Last year was a banner year for initial public offerings (IPOs). A total of 397 companies came public in 2021, raising a total of $142.4 billion. That’s far and away the biggest year for public offerings in some time. Since 2013 the second biggest year (2014) was 275 IPOs and $85.3 million raised.

While the market has been tough for many companies that have come public in the last six months – the growth-heavy Renaissance IPO ETF (IPO) is trading 39% off its high and is down 10.5% year-to-date – there are many recent IPO stocks that are performing well.

Here are three from very different industries that caught my attention.

[text_ad]

IPO Stock #1: Dutch Bros. (BROS)

Dutch Bros. (BROS) is an Oregon-based coffee shop that is singularly focused on hot, blended and iced coffee and drive-thru service. It was founded in 1992 and over the last six years Dutch Bros. has grown store locations from 254 to over 470.

The big-picture trend for specialty coffee shops is very strong. The industry is growing at around 7% annually (twice as fast as the broader industry) as consumers increasingly seek coffee options outside of their homes. This is especially true of younger coffee consumers, which make up a large portion of the Dutch Bros customer base.

Because Dutch Bros focused solely on beverages – there are no donuts, pastries, or sandwiches here – the company tends to generate high margins. It also has a proprietary Blue Rebel energy drink that helps in that regard.

Dutch Bros is a growth company. Management is looking to grow the store base more than eightfold to around 4,000 shops, each of which will fall somewhere between 500 – 900 square feet. While it will take many years to build out the store base Dutch Bros’ relatively simple business model, brand recognition and healthy margins could make it a long-term winner.

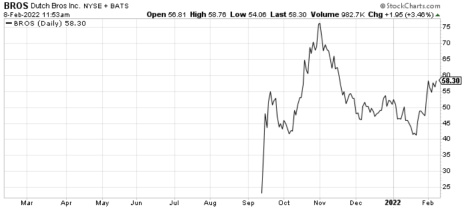

The company came public at 23 on September 15, 2021 and rose 59.5% the first day. Since then BROS is up 144%. The company has a market cap of $2.9 billion and lockup expiration is on March 14.

In 2021, revenue is seen up 50% to $490 million while adjusted EPS is seen up 350% to $0.18. In 2022, revenue is seen up 41% to $690 million while adjusted EPS is seen up 50% to $0.27.

IPO Stock #2: Ryan Specialty Group (RYAN)

Ryan Specialty Group (RYAN) is the second biggest insurance wholesale broker in the U.S. with approximately 20% market share. Only AmWINS Group is larger (30% market share). The company provides specialty products and solutions for insurance brokers, agents and carriers, including distribution, underwriting and product development.

Because Ryan also offers administration and risk management services Ryan acts as a wholesale broker and a managing underwriter.

The big-picture idea behind the company is that wholesale brokerage is a better business than insurance underwriting and should deliver strong, stable growth with attractive profit margins. Ryan is somewhat unique in that it is not affiliated with a retail broker. JP Morgan believes this could help the company leverage its independence, scale and breadth of insurance carrier relationships to gain market share.

The company came public on July 7, 2021 at 23.5 and rose 17% the first day. Shares are up roughly 63% from their IPO price. Lockup expiration was on January 18.

In 2021, revenue is seen rising 40% to $1.43 billion while adjusted EPS is seen up 142% to $1.09. In 2022, revenue is seen up 18% to $1.7 billion while adjusted EPS is seen up 12% to $1.22.

IPO Stock #3: Bridge Investment Group (BRDG)

Bridge Investment Group (BRDG) operates as a real estate investment and property management firm. The company invests in multifamily, senior housing, affordable housing, medical properties and office space. Bridge also offers a variety of property services, including property management, insurance and financing. These services help the company generate proprietary data that can help it source and price property investments. Bridge’s data-driven approach helps set the company apart from smaller mom and pop type outfits.

While Bridge is much smaller than larger (and better-known) peers Blackstone (BX) and Invesco the company has a history of generating very strong investment returns. Most of its funds have been top-quartile performers.

Bridge has a market cap of $614 million and lockup expiration was on January 12.

Bridge came public on July 16, 2021 at 16 and closed down 2% that day. Shares have worked themselves higher over the last seven months and are now up roughly 40%. Bridge has a market cap of $570 million and offers investors a 4.2% yield.

A quick final note on investing in IPOs.

Don’t get too hung up on trying to trade the stock and get in at the very best price with one share purchase. It’s far more important to focus on the business and business model, whether you like it or not, and where the business is likely to go in the future. Then average into the stock over time to spread out your cost basis. This is especially important during periods of market volatility, as we’re experiencing now.

[author_ad]