Today, I have a great small-cap IoT stock to recommend. But first, let me explain my reasoning behind it.

How to Stream 40 Million Movies Per Second

While doing my daily scan through technology-related headlines late last week, I came across news that Nokia (NOK) will soon launch the world’s fastest router. Rumor has it that the ultra-fast router will help Nokia gain business from companies like Amazon (AMZN), Google (GOOG) and Facebook (FB), who care deeply about offering lighting-fast transmission speed and are willing to pay for it.

I immediately thought of how this new router will help drive the next iteration of Internet of Things (IoT) innovation.

[text_ad use_post='129618']

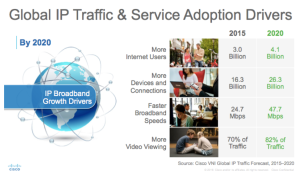

Nokia, like Cisco (CSCO), recognizes that machine-to-machine (M2M) connections will represent nearly half of all connected devices within the next three years. And as data from Cisco’s latest Virtual Networking Index (VNI) shows, more Internet users with more devices, using more bandwidth-intensive applications (like video), require faster transmission speeds. That’s what Nokia’s router will provide, and it should be a welcome addition given that there will likely be 26 billion connected devices by 2020!

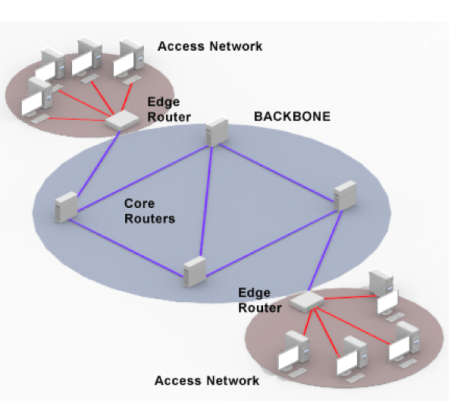

This isn’t a router aimed at the consumer market. It’s targeted at web-scale customers operating ultra-high-speed core networks, as well as edge networks that link datacenters to customer services on mobile and/or fixed-line networks. These networks make up the backbone of the Internet, as this image from PC Magazine shows.

Nokia’s target customers want the increased performance to handle virtual reality programming, cloud-based Internet services and next-generation mobile communications. In other words, they also see the IoT market growing rapidly, and they want to be able to connect more things, more quickly, and more reliably.

To put the speed of these new routers in perspective, one of Nokia’s new models offers 7,950 petabits. Just one petabit can transmit 5,000 two-hour high-definition videos per second. That works out to nearly 40 million movies, per second!

Antennas: The Unsung Hero of Wireless Networking

Nokia is upping the ante on Juniper Networks (JNPR), Cisco and Huawei because the IoT is gaining scale.

Even your toothbrush can have an IP address. Remote controls are now voice-activated, 4K ultra-high definition (UHD) smart TVs can stream uninterrupted. And beyond consumer devices, there is a massive amount of manufacturing equipment, health care equipment and transportation-related infrastructure that contributes to the growth in IoT.

As the IoT market grows, companies from Nokia to Huawei, Google to Amazon, Comcast (CMCSA) to AT&T (T), and Netgear (NTGR) to Belkin need to design new networking hardware that not only handles faster speeds, but is compatible with the latest wireless protocols.

While there is a lot of complicated technology involved that can make it hard to pinpoint how to invest in small-cap IoT stock opportunities, one that’s fairly easy to understand is the old fashioned antenna. All these different wireless technologies rely on radio waves, which means they need antennas to send and receive wireless data.

Antennas are part of the critical hardware (along with chipsets) that determine wireless network performance, and thus support the IoT. Antennas help differentiate networking devices based on throughput, coverage and supported wireless protocols. Since each protocol requires a different antenna technology, more protocols and faster speed means more antennas per device.

For instance, Amazon Echo has two antennas. Modern Wi-Fi gateways have up to eight. Soon, they’ll have 10 to 12.

