The big news this week was the failure of Republicans to move forward on repeal and replace of the Affordable Care Act (ACA), also known as Obamacare.

Even though President Trump came out on Wednesday to try and rally the troops, it seems far more likely that not only will repeal and replace not happen, but rumored back-up-plan #1, straight out repeal, is a non-starter as well. As it should be, in my opinion. Regardless of where your loyalties lie, I think most people (and healthcare company CEOs) would agree that it’s better to stick with what you have then throw it out the window and expose the country to a completely unknown healthcare environment, especially when Washington isn’t exactly instilling confidence in its ability to get things done.

Thankfully I’m not a political analyst, so I can limit my views and research to how this all is affecting stocks. And most specifically, the healthcare sector stocks we cover in Cabot Small-Cap Confidential, which are medical device stocks.

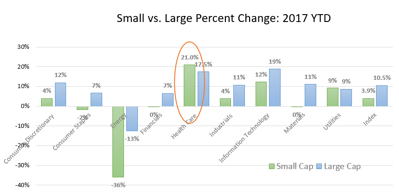

Perhaps surprisingly, small-cap healthcare is still the number-one performing sector this year. Not only does its 21% rally make it the best performing small-cap sector, but it also puts it 2% ahead of the best performing large-cap sector, technology, which is up 19%.

The advance has been consistent since the beginning of the year, and the chart of the PowerShares Small Cap Health Care ETF (PSCH) looks awesome.

I don’t think all healthcare stocks are going to the moon tonight. They’re a little expensive on a forward P/E basis, but not so much on a forward price-to-sales basis. I think selective investments can still be made. We have two medical device stocks in the Cabot Small-Cap Confidential portfolio. Both are rated Buy, and both are trading at or near 52-week highs.

[author_ad]