In the beginning of 2016, I recommended that Cabot Small-Cap Confidential subscribers buy a small-cap stock with a compelling software-as-a-service (SaaS) business model.

At the time, the company had a market cap of more than $2 billion, which is larger than most of the small caps I recommend. But the broad market was melting down at the time, and that I knew that this was a quality company selling at a fire-sale price. So we jumped on the opportunity to buy one of the market’s best SaaS stocks before it disappeared.

I’ll get to the name of that stock, what it does and how shares are doing in just a minute. First, I want to talk about how looking back at that trade can provide some useful lessons.

We’ve seen some crazy swings in the market this month. Maybe we’re out of the woods. Maybe we’re not. Either way, looking back at past periods of intense volatility can help you make good decisions today.

A Measured Approach to Market Volatility

What was the state of the market in early 2016?

[text_ad]

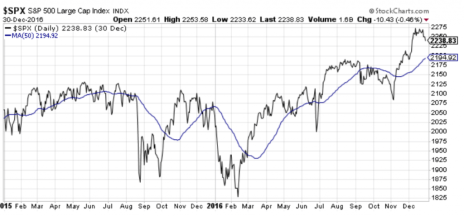

The market had fallen apart in August 2015, but then recovered quickly. That recovery soon fell apart, however, and in early 2016, the S&P 500 tested its previous low. It looked poised to go even lower but firmed up and ended up having a good year.

The pattern was a little different with the S&P 600 Small Cap Index, which didn’t fall as much in August, but broke well below its 2015 trading range in the beginning of 2016. Just like large caps, small caps came roaring back, then rallied throughout the year and on into 2017.

Like most investors, I didn’t know if the market was going to recover in early 2016. But my research led me to believe that 2016 would ultimately be a good year, and that focusing on quality small-cap stocks with stable revenue streams would reduce downside risk and position subscribers to profit when the volatility was over.

On January 15, 2016, I wrote to subscribers, “At this point, it’s a guessing game as far as trying to predict the market’s near-term direction. We need to work through this volatility by trying to stick with what works and avoiding what doesn’t. I think we’ll ultimately have a good year—the 8% decline in small caps year-to-date only increases the return potential of newly established positions by year-end, assuming small caps can return to the 2015 highs (I think they can).”

It seemed things were tilted more toward a strengthening market than a weakening one, so we pulled the trigger on one of the best SaaS stocks on the market. That company is LogMeIn (LOGM). This is what the chart looked like when Cabot Small-Cap Confidential subscribers received the buy alert and research report.

That’s not a particularly great-looking chart! But as I said, history suggested this was a quality company selling at a fire-sale price.

This is what LOGM’s chart looks like since we jumped on board.

Buy Stocks When They’re on Sale

Since we added LogMeIn to our portfolio, the stock is up around 102%. The trade sticks in my mind because it required conviction to step in and buy, given what its chart looked like and what was going on in the broad market at the time.

The takeaway lesson is that when volatility strikes, you need to have a position on where you think the market will go once it subsides (there are a number of fine analysts here at Cabot that you can rely on to help you establish that position).

Once you have that position, you need to act accordingly. If you think stocks are going to go down, you should lighten up. If you think they will go up, you should pick your points and buy. Your position should evolve along with the market and the evidence in front of you. The point isn’t to be perfectly right, and to pick tops and bottoms, but to be right more often than you’re wrong, and through a measured buy and sell methodology, try and take advantage of the volatility.

What does LogMeIn (LOGM) do?

This is how I described the company to Cabot Small-Cap Confidential subscribers on January 8, 2016:

“If you need to connect to a person, place or thing, LogMeIn (LOGM) has you covered. The company is a leading pure-play provider of collaboration software and applications that allow people and devices to connect from anywhere in the world with an internet connection. Its cloud-based services empower people to work remotely, host and/or attend web-based meetings, access and control remote computers, provide web-based customer service and support and set-up and maintain IT resources …

“Since introducing its first product in 2004, LogMeIn’s simple and intuitive services have freed millions of people from the constraints of location-specific work environments and have connected over 300 million devices around the globe. The simple, yet powerful premise underlying its growth - if everything is connected, anything is possible – has only become more relevant (and valuable) in today’s economy, where physical proximity to co-workers, customers and computing resources is far less important than productivity…

“LogMeIn offers simple and convenient products that are easy to try, buy and use for everyone from the average consumer with basic needs to the IT professional managing complex internet-enabled devices and networks … The company’s first product was a cloud-based software-as-a-service (SaaS) that offered working professionals and IT service providers remote connections to a computer, thereby allowing a user access to files, applications and support. In the decade since, LogMeIn has scaled and expanded its SaaS offerings to include more than a dozen products centered around collaboration, customer service, IT management and, recently, connected product development.”

Since I wrote that, a lot has changed at LogMeIn, but it’s still the high-quality SaaS company that I recommended two years ago.

The biggest changes are that it now owns the GoTo business previously run by Citrix (CTXS). This deal was closed just over a year ago and helped turn LogMeIn into one of the world’s top-10 public SaaS companies, with expected 2018 revenue of more than $1.1 billion.

As a much larger company now, LogMeIn won’t be growing as quickly as it was two years ago. But there’s potential for annual growth to approach 18% in 2018 and 10% in 2019, and possibly more if the recent $342 million acquisition of Jive Communications, a provider of cloud-based phone systems and Unified Communications services, helps spur cross-selling in the collaboration segment.

A lot more has changed at the company, but the bottom line is that LogMeIn’s management team continues to make good decisions and execute above expectations. That’s impressive given the team has been taking on major initiatives relative to the size of the company, including significant M&A. And when you want to stick with a relatively small company for the long-term, you often need to trust that the management team will make good decisions. LogMeIn’s management team has earned that trust, in my book.

Will we continue to hold the stock?

For now, yes. We took partial profits in the stock when we had around a 50% gain. And we’re holding on to the other half for as long as possible, as long as nothing big changes for the worse. I won’t move it back to Buy because LogMeIn now has a market cap of over $6 billion. That’s too big for new purchases in our portfolio.

The Best SaaS Stocks to Buy Today

Hopefully we have several more “LogMeIns” in our current portfolio, which features eight small-cap cloud software stocks (and more to come!). Not all these SaaS stocks will soar in the years ahead, but by continuing to focus on quality companies with solid revenue streams, and taking a measured approach to buying (including adding exposure during periods of volatility), we’ve been able to do better than the broad market. Even with this recent pullback, our stocks are still beating their benchmark by an average of 27%!

If you’re interested in gaining access to my research on the best SaaS stocks and other small cap stocks, including Buy and Sell price targets, consider becoming a regular subscriber. Just click here to get started now.

[author_ad]