Aside from a few exceptions, I don’t have excessively rigid guidelines for the small-cap stocks that I search for in Cabot Small-Cap Confidential. This flexible (within reason) strategy means we’re always open to what’s working. Lately that’s meant that I’ve been looking more closely at small-cap growth and value stocks - those that possess both attributes.

What qualifies as a small-cap growth and value stock is admittedly subjective. But in my eyes, stocks that fall into this “blend” bucket typically meet at least a few of the following criteria: They’re profitable, have a beta (volatility compared to the S&P 500) that’s not wildly out of line and trade at valuation ratios that are closer to the value end of the spectrum than the growth end. They may pay a dividend.

Fund managers that include these types of stocks in their funds would probably be pursuing a Growth at a Reasonable Price (often dubbed GARP) strategy. That basically means growth stocks that have at least some value stock characteristics. Or perhaps growth stocks that fell sharply after a disappointing quarter, or that remain overlooked by the analyst community. Again, the precise criteria is somewhat subjective.

[text_ad use_post='129618']

This relates to the here and now because small-cap growth stocks are up 20% year-to-date. This performance is twice as good as that of small-cap value stocks, which are up 10% so far in 2018.

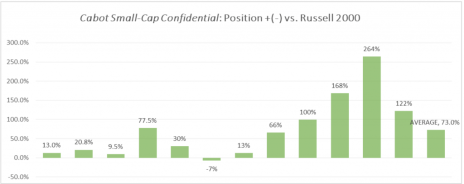

Another measure of growth stock performance can be seen in the Cabot Small-Cap Confidential portfolio, which is comprised roughly 80% of growth stocks right now. On average, our stocks are beating the benchmark Russell 2000 Small Cap Index by an average of 73%! Hurrah! This calculation is based on relative performance of each position to the Russell 2000 from the day it was included in the portfolio.

Subscribers and I are obviously thrilled with the outperformance; it’s been a great run. But all of these figures raise one obvious question: when will value stocks begin to close the gap?

For those of us that don’t think it’s wise to bet against a charging bull, but also don’t want to ignore the reality that this performance disparity probably won’t last forever, blended growth and value small-cap stocks can offer the perfect compromise.

As always, the trick is to buy the right ones. That’s been our goal since the middle of 2018. Here are a few that might be worth a look.

Finding Growth And Value in Defense and Industrial Stocks

Mercury Systems (MRCY)

Mercury Systems is an aerospace and defense company that sells secure sensor and safety-critical processing subsystems. It specializes in secure embedded processing modules and subsystems, mission computers, RF components and safety-critical avionics. Major programs include Patriot, F-35, F-16 SABR, Predator, Aegis and Reaper, to name a few.

One of the key facets of Mercury’s growth strategy is to develop its business model around the industry’s current technology trends. Broadly speaking, this means Mercury acts as a commercial outsourcing partner to the big defense contractors (Raytheon and Lockheed accounted for 48% of revenue in 2017) that need subsystem level engineering as well as ongoing systems integration services. While its services segment only contributes 10% of revenue, its strategic nature helps drive sales in the software and hardware segments that make up the bulk of revenue from defense contractors.

Growth has been impressive. Over the last five years, revenues have advanced at an average 24%, average earnings per share (EPS) growth has been 39% and average bookings growth has been 23%. Revenue was up 21%, to $493 million, in fiscal 2018 (ended June 30), while EPS was up 23%, to $1.42.

In fiscal 2019 analysts expect revenue growth of 25% and EPS growth of 19%. Mercury Systems has a market cap of $2.7 billion. The stock trades with a forward PE of 28 and carries a beta of 1.1.

Shares were hammered in April when Q3 fiscal 2018 results missed expectations. But in hindsight it appears the market overreacted as investors began piling back in almost immediately after the selloff. The fourth-quarter report drove another big wave of buying in late July.

US Ecology (ECOL)

US Ecology is a $1.6 billion market cap company that provides environmental services to businesses and government entities throughout North America. Think of things like spill cleanup, tank cleaning, decontamination, and transporting, recycling, treating and properly getting rid of hazardous and non-hazardous waste. It owns its own landfill, wastewater and treatment facilities, and also works with customers to dispose of materials at their facilities.

As you’d expect, customers are mostly from the industrial manufacturing segment (46% of revenue), but the company also helps refineries (11% of revenue), waste brokers, real estate developers, pharmaceutical customers, marinas and various small manufacturers. Essentially, if you’ve got a waste issue, US Ecology can help.

The company has been around for a while. It was founded in 1952 as a nuclear engineering company, then it began opening up hazardous waste disposal and treatment facilities. It went public in 1984 as American Ecology, then changed its name in 2010. It’s based out of Boise, Idaho, but has operations nationwide. It owns 22 treatment and recycling centers, 13 service centers, 13 retail satellites and 5 disposal sites. The recent acquisition of ES&H of Dallas will add depth to its emergency and spill response services in the Gulf region, while adding around $20 million in revenue and $4 million in EBITDA in fiscal 2019.

With the exception of 2016, US Ecology has been a fairly steady grower. Over the last five years, revenue grew at an average annual rage of 32%, in part due to acquisitions. The dip in 2016 was partially due to divestment of a sizeable business in mid-2015. In 2017 revenue expanded by 6%, to $504 million, while EPS grew by 12% to $1.72.

This year, analysts expect revenue to grow by 8% while EPS should grow by 31%, to $2.25. US Ecology pays a dividend of almost 1%, trades with a forward PE of 29 and carries a beta of 0.87.

Shares have been advancing steadily in 2018 with pops and drops here and there.

My Favorite Small-Cap Growth And Value Stock

My favorite small-cap growth and value stock is one I can’t discuss by name since I just recently recommended it to Cabot Small-Cap Confidential subscribers. But I can say that this company has a business model that is extremely difficult to emulate, serves consumers across the U.S. and in select areas in Canada, and is poised to grow earnings by almost 80% this year.

The stock shares characteristics of both Mercury Systems and US Ecology and fits the mold of what I look for in a high-potential small-cap stock.

That means it’s a pure-play small cap benefiting from a long-term growth trend. It also means it has a great business model, has excellent products now and has shown evidence that more excellent products are coming in the future. It also has the potential to double in value within 18 months of being added to the portfolio.

This is what the stock chart looks like today.

This is just one of the stocks that’s contributing to our portfolio’s average gain of 88%. If this performance sounds good to you and you like growth, value, or small-cap growth and value stocks, sign up! I’d love to have you as a subscriber. And I’ll not only send you the best research on small-cap stocks out there, I’ll answer any questions you have too.

Just click here to get started now.

[author_ad]