Small-Cap Energy Stocks Rally 20%

Small-cap energy stocks have been leading the market higher on news that OPEC reached a deal to curb oil output in 2017. I detailed that announcement last week, and suggested that investors add a little exposure to small-cap energy stocks at the time, then wait until this past weekend’s meeting between OPEC and non-OPEC producers in Vienna to consider adding a little more. My reasoning was that this second meeting would shed some light on the viability of a coordinated effort, which is necessary to combat the global oil glut and provide price stability in the $55 to $60 a barrel range (for starters).

It appears that Saturday’s meeting went well. Non-OPEC producers, including Russia, agreed to cut production by 558,000 barrels a day. That, combined with OPEC production cuts of 1.2 million barrels, should reduce global supply by roughly 2% starting in January 2017. While compliance will be a challenge, the immediate reaction to the news sent the price of oil up over 3% on Monday, to 54.17.

[text_ad]

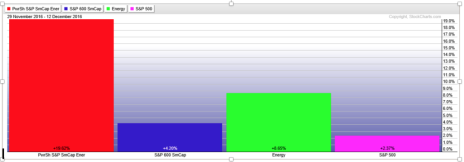

That move helped small-cap energy stocks maintain their rally. Over the past two weeks, the small-cap energy sector is up 19.6%, outpacing the broader small cap sector (up 4.2%), the large cap energy sector (up 8.7%) and the S&P 500 (up 2.4%).

Last week I gave some clues about the recovering small-cap energy stock that Cabot Small-Cap Confidential subscribers have been buying to play the trend. This week I thought I’d add three more under-followed small-cap energy stocks to your list of potential buys.

For the record, I’m not officially endorsing any of these three. And none are oil producers. They are relatively high-risk, high-reward stocks that develop oil exploration technologies and/or provide services to exploration and energy infrastructure companies. There’s not a lot of analyst coverage, meaning investors must rely on independent research to understand ongoing developments. Let’s look at the least speculative one first.

Small-Cap Energy Stock #1: Badger Daylighting (BADFF)

Badger Daylighting is $1.3 billion market cap Canadian-based provider of non-destructive daylighting services. It uses purpose-built trucks, called hydrovacs, with high-pressure water nozzles and vacuum systems to blast soil, dirt and rock out of holes, then suck it away. The system can be much more efficient than hand or machine-excavation, especially around existing underground utilities. And it’s very handy for making a neat and tidy trench, which is preferable to a beat-up excavation site.

Badger’s hydrovacs can excavate 50 feet down into the ground, and the equipment reaches 500 feet away from the Badger unit, which resembles the offspring of a cement truck and a recycling truck. Hydrovac manufacturing is completed in-house, and the company operates just over 1,000 trucks in North America (675 in the U.S. and 353 in Canada).

The company and the stock were going gangbusters until 2014 when oversupply caused the price of oil to plummet and producers slashed investment. Revenue topped out at $405 million in 2015, and analysts expect that to drop by roughly 25% this year and for EPS to fall by 54%, to $0.68 (on the bright side, it’s a profitable company). But upgrades are pouring in and consensus estimates now point toward revenue and EPS growth of 13% and 57% in 2017, respectively. You can buy the stock on the Toronto exchange (ticker symbol BAD.TO), or through U.S. market makers (ticker symbol BADFF). It’s been a favorite in Fidelity small-cap mutual funds in the past.

Small-Cap Energy Stock #2: Energy Recovery (ERII)

Energy Recovery is a $585 million market cap company that makes an assortment of energy recovery and water desalination devices. Its technologies are focused on pressure energy, working to eliminate or preserve pumps (which are subject to breakage by corrosive fluids), or convert wasted pressure energy into usable energy. Its desalination solution is a pressure exchanger that is used in over 17,000 locations around the world. For the oil and gas markets, it has three solutions: IsoBoost and IsoGen for gas processing, pipeline and ammonia applications, and VorTeq for hydraulic fracturing applications.

VorTeq has been the headline solution given the October 2015 news of a 15-year deal with Schlumberger (SLB) to provide exclusive rights to Energy Recovery’s VorTeq hydraulic pumping system. The core advantage of VorTeq is that it reduces wear and tear on traditional fracking equipment, and reduces drilling and production costs.

News of the Schlumberger deal sent shares of Energy Recovery skyward, from around 2.50 to over 7. Throughout 2016, the stock has traded in a wide range, and peaked at just over 16 in late-September. A pullback brought it down to 12 in early-November. Then news that the first milestone for commercializing with Schlumberger would be pushed to 2017 (due to vibration issues) slashed the stock by over 20%.

The main concern is that the disruptive technology won’t work as advertised, and that the 375%-plus gain in shares since the deal’s announcement places the stock at the edge of a massive cliff. On the other hand, it is a new technology and management has all hands on deck working to solve the engineering challenges. The near-term performance of the stock depends on the Schlumberger partnership moving forward, so I suggest putting this one on a watch list until more is known. If Energy Recovery gets VorTeq up to snuff, and Schlumberger ramps up its business, then the small-cap energy stock could be in for a nice run in 2017. But I don’t think you don’t need to buy it until the technology gets the green light from Schlumberger.

Small-Cap Energy Stock #3: Mitcham Industries (MIND)

Mitcham Industries is a way to play a potential up-tick in global oil exploration (over 85% of revenue comes from outside the U.S.). The company rents and sells seismic equipment to surveying contractors (27% of sales), and manufactures marine seismic, oceanographic and hydrographic equipment (73% of sales). When contractors aren’t being hired to seek out new deposits and/or refine existing ones, the seismic equipment sits on a shelf. And that harsh reality is reflected in Mitcham’s revenues, which have been cut in half over the past three years.

At its best moment in 2012, Mitcham was a 26 stock. Today, it trades just under 4, and has a market cap of under $60 million. The stock had been drifting lower as oil exploration languished. But investors looking for deep values have driven shares up 35% over the past 3.5 months. The small-cap energy stock’s action reflects the hugely cyclical nature of its revenue streams. It’s always on my radar since it can deliver very big gains when it’s working. For instance, it delivered a 500% return over a three-year period (2009–2012) after the last oil crash.

So, what’s the outlook now? Management says it’s seeing more potential in its equipment manufacturing division, which was helped by the 2015 acquisition of Klein from L-3 Communication. That purchase helped to diversify the business by adding sonar and waterside security systems for military customers. Revenue growth could reach 30% next year, and while EPS is still likely to be negative, it should improve by around 80%, to -$0.20. Of course, there is both upside and downside to those figures, depending on where the price of oil goes.

Details Matter with Small Caps

If the market is right in predicting that OPEC and non-OPEC producers have reached a viable deal to cut production, and they re-up the deal after OPEC’s May 25, 2017 meeting, small-cap energy stocks should be in for an extended run. If so, I expect all three of these stocks will deliver handsome returns.

That said, their management teams will have to make the right moves to capitalize on the opportunities in front of them. These aren’t diversified large caps that can absorb managerial missteps easily. Every deal and every dollar counts. That’s why it’s critical that investors keep a close eye on all developments relevant to their small-cap stock holdings.

And it’s why I do the heavy lifting for Cabot Small-Cap Confidential subscribers, publishing in-depth research reports, weekly updates and special bulletins that detail all the news relevant to our positions. If you’re interested in capturing market-beating gains from small-cap stocks, but don’t want to do the legwork yourself, you should jump on a subscription to Cabot Small-Cap Confidential. Our most recent addition, from December 2, is already up over 10%. And every stock is selected for it’s potential to double within two years.

[author_ad]