Amazing things are happening in health care, particularly with medical devices. And that’s been good for medical device stocks. More on those in a bit.

Advances in technologies and materials are allowing doctors to make better repairs in the body. One example is in the area of nerve repair. This is a highly-specialized market where surgeons work to “re-wire” nerve networks so the brain can begin communicating with parts of the body that went dark due to nerve damage.

The Highly Specialized Nerve Repair Market

There are a number of healthcare stocks with cutting-edge medical devices helping patients recover from nerve damage. I’ll talk about a few market leaders and their products in just a moment. But first, I want to share a story that exemplifies just how much progress has been made developing medical devices for nerve repair.

[text_ad]

It began in 2010 with a young U.S. Marine Corporal who was on routine patrol with his unit in Afghanistan, checking to see if there had been any Taliban activity in the area. Things went

south, and his patrol began taking gunfire from enemy forces. This young man was hit six times.

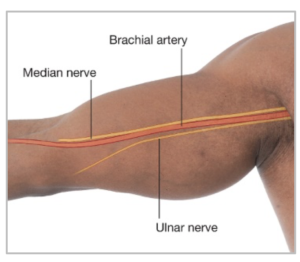

His body armor absorbed four of the bullets. But the other two struck his left arm, badly damaging his brachial artery and ulnar nerve. After meeting with surgeons back in the U.S., he found out the gap in his ulnar nerve was almost three inches long.

Nerves provide the pathway for motor and sensory signals throughout the body. Suffice to say, with such a large gap in his ulnar nerve, this man’s left arm and brain were no longer communicating. In short, his arm no longer worked.

The doctors said he had a few options.

Option number one was that he could amputate his arm. As you can imagine, he wasn’t too excited about going down this path.

Alternatively, he could try to repair the nerve. Given the size of the gap, it wasn’t practical to pull the existing nerve ends together and suture them up. He needed a nerve transplant to bridge the gap. And there were a few ways of doing this.

The first nerve transplant option was to undergo a nerve autograft procedure. This surgery involved removing nerve from another part of his body, and using it to bridge the gap in the ulnar nerve. The donated material would come from the sural nerve, located in the back of the lower leg.

The downside was that this would create a nerve deficit in his lower leg, which could lead to loss of some sensation in his foot. The procedure also meant another surgery, greater expense and waiting three to six months to complete the nerve transplant. Plus, with such a large gap, he would need nerve material from both legs. The prospect of undergoing three surgeries, and then having compromised nerves in both legs plus his left arm didn’t sound very appealing.

A second nerve transplant option was to bridge the gap in his ulnar nerve with other materials on the market. The doctors discussed hollow-tube synthetics and hollow-tube nerve cuffs, which are made of either bovine (cow) collagen or polyglycolic acid. These products would likely restore some arm function, but would also limit nerve healing since their architecture and flexibility don’t match that of a human nerve.

The route this patient ultimately went with was a nerve transplant, but the material didn’t come from his body. It was a cadaver allograft—nerve tissue from a deceased person.

The allograft bridged the gap without damaging nerve function in his legs, and since it was processed from donated human nerve tissue, it had an architecture that allowed the nerve cells to regenerate through it, thereby restoring function of his arm over time.

The man’s arm would never be like new. But after a couple of years, he had recovered partial use, wasn’t at risk of amputation, and had a job working at a U.S. national park.

How to Repair the Body’s “Internet Cable”

I came across this story while researching medical device stocks. And what jumped out at me was just how invasive sourcing nerve material from a patient’s own sural nerve is. It struck me as a giant leap forward that patients might have the option to leave their own nerve structure intact, but still get the benefits of human nerve material for their nerve transplants.

To understand why human nerve material is so superior, you need to know just a little bit about nerve architecture.

