Small-Cap Healthcare Still the Best Stock Market Sector

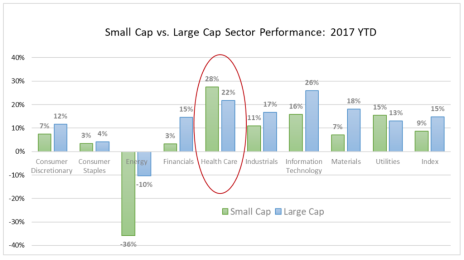

Back in July I wrote an article about how small-cap healthcare was the best stock market sector in 2017 (it was up 21% at the time), despite uncertainty surrounding the future of the Affordable Care Act (ACA). Fast forward three months and nothing has changed. The ACA’s future is still unknown, and small-cap healthcare is still the best performing stock market sector (it’s now up 28% year-to-date)!

I then went on to feature three small-cap medical device stocks that looked good. They were LeMaitre Vascular (LMAT), Lantheus Holdings (LNTH) and Orthofix (OFIX).

Since I wrote the article on July 25, those three stocks are up an average of 13.1%. LeMaitre Vascular is leading the charge with a 36% gain, Orthofix is up 8.4% and Lantheus Holdings is down 5%.

Over the same timeframe, the broad market is up 3.9%, and the small cap health care sector is up 4.8%. In other words, these three small-cap medical device stocks are handily outperforming!

[text_ad]

2 Small-Cap Medical Device Stocks to Buy Now

Given that small-cap healthcare is the best stock market sector in 2017, I thought it would be worth going back to the well and looking at a couple more small-cap medical device stocks.

To structure my research a little, I focused on stocks related to a theme we’ve been following in Cabot Small-Cap Confidential. That theme is at-home care. More specifically, we’re looking at stocks with exposure to digital health care services and medical devices that help lower the cost of care (especially for those with chronic conditions), and improve patients’ quality of life through technologies such as remote monitoring devices and services, implantable devices and portable equipment.

Here are two more stocks that made the cut.

Medical Device Stock #1: Inogen (INGN)

Inogen (INGN) is a $2 billion market cap company that makes portable oxygen concentrators for patients with chronic respiratory conditions. The vast majority of revenue (83% in 2016) comes from equipment sales, while the rest comes from rentals. The company’s pitch is relatively straightforward: patients can tow around a cart with a big, cumbersome oxygen tank (or stay at home), or use one of Inogen’s products, which are roughly the size of a medium-sized handbag. Given that revenues have been growing well above 25% annually for the last five years, it doesn’t seem there’s much comparison!

Inogen primarily sells business-to-business (64% of revenue), but does have a direct-to-consumer channel as well (23% of revenue). A quick review of products on its website shows most systems are priced in the $2,500 to $3,500 range. While Inogen’s growth rate will likely decrease to around 20% annually over the next couple of years, it is becoming increasingly profitable (net margin of 10% in 2016 versus 6.3% in 2015) and EPS should jump by 25% in 2017 (to $1.21). The stock has been a good buy at just about any time in 2017, and history suggests the current dip to the 50-day line is a good place to pick up shares.

Medical Device Stock #2: Senseonics Holdings (SENS)

Senseonics Holdings (SENS) is a medical device stock specializing in glucose monitoring. It has developed the Eversense System, an implantable monitoring device (up to 90 days) that is inserted into the upper arm and which transmits real-time readings and alerts via a patch-like transmitter to an app on a patient’s smartphone. The obvious benefit of the device is that patients don’t need to take blood samples, and they have continuous monitoring of their blood sugar levels. The company is small and still relatively unknown—its market cap is just $335 million, and it went public in March of 2016.

Senseonics Holdings is pursuing a growth strategy whereby it targets North America with a direct sales force, Europe, the Middle East and Africa through a partnership with Roche, and Scandinavian countries through a partnership with Rubin Medical. Eversense is commercially available in a few European countries and, according to management’s guidance on its Q2 conference call in August, should generate $6 million to $7 million in revenue in 2017.

The product is not yet approved in the U.S., but Senseonics filed a premarket approval (PMA) with the FDA in the fourth quarter of 2016 and expects to hear back before the end of this year. A PMA is required for a Class III device, which is the most stringent type of device marketing application required by the FDA. If approved, shares should take off!

The stock hasn’t been doing so well lately, though at this stage of development, it’s not surprising given the extent of uncertainty and dilution from a recent equity offering. The stock is fairly speculative at this stage.

(Still) My Favorite Small-Cap Medical Device Stock

I like LeMaitre Vascular, Lantheus Holdings, Orthofix, Inogen and Senseonics. But my favorite medical device stock is a little company that makes nerve repair solutions. I can’t reveal its name since it’s still a relatively new recommendation in Cabot Small-Cap Confidential. But I can tell you why I like it.

The company makes implantable surgical products for peripheral nerve injuries. These are considered regenerative medical products, which means their complex structure supports nerve cell regeneration in the patient’s body. They are all off-the-shelf products, meaning they can be purchased, stored and made available for use at a moment’s notice.

It has a compelling story, is a small cap, and growth is terrific. Revenues are growing north of 40%!

You can find out more, and grab a subscription, here.

[author_ad]