Small Cap Stocks Rallied 25% in 2016

The performance of small cap stocks in 2016 was nothing short of phenomenal. The asset class rallied by 25%, delivering more than twice the return of the S&P 500, which rose by 9.5%. At the end of 2015, I detailed a number of reasons I thought small caps were poised to outperform in 2016. But my conclusion, that the asset class would deliver a 15% return, proved to be far too conservative (not necessarily a bad thing!). And the best small cap stocks performed far better than that.

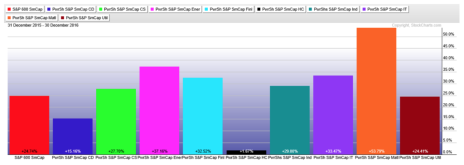

One of the main drivers of small-cap outperformance over the past year (and especially since the U.S. election) was strength in previously underperforming sectors, mainly energy, industrials and materials. While small-cap financials and technology also helped pull the average up, cyclicals were the best small cap stocks, with sector returns of 54% (materials), 37% (energy) and 29% (industrials) in 2016.

The Five Best Small Cap Stocks May Surprise You

I wanted to dig a little deeper, so I downloaded the 2016 calendar-year performance of all 600 stocks in the S&P 600 Small Cap Stock index to see exactly how the chips fell. I expected to find a few cyclical stocks topping the list, but I wasn’t expecting as many as I found. As it turns out, each of the five best small cap stocks from 2016 were cyclicals. And there were several more in the top 20.

Here were the five best small cap stocks from 2016.

Best Small Cap Stock #1: AK Steel Holding (AKS) +355%

This was a recovery play that gathered steam as the company refinanced debt and returned to positive earnings in the second quarter. Shareholders were also encouraged by the U.S. Commerce Department’s investigation of dumping and unfair subsidies for stainless steel (from China) and cold-rolled steel (from Brazil, South Korea, India, Russia and the U.K.). But shares really took off after the election, given that Trump is potentially bullish for U.S. steel fundamentals and tighter enforcement of U.S. trade laws. A surge in raw material prices and AK’s ability to hike prices several times in the second half of the year also helped—as did improving demand from the auto and energy sectors.

AK’s revenue will likely be down 12% in 2016, but grow by 5% in 2017, while EPS should grow by around 200% each year. In 2015, revenue by end market was 60% automotive, 24% distributors and converters, and 16% infrastructure and manufacturing. Revenue by product was 71% carbon steel, 26% stainless steel/electrical and 3% tubular steel.

[text_ad use_post='129618']

Best Small Cap Stock #2: SunCoke Energy (SXC) +226%

Shares of this metallurgical coal producer followed a recovery trend similar to AK Steel’s. Namely, a big drop in 2015 followed by a quick turnaround in 2016, and a big jump after the November election. This isn’t entirely a coincidence—SunCoke generated 94% of revenue from three steel producers in 2015, including 29% from AK Steel. Also not surprising is that the company’s revenue and profit trend is directionally similar to AK Steel’s.

In 2016, revenue will likely be flat compared to 2015, but should expand by 28% in 2017. Earnings will contract by around 65% (to $0.06) in 2016, but then should explode by 760% to $0.52 in 2017. Take those estimates with a grain of salt, however. In October, the company announced its intention to acquire its remaining stake in SunCoke Energy Partners, LP, and that proposed acquisition has raised a few eyebrows. I wouldn’t mess around with this one unless you feel compelled to really dig into the details and follow it closely.

Best Small Cap Stock #3: Pioneer Energy Services (PES) +215%

Once again, one of the best small caps was crushed in 2015 before recovering in 2016. In the case of Pioneer Energy Services, which provides contract land drilling services, the recovery has a way to go before many investors are “whole.” The stock traded above 18 in 2008, 2011 and 2014, but even after a 215% rally last year, the stock is still only in the mid 6s. Obviously, it’s a cyclical play, so be sure to factor that into any purchase decisions. The 2014 to 2016 downturn was arguably the worst in 30 years, and was bad enough to send this stock well below its 2009 low (the 2016 low was 0.95).

