Given that our Cabot Early Opportunities advisory services focuses on early-stage stocks I’ve spent a good deal of time evaluating the 2021 crop of IPOs.

Potential stock price returns aside, I’m excited by much of what I see. Many of these business offer exposure to large and growing markets that, in my view, investors should have exposure to.

Today I want to review three IPOs for 2022 that I think can deliver significant gains in the year ahead. But before we get to the stocks, a couple quick general notes on investing in IPOs.

[text_ad]

First, it’s critical to recognize that a company doesn’t go public because management just wants to expand the investor base to include you and me. An IPO is usually a liquidity event that allows early investors to cash out part, or all, of their investment. Or it’s a capital raising event that will raise money to keep the business running (not the ideal scenario for new investors) or fund growth initiatives (much more compelling, in my opinion). Investors should expect there to be secondary offerings along the way.

It’s also wise to recognize the difference between a spin-off and an IPO. In a spin-off scenario we see the creation of a pure-play public company that was previously a business unit within a much larger organization. That’s different from companies that have always been independent and are just coming public through a traditional IPO. Spin-offs are often interesting opportunities because these businesses are free to go it alone and seek out their best future, not work within the confines of the company they used to be a part of. There can be a fresh energy that can help them thrive.

Finally, when investing in IPOs, don’t get too hung up on trying to trade the stock and get in at the very best price with one share purchase. It’s far more important to focus on the business and business model, whether you like it or not, and where the business is likely to go in the future. Then average into the stock over time to spread out your cost basis. This is especially important during periods of market volatility, as we’re experiencing now.

3 Hot IPOs for 2022

With that out of the way let’s turn to three IPOs that should serve investors well in 2022 and the years afterward.

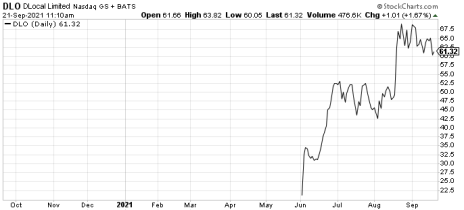

Hot IPO for 2022: dLocal (DLO)

DLocal (DLO) was founded in 2016 and is located in Uruguay. Not surprisingly, the business is heavily skewed toward Latin America, which represents the bulk of dLocal’s payment volume. The company came public in June at 21 and currently has a market cap of around $18 billion.

While dLocal (yes, the “d” is lower case) is a niche player, it has a sophisticated, proprietary platform that addresses pain points for global enterprise merchants that are trying to deal with the complex nature of emerging market e-commerce payments. This is why dLocal has an impressive roster of clients, including Amazon (AMZN), Alphabet (GOOG), Uber (UBER), Netflix (NFLX), Facebook (FB) and Microsoft (MSFT).

These customers and others across retail, streaming, SaaS, advertising, and retail work with dLocal for a couple of reasons. First, because emerging markets represent some of their fastest growing markets (averaging 27% annual growth through 2024). And second, because dLocal connects them to over 600 local payment methods across 30 emerging market geographies (Vietnam, Malaysia and Guatemala just added), all through a single direct API.

Revenue grew by 88% to $104.1 million in 2020. DLocal is seen growing revenue by 111% to $220 million this year (could easily be conservative given the trends) and delivering adjusted EPS of $0.26 (up 160% from last year). That type of top-line growth combined with profitability is a rarity, especially in a recently public company.

Hot IPO for 2022: Telus International (TIXT)

Telus International (TIXT) is a customer care company that serves enterprise clients and their digital customer experiences by designing, building and managing engagement and HR tools that reach end consumers. Examples of services it provides on behalf of clients are sales, after sales support, transaction processing and complaint management.

More specifically, Telus helps clients with lead gen, sales, onboarding, customer acquisition, technical support, welcome and win-back programs, loyalty and retention programs and cross-sell and up-sell opportunities. It has a market cap just north of $9 billion.

Like many customer-care companies, Telus provides voice call center services. But it is differentiated by the fact that more than 50% of revenue comes from other digital services, including video digital experience (virtual assistants, chat bots, etc.), content moderation, omnichannel customer support (chat, email and social, in addition to voice) and IT Services (digital app development).

