Nine months ago, I wrote an article entitled The Best Small Cap Dividend Stocks to Buy Now, featuring three small-cap dividend stocks I thought could work for your portfolio. Given the strength in the market in 2016, and especially since President Trump was elected, I figured it was a good time to revisit these stocks to see if they are still good buys.

Small Caps Lead the Market

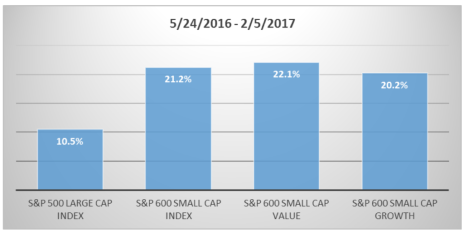

I should note that in the nine months since I wrote the article, the broad market (as measured by the S&P 500) is up by 10.5%. Small cap stocks, as measured by the S&P 600, have outperformed by a factor of two, rising by 21.2%. And small cap value (up 22.1%) has outperformed small cap growth (up 20.2%) by almost 2%.

That performance helps to validate the general premise of my original article, which I summed up by saying, “While small cap dividend stocks don’t always make for juicy storylines, the fact is that many of the best performers in the stock market today are these little income producers. And if you have the willpower to stick with them, you may easily find their performance rivals that of the best performing growth stocks in the market.”

That assertion was backed up by two compelling studies suggesting small-cap dividend stocks outperform over the long term. I won’t restate the data again since you can find it by following the link above to my initial article. But I will restate one of the critical caveats you should consider any time you’re relying on index data, and especially index data for small cap stocks.

And that is that analysis of small cap index data is prone to migration error, which is when a stock moves up (or down) from one index to the next. This is a particularly prevalent problem with small caps because, especially over longer timeframes, many good performing small cap stocks graduate up to a mid-cap index, and possibly even on to a large cap index (some move down as well).

[text_ad use_post='129618']

I highlight this because one of our holdings in Cabot Small-Cap Confidential just moved up to the S&P 400 Mid-Cap Index from the S&P 600 Small-Cap Index. This is great news for subscribers because it means the company has officially grown out of the small cap asset class due to a rising share price and market cap. We’ve elected to hold the position for a very simple reason - it’s still going up! But if we held shares in an ETF tracking the small cap index, and not the stock itself, we would lose our exposure. That’s because the ETF would have to sell out of its position since the stock would no longer be part of the underlying index it’s designed to track.

That’s the problem with index analysis. And it’s somewhat ironic that outperformance - the very reason investors should be attracted to small cap stocks - can actually hurt performance of the asset class over the long term. One way to get around the migration error issue is to buy individual small cap stocks, like the three I featured nine months ago.

My Small Cap Dividend Stocks: 34% Gain in Nine Months

What were they, and how did they perform?

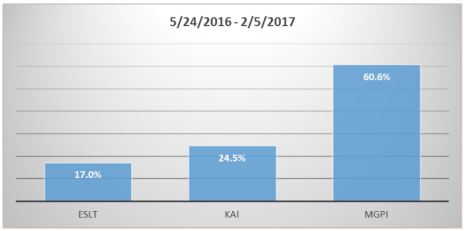

The three stocks were Elbit Systems (ESLT), Kadant (KAI) and MGP Ingredients (MGPI). All three beat the broad market, and two (Kadant and MGP Ingredients) beat both the small cap index and the small cap value index. The simple average gain of the three positions was 34%.

Here’s what I wrote about them, as well as a brief update on each stock.

Elbit Systems (ESLT)

Elbit Systems is a stock I’ve followed since 2014. I described it nine months ago as “…a defense contractor, though some of its technologies are finding their way into consumer goods. It recently spun out a company called Everysight, which is making wearable technologies for consumes. The first product is a set of augmented display smart glasses designed for cyclists. Elbit does a lot of things. It is the market leader in advanced fighter jet and rotary wing helmet mounted display systems. It is the world’s largest manufacturer of drones. It makes components for aircraft, helicopters, tanks and other land-based vehicles. It makes flight simulators. And it’s also the largest electro-optics company outside of the U.S., making devices for gathering intelligence, identifying targets and protecting soldiers for the U.S. Marines, the U.S. Navy, NATO forces and the Israel Defense Forces. In other words, if it can swim, fly or roll, Elbit Systems are probably make it better. The company is a modest grower, but is profitable and pays a dividend of 1.8%.”

