With the market hitting a weak spot, it’s a good time to fine-tune your list of stocks to buy when things turn around. Part of your process should be to consider the big picture trends that will help your choices lead the market higher. I have one suggestion: consider cloud software stocks that are benefiting from low unemployment in the U.S.

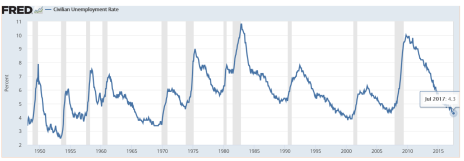

Unemployment Trending Toward Historical Low

The market’s advance in recent years has been firmly supported, in part, by low unemployment. When that’s combined with low inflation, low interest rates and slow GDP growth, we tend to see a long and drawn out economic expansion. That’s what we’re seeing now. Given this, it stands to reason that it’s a good time to own cloud software stocks that power human resources departments.

After all, these are the companies that are helping business meet all their hiring, payroll processing, benefits management and talent management needs. There is a heck of a lot of activity being run through their software. It only makes sense that they should be growing.

And they have been! Revenue growth for three of the best small- and mid-cap cloud software stocks with human capital management (HCM) platforms averaged 33% in 2016. But the stocks haven’t gone up in recent months, and two of them have come down significantly.

Given that the unemployment rate is 4.3%, and could even fall near historical lows below 3% (it hit 2.5% in 1953), it’s possible one or more of these cloud software stocks is worth adding to your potential buy list.

[text_ad]

I decided to dig in to their earnings reports to see what was going on under the surface of each stock. I’ll get to what I found in a minute. But first, let’s briefly talk about what’s going on in the HCM industry, and how this should play into the hands of industry software providers.

The industry term for the software solutions these companies provide is Human Capital Management (HCM). HCM software helps enterprises handle all elements of HR, payroll, benefits and talent management, while also helping employees navigate through the web of confusion.

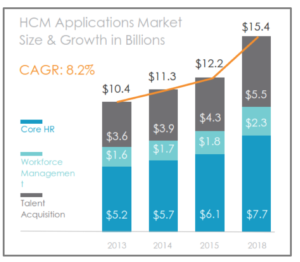

HCM is a massive global market that surpasses $12 billion today, and is estimated to be growing north of 8% annually.

It’s also an extremely fragmented market, with an estimated 40% of companies relying on very small and limited solutions (versus enterprise-wide solutions). That means there is a lot of room for new providers to grow.

As I mentioned, the three market leaders I’ll soon discuss grew revenue by an average of 33% last year. Yet, shares of two of the companies fell after reporting Q2 results.

The reasons are varied, ranging from tough market conditions (a lot of stocks fell after reporting) and the threat of military confrontation with North Korea, to more stock-specific reasons.

But part of the reason is also likely due to the fact that valuations for cloud software stocks had become quite high. Prior to this latest pullback, the sector was a full standard deviation above its seven-year historical average valuation. That meant they were trading with an enterprise-value to forward revenue (EV/forward revenue) ratio of around 5.6. That likely raised a few eyebrows, regardless of how fast many of these stocks are growing.

Now, cloud software stocks are trading with an EV/forward revenue ratio closer to 5.1. That’s still above the seven-year average ratio of 4.7, but it means they’re no longer so extended based on this valuation metric, and that values are starting to open up.

Here are three HCM stocks that might be worth a look.

3 Cloud Software Stocks to Play the Trend

Best Cloud Software Stock #1: Ultimate Software (ULTI)

Shares of Ultimate Software were slaughtered after the company reported lower than expected revenue for the second consecutive quarter. Even though revenue was up 21%, and EPS of $0.93 beat by $0.02, investor confidence was shaken given that this was the worst combination of revenue shortfall and reduced forward guidance in nearly a decade. The main culprit seems to be delayed implementations for large customers.

