In a surprisingly busy year for new public companies, these have been the best IPOs of 2020.

This has been a great year for those of us who focus on early-stage stocks. The IPO market is as strong as it’s been at any point over the last six years. Even if all the companies coming public aren’t great buys right this minute, collectively they are recharging the pipeline of potential opportunities. That means plenty of fresh ideas for investors to consider buying in the coming months.

Consider these statistics.

Year-to-date we’ve seen 172 IPOs. That’s 12 more than all of 2019 and just 20 shy of the 192 IPOs in 2018, which was the most active year since 2014 (when 275 came public). Given a full pipeline of IPOs in the coming months it’s still possible that 2020 could be a six-year high for IPOs.

Today I want to talk about five best IPOs of 2020 (so far). But before we get to that, a couple of quick notes on IPOs in general, as well as a strategy for balancing the risk and reward of investing in them.

[text_ad]

First, what we’ve seen recently is that the bulk of IPO gains are coming on their first day of trading. That means there’s no rush to buy into a full position in these stocks. You can’t get the same price as the big institutional buyers on day one, so don’t bother trying. Often, after a few days or weeks of gains, you’ll see newly-public stocks pull back and offer a better buying window.

Second, it’s critical to recognize that when a company goes public it’s usually a liquidity event that allows early investors and/or employees to cash out part of their investment and/or stock options. Or it’s a capital raising event that will raise money to keep the business running and fund growth initiatives.

In other words, one needs to consider the potential impacts of the IPO – both positive and negative – on the company and the stock.

Finally, when investing in IPOs don’t get hung up on trying to trade the stock and get in at the very best price. I personally don’t think that’s going to work out with any consistency. A better approach is to seek out businesses that interest you, and average into them over time. That might mean buying some shares on the first day and throughout the first week or two, as well as in the months afterward when many IPOs give back some of their initial gains.

Remember, if you’re an investor and not a trader, you’re buying a slice of the business, not just a name. If you’re a trader, different rules apply. But I’m not going to get into that today since I want to get to the stocks.

The 5 Best IPOs of 2020

Best IPOs of 2020 #1: Laird Superfood (LSF)

Laird Superfood is a packaged food company that’s partially backed by Laird Hamilton, one of the biggest names in surfing. The company offers powdered coffee creamers, instant coffees, coffee beans, plant-based protein powders, snacks and other supplements. It has been rolling out new products quickly, both before and after its IPO on September 3, 2020. LSF jumped 85% from its IPO price of 22 on its first day of trading.

With a market cap of just under $500 million this is the type of company that can fly under the radar for a while, but do quite well as it gains space on grocery and specialty store shelves. I wouldn’t be surprised if it has a market cap of a couple billion dollars in a few years and has highly visible displays in larger grocery chains and a very successful direct-to-consumer website. I’ve been using the powdered coffee creamer off and on for a few years and think it’s quite good. Laird Superfood sells on Amazon and through its own website. The latter is where you’ll get better pricing.

Laird’s IPO filing shows revenue was up 58% in 2019. Analysts currently see a similar rate of growth this year, to $20 million, then a roughly doubling of revenue in 2021. The company is not profitable and based on current estimates is seen delivering adjusted EPS of -$2.28 this year and -$1.10 in 2021. Third-quarter results are coming out on November 12.

Best IPO of 2020 #2: Accolade (ACCD)

Accolade (ACCD) is a digital healthcare company with a platform that helps members navigate the healthcare system, make better decisions for their healthcare and benefits needs, and control costs. It achieves this through use of cloud-based technology, data-driven insights and the support of Accolade Health Assistants and Clinicians. Accolade does not provide care. Founded in 2007, it came public on July 2 at 22 and jumped 35% the first day.

The company’s primary customers are enterprise-scale (1,000+ employees) companies with self-insured healthcare programs, also known as ASO (Administrative Services Only) plans. However, recently Accolade has begun to offer solutions for slightly smaller companies that don’t want to ditch their existing insurance carrier. Altogether, Accolade is now going after more than $16 billion in self-insured spending that covers nearly 160 million lives.

Accolade has a market cap just under $2 billion and is based in Seattle, Washington. Revenue grew by 40% to $133 million in 2019. Accolade is not profitable and lost $1.05 per share last fiscal year. Consensus estimates suggest Accolade should grow revenue by around 21% this year (fiscal 2021), 25% next year and 30% in fiscal 2023.

Best IPO of 2020 #3: GoodRx Holdings (GDRX)

GoodRx offers a platform that helps consumers get lower prices on their prescription drugs. According to management, drug prices can vary wildly between pharmacies, even those that are across the street from one another. The platform evaluates current prices and discounts to help users get the best deal. It has partnerships across the healthcare system that allows it to run 150 billion pricing data points every day.

This seems like a big idea that could catch on with both consumers and investors. The growth is certainly there. In 2019 revenue was up 56% and it is on pace to grow by almost 40% this year. Contrary to many newly-public companies GoodRx is profitable. Adjusted EPS was $0.17 in 2019 and is seen rising by 124% to $0.38 this year. GoodRx has a market cap of $21 billion and went public at 33 on September 9. It rose 53% on its first day.

Best IPO of 2020 #4: Unity Software (U)

Unity Software (U) has developed the leading platform for creating and operating interactive, real time 3D content. The platform is used by game developers, architects, automotive designers, filmmakers and more to bring their creations to life. Unity offers a full suite of software solutions to run and monetize 2D and 3D content for mobile phones, tablets, PCs, consoles, and augmented and virtual reality devices.

Unity recently received a vote of confidence from Wedbush, who placed a 125 price target on shares. Unity is a little larger than many other IPOs given its nearly $27 billion market cap. Revenue growth isn’t off the charts but is still impressive at this scale. The company grew sales by 42% in 2019 and is on pace to grow by 37%, to $740 million, this year. It is not profitable. Adjusted EPS should be around -$0.47 this year then -$0.34 in 2021.

Unity went public at 52 on September 18 and jumped 31% the first day.

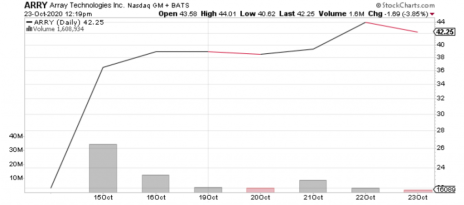

Best IPO of 2020 #5: Array Technologies (ARRY)

Array is a nuts and bolts type of clean energy stock that was brought public by Goldman Sachs and JPMorgan on October 15 at 22. It jumped 66% on the first day. The company is one of the world’s largest manufacturers of ground-mounting systems used in solar energy projects. Array’s main product is a single axis “tracker,” which is the system of supports, electric motors, gear boxes and electronics that support the panels and orient them toward the sun. Management says its equipment contributes 10% to 15% of the cost of a ground-mounted solar array.

To state the obvious, this stock will do well if solar arrays continue to be built, which the trends suggest will occur. This stock, like a lot of clean energy stocks, may do better under a Joe Biden presidency than a Donald Trump one, though these days the market is offering up all sorts of surprises. Array is growing very quickly and its IPO filings show it was profitable in 2019, when revenue was up 123% to $648 million and adjusted EPS was $0.60. Array has a market cap of $5.6 billion.

Those are my five favorite IPOs of 2020 thus far. If you want to know what other early-stage stocks I currently recommend, you can take out a subscription to my Cabot Early Opportunities advisory. I launched it a year ago, and the stocks presently in my portfolio have an average return of 74% since I recommended them to my readers.

To learn how to become one of them, click here.

[author_ad]