After rising by 17%, Elbit now has a market cap of $4.7 billion and the dividend yield has fallen to 1.4%. Growth remains modest but solid, with revenues up by 7% in Q2 2016 and 2% in Q3 2016, and EPS up by 18% and 0%, respectively. At the end of Q3, Elbit’s backlog was up by 6.5% to $6.8 billion. Elbit continues to spin out technologies into consumer-oriented businesses, and in 2016 it completed two such spin outs, the second of which resulted in a $10.5 million gain in Q3. There is very little analyst coverage on Elbit even though it’s grown into the mid-cap asset class category. I still like it, and continue to follow it since it’s doubled since I first began following it in early 2014. Over the course of this multi-year rally shares have traded in a relatively well defined channel, and the best buys have typically been around the 50-day moving average line. Given that the stock is almost 10 points above that now I’d recommend waiting for a pullback to buy, perhaps in the 100 to 105 range.

Kadant (KAI)

I described Kadant as an “…industrial company that makes equipment and consumables for making paper and engineered wood. Like many industrials, it’s not a particularly interesting company. But the stock has more than doubled over the last four years and has been on fire in 2016, rising 29% year-to-date. It might be worth looking past the details of Kadant’s pulping, filtration, condensing and chipping equipment and focusing more on stock performance. And, of course, dividend payments and share repurchases. The stock yields 1.6% today, and management has increased the dividend from $0.125 per quarter in 2013 (when it initiated the dividend) to $0.19 per quarter today. Management has also just re-upped the $20 million share repurchase plan that was set to expire on May 18, 2016. They had repurchased $5.9 million worth of stock, but now have another $20 million to go. Kadant has a market cap of $530 million.”

Today, Kadant has a market cap of $670 million, still pays an annual dividend of $0.76, and is still the relatively boring company it was nine months ago. It has also beaten expectations on both revenue and EPS over the last two quarters. In Q2 2016, revenue grew by 13.7% and EPS of $0.88 beat by $0.23. In Q3 revenue grew by 14.8% while EPS of $0.81 beat by $0.16. Looking forward, analysts see 2017 revenue growth of 7% and EPS growth of 14% to $3.48. It has also announced that it will expand a business acquired in early 2016, focused on designing and manufacturing balers for the recycling industry. Kadant is the type of company I tend to like a lot – it goes about its business without much fanfare. It’s trading near its 50-day moving average and with a forward PE of 17.6 (lower than the small cap index) it still looks like a reasonably valued stock to me.

MGP Ingredients (MGPI)

I described MGP Ingredients as “…quite possibly the least known food and beverage company in the country. The company makes food ingredients (specialty wheat proteins and starches) and distilled spirits (bourbon, whiskey, vodka and gin). With the spirits business making up nearly 90% of revenue, it’s really in the business of making alcohol. And that business is about as steady as they come. The company is far from being a growth stock (revenue growth in 2015 was 4.5%), but it has been a long-time dividend payer and has been increasingly profitable since re-focusing its business in 2013. Last year it delivered EPS of 1.48, and was also added to the Russell 2000 Small Cap Index.”

When I wrote that MGP Ingredients paid an annual dividend of $0.08, had a market cap of $450 million and was the largest supplier of rye whiskey and distilled gin in the U.S. It was enjoying growing demand picking for premium and craft spirits, and was placing less emphasis on its lower margin industrial alcohol business. The company had recently introduced its own branded products, including the limited edition Metze’s Select Indiana Straight Bourbon Whiskey, which launched in the third quarter of 2015 at $75.00 a bottle.

Nine months later, MGP Ingredients is still paying an annual dividend of $0.08, but has a market cap of $738 million. Revenues haven’t grown over the last two quarters (down 6% in Q2 and flat in Q3), but EPS did jump by 45% to $0.55 (beating by $0.24, in large part due to non-recurring items) in Q3. I highlighted growth in profit margins, but not revenue growth, in my original piece. And indeed, MGP’s net margin hit an all-time high of 11.9% in Q3. Management suggested that over the next three years operating income should grow by 10% to 15%. And that it added $4.7 million to its inventory of aging whiskey, bringing the total value up to $45 million. It also purchased a bourbon brand, George Remus.

Opinion on the stock varies widely from very bullish to very bearish. I think the market for craft alcohol will be long and strong. And it appears that MGP is a great way to have some pure-play exposure. That said, I recommend passing on new purchases right now and even taking some partial profits on the position, simply to remove some risk after a nice run.

How to Beat the Market, Without Excessive Risk

I don’t cover a lot of small cap dividend stocks in Cabot Small-Cap Confidential. I’m mainly focused on growth. But as these three stocks show, small cap dividend stocks can deliver superior returns.

One of the few that I cover in Cabot Small-Cap Confidential is doing just that, and is currently beating the small cap index by 20% since I recommended it. That’s not as good as the 50% outperformance from some of our other positions, but it’s still very good! If you’d like to find out how we’re delivering gains that best the broad market, without taking on excessive risk, sign up for a trial subscription to Cabot Small-Cap Confidential today. My latest recommendation was sent to subscribers on Friday. So don’t miss out on finding the name of the next market winner.

[author_ad]