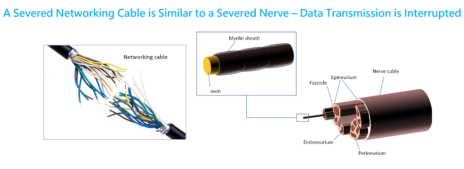

A typical nerve has hundreds of axons (cell cytoplasm resembling a hair-like fiber) lying inside long, thin endoneurial tubes. These tubes are bundled together in groups called fascicles. When a nerve cable is cut or crushed, the sheath structure protecting the axons gets damaged, and the axons are no longer able to carry signals.

Nerve damage is similar to a break in the networking cable that goes from a router to a computer—cutting it knocks out internet service. Unfortunately, there is no wireless service to replace nerve function just yet!

When sensory and motor signals are interrupted, bad things happen. Sensory nerve damage can lead to feelings of numbness or no sensation at all. Imagine grabbing a scalding hot iron and not even feeling it. Motor nerve damage can mean that muscles, limbs and joints don’t work properly (or at all), like in the case of the young man we just talked about.

The bottom line is that nerve damage is likely to lead to some sort of pain, loss of sensation, reduction of movement, and a lower quality of life. In most cases, nerve injuries—whether they be cut (transection injury), crushed (compression injury) or infected/irritated (inflammation)—require surgical repair.

The best repair outcomes involve medical devices to complete a tension-free repair, support structure to allow for cell regeneration, isolation from surrounding tissue, and materials that the body readily accepts.

Three Medical Device Stocks Showing Growth

Most of the medical device stocks that offer nerve repair solutions offer more than one. Product portfolios likely cover at least a couple options for transected and non-transected nerve repair, including direct suture repair, autograft, hollow-tube nerve conduits, and materials used to wrap and protect nerve tissue.

For instance, Integra LifeSciences (IART) sells off-the-shelf repair options, including hollow-tube conduits and bio-absorbable wraps. Leading products include NeuraGen, a hollow tube made of reconstituted bovine collagen, and NeuraWrap, nerve wrapping made of reconstituted bovine collagen biomaterial. The mid-cap company has a market cap of $4.2 billion, and should grow sales by 14% in 2017.

Then there is Baxter International (BAX), which sells Neurotube, a hollow tube made of polyglycolic acid. The company has a market cap of $35 billion and is growing revenue in the 3% to 4% range.

Stryker (SYK) is probably best known for making operating and emergency room equipment, since that’s what patients tend to see most often. But it’s a big company (market cap of $54 billion) and has its hands in a lot of markets, one of which is nerve repair. Stryker offers NeuroMatrix and Neuroflex, both of which are hollow tubes derived from reconstituted bovine collagen. It also makes NeuroMend, a nerve wrapping made of reconstituted bovine collagen biomaterial. The company grew revenue by 14% in 2016, and should grow both revenue and EPS by around 10% in 2017.

My Favorite Medical Device Stock for Nerve Repair

These are all good companies. But my favorite medical device stock in the area of nerve repair is a pure-play small cap. I can’t reveal its name since I recently recommended it to subscribers of Cabot Small-Cap Confidential. But I can tell you a little about why I like it, and let you know how to start a subscription to my advisory service.

The company specializes in surgical products for peripheral nerve injuries. Products can be used to bridge gaps in severed nerves, repair crushed and damaged nerves, and wrap and protect repaired nerves.

One of the more compelling things about its implants is that they are considered regenerative medical products. That means their complex structure supports nerve cell regeneration in the patient’s body. They are pliable, can be sutured, and are translucent, which helps surgeons see through them to the underlying nerve.

They are all off-the-shelf solutions, meaning they can be purchased, stored and made available for use at a moment’s notice.

It’s a small-cap stock, and revenue growth is great. Sales were up over 40% in 2016, and should be at or above that mark for the next two years.

As you likely suspect, this is the company that provided the nerve allograft to the U.S. Marine Corporal. It’s a compelling opportunity. And it’s one of the stocks that’s helping Cabot Small-Cap Confidential outperform the small cap index by an average of 26%!

You can find out more, and grab a subscription here.

[author_ad]