While management said the demand environment is strong, and there are no new competitive threats, most analysts following the stock felt compelled to reduce their price targets until better execution turns into faster recurring revenue growth. The combination of deteriorating fundamentals and weak stock performance suggest it’s not the time to go in heavy with new purchases. But for those looking to pick up a potential deal, Ultimate Software’s chart suggests buying between 180 and 200 could work out, provided fundamentals improve in the back half of 2017 and early 2018.

Best Cloud Software Stock #2: Cornerstone OnDemand (CSOD)

Cornerstone OnDemand’s HCM platform is tailored toward recruiting, training and managing people. The stock has underperformed over the past year, most likely because of uneven financial performance. Second-quarter results were released at the beginning of August, and while revenue growth of 9% (to $116.7 million) was essentially in-line, EPS of $0.02 missed by $0.04.

Billings appeared to be fine, and several deals closed faster than expected. A big win with the U.S. Postal Service could lead to more deals with government agencies. And there was a pickup in European business (one-third of revenue comes from outside the U.S.) and growth in the sales pipeline. On the downside, Cornerstone spent more than expected on hiring and marketing, which resulted in the EPS miss.

While the stock sold off hard following its Q2 report, and hasn’t recovered at all, analysts aren’t exactly bearish on the stock. Many are maintaining price targets in the upper 40s. And activist investors are beginning to put more pressure on the company to consider value-creating initiatives, including selling the company. With a market cap of nearly $2 billion, expected 2017 revenue and EPS growth of 14% and 255% (to $0.39), respectively, Cornerstone OnDemand would represent a sizeable purchase. It could be attractive to industry titan ADP (ADP), which just revealed an 8% ownership stake by activist investor Pershing Square.

Best Cloud Software Stock #3: Paycom Software (PAYC)

Paycom’s cloud-based HCM software helps employers manage payroll, human resources, talent acquisition and time and labor. While revenue growth in 2017 most likely won’t hit 40% as in years past (the revenue base is much larger now), second-quarter revenue growth of 33% (to $98.2 million) was better than expected. And EPS of $0.26 beat by $0.06.

Paycom has been beating analyst expectations for years now, which partially explains why it has the best performing stock from today’s list. While shares initially pulled-back following the release of Q2 results, I suspect that might have been more of a sympathy move for Ultimate Software’s decline than a crack in Paycom’s bullish trends.

On this year’s quarterly conference calls, management has stressed how the company’s sales teams are becoming more productive selling the HCM suite and how the addition of new offices will supplement growth in mature markets. The company continues to grab market share from larger competitors (like ADP). With unemployment rates continuing to trend down, and Paycom’s revenue and EPS continuing to trend up (expect 30% growth on both the top and bottom line in 2017), this looks like a better buy than either Ultimate Software, or Cornerstone OnDemand. The chart looks great too.

My Favorite Cloud Software Stock

I cover a number of cloud software stocks in Cabot Small-Cap Confidential, including one that specializes in HCM solutions.

The market cap of this stock is much smaller than that of Ultimate Software, Cornerstone OnDemand and Paycom. But the company’s growth rate is much faster. While those three companies are expected to grow revenue by an average of 22% in 2017, this company should grow revenue by over 50%.

It reported second-quarter results shortly after the other three. And I sent out a Special Bulletin to Cabot Small-Cap Confidential subscribers detailing the report.

The good news was that revenue growth in the quarter was well over 30% and beat expectations, although EPS (the company is profitable) missed slightly due to integration costs (the company has made several sizeable acquisitions lately). Importantly, growth in cloud revenue was well over 60%, and now represents nearly 70% of total revenue. We also saw gross margins move higher, and it looks like more acquisitions are on the way!

One of the most notable things about this company is that that the stock is very inexpensive as compared to Ultimate Software, Cornerstone OnDemand and Paycom. The average forward P/E for those stocks is 68, but my HCM stock has a forward P/E of just 21. You can learn more about this company here.

[author_ad]