That said, full recovery (in stocks, not just the industry) could extend for several years. And for Pioneer, two years of 49% revenue contraction in 2015 and 2016 will be nice to have in the rearview mirror. In 2017, revenue growth could reach 40% and EPS could improve by 32% (to -$0.82). The company should be in a better position to address the recovery with a public offering in early December that resulted in roughly 20% dilution, but raised $65.4 million.

Best Small Cap Stock #4: US Silica Holdings (SLCA) +202%

Another cyclical energy play, US Silica’s 2016 rally was as impressive as its 2014 meltdown. That year, the stock moved from around 30 up to 70, before plummeting back to 25 by year-end as energy-sector demand for its silica sand proppants (used to improve flow rates from wells) dried up. The next year, 2015, wasn’t any better as shares slid below 15. But nearly everything related to the sand industry improved in 2016—from demand to the amount of sand used per well to pricing—and that helped fuel an industry-wide rally.

With a 202% rise, US Silica actually lagged smaller peer Hi-Crush Partners (HCLP), which is not in the S&P 600, but outperformed the much smaller Emerge Energy Services (EMES). The much smaller Vancouver, Canada-listed frack sand provider Select Sands (SNS.V, SLSDF) was also a strong performer, rising by 150% last year. These are not buy and hold stocks as one look at any of their respective charts shows that they will all rise and fall depending on drilling and completion activity. But as the performance in 2016 shows, when they work, they really work!

Best Small Cap Stock #5: Titan International (TWI) +184%

Titan makes tires and rims for the agriculture (45% of sales), mining and construction (42% of sales) and off-road consumer (13% of revenue) industries, so its fortunes rise and fall accordingly. The downturn in mining and, to some degree, global agriculture, took a toll on the stock in 2015 and drove it from a high of 12.43 down to 4 by the end of the year. By February 2016, the stock was trading for 2.50. But like the other four cyclical stocks that led the S&P Small Cap 600 last year, Titan International got rolling as the year went on. The quarterly sales declines of 20% to 30% that persisted in 2014 and 2015 abated by mid-2016. And in its two most recent quarters, sales only fell by 12% and 1%, respectively. That should mean that in 2016, sales will have fallen by a mere 9% compared to a 26% decline in 2015.

Next year, Titan’s sales should expand modestly by 3%. Earnings per share, which will come in around -$0.49 in 2016, should improve to breakeven in 2017. In other words, this is yet another recovery story where the beginning of 2016 not only marked the bottom of the cycle, it also marked the best time in several years to buy this stock.

What Small Cap Stocks to Buy for 2017

Truth be told, I don’t like any of these stocks right now.

Yes, they all did phenomenally well in the last calendar year. But a large contributor to that stellar performance was the terrible performance that preceded the run. While investors can clearly make a lot of money investing in cyclical stocks when they’re going up, I’ve found many investors hold on too long during the downturn. And over a multi-year stretch, the money would have been better invested in a company with a more durable business model, such as many of the technology and healthcare stocks that I cover in Cabot Small-Cap Confidential.

That’s not to say that I don’t cover any cyclical stocks (I do). But I don’t load up on them. And those that I do buy tend to be less prone to gut-wrenching boom and bust cycles than the five that led the S&P 600 Small Cap index in 2016. I doubt that any 2016’s five best small cap stocks will be at the top of the list again in 2017. But I have a number of candidates that stand a good chance!

If you’re interested to hear what I’m recommending, and to get my 2017 Small Cap Outlook (coming later this month), you should immediately jump on a subscription to Cabot Small-Cap Confidential. December’s addition is already up by 20%, 11 of our 13 positions are in the black, and on average, each position is outperforming the small cap index by 10%.

[author_ad]