The Best Small-Cap IoT Stock

To have a basic understanding of antenna technology, you need to know a little more about wireless protocols. Boring subject matter? Yes. Useful information when investing in IoT opportunities? You bet.

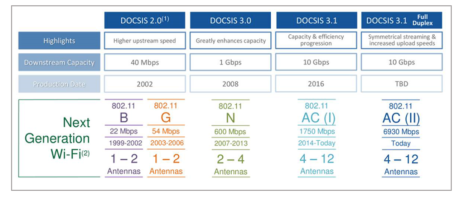

Here’s the CliffsNotes Version. In 1997, Victor Hayes (a.k.a. the “Father of Wi-Fi”) established a Wi-Fi standard to ensure interoperability, technically known as IEEE 802.11. It was endorsed by a trade association in 1999, which came to be known as the Wi-Fi Alliance.

Over time, 802.11 standards (including semiconductor chip design) evolved to support the higher throughput, faster speeds and greater range needed to accommodate the growing number of data-hungry connected devices and growth in on-demand services. Today, when somebody is talking about Wi-Fi, they are referring to 802.11 protocols.

In 2013, 802.11ac entered the market. This is the protocol used on the Netgear gateway that I rent from my Internet service provider (ISP).

The gateway houses a router and a dual-band wireless access point. It offers speeds up to 1,300 mbps on the 5GHz RF band (more data, but shorter range), and 600 mbps on the 2.4 GHz RF band (less data, but greater range).

This 802.11ac gateway can support up to eight Wi-Fi antennas, double the number of the 802.11n protocol (released in 2009).

Multiple antennas allow more than one data signal to be sent over the same radio channel, and have given rise to the technical term “MIMO,” short for multiple-input and multiple-output. MIMO technology has become widespread in both wireless and mobile phone networks since it allows more devices to be used on the same wireless network.

Recently, other wireless standards have emerged that are differentiated from Wi-Fi by power consumption, speed and cost. Different types of antennas are needed to transmit and receive data over these wireless standards.

For example, Bluetooth is a wireless technology used to connect devices (headphones, speakers, etc.) over short distances.

And both ZigBee and Z-Wave are low-cost wireless protocols used for low-power, short-range M2M networking applications where simplicity and long battery life is important (wireless light switches, electrical meters, home theatre, window treatments, medical devices, etc.).

The next generation of networking equipment will have hardware to support multiple protocols. This should help clear up confusion on the part of consumers who, understandably, are struggling to grasp exactly what IoT devices will work together in their homes.

For instance, 802.11ah is being developed to operate on the 900 MHz RF band, making it good for handling quick bursts of data from long-range sensors and controllers with low power consumption and low data needs. It can penetrate walls and obstructions, making it good for smart buildings and IoT devices.

And late next year, 802.11ax should be released. It will be the updated version of 802.11ac, but much faster. Huawei, which is leading the charge on 802.11ax, says the protocol increases max theoretical bandwidth by up to 10-times the current 802.11ac protocol.

To sum things up, antennas are part of the hardware required to support the IoT. They need to go in routers, gateways and all variety of devices that will be connected over Wi-Fi.

One small-cap IoT stock that I like makes antennas for TVs, routers, gateways, set-top boxes, security cameras and automobiles. Its customer base includes Google, Comcast, Samsung, Arris and AT&T. One of the more compelling aspects of the company is its testing facilities, which have been designed to simulate real-world applications, complete with multiple devices and disturbances. These facilities have generated thousands of hours of test data, which helps the company design better-functioning antennas than its competition.

Analysts think this small-cap IoT stock will grow revenue by 30% this year. I think those estimates are too low. The company is profitable, is gaining market share and still has a market cap well below $500 million. It’s still under the radar, and unlike many technology stocks out there, shares haven’t surged (yet!).

In short, if you’re looking for an undervalued, high growth small cap stock to play growth in the IoT sector, this one is right up your alley. To read all the details on this stock, and all the others I cover, try a subscription to Cabot Small-Cap Confidential today.

[author_ad]