).

But it also separates out its cloud businesses, which include Azure (the number-two public cloud platform, behind Amazon), Office 365 and Dynamics 365. And Microsoft reports these Commercial Cloud results to investors separately.

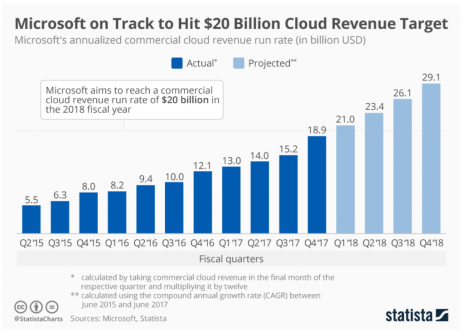

Commercial Cloud shows how well Microsoft is executing its cloud transformation strategy. In terms of cloud growth highlights from the most recent quarter (second quarter of fiscal year 2018), Dynamics 365 revenue was up 67%, Office 365 commercial revenue was up 41% and Azure revenue was up 98%. All in, Commercial Cloud revenue was up 56% to $5.3 billion, and now equals more than 18% of total revenue.

On an annual basis, Commercial Cloud now generates well over $20 billion a year, and is on pace to surpass $32 billion next year. That’s a massive improvement from roughly $2.5 billion back in fiscal year 2014.

Importantly, Commercial Cloud revenue is not only growing, but it is becoming vastly more profitable too. Gross margin in the last quarter was 55%, a 7% improvement from a year ago. As Commercial Cloud continues to grow, and a greater share of revenue comes from recurring sources (most likely more than 50% within five years), Microsoft should be able to maintain its status as one of the leaders in the cloud.

Large-Cap Cloud Software Stock #2: Salesforce.com (CRM)

Salesforce.com was a pioneer of the SaaS business model back in the 1990s and has evolved into a subscription software powerhouse over the last two decades. Revenue growth hasn’t dipped below 24% since 2010. And with a strong finish to fiscal year 2018 (with $10.5 billion in revenue) delivered in late-February, analysts are bullish on the company reaching its goal of $20 billion to $22 billion in revenue by FY 2022.

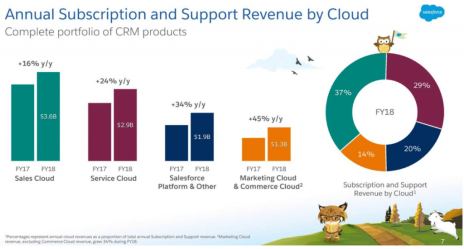

Salesforce.com’s SaaS prowess is best exemplified by looking at its customer relationship management (CRM) solutions, each of which is growing at double digit rates and generating over $1 billion in annual revenue. The biggest, Sales Cloud, grew by 16% to $3.6 billion last year, followed by Service Cloud (up 24% to $2.9 billion), App Cloud (up 34% to $1.9 billion) and Marketing Cloud (up 45% to $1.3 billion).

Salesforce.com isn’t slowing down, and guidance implied it will invest an incremental $1 billion in distribution, security, engineering and partnerships over the next year. While this will pressure margins in the near-term, it will also help the company broaden its solution portfolio to address a larger market and, most likely, solidify Salesforce.com’s notoriety as a full platform solution where customers increasingly adopt a greater number of products (over 75% use four right now).

Large-Cap Cloud Software Stock #3: Autodesk (ADSK)

Autodesk is the smallest company on this list, but with a market cap of $25 billion, it’s still firmly in the large cap space. The company is a leading provider of computer aided design (CAD) software for architecture, construction, engineering, manufacturing media and other entertainment industries.

Like many established software companies (the company was founded in 1982), Autodesk realized it needed to switch to a software-as-a-services (SaaS) delivery model and has been accelerating that process in recent years. The key benefits are increasing recurring revenue streams, further cementing high customer loyalty, and combating rampant piracy of Autodesk software, which surpasses 25% in many developed countries.

Autodesk is adapting well to evolving market trends, with recent investments in mobile and social markets (it acquired Socialcam, Instructables and Pixlr), easily-deployed cloud software product releases (including Cloud 360 platform solutions BIM 360 and Fusion 360), and expansion into adjacent markets (simulation, product lifecycle management) helping it drive annualized recurring revenue (ARR) growth north of 25%. In the fourth quarter of fiscal 2018, management reported ARR was up 25% and should accelerate to 28% to 30% within the next year.

With many companies, the change to a subscription-based business model is messy as subscriber additions fluctuate quarter to quarter. This is the case with Autodesk. Net subscription adds have been volatile (127,000 in the last quarter missed expectations of 159,000), but average revenue per subscriber (ARPS) is trending in the right direction (up 5% last quarter) as adoption rates go up, subscribers pay up for higher priced Collections software and maintenance prices increase.

The bottom line with Autodesk is that, while the process is lumpy, the company is successfully transitioning to a SaaS business model, non-paying users are converting (which helps reduce piracy rates), and management is demonstrating discipline on expenses.

Collectively, over the next two years, these factors should help revenue growth accelerate from just 1% (in FY 2018) to 20% to 30%, drive EPS growth up to 250% to 300% (to $0.88 in FY 2019 and $3.25 in FY 2020), and push free cash flow from around negative $108 million in FY 2018 to positive $1.4 billion in FY 2020.

The Best Small-Cap Cloud Computing Stocks to Buy Now

There is no doubt that the pace of migration to the cloud has accelerated. Even a few years ago, there were discussions about whether a company would move resources to the cloud or if those with on-premise solutions would transition to cloud-based software solutions.

Today, there is no more debate. The questions are more about how to do so than if. Today, every software company out there, regardless of industry, age and growth profile, has embraced a cloud strategy and/or a subscription-based business model of some sort. As a result, industry analysts see subscription software revenue doubling by 2021, when it will make up nearly half of all software-related spending.

We’ve seen Adobe and Microsoft change. And now, Oracle and Autodesk and others are doing the same.

Then, of course, there’s a huge wave of new companies that were founded on cloud strategies and SaaS business models, including many that have generated market-beating returns for Cabot Small-Cap Confidential subscribers.

In my current portfolio, many small-cap cloud software stocks are posting gains well over 100%. We have more than a half-dozen to choose from! And with the returns likely to keep coming, I’ve just written a Special Report, Cabot’s 10 Best Small-Cap Cloud Computing Stocks to Buy Now, featuring 10 more timely opportunities.

Get your copy of this must-have report by clicking here now.

[author_ad]