Telus was spun out of parent company Telus Corporation (TU), one of Canada’s leading telecom providers, in February 2021 and came public at 25. Prior to the spin it functioned as the customer service group within its parent company. Through a series of acquisitions and investments it grew into a significant enterprise, serving over 600 clients with a team of 50,000 people spread across 20 countries and 50 delivery locations.

Given its focus on digital customer experience, it should come as little surprise that Telus is particularly strong in technology and games (47% of revenue), media and communications (25%) and fintech and e-commerce (9%) markets.

The biggest customer by far is previous parent company Telus Corp., which provides around 17% of total revenue (a 10-year contract valued at a minimum of $200 million annually was just signed but is trending toward $300 million). Alphabet, a large social media client, and one other client also contribute roughly 15% of revenue each, meaning the top five clients comprise just over half of all revenue.

Revenue was up 55% to $1.58 billion in 2020 and should be up around 37% to $2.16 billion this year. Adjusted EPS in 2019 was up 50% to $0.39 and is seen up 176% to $0.94 in 2021. Organic growth is solid, but investors should expect that acquisitions will continue to be part of the long-term growth story.

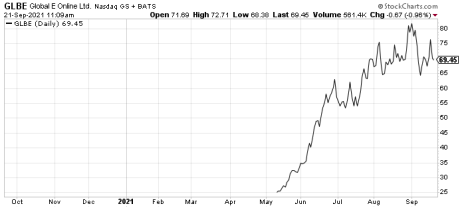

Hot IPO for 2022: Global-E Online (GLBE)

Global-E Online (GLBE) is another global commerce idea. The company has developed a cross-border e-commerce platform that helps businesses sell to consumers all over the world. Cross-border commerce represents a meaningful market opportunity worth nearly $800 billion today. That number would be significantly higher if it wasn’t such a pain in the neck.

The company is on a mission to help businesses sell online in international markets, and to provide a consumer shopping experience that mirrors what people are used to seeing when buying online in their home markets.

This is no small task given the complexities of international sales, which span taxes, duties, delivery, exchange rates, language barriers, local country website variations and more.

Consider what happens if somebody in the U.S. wants to buy a pair of shoes from an Italian company. How do you know if the sizing is accurate? What are the shipping charges? Taxes? When will it arrive? How can you be sure the website is accurately translated and you’re buying the color and material you want? What about reviews? There are so many hurdles to making this a seamless experience.

This is where Global-E comes in. The platform covers the big three categories, tying localized web, payments and fulfillment together into one cohesive package. Businesses on the Global-E platform give consumers a shopping experience they understand and all-in, to-the-front-door product and delivery prices.

Global-E skews toward more established companies, whereas other competitors, including Shopify (SHOP), tend to cater to smaller sellers. Many of Global-E’s 400-plus customers sell luxury, makeup and clothing, and include brands such as Marks & Spencer, Hugo Boss, Cartier, Marc Jacobs, Forever 21, and Versace.

Once customers see how well the platform works, some even hand over domestic operations. This has helped Global-E’s revenue retention rate soar to 140% and drive average cohort growth of 3x. In short, customers spend more money once on the platform because consumers spend more with them.

Regarding Shopify, before it came public in May Global-E landed a three-year partnership with Shopify that includes a revenue share agreement. This program could drive significant growth in 2023 and beyond once it’s up and running, and/or could pave the way for a more formal tie-up of these two companies (as part of the deal SHOP has warrants to buy up to 19.6 million shares of GLBE).

For now, Global-E offers huge growth as an independent company. Revenue jumped 107% to $136.4 million in 2020, is seen up 56% (to $213 million) then growing by above 50% again in 2022. Global-E is not profitable and is expected to deliver adjusted EPS of around -$0.51 this year. It came public in May at 25.

If you want to know what other early-stage growth stocks I’m currently recommending, click here to subscribe to my Cabot Early Opportunities advisory, where we have an average return of 107%.

Have you invested in any recent IPOs? Tell us how they’ve performed in the comments below.

